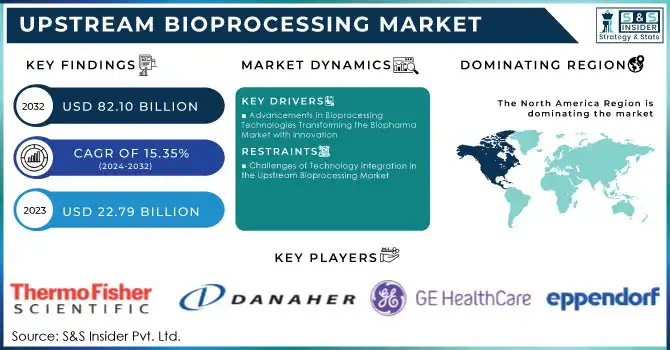

Upstream Bioprocessing Market Size & Overview:

To Get More Information on Upstream Bioprocessing Market - Request Sample Report

Upstream Bioprocessing Market was valued at USD 22.79 billion in 2023 and is expected to reach USD 82.10 billion by 2032, growing at a CAGR of 15.35% from 2024-2032.

The Upstream Bioprocessing market continues to grow steadily with the increasing involvement of biopharmaceuticals in healthcare and development in the field of production of biologics. Advancing investment in optimizing cell culture, media development, and fermentation processes, with U.S. and EU biotech companies collectively raised a total of USD 81.1 billion in 2023 and in the first quarter of 2024, the biopharma sector formed 115 R&D partnerships totaling USD 36 billion, highlighting a strong focus on innovation and collaboration. With innovations such as single-use bioreactors and automation continuing to make upstream bioprocessing increasingly efficient, companies can push production processes further for cost and quality. This progress reflects a wider industry trend toward making biopharmaceutical manufacturing more adaptable and scalable.

The upstream bioprocessing market will be influenced by several factors that will shape the demand for biologics, vaccines, and advanced therapies that call for complex, high-precision manufacturing. Increasing interest in personalized medicine and also in biosimilars has added complexity to this entire market as well, as companies try to strike a balance between maximum volumes and tailored solutions. With the increase in competition, firms are increasingly focusing on flexible and efficient production platforms to meet the dynamic needs of the biopharmaceutical sector, building capabilities to accommodate evolving therapeutic innovation.

Emerging technologies such as artificial intelligence and advanced sensing are expected to drive the future of upstream bioprocessing by improving process optimization and real-time monitoring. AI also enables the improvement of quality control-it is one of the factors that 60% of professionals assert can analyze large datasets quickly and ensure high standards. Finally, policy support for biotechnological innovation is likely to spur growth as regulatory agencies switch to more flexible manufacturing approaches. It's also developing sustainable bioprocessing practices that reduce environmental impact. All these advancements will promote innovation and adaptability, important aspects of sustainability, which are crucial for long-term market growth.

Upstream Bioprocessing Market Dynamics

DRIVERS

-

Advancements in Bioprocessing Technologies Transforming the Biopharma Market with Innovation

Single-use technologies, automation, and high-throughput systems have more than doubled the efficiency, scalability, and flexibility of biologics production. These innovations cut the complicated cleaning and sterilization processes, simplify workflows, and reduce timelines for the manufacture, thus aligning with the demand for cost-effectiveness and high efficiency. Where the industry continues to value faster development and lower production costs, these technologies keep companies ahead of the changing market. Thereafter, expansion in this market with the adoption of these advancements would expand existing product access, open up opportunities for new entrants to the biopharma space, and attract more players.

-

The Impact of Emerging Biotech Companies on the Upstream Bioprocessing Market Fueling Growth through Novel Therapies and Precision Medicine

These new companies, developing innovative therapies and targeted medicines, are increasingly demanding scalable bioprocessing solutions able to match the specific demands for small-batch, high-value biologic production. As gene and cell therapies advance, these companies need cost-effective, flexible biomanufacturing platforms that assist in innovation while driving timelines down. As regulatory environments evolve to support novel therapies, such biotech firms are applying new technologies for increased acceleration in development, which means a great scope of growth within the bioprocessing sector. Expansions for these biotech companies will continue to fuel demand for advanced bioprocessing solutions, along with competition and opportunities for further market innovation.

RESTRAINTS

-

Challenges of Technology Integration in the Upstream Bioprocessing Market

A major constraint in the upstream bioprocessing market is the difficulty of adopting and integrating advanced technologies like AI, automation, and single-use systems in the existing production environment. As these technologies are the future to improve efficiency and scale up, for many biopharma companies, integrating them poses severe obstacles. The key challenge in all this is the cost factor required in upgrading existing systems for new technologies. Also, the incorporation of such technologies by itself calls for specialty skills and a long period of training, hence with higher cost. Other regulatory hurdles add to this complexity as new technologies must come up with strict compliance and safety requirements, which eventually hampers real progress. Such financial and operational barriers may make growth hard and, for instance, confine small companies from embracing new technologies.

Upstream Bioprocessing Market Segment Analysis

BY USE TYPE

The multi-use segment dominated the upstream bioprocessing market in 2023, with the largest share of about 56%. This can be attributed to established demand in the market, proven technology delivery, and scalability in high-volume production. Multi-use systems have long been preferred due to their capital and lifecycle cost competitiveness and long-term operational stability, confirming their dominant position in the market.

The single-use segment is expected to grow at the fastest CAGR of 16.53% from 2024 to 2032 due to flexibility, reduced setup times, and lesser chances of contamination. Innovations in materials and designs are making single-use technologies more attractive, particularly for smaller-scale and personal biomanufacturing. As this segment expands, it may reshape the market competition, creating new opportunities for investments, and change the production strategies throughout the industry.

BY MODE

The in-house segment dominated the upstream bioprocessing market in 2023, with the highest revenue share of 59%, since it is the segment that facilitates control over product quality, intellectual property, and process integration. Technological advancements in automation further enhance operations' security in-house, making them more efficient and scalable. Consequently, in-house biomanufacturing remains a key investment area, thereby adding to the stronghold of the market leaders in the industry.

The outsourced segment is expected to grow at the fastest CAGR of 16.39% from 2024 to 2032, because of the increasing demand for cost efficiency, flexibility, and specialized expertise. Innovation in contract manufacturing and the rise in small to mid-sized biopharma companies are growth factors for the market. As outsourcing expands, it would shift market dynamics toward new partnerships and investment opportunities within specialized service providers.

BY WORKFLOW

The cell culture segment dominated the upstream bioprocessing market in 2023, with the highest revenue share of about 58%. Its growth is buoyed by the well-established demands for biologics, especially in vaccine and monoclonal antibody production, where cell culture plays a crucial role. Improvement in process efficiency has come from enhancements in cell line optimization and the design of bioreactors and has cemented the cell culture segment's position in the market.

The media preparation segment is expected to grow at the fastest CAGR of 16.64% from 2024 to 2032, because of innovation in cell culture media and the surging demand for personalized therapies. As companies focus on optimizing cell growth conditions, the need for advanced, tailored media solutions is expanding. Therefore, this growth is likely to drive increased investment in media development shifting market dynamics and encouraging new players to enter the market with specialized offerings.

BY PRODUCT

In 2023, the bioreactors/fermenters segment dominated the upstream bioprocessing market with the highest revenue share of 32%. This is attributed to the strong demand for large-scale biologics production, wherein bioreactors play a key role in optimizing the growth of cells and improving yields. Automation and real-time monitoring in bioreactor systems have contributed to further better efficiency. This, in turn, captures greater investment and cements market leadership for the segment in the manufacturing of biopharmaceuticals.

Cell culture products are also expected to grow at the fastest CAGR of 17.04% from 2024 to 2032, driven by innovations in cell culture media and equipment. Increasing demand for personalized therapies and complex biologics increases the demand for advanced, customized cell culture products. This growth is expected to fuel more competition and investment in developing customized solutions, shaping biopharmaceutical production's future.

Upstream Bioprocessing Market Regional Outlook

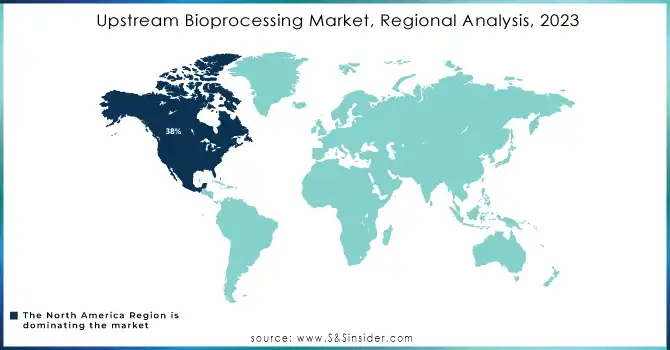

North America region dominated the upstream bioprocessing market with the highest revenue share of about 38% in 2023. Its dominance is due to the demand for biopharmaceuticals, which is underpinned by good infrastructure as well as leading market players. Advanced manufacturing capabilities, access to cutting-edge technologies, and a favorable regulatory environment continue to fuel the region's share. As a result, North America would be the stronghold with continued investments improving its competitive edge in global biomanufacturing.

The Asia Pacific region is expected to grow at the fastest CAGR of 17.74% during the forecast period from 2024 to 2032, led by major investment inflows and untapped opportunities in biopharmaceutical manufacturing. Emerging trends such as increasing healthcare demands, government support for biotechnology, and growing contract manufacturing capabilities are fueling this growth. The bioprocessing footprint of Asia Pacific is expected to change as it reshapes the competitive landscape while attracting more investment and increasing its share in the global biopharma market, thereby altering production strategies and consumer dynamics.

Do You Need any Customization Research on Upstream Bioprocessing Market - Enquire Now

LATEST NEWS -

-

In 2024, Thermo Fisher Scientific launched biobased solutions to reduce the climate impact of biologics manufacturing. These innovations include sustainable single-use bioprocessing containers, aiming to lower emissions while ensuring high product performance and consistency

-

In August 2024, Merck KGaA acquired Mirus Bio, a leader in advanced transfection technologies for cell and gene therapies, strengthening its position in upstream bioprocessing solutions. This acquisition enhances Merck’s ability to support innovations in biological production.

KEY PLAYERS

-

Thermo Fisher Scientific, Inc. (Nalgene Labware, HyClone Cell Culture Media)

-

Merck KGaA (Millipore Sigma Cell Culture Media, Merck Millipore Bioreactors)

-

Corning Incorporated (Cell Culture Dishes, Bioprocess Containers)

-

Sartorius AG (BIOSTAT Bioreactors, Sartorius Stedim Biotech Single-Use Systems)

-

Eppendorf AG (Bioreactor Systems, Cell Culture Equipment)

-

Danaher (Ultipor Membranes, XRS Bioreactor)

-

Boehringer Ingelheim GmbH (Cell Culture Media, Bioprocess Systems)

-

Applikon Biotechnology (Bioreactor Systems, Control Systems)

-

PBS Biotech, Inc (Wave Bioreactor, Bioreactor Systems)

-

Lonza (CHO Media, Disposable Bioreactors)

-

VWR International, LLC (Bioprocessing Buffers, Single-Use Bioreactors)

-

Meissner Filtration Products, Inc. (Bioprocess Filtration, Single-Use Systems)

-

Repligen Corporation (Protein A Chromatography Resins, Filtration Solutions)

-

Entegris (Bioprocessing Filtration, Single-Use Systems)

-

Kuhner AG (ShakeFlask, Bioreactor Systems)

-

GE Healthcare Life Sciences (Xcellerex Single-Use Bioreactors, HyClone Cell Culture Media)

-

AbbVie (CHO Media, Cell Line Development Services)

-

Fisher Scientific (Nalgene Labware, HyClone Cell Culture Media)

-

Bio-Rad Laboratories, Inc. (Bio-Plex Pro Assays, Protein Purification Systems)

-

Cytiva (Bioprocess Single-Use Systems, Flow Cytometry Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.79 Billion |

| Market Size by 2032 | USD 82.10 Billion |

| CAGR | CAGR of 15.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bioreactors/Fermenters, Cell Culture Products, Filters, Bioreactors Accessories, Bags & Containers, Others) • By Workflow (Media Preparation, Cell Culture, Cell Separation) • By Use Type (Multi-use, Single-use) • By Mode (In-house, Outsourced) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Corning Incorporated, Sartorius AG, Eppendorf AG, Danaher, Boehringer Ingelheim GmbH, Applikon Biotechnology, PBS Biotech, Inc., Lonza, VWR International, LLC, Meissner Filtration Products, Inc., Repligen Corporation, Entegris, Kuhner AG, GE Healthcare Life Sciences, AbbVie, Fisher Scientific, Bio-Rad Laboratories, Inc., Cytiva |

| Key Drivers | • Advancements in Bioprocessing Technologies Transforming the Biopharma Market with Innovation • The Impact of Emerging Biotech Companies on the Upstream Bioprocessing Market Fueling Growth through Novel Therapies and Precision Medicine |

| RESTRAINTS | • Challenges of Technology Integration in the Upstream Bioprocessing Market |