InGaAs Camera Market Size & Trends:

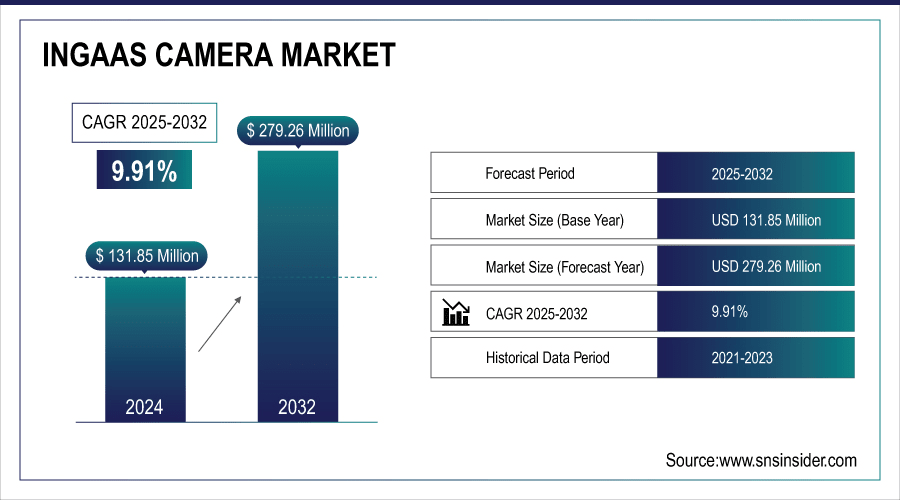

The InGaAs Camera Market Size was valued at USD 131.85 million in 2024 and is expected to reach USD 279.26 million by 2032 and grow at a CAGR of 9.91% over the forecast period 2025-2032.

To Get More Information On InGaAs Camera Market - Request Free Sample Report

The global market growth is driven by the rising demand for high-resolution imaging in low light and infrared conditions in industries like defense, industrial automation and scientific research. The growth of the market is also stimulated by the recent developments in shortwave infrared (SWIR) technology and increasing adoption of InGaAs cameras in smart vision systems in the developed as well as developing countries.

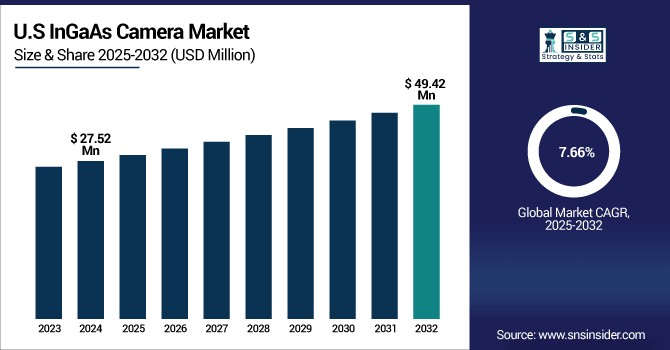

The U.S. InGaAs Camera Market size was USD 27.52 million in 2024 and is expected to reach USD 49.42 million by 2032, growing at a CAGR of 7.66% over the forecast period of 2025–2032.

The US market is growing due to the rising defense spending in emerging countries and technological advancements in ultrasound imaging in the developed markets and rise in adoption of InGaAs cameras in machine vision cameras and industrial cameras, and among others. Growing adoption of InGaAs cameras in military, industrial, and scientific research in the US is boosting demand.

InGaAs Camera Market Dynamics

Key Drivers:

-

The growing adoption of InGaAs cameras in industrial automation enhances quality control and process efficiency.

In the automotive, semiconductor and pharmaceutical sectors InGaAs cameras are more and more involved in the automation for applications like monitoring, quality control and process control. Based on their robustness and large sensitivity values in the short wave infrared they are well–suited for industrial applications. Machine vision-based systems are getting ever more powerful thanks to improvements in machine vision, AI, and IoT; they are capable of predictive maintenance and autonomous quality control, thus, fostering market expansion.

According to research, Over 60% of new industrial automation installations now include AI or IoT components, amplifying the capabilities of imaging solutions like InGaAs cameras.

Restrain:

-

Limited availability of raw materials such as indium and gallium poses challenges to the market.

The shortage of superior quality InGaAs substrates, which mainly consists of indium, gallium and arsenic, constrains the development and availability of InGaAs cameras. Such elements are less plentiful and accessible than silicon, causing supply chain disruptions as well as price and production uncertainty. This includes particularly strict export and use regulations for several materials, which has a dampening effect on the market's expansion.

Opportunities:

-

Integration of InGaAs cameras with AI and machine learning is driving smarter imaging solutions and unlocking new market segments.

The integration of InGaAs imaging cameras with artificial intelligence and machine learning algorithms enables improved image analysis, pattern identification, and automated decision making in a wide variety of applications. The impact of this combination of technologies improves system performance including predictive maintenance, real-time quality checking, and security monitoring providing imaging that is smarter, quicker, and more reliable. As computational power and algorithm sophistication continue to improve at an exponential rate, the possibilities for applied AI-powered InGaAs cameras for new applications and services are growing by the day, creating previously unimagined opportunities in many industries, including manufacturing, environmental monitoring, and defense.

According to research, AI-enhanced InGaAs imaging systems can increase defect detection accuracy by up to 92%, significantly reducing error rates from 19% to 8%.

Challenges:

Stringent export regulations on infrared cameras impede the global distribution and adoption of InGaAs cameras.

InGaAs sensors are considered as advanced imaging devices and as such are controlled under the strictest regulations, especially in military or surveillance applications. These regulations can effectively preclude some manufacturers from truly competing in the global market, which in turn affects the potential market reach and growth potential that these manufacturers may otherwise have enjoyed. They also describe the significant resource and compliance challenges involved in navigating such complex regulatory environments and seeking to expand markets. Furthermore, uncertain changes in international trade policies and geopolitical tensions are affecting global supply chains and jeopardizing the timing of product flowing to certain markets.

InGaAs Camera Market Segment Analysis:

By Scanning Type

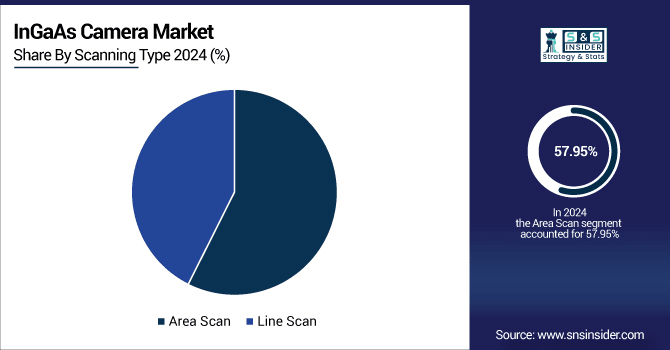

The Area Scan segment dominated the InGaAs Camera Market share the highest of about 57.95% in 2024, due to versatile and well utilization. Area scan cameras generate high-resolution, full-frame images and are suited to applications demanding high spatial resolution, such as industrial inspection and scientific imaging. Because they can record significantly larger areas at once, it allows for faster processing and simpler integration in different systems. Moreover, the development of increasing sensitive sensors and better image quality factors, respectively, has further reinforced their supremacy. An increasing demand for overall imaging solutions in areas including military surveillance and environmental monitoring, has also played a large role in their significant market share worldwide.

The Line Scan segment is expected to grow at the fastest CAGR of about 10.80% from 2025 to 2032, fueled with growing need for continuous and fast imaging applications. Line scan cameras are used, for example, in the semiconductor and web inspection industries and in food processing, which require a non-stop and fast scanning for quality assurance. They can record images line by line and offer a closer look at things on the move. Advancements in sensor technology and the increasing speed of data processing are driving their adoption. This segment is estimated to witness a rapid InGaAs camera market growth worldwide during the forecast period, due to increasing adoption of automation and demand for accurate, real-time imaging on the production lines.

By Cooling Technology

Cooled segment dominated the InGaAs Camera Market with the highest revenue share of about 73.88% in 2024, because of better sensitivity and image quality. Cooled InGaAs cameras reduce thermal noise to allow clearer and more sensitive images, for example, in low-light or long-exposure uses. This makes them very well in defense, astronomy and scientific research where clear and stable image is very important. About FLIR Systems FLIR Systems is a world leader in cooled InGaAs camera technology, with high-end models for advanced applications. With continuous technological innovations that deliver performance and power reduction, cooling system sizes of PSUs also decrease and push the boundary of preferred choice with professional user all over the world.

The uncooled segment is expected to grow at the fastest CAGR of about 11.33% from 2025-2032, because of growing needs for inexpensive and portable imaging systems. The uncooled InGaAs cameras are increasingly popular for the low price, small volume and convenience, as compared with the cooled ones. They find more and more applications in industrial automation, surveillance, and mobile applications in which portability and economy is of great importance. Sensors Unlimited, Inc. also provides uncooled InGaAs cameras for cost-sensitive markets, increasing penetration in new applications. Advances in sensor materials and electronic components are also improving their performance, shrinking the performance gap with cooled cameras.

By Application

The Military & Defense segment dominated the InGaAs Camera Market with the highest revenue share of about 31.84% in 2024, due to growing concerns with security and by technological upgrading. The defence industry is a major user of InGaAs cameras for applications such as night-vision, target acquisition and surveillance, because of their unique capability to deliver performance and response in low-light and difficult conditions. Teledyne Imaging Sensors is a leading provider of robust deployable InGaAs camera solutions fielded in military and defense applications around the world. Geopolitical tensions on upsurge and modernization of military are driving demand for the integration of cameras, to dominate the sector.

The Industrial Automation segment is expected to grow at the fastest CAGR of about 11.01% from 2025-2032, fueled by increasing penetration of machine vision and robotics. InGaAs cameras are also being adopted by industries such as automotive, electronics and pharmaceuticals, for quality control, process monitoring or defect recognition applications. Incorporating these cameras in the context of AI and robotics for increased level of measurements accuracy and automation. Some InGaAs cameras companies, like Xenics NV are major contributor to the industrial automation market segment with their inGaAs cameras aligned with the move to Industry 4.0. Rising trend of investment in smart factories is promoting the demand for these imaging technologies across the globe.

InGaAs Camera Market Regional Outlook:

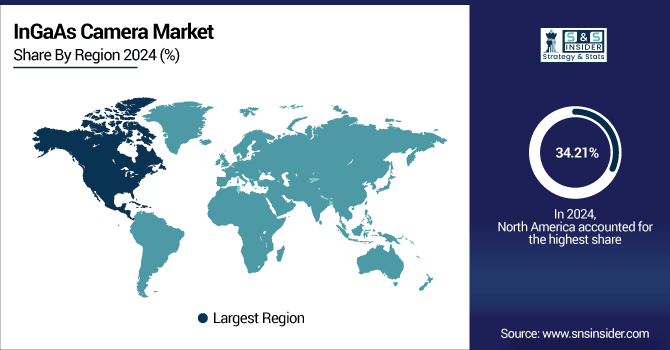

North America had the largest market share of 34.21% due to its advanced technological infrastructure as well as large defense expenditure in 2024. Strong presence of key manufacturers and early adoption of advanced imaging technologies, especially in industries such as military, aerospace and industrial automation together drive the overall market. Moreover, experienced research centers and government support for innovative technology are also contributing to the dominance of the region in the worldwide InGaAs camera market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The United States leads North America due to its large defense budget, existing research institutions, and the manufacturing of InGaAs cameras by several companies. Government funding and early adopters within defense, aerospace, and industrial satisfy the lead in the market.

Asia Pacific segment is expected to grow at the fastest CAGR of about 1153% from 2025-2032, because of the fast-paced industrialization and defense budget expansions in nations such as Japan, China and India. The region’s growing manufacturing industry is developing its applications of advanced imaging for automation, quality control and process optimisation. Government policies that encourage technology innovation and construction of infrastructure are also rising the demand.

China leads the Asia Pacific InGaAs Camera market through heavy investment in military spending, manufacturing automation, and technological innovation. Strong support from government provide a drivers of demand due to a rapidly expanding industrial base, and still expanding surveillance needs.

The InGaAs Camera Market in Europe has a strong base of industrial users and led by these users demanding for advanced technology. Nations like Germany and the U.K. spend heavily on defense, automotive and scientific research, increasing demand. Moreover, stringent laws and regulations pertaining to safety and security drive the demand for superior imaging systems. Continual innovation and cooperation between technology developers and research centres will additionally stimulate the European market and its technological leadership.

Germany is the market leader of the European InGaAs Camera market because of its established industrial sector, commitment to research and development, significant defense spending, and implementation of advanced imaging technologies for industrial automation and scientific applications that can all contribute to regular growth in their respective markets.

Saudi Arabia is driving the Middle East & Africa Market as it has made considerable investment in defense and is building security infrastructure. In South America, Brazil has made the most gains with a rise in industrial automation in addition to a modernization of defense. Both regions are experiencing rising demand for advanced imaging technologies. This is driven by governments in both regions as well as an increased number of applications for surveillance and research.

InGaAs Camera Companies are:

Major Key Players in InGaAs Camera Market are Hamamatsu Photonics K.K., Teledyne Technologies Inc., Allied Vision Technologies GmbH, Sensors Unlimited, Xenics, FLIR Systems Inc., Jenoptik AG, Raptor Photonics Ltd., New Imaging Technologies (NIT), Thorlabs Inc.

Recent Development:

-

In February 2025, Hamamatsu launched the C16795 series InGaAs area image sensor module, featuring a high dynamic range of 3500 and capable of high-speed operations at up to 503 frames per second. This module is designed for hyperspectral imaging applications.

-

April 2025, Xenics announced the release of the Xenics Gobi-640 series, a compact InGaAs camera offering high-resolution imaging in the SWIR range. This camera is aimed at industrial inspection and scientific research applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 131.85 Million |

| Market Size by 2032 | USD 279.26 Million |

| CAGR | CAGR of 9.91% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Scanning Type (Area Scan, Line Scan) • By Cooling Technology (Cooled, Uncooled) • By Application (Military & Defense, Industrial Automation, Surveillance, Safety, and Security, Scientific Research, Spectroscopy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Hamamatsu Photonics K.K., Teledyne Technologies Inc., Allied Vision Technologies GmbH, Sensors Unlimited, Xenics, FLIR Systems Inc., Jenoptik AG, Raptor Photonics Ltd., New Imaging Technologies (NIT), Thorlabs Inc. |