Digital Substation Market Size & Growth:

The Digital Substation Market Size was valued at USD 8.48 Billion in 2025 and is expected to grow at a CAGR of 7.2% to reach USD 16.99 Billion by 2035. The Market is growing rapidly due to rising grid modernization efforts, energy efficiency needs, and renewable energy integration. Digital substations leverage automation, advanced communication networks, and intelligent electronic devices (IEDs) to enhance power distribution reliability while reducing maintenance costs and power losses.

Governments and utilities are heavily investing in smart grid infrastructure to improve grid resilience. The adoption of IEC 61850 standards, along with advancements in fiber-optic communication, cloud-based SCADA, and cybersecurity, is driving market expansion. While North America and Asia-Pacific lead in adoption, challenges like high initial costs and cybersecurity risks remain. Continuous innovation ensures sustained market growth.

Digital Substation Market Size and Forecast:

-

Market Size in 2025 USD 8.48 Billion

-

Market Size by 2035 USD 16.99 Billion

-

CAGR of 7.2% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information on Digital Substation Market - Request Free Sample Report

Digital Substation Market Trends:

-

Rising investments in smart grid modernization and renewable energy integration are accelerating the adoption of digital substations for improved efficiency and reliability.

-

Implementation of IEC 61850 standards enhances interoperability, automation, and communication across substation components, boosting operational performance.

-

Advancements in fiber-optic communication, intelligent electronic devices (IEDs), and cybersecurity are strengthening automation and system protection.

-

Integration of AI, IoT, and cloud-based SCADA systems enables predictive maintenance, real-time monitoring, and optimized asset management.

-

Growing digital transformation and adoption of edge computing and digital twin technologies are enhancing grid flexibility and decision-making efficiency.

The U.S. Digital Substation market size was valued at an estimated USD 3.05 billion in 2025 and is projected to reach USD 5.30 billion by 2035, growing at a CAGR of 7.0% over the forecast period 2026–2035. Market growth is driven by increasing demand for reliable and efficient power transmission and distribution, rising adoption of smart grid technologies, and the need to modernize aging substation infrastructure. Deployment of digital substations enables real-time monitoring, improved operational efficiency, and enhanced fault detection, supporting grid stability and resilience. Additionally, advancements in IEC 61850-based communication protocols, integration of automation systems, and strong utility sector investments further strengthen the growth outlook of the U.S. digital substation market during the forecast period.

Digital Substation Market Growth Drivers:

-

Increasing Adoption of Smart Grid Infrastructure and Renewable Energy Integration Drives Digital Substation Market Growth

The growing focus on modernizing power grids and integrating renewable energy sources is significantly driving the Digital Substation Market. Governments and utilities worldwide are investing in smart grid projects to enhance energy efficiency, reduce power losses, and improve grid reliability. Digital substations facilitate real-time monitoring, automation, and remote control of power networks, enabling seamless renewable energy integration. The adoption of IEC 61850 standards ensures interoperability among digital substation components, enhancing overall operational efficiency.

Moreover, advancements in fiber-optic communication and intelligent electronic devices (IEDs) are further improving substation automation and security. As global energy demand rises, digital substations are playing a crucial role in ensuring stable and resilient power transmission and distribution. The rapid industrialization and electrification of transportation sectors, particularly in regions like North America, Europe, and Asia-Pacific, are also contributing to market expansion. The increasing demand for decentralized power generation and grid flexibility further accelerates market growth.

Digital Substation Market Restraints:

-

High Initial Investment and Complex Deployment Processes Restrict Digital Substation Market Expansion

Despite its benefits, the Digital Substation Market faces challenges due to the high upfront costs associated with implementing digital infrastructure. The transition from conventional to digital substations requires significant capital investment in intelligent electronic devices (IEDs), automation systems, fiber-optic networks, and cybersecurity solutions. Additionally, the deployment process is complex, involving retrofitting existing substations, training personnel, and ensuring compliance with industry standards. Utilities and industries, especially in emerging economies, often hesitate to adopt digital substations due to budget constraints and concerns about return on investment (ROI).

Moreover, integrating digital substations with aging power grid infrastructure requires careful planning and system upgrades, further increasing deployment time and costs. The lack of skilled workforce to manage and maintain digital substations also poses operational challenges. While long-term benefits such as reduced maintenance costs and improved efficiency exist, the initial financial burden remains a major restraint for widespread market adoption.

Digital Substation Market Opportunities:

-

Rising Adoption of IoT, AI, and Cloud-Based SCADA Systems Creates Lucrative Opportunities for Digital Substation Market

The integration of the Internet of Things (IoT), Artificial Intelligence (AI), and cloud-based Supervisory Control and Data Acquisition (SCADA) systems presents significant growth opportunities for the Digital Substation Market. AI-driven predictive analytics enable utilities to proactively identify faults, optimize asset management, and reduce downtime, improving overall grid efficiency. Cloud-based SCADA solutions facilitate real-time remote monitoring and control of digital substations, enhancing operational flexibility and security. The adoption of edge computing and digital twin technology further strengthens decision-making processes and performance optimization.

Additionally, IoT sensors and automation systems enhance data collection, ensuring seamless communication between substations and central control centers. With increasing digital transformation initiatives across the power sector, utilities are leveraging these advanced technologies to modernize their infrastructure. As cybersecurity solutions improve and regulatory frameworks evolve, the demand for AI-driven grid automation and cloud-based power management systems is expected to surge, unlocking new market opportunities.

Digital Substation Market Segment Analysis:

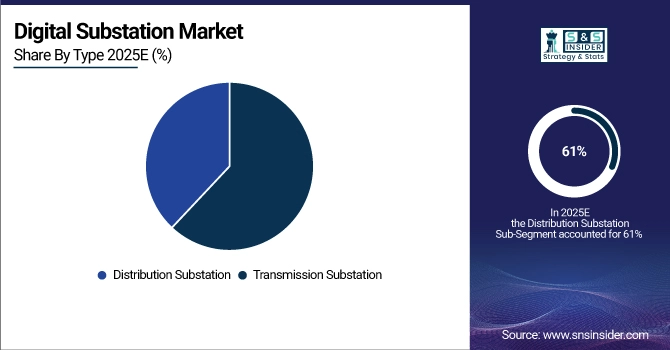

By Type

The Distribution Substation segment held the largest market share, accounting for 61% of total revenue in 2025, driven by the increasing urbanization, industrialization, and expansion of power distribution networks. These substations play a crucial role in stepping down high-voltage electricity to a usable level for commercial, industrial, and residential consumers. The growing adoption of smart grid technologies, automation, and real-time monitoring solutions has accelerated the demand for digital distribution substations.

Additionally, General Electric (GE) Grid Solutions launched an advanced digital switchgear system with integrated IoT sensors and AI-driven analytics, enabling predictive maintenance and reducing downtime. With the rising integration of renewable energy sources and government initiatives for grid modernization, utilities are increasingly deploying digital distribution substations to improve energy efficiency and reliability.

The Transmission Substation segment is expected to witness the highest CAGR of 8.0% during the forecast period, fueled by increasing investments in high-voltage power transmission infrastructure and interregional grid connectivity projects. Transmission substations are essential for efficient long-distance electricity transmission, reducing losses and ensuring stable power delivery. With the rising penetration of renewable energy projects and HVDC (High Voltage Direct Current) networks, the need for advanced digital transmission substations is expanding.

In June 2023, ABB Ltd. launched a modular digital transmission substation solution that integrates artificial intelligence, cloud-based SCADA, and real-time data analytics, enhancing operational efficiency. Similarly, Siemens Energy introduced a next-gen gas-insulated transmission substation with IoT-enabled monitoring, ensuring grid stability and predictive fault detection.

By Module

The hardware segment holds the largest share of the Digital Substation Market, accounting for 53% of total revenue in 2025. This dominance is driven by the increasing deployment of intelligent electronic devices (IEDs), remote terminal units (RTUs), merging units, and fiber-optic communication systems that enhance automation, real-time monitoring, and grid reliability. Leading companies are continuously investing in new product developments to strengthen this segment.

For instance, in July 2023, ABB Ltd. launched an advanced IED platform with enhanced cybersecurity features, ensuring secure data transmission in digital substations. Similarly, Siemens AG introduced its SIPROTEC 5 Protection Relay Series, designed for high-performance grid automation and fault detection.

The SCADA segment is projected to grow at the highest CAGR in the Digital Substation Market, driven by increasing demand for high-performance insulation materials and coatings that enhance electrical equipment durability and efficiency. SB Latex-based polymeric insulators, transformers, and switchgear coatings offer superior moisture resistance, thermal stability, and dielectric properties, making them essential for modern digital substations. These innovations are critical as utilities shift towards smart substations, requiring advanced materials that ensure safety and efficiency. Additionally, stringent environmental regulations are accelerating the adoption of SB Latex-based insulating solutions, reinforcing their role in enhancing substation resilience, reducing outages, and supporting the grid modernization movement.

By Voltage

The 220-500kV voltage segment held the largest revenue share of 43% in 2025, driven by the increasing demand for high-voltage transmission and grid expansion projects. This voltage range is widely used in regional power transmission networks, large industrial plants, and interconnecting renewable energy sources. The rising adoption of HVDC (High Voltage Direct Current) and smart grid technologies has further fueled demand for digital substations operating at 220-500kV.

Additionally, Siemens Energy launched an AI-powered predictive maintenance system for high-voltage substations, enabling real-time condition monitoring and fault detection. Governments and utilities are investing heavily in upgrading aging high-voltage infrastructure to support the increasing integration of renewable energy sources. As countries transition toward decarbonized and resilient power grids.

The Up to 220kV voltage segment is projected to register the Fastest CAGR of 8.21% during the forecast period, driven by the rising demand for medium-voltage distribution networks, urban electrification, and industrial power solutions. Digital substations operating in this voltage range are widely used in distribution networks, renewable energy plants, and commercial infrastructure. The growing emphasis on smart grids, automation, and decentralized energy generation has increased investments in this segment. As utilities and industrial players focus on enhancing grid reliability and reducing power losses, the Up to 220kV segment is set to experience robust growth, driven by technological advancements, regulatory support, and increasing electrification projects worldwide.

By End-Use

The utility segment accounted for 52% of the total revenue share in 2025, driven by the increasing adoption of smart grid technology, renewable energy integration, and grid modernization initiatives. Utilities worldwide are transitioning from traditional substations to digital substations to enhance grid reliability, reduce operational costs, and improve energy efficiency. The shift towards IEC 61850-compliant automation systems is enabling seamless data communication and interoperability in digital substations.

In July 2023, General Electric (GE) Grid Solutions launched an advanced substation automation system for utilities, improving real-time monitoring, fault detection, and predictive maintenance. Similarly, Hitachi Energy Ltd. introduced a cloud-based SCADA platform, enhancing remote operation capabilities for utility-grade digital substations.

The transportation segment is projected to grow at the highest CAGR of 8.7% during the forecast period, fueled by the electrification of railways, metro systems, and electric vehicle (EV) charging infrastructure. As transportation networks become increasingly dependent on efficient and stable power supply, the demand for digital substations is rising. These substations ensure real-time monitoring, automation, and reduced power losses, making them ideal for railway electrification, airport power distribution, and EV charging stations.

Additionally, Eaton Corporation introduced a compact digital substation for metro rail systems, enabling optimized energy management and predictive maintenance. With governments worldwide investing in smart transportation infrastructure and sustainable mobility solutions, digital substations play a critical role in ensuring uninterrupted power supply. The growing focus on green mobility, electrified transport networks, and resilient power systems is set to drive significant market expansion in this segment.

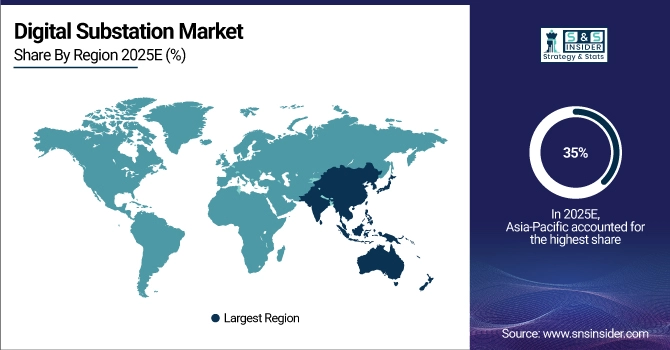

Digital Substation Market Regional Analysis:

Asia Pacific Digital Substation Market Insights

The Asia-Pacific region led the Digital Substation Market in 2025, accounting for an estimated 35% market share, driven by rapid urbanization, industrial expansion, and increasing investments in smart grid infrastructure. Countries like China, India, and Japan are heavily investing in grid modernization, renewable energy integration, and digital transformation of power distribution systems.

For instance, in August 2023, China State Grid Corporation announced a USD 10 billion investment in digital substation projects to enhance grid stability and efficiency. Similarly, India’s Power Grid Corporation is actively deploying IEC 61850-compliant digital substations to support the country’s growing electricity demand and renewable energy projects.

Additionally, Hitachi Energy Ltd. and ABB Ltd. are expanding their operations in the region, launching advanced automation and cloud-based SCADA solutions. With governments focusing on energy security and decarbonization, the Asia-Pacific region is expected to maintain its dominance in the Digital Substation Market in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Digital Substation Market Insights

North America is experiencing the fastest growth in the Digital Substation Market, with an estimated CAGR of 8.3% during the forecast period 2026-2035. The region's growth is driven by significant investments in smart grid technology, modernization of aging power infrastructure, and increasing renewable energy deployment. The United States and Canada are leading the adoption of AI-driven automation, cybersecurity solutions, and IoT-enabled monitoring systems in digital substations.

Additionally, Siemens Energy partnered with multiple North American utilities to develop next-generation digital substations with predictive analytics and remote monitoring capabilities. The growing demand for EV charging networks, data center power management, and industrial electrification is further accelerating the adoption of digital substations.

Europe Digital Substation Market Insights

Europe’s digital substation market is driven by strong regulatory support for smart grid modernization and renewable energy integration. Countries such as Germany, France, and the U.K. are investing heavily in digital infrastructure to enhance grid reliability and efficiency. The region’s focus on carbon neutrality, coupled with advancements in automation, cybersecurity, and AI-driven grid monitoring, is accelerating the deployment of next-generation digital substations.

Latin America (LATAM) and Middle East & Africa (MEA) Digital Substation Market Insights

The LATAM and MEA digital substation markets are witnessing steady growth fueled by power infrastructure modernization and expanding renewable energy projects. Governments are prioritizing grid reliability, automation, and smart energy management to meet rising electricity demand. Investments in SCADA, IoT, and communication technologies are enabling efficient power distribution, while collaborations with global technology providers are enhancing regional grid resilience and operational performance.

Digital Substation Companies are:

-

ABB Ltd. (ABB Ability™ Digital Substation, ABB MicroSCADA X)

-

Siemens AG (Siemens SIPROTEC Digital Protection Relays, Siemens SICAM Digital Substation Solutions)

-

General Electric Company (GE Grid Solutions Digital Substation, GE Multilin Protection Relays)

-

Schneider Electric (Schneider EcoStruxure™ Digital Substation, Easergy T300 Remote Terminal Unit)

-

Honeywell International Inc. (Honeywell Smart Grid Substation Automation, Honeywell Experion SCADA)

-

Cisco Systems Inc. (Cisco Grid Security Solutions, Cisco Industrial Ethernet Switches for Substations)

-

Eaton Corporation plc (Eaton Grid Automation System, Eaton CYME Power Engineering Software)

-

Emerson Electric Co. (Emerson Ovation™ Substation Automation, Emerson Smart Grid Solutions)

-

NR Electric Co. Ltd. (NR PCS Digital Substation Protection System, NR Electric SCADA/EMS Solutions)

-

Hitachi Energy Ltd. (Hitachi Energy Digital Substation, Hitachi Lumada APM for Grid)

Recent Trends

ABB Ltd. is a global leader in electrification and automation, offering advanced solutions for digital substations through its ABB Ability™ platform. In the digital substation market, ABB provides integrated systems for real-time monitoring, protection, and control of power networks. Its innovations in IEC 61850-based communication, intelligent electronic devices (IEDs), and cybersecurity enhance grid reliability, efficiency, and adaptability to renewable energy integration across global utility networks.

-

In December 2024, ABB signed an agreement to acquire Siemens Gamesa's power electronics business, which includes assets in India. This strategic move aims to strengthen ABB's position in the renewable power conversion technology market, enhancing its offerings for high-powered renewable applications.

Siemens Gamesa focuses on advancing digital and renewable energy integration within power infrastructure, offering intelligent substation and grid connectivity solutions. In the digital substation market, the company leverages automation, AI, and data-driven technologies to optimize power flow and grid stability. Siemens Gamesa’s innovations support seamless renewable energy integration, enhanced operational efficiency, and sustainable energy transition, aligning with global smart grid modernization initiatives.

-

In December 2024, Siemens Gamesa, a subsidiary of Siemens AG, agreed to sell its power electronics business to ABB. This divestment allows Siemens Gamesa to focus on its core business areas while entering into a long-term collaboration with ABB for power electronics supply to its turbines.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8.48 Billion |

| Market Size by 2035 | USD 16.99 Billion |

| CAGR | CAGR of 7.2% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Module (Hardware, Fiber-optic Communication Networks, SCADA) • By Type (Transmission Substation, Distribution Substation) • By Voltage (Up to 220kV, 220-500kV, Above 500kV) • By End-Use (Utility, Heavy Industries, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB Ltd., Siemens AG, General Electric Company, Schneider Electric, Honeywell International Inc., Cisco Systems Inc., Eaton Corporation plc, Emerson Electric Co., NR Electric Co. Ltd., Hitachi Energy Ltd. |