Mortuary Equipment Market Analysis:

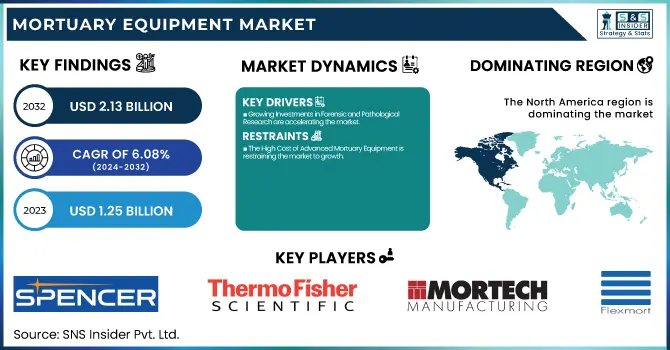

The Mortuary Equipment Market size was valued at USD 1.25 billion in 2023 and is projected to reach USD 2.13 billion by 2032, growing at a 6.08% CAGR from 2024 to 2032.

To Get more information on Mortuary Equipment Market - Request Free Sample Report

The Mortuary Equipment Market report provides insights through mortality and death statistics and rates by region, which are used to ascertain demand shifts. The report also analyzes funeral and burial patterns, such as trends toward cremation and green funerals, that affect equipment requirements. Furthermore, the report provides mortuary equipment volume trends between 2020 and 2032, including installations and technology developments. One of the major highlights is comparing government and private investments in mortuary facilities, which reveals infrastructure developments and financing allocations. These data-driven perspectives give a full view of market trends, regional demand, and investment opportunities, making the report distinct from others.

Mortuary Equipment Market Dynamics

Drivers

-

Rising Mortality Rates and Aging Population propelling market growth.

The rising global death rate, together with an accelerating aging population, is a key thrust behind the Mortuary Equipment Market. As per the United Nations, the global population aged 65 years and above is set to double in 2050, which will translate into increased demand for funeral services and mortuary equipment. The US alone had over 3.4 million death cases in the year 2023, prompting the need for sophisticated embalming workstations, autopsy platforms, and cooling units. Increasing numbers of long-term diseases, including cardiovascular illnesses and cancer, are also putting pressure on the storage of cadavers and post-mortem analysis with efficiency. Current advancements include automated autopsy solutions aided by AI as well as self-operating mortuary refrigerators, enhancing the efficiency and the preservation process. The growing demand for forensic labs and hospitals with adequate equipment further boosts market growth.

-

Growing Investments in Forensic and Pathological Research are accelerating the market.

Forensic research expansion and enhanced post-mortem examination are driving the demand for new mortuary equipment. Governments and healthcare organizations are spending heavily on forensic pathology and medical research, promoting the use of advanced autopsy stations, dissection tables, and body storage systems. In 2023, the UK government made the provision of greater funding for forensic science developments, which was part of a wider global trend. The increased crime rates and number of unexplained deaths have also resulted in greater demand for forensic labs, particularly in North America and Europe. New solutions like virtual autopsies using 3D imaging and automated dissection tables are being brought into forensic centers. With stringent regulatory demands for body handling and storage, institutions are turning more and more to high-tech mortuary solutions to guarantee compliance and efficiency.

Restraint

-

The High Cost of Advanced Mortuary Equipment is restraining the market to growth.

One of the major constraints in the Mortuary Equipment Market is the exorbitant price tag attached to sophisticated mortuary solutions, which discourages adoption, especially in emerging economies. Machines like automated dissection tables, technologically advanced embalming workstations, and sophisticated mortuary refrigeration units entail heavy investment, and it is challenging for small funeral homes, forensic laboratories, and hospitals to undertake them. For example, an upscale mortuary refrigeration unit may range from USD 10,000 to USD 50,000, while auto-path stations may go up to over $100,000, putting a financial burden on healthcare and forensic organizations. On top of this, maintenance charges and strict compliance rules add to operating costs. Insufficient government funding and financial support in some areas limit market penetration. Consequently, smaller organizations operate on aging or manual systems, hindering overall industry growth.

Opportunities

-

Technological Advancements in Mortuary Equipment present a significant growth opportunity for the Mortuary Equipment Market.

Growing adoption of automation, artificial intelligence (AI), and smart preservation technology offers a substantial growth prospect to the Mortuary Equipment Market. Technological advancements like AI-powered virtual autopsies, robotic cadaver storage units, and temperature-controlled embalming stations are enhancing operating efficiency and standards of body preservation. IoT-integrated refrigeration units enable remote monitoring of temperature levels, which ensures the best possible storage conditions. Also, 3D imaging and robotic dissection tables are revolutionizing forensic investigation, minimizing manual mistakes and increasing procedural precision. With increased investment in forensic science research and pathology labs, demand for high-technology, low-cost, and automated solutions is on the rise. Increased healthcare infrastructure and hospital and funeral home modernization in emerging economies also contribute to this trend, which makes technology-based innovation a principal growth driver of the future.

Challenges

-

Stringent Regulatory and Ethical Concerns facing significant challenges in the market.

The mortuary equipment market is severely tested by stringent regulatory and ethical pressures related to the handling of cadavers, post-mortem examination, and cremation. National governments have various legal requirements in place for mortuary activities that necessitate business compliance with complex standards of storage, embalming, and human remains disposal. For instance, the European Union has mandatory cadaver cooling and embalming fluid restrictions to reduce the environmental risk. Also, cultural and religious norms affect burial and funeral traditions and restrict the incorporation of some newer mortuary technology. Ethical issues related to autopsies and forensic analyses complicate the take-up of automatic or AI-based autopsy technology even more. These problems boost operational and administrative expenses for players in the industry, discouraging the smooth adoption of sophisticated mortuary devices in varied regions.

Mortuary Equipment Market Segmentation Insights

By Equipment Type

The Refrigeration Units segment dominated the market with a 30.25% market share in 2023 because of its essential role in storing cadavers over long durations. High rates of death, along with growing demand from hospitals, forensic labs, and funeral homes, have fueled the mass use of sophisticated mortuary refrigeration units. Developments such as dual-temperature chambers, energy-saving cooling technologies, and IoT-supported monitoring systems have improved their efficiency and reliability. Moreover, strict protocols for body storage and the prevention of decomposition have even increased the requirement for temperature-controlled mortuary solutions. The increasing application of modular refrigeration systems in disaster operations and mass casualties has also promoted segment leadership. With the rise in the worldwide aging population, as well as an increase in the number of medical research centers, the demand for long-term cadaver preservation still drives this segment.

The autopsy platforms and equipment segment will have the fastest growth during the forecast period with the highest CAGR due to improvements in forensic science, growing crime rates, and heightened clinical pathology study demands. Contemporary autopsy platforms now include height-adjustable designs, onboard drainage systems, and robotic dissection functionality, enhancing procedural effectiveness and accuracy. In addition, the growing research into infectious diseases and anatomical studies has boosted the demand for advanced autopsy equipment and dissection tables within academic centers and forensic laboratories. Government efforts to improve forensic facilities in developing nations and the inclusion of AI-driven virtual autopsy solutions also complement this segment's rapid expansion. The increasing emphasis on post-mortem diagnosis for disease monitoring is also likely to drive demand, making autopsy devices a key investment sector in the forecast years.

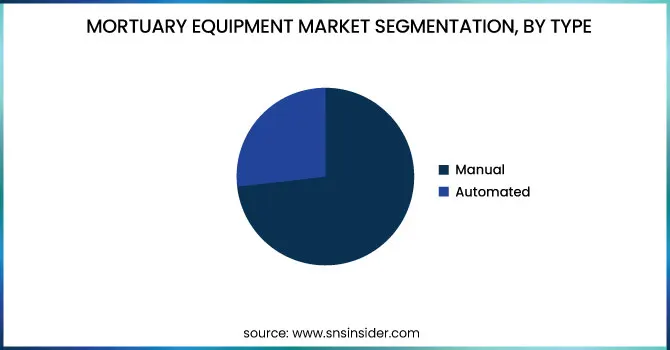

By Type

The Automated segment dominated the mortuary equipment market with around 75.16% market share in 2023 because of the growing demand for efficiency, accuracy, and less manual handling in mortuary procedures. Automated mortuary systems, such as body lifts, autopsy tables, and refrigeration units with electronic controls, are becoming more popular because they can automate body handling, improve the safety of workers, and reduce the risk of contamination. Hospitals, funeral homes, and forensic labs are increasingly integrating automated dissection tables, hydraulic lift mechanisms, and robot-assisted autopsy equipment to enhance workflows and address rigorous regulation standards. Moreover, intelligent mortuary devices with temperature control, automated reporting, and remote-operated features have also influenced segment growth. The worldwide shortage of skilled mortuary personnel and the demand for hygienic and touchless body care solutions have both contributed to establishing the supremacy of automated mortuary machinery in 2023.

By End-User

The Research and Academic Institutions segment is anticipated to see the fastest growth in the mortuary equipment market in the forecast period as a result of increased emphasis on forensic sciences, pathology research, and medical education. The increasing number of medical schools and research centers performing cadaveric studies for anatomical dissection, forensic training, and surgical innovation is fueling demand for autopsy platforms, dissection tables, and sophisticated embalming workstations. Moreover, growth in government and private investments for medical research and forensic sciences is driving investments into cutting-edge mortuary facilities. Technological breakthroughs like AI-driven autopsy tools and 3D imaging technology for virtual cadaveric analyses are also spurring adoption further. With the growth in disease research, forensic pathology, and medical training programs globally, the demand for high-quality mortuary equipment for research and education institutions will substantially increase.

Mortuary Equipment Market Regional Overview

North America dominated the market with a 37.20% market share and became the largest contributor to the mortuary equipment market in 2023, due mainly to the well-developed healthcare and funeral service industry in the region, high mortality rates, and strict regulatory norms for cadaver management. The high demand for sophisticated mortuary equipment, such as automated refrigeration units, autopsy platforms, and embalming workstations in the United States and Canada is boosted by the increased number of hospitals, forensic laboratories, and funeral homes. Also, the growing incidence of chronic diseases, the aging population, and rising investments in forensic and pathological studies drive market leadership. The existence of industry leaders, ongoing innovation in technologies, and greater adoption of automated mortuary solutions further establish North America as the market leader.

Asia Pacific is expected to be the fastest-growing mortuary Equipment market with 7.17% CAGR throughout the forecast period, driven by growing urbanization, rising mortality rates, and enhanced healthcare infrastructure in nations like China, India, and Japan. The expansion of hospitals, research centers, and forensic labs, as well as government efforts to upgrade healthcare facilities, is boosting demand for sophisticated mortuary equipment. Moreover, the growing geriatric population, growing cases of infectious diseases, and rising awareness for professional funeral services are driving the market growth at a faster pace. The region's low-cost manufacturing facilities and rising use of Western-style funeral practices also aid in its accelerated growth, thereby making Asia Pacific a prominent emerging mortuary equipment market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Mortuary Equipment Market Comapnies

-

Holland Supply (Burial Vault Equipment, Cremation Equipment)

-

MortuaryMall.com (Ferno Model 24 Multi-Level Cot, Mortech Autopsy Station)

-

Link Mortuary Equipment (Mortuary Ramps, Mortuary Decks)

-

Slaughter Supply (2 Body Mortuary Cooler, Autopsy/Embalming Tables)

-

American Crematory Equipment Company (Cremation Retorts, Crematory Equipment)

-

Lynch Supply (Embalming Fluids, Chapel Equipment)

-

Cemetery Funeral Supply (Cemetery Tents, Lowering Devices)

-

Buy Mortuary Equipment (Hearses, Mortuary Stretchers)

-

William Kenyon (Body Chambers, Coffin Handling Equipment)

-

Mobi Medical Supply (MOBI F500 Multi-Level Cot, Embalming Tables)

-

Affordable Funeral Supply (Church Trucks, Embalming Tables)

-

Mopec (Autopsy Saw, Grossing Station)

-

LEEC Limited (Mortuary Refrigeration Units, Autopsy Tables)

-

Flexmort (Mortuary Cooling Systems, Cadaver Storage Solutions)

-

Ferno-Washington (Mortuary Cots, Mortuary Stretchers)

-

Junkin Safety Appliance Company (Mortuary Stretchers, First Call Covers)

-

Mortech Manufacturing (Autopsy Sinks, Mortuary Refrigerators)

-

Thermo Fisher Scientific (Mortuary Refrigeration Systems, Autopsy Tables)

-

Spencer Italia (Mortuary Stretchers, Body Bags)

-

Roftek Ltd (Mortuary Lifts, Body Storage Racks)

Suppliers (These key suppliers provide a wide range of mortuary equipment and solutions, including mortuary refrigeration systems, autopsy tables, embalming stations, cadaver storage racks, and cremation equipment) in Mortuary Equipment Market

-

Thermo Fisher Scientific

-

Mopec

-

LEEC Limited

-

Flexmort

-

Mortech Manufacturing

-

Ferno-Washington

-

Junkin Safety Appliance Company

-

American Crematory Equipment Company

-

Mobi Medical Supply

-

Slaughter Supply

Recent Development

-

In January 2025, Holland Supply featured the "Must-Have Funeral Products for 2025" in January 2025, featuring top-of-the-line products that will be the best sellers of the coming year.

-

In January 2025, MortuaryMall.com reported that Link Mortuary Equipment launched the SS150XLC Single Deck System for full-size cargo vans with a wider deck to fit bigger cots and stretchers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.25 billion |

| Market Size by 2032 | US$ 2.13 billion |

| CAGR | CAGR of 6.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment Type (Trolleys, Refrigeration Units, Autopsy Platforms and Equipment, Embalming Workstation, Dissection Table, Other Accessories) • By Type (Manual, Automated) • By End-User (Hospitals, Funeral Homes, Research and Academic Institutions, Forensic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Holland Supply, MortuaryMall.com, Link Mortuary Equipment, Slaughter Supply, American Crematory Equipment Company, Lynch Supply, Cemetery Funeral Supply, Buy Mortuary Equipment, William Kenyon, Mobi Medical Supply, Affordable Funeral Supply, Mopec, LEEC Limited, Flexmort, Ferno-Washington, Junkin Safety Appliance Company, Mortech Manufacturing, Thermo Fisher Scientific, Spencer Italia, Roftek Ltd, and other players. |