UV Curing System Market Size:

Get more information on UV Curing System Market - Request Sample Report

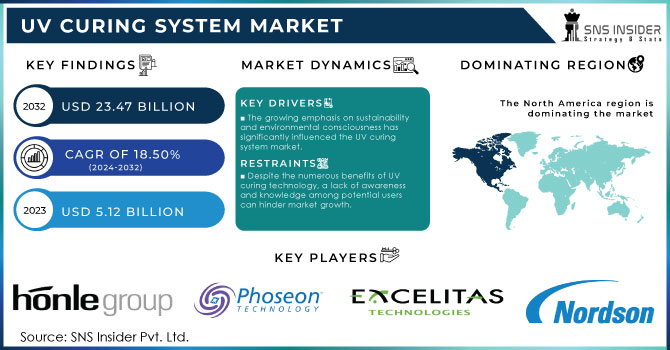

The UV Curing System Market Size was valued at USD 5.12 Billion in 2023 and is expected to reach USD 23.47 Billion by 2032, growing at a CAGR of 18.50% over the forecast period 2024-2032.

The UV curing system market has experienced substantial growth in recent years, primarily driven by the increasing demand for efficient and sustainable curing solutions across various industries. These systems are widely employed in applications such as coatings, adhesives, inks, and 3D printing. Traditional curing methods often rely on volatile organic compounds (VOCs), which can adversely affect both human health and the environment. In contrast, UV curing technology offers a more sustainable alternative by eliminating the need for solvents and significantly reducing emissions. This shift towards eco-friendly practices has compelled manufacturers to adopt UV curing systems to comply with regulatory standards and meet consumer preferences for greener products. Moreover, ultraviolet light exhibits powerful germicidal properties in the UVC range, particularly at a wavelength of 254 nm. In the U.S., healthcare-acquired infections (HAIs) are alarmingly prevalent, with 1 in 20 patients developing infections linked to their hospital stays, according to the Office of Disease Prevention and Health Promotion. Utilizing UV light disinfection in hospitals can eliminate up to 98% of harmful pathogens in operating rooms, enhancing patient safety.

The automotive industry is a significant end-user of UV curing systems, employing them for critical applications such as coating and bonding components. In 2024, organic sales of automotive coatings surged by over 10%, fueled by increased selling prices across all regions and higher sales volumes in the U.S. and Latin America. UV-cured coatings deliver exceptional durability and scratch resistance, vital for automotive finishes. Furthermore, the rapid curing process associated with UV technology enables faster production cycles, allowing manufacturers to enhance their overall productivity. As the automotive sector continues to innovate by incorporating lightweight materials and advanced coatings, the demand for UV curing systems is projected to rise significantly.

UV Curing System Market Dynamics

Drivers

-

The growing emphasis on sustainability and environmental consciousness has significantly influenced the UV curing system market.

Conventional curing techniques like solvent-based curing commonly emit volatile organic compounds (VOCs) which add to air pollution and environmental harm. UV curing technology provides a greener option. UV curing systems use photoinitiators that induce polymerization upon UV light exposure, leading to little to no VOC emissions. This feature is in line with regulations and standards in the industry that aim to minimize environmental impact. As companies work towards incorporating sustainable methods, there is an increasing need for UV curing solutions that are environmentally friendly. The move towards sustainability is not just about following regulations; it also connects with customers. Consumers are more and more choosing products that are eco-friendly and ethically produced. This change in consumer behavior encourages manufacturers to put more money into UV curing technologies that support sustainability objectives, thus growing the market for UV curing systems.

-

The versatility of UV curing systems has led to their widespread adoption across diverse industries.

At first mostly used in the printing and coatings industries, UV curing technology has now been adopted in a variety of sectors such as automotive, electronics, packaging, and medical devices. In the automotive sector, UV curing systems are used for coatings that improve the look and longevity of vehicles. UV-cured coatings are perfect for use in automotive settings due to their exceptional gloss, scratch resistance, and ability to protect against environmental factors. Furthermore, with the automotive industry adopting lightweight materials and advanced manufacturing techniques, UV curing technology offers a viable option for bonding and sealing needs. UV curing technology is also advantageous for the electronics sector, especially in manufacturing circuit boards and components. UV-cured adhesives and encapsulants provide strong thermal stability and electrical insulation, guaranteeing consistent operation in electronic devices. The growing need for compact electronic parts also intensifies the requirement for effective curing solutions. Within the packaging industry, UV curing is utilized for inks and coatings to improve product visibility and provide protection. The quick curing process enables UV curing to be an appealing choice for packaging manufacturers aiming to fulfill consumer needs for fast production speeds.

Restraints

-

Despite the numerous benefits of UV curing technology, a lack of awareness and knowledge among potential users can hinder market growth.

Many manufacturers may not fully understand the advantages and applications of UV curing systems, leading to hesitancy in adopting the technology. The complexity of UV curing processes and the variations in equipment and materials can further complicate the decision-making process for businesses. Potential users may require specialized training to effectively implement and operate UV curing systems, adding to the perceived barriers to entry. Moreover, some industries may have longstanding practices and preferences for traditional curing methods, making it challenging for UV curing technology to gain traction. Changing established practices often requires convincing stakeholders of the benefits, which can be a time-consuming and resource-intensive process. To address this restraint, increased educational efforts and outreach initiatives from manufacturers, industry associations, and training organizations are essential. Raising awareness about the advantages of UV curing technology and providing resources for training and implementation can facilitate its adoption across various sectors.

UV Curing System Market Segmentation

by Technology

The UV LED segment led the UV Curing System Market in 2023 with over 55% market share because of its energy efficiency, extended lifespan, and eco-friendly qualities. In contrast to traditional mercury lamps, UV LEDs produce specific wavelengths, leading to quicker curing and less heat production, especially important for heat-sensitive surfaces. This sector is commonly utilized in sectors such as printing, coatings, and adhesives, where accurate curing is crucial. For example, companies such as Phoseon Technology offer cutting-edge UV LED solutions for industrial use, which increase efficiency and reduce energy usage.

The mercury lamps segment is expected to become the fastest-growing segment during 2024-2032. These lamps are now widely used in industries like automotive, aerospace, and heavy manufacturing, where strong curing options are essential. Companies such as Fusion UV Systems, which is a frontrunner in mercury lamp technology, are constantly developing new solutions to improve curing efficiency for coatings, inks, and adhesives. In addition, companies such as GEW (EC) Limited are creating state-of-the-art mercury-based systems that provide dependability and efficient operation, making them appealing for manufacturing processes.

by Type

The spot cure segment dominated in 2023 with over 45% market share because of its capability to provide intense UV light to precise locations, enabling fast and effective material curing. The spot-curing process reduces waste and energy use by directing UV light precisely for fast curing of adhesives, coatings, and inks. 3M and Henkel employ spot curing technology in electronics manufacturing for bonding applications, guaranteeing sturdy connections and a tidy production setting.

The flood & focused beam is expected to witness the fastest CAGR during 2024-2032, as it utilizes UV light to cure materials on larger surfaces, making it perfect for tasks needing even curing on broad areas. This specific part is commonly used in sectors like printing, coatings, and surface treatments, where ensuring consistent and thorough curing is highly important. Phoseon Technology and other companies use flood curing technology in UV LED curing systems to improve printing process efficiency by ensuring ink is applied and cured evenly.

by Application

The bonding & assembling segment led the UV curing system market in 2023 with around 38% market share because of its broad usage across industries like automotive, electronics, and construction. The technology is especially preferred because it can securely bond different materials, like plastics and metals. 3M and Henkel use UV-curing adhesives in their products to create strong bonds in various applications, from automotive assembly to electronic component manufacturing.

The printing segment is recognized as the most rapidly expanding segment in the UV curing system market during 2024-2032, due to the rising need for top-notch printing options in packaging, labels, and promotional materials. UV curing technology allows for instant drying and curing of inks, increasing printing speed and producing vivid colors and finishes that are smudge and fade-resistant. Heidelberg and Epson are at the forefront, using UV-curable inks in their printing machines to keep up with the increasing need for personalized and eco-friendly packaging options.

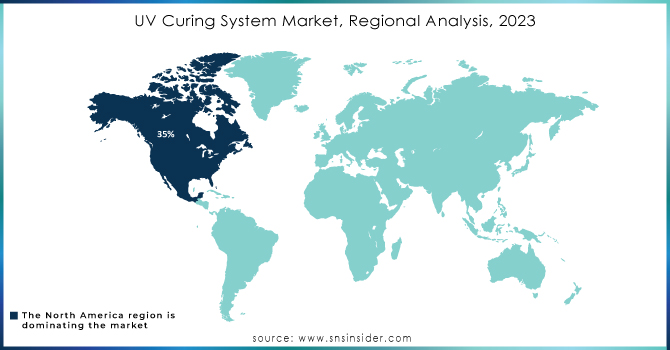

UV Curing System Market Regional Outlook

North America dominated in 2023 with a 35% market share in the UV curing system market, mainly because of its advanced technological infrastructure, solid manufacturing base, and extensive R&D efforts. The area is where top companies such as Heraeus Noblelight, Phoseon Technology, and Dymax are located, playing a key role in advancing UV curing technologies. The automotive, electronics, and packaging sectors are the main drivers of demand in this market. In addition, strict guidelines on VOC emissions have encouraged manufacturers to use UV curing systems, providing environmentally friendly options.

Asia-Pacific region is anticipated to see the fastest expansion during the forecast period 2024-2032, due to the rise in industrial activities and growth in the manufacturing industry. Nations such as China, India, and Japan are at the forefront of this advancement, propelled by growth in the automotive, electronics, and healthcare sectors. Showa Denko Materials, Nippon Steel Corporation, and Ushio Inc. are leading the way by providing cutting-edge UV curing solutions customized for different applications. The increasing need for UV-cured coatings and inks, combined with the region's emphasis on environmentally friendly products, is driving the growth of the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the UV Curing System Market are:

-

Honle AG (Honle UV-LED Curing Systems, Honle LAMP Curing Systems)

-

Phoseon Technology (FireJet FJ200, FireJet FJ100)

-

UV Process Supply (UV Curing Equipment, UV Adhesives)

-

Excelitas Technologies (SPECTRA UV LED Modules, OmniCure Series)

-

GEW (EC) Limited (GEW UV LED Curing Systems, GEW Arc Curing Systems)

-

American Ultraviolet Company (Cure UV LED Systems, AUV Series UV Lamps)

-

Nordson Corporation (BlueMax II UV Curing System, UV Curing Conveyor)

-

Allied Electronics (UV Curing Systems, UV Light Sources)

-

LightSources, Inc. (Lamps for UV Curing, Custom UV Solutions)

-

Miraclean (UV Curing Equipment, UV Coatings)

-

Elekta (UV Light Units, UV Curing Machines)

-

Dymax Corporation (Dymax UV Curing Adhesives, Dymax UV Lamps)

-

Omni International (UV Cure Systems, UV Light Units)

-

Aremco Products (UV Curing Adhesives, UV Curing Equipment)

-

Photonics Group (LED Curing Systems, UV Coating Systems)

-

Hammond Manufacturing (Hammond UV Curing Equipment, UV Light Fixtures)

-

Sika AG (Sika UV Curing Adhesives, Sika UV Coatings)

-

Ultraviolet Devices, Inc. (UVDI UV Curing Systems, UVDI UV Light Sources)

-

Sculpteo (UV Curing Services, UV Resin Products)

-

Violet Defense (Violet Defense UV Systems, Portable UV Disinfection Units)

Suppliers of Raw Materials/Components:

-

3M

-

Henkel

-

Merck Group

-

Huntsman Corporation

-

Ferro Corporation

-

SABIC

-

Covestro AG

-

BASF

-

DSM

-

Eastman Chemical Company

Recent Development

-

April 2024: GEW, the curing systems manufacturer, reported that they are going to launch a new UV-LED system at Drupa that will allow the sheetfed press users to change to Arc or LED in both interdeck and delivery positions as desired for the job. In this system the Arc/LED can be changed for the individual requirements of each job.

-

March 2024: Master Bond introduced a special colour-changing low-viscosity cationic UV curing system UV15RCL. The material is red in colour when poured, but will turn transparent once exposed to UV light. The system has been fully chemistry, extreme temperatures and other similar processing conditions. It has a tensile strength of up to 1300 psi.

-

September 2024: Specialty Coating Systems (SCS) announced the launch of PrecisionCure UVC, a mercury arc UV curing system that provides uniform and efficient UV radiation to deliver appropriate condition for curing of a wide range of materials.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.12 Billion |

| Market Size by 2032 | USD 23.47 Billion |

| CAGR | CAGR of 18.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (UV LEDs, Mercury Lamps) • By Type (Spot Cure, Flood & Focused Beam, Conveyor) • By Pressure Type (High, Medium, Low) • By Application (Printing, Bonding & Assembling, Coating & Finishing, Others) • By Vertical (Life Science & Medical, Consumer Electronics, Industrial & Machinery, Semiconductor, Automotive, Aerospace & Defense, Marine, Energy, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honle AG, Phoseon Technology, UV Process Supply, Excelitas Technologies, GEW (EC) Limited, American Ultraviolet Company, Nordson Corporation, Allied Electronics, LightSources, Inc., Miraclean, Elekta, Dymax Corporation, Omni International, Aremco Products, Photonics Group, Hammond Manufacturing, Sika AG, Ultraviolet Devices, Inc., Sculpteo, Violet Defense. |

| Key Drivers | • The growing emphasis on sustainability and environmental consciousness has significantly influenced the UV curing system market. • The versatility of UV curing systems has led to their widespread adoption across diverse industries. |

| RESTRAINTS | • Despite the numerous benefits of UV curing technology, a lack of awareness and knowledge among potential users can hinder market growth. |