Zinc Oxide Market Report Scope & Overview:

Zinc Oxide Market Report Scope & Overview:

The Zinc Oxide Market size was valued at USD 5.5 Billion in 2023. It is expected to grow to USD 9.03 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period of 2024-2032.

One of the key drivers of the zinc oxide market is the increasing demand for sunscreens and skincare products. With growing awareness about the harmful effects of UV radiation, consumers are increasingly turning to products that offer effective sun protection. Zinc oxide, with its ability to reflect and scatter UV rays, has become a popular choice among manufacturers and consumers alike. Additionally, the rising prevalence of skin diseases and disorders has further fueled the demand for zinc oxide-based pharmaceutical products. The rubber industry is another major consumer of zinc oxide.

The U.S. Food and Drug Administration (FDA) has mandated that sunscreens labeled as "broad spectrum" must protect against both UVA and UVB radiation, further driving the use of zinc oxide in these formulations. These regulations ensure that manufacturers prioritize ingredients like zinc oxide that offer broad-spectrum protection.

This compound is widely used as a vulcanizing agent in the production of rubber goods. It enhances the mechanical properties of rubber, improving its durability and resistance to heat, organic chemicals, and abrasion. The increasing demand for automobiles and the subsequent growth of the automotive industry have significantly contributed to the demand for zinc oxide in the rubber sector. Furthermore, the ceramics industry has also witnessed a surge in the use of zinc oxide. This compound is added to ceramic glazes to enhance their brightness and opacity.

In 2021, EverZinc established Zano, state-of-the-art zinc oxide production after the acquisition of “Umicore’s” production plant. Zano is the ultra-fine particle of zinc oxide, used particularly in the rubber and ceramics industry.

The rubber industry is still one of the most important consumption sectors for zinc oxide. In particular, it is widely used in the automotive sector in the production of tires. As a vulcanizing agent, ZnO contributes to the increased resistance to wear, temperature, and mechanical strength of tires. The growing demand for high-performance tires due to the increasing consumption of vehicles drives the consumption of ZnO. Moreover, the pace of Electric Vehicle production has increased the need for rubber, which has to have higher characteristics. In 2022, the total number of sold EVs in the world has reached 10.5 million units.

Drivers

-

Rising demand for rubber products, especially in the automotive industry

-

Growing awareness regarding the benefits of zinc oxide in personal care products

Zinc oxide possesses exceptional properties that make it highly desirable for use in various products such as sunscreens, cosmetics, and skincare items. Zinc oxide acts as a physical barrier against harmful ultraviolet (UV) rays emitted by the sun. This UV protection attribute has made zinc oxide a crucial ingredient in sunscreens, ensuring the prevention of sunburns, premature aging, and even skin cancer. Moreover, zinc oxide exhibits excellent soothing and healing properties, making it an ideal component in skincare products. Furthermore, zinc oxide is non-comedogenic, meaning it does not clog pores. The growing awareness of these remarkable benefits has led to an increased demand for zinc oxide in personal care products.

Moreover, government data supports the demand for zinc oxide in personal care. For instance, the Centers for Disease Control and Prevention report that over 1 in 3 Americans get sunburned each year, suggesting a high demand for a protective agent such as zinc oxide sunscreens. Similarly, The World Health Organization states that anywhere from 70 to 90% of skin cancer cases develop due to exposure to UV radiation, reiterating the high demand for UV-blocking material such as zinc oxide in personal care products.

Restraint

-

Fluctuating prices of raw materials, particularly zinc metal

-

Stringent regulations regarding the use of zinc oxide in certain applications, such as in food and pharmaceuticals

Zinc oxide, a versatile compound with numerous applications, faces limitations due to strict regulations imposed on its usage in specific sectors, particularly the food and pharmaceutical industries. In the food industry, concerns regarding its potential health risks, lead to the implementation of stringent regulations. These regulations aim to control the amount of zinc oxide used in food products, ensuring that it remains within safe limits and does not pose any harm to consumers. Similarly, in the pharmaceutical industry, zinc oxide is utilized in various medications and topical creams due to its antimicrobial and anti-inflammatory properties. However, the regulatory authorities have imposed strict guidelines to ensure the safety and efficacy of these products.

Market segmentation

By Grade

Standard grade dominated the zinc oxide market in 2023, in terms of grade. Standard grade is a versatile form having a broad range of applications meeting standardized technical specifications. Activities in commercial applications are developed to have an appropriate balance between costs and quality. They are available in high purity, controlled particle size, and are white or off-white, sticking to standardized specifications. They are used in various industries including the rubber industry. The product acts as a reinforcing agent and accelerator activator in rubber, enabling superior performance and durability.

The Food and Chemical Codex (FCC) grade has multi-utility in the food industry, as in the food product it is used as a safe fortifying agent and supplements to fight zinc deficiency levels. Apart from this, the product is used as a processing aid, as, in the food industry, it is used as an anti-caking and pH regulator in dairy products and bakery products. The increasing focus on fortification and the increasing zinc deficiency level is expected to increase the demand for the food industry in the forecasted period.

By Process

The indirect (French) process dominated the zinc oxide market with the highest revenue share of about 78.5% in 2023. This is due to its properties, as it is widely recognized as the fastest and most efficient method of production. The quality of ZnO manufactured depends on the type of zinc utilized in the process. For instance, the production of gold seals or pharmaceutical-grade ZnO requires the use of special high-grade zinc with a concentration of 99.99%, while ordinary zinc with a concentration of 99.95% is sufficient for producing zinc for the rubber industry. It is worth noting that the maximum yield of ZnO obtained from 1 ton of special high-grade zinc is 1.2 tons.

By Form

In 2023, the powder form segment accounted for the highest revenue at 76.9% and is expected to remain dominant throughout the forecast period. This is attributed to the fact that it is increasingly used in a number of applications such as batteries, lubricants, friction materials, gold extraction, silver extraction, spray galvanizing, and others. Zinc oxide in powder form is mainly used for providing UV and corrosion protection to paints and as a catalyst in various chemical processes. A very fine zinc oxide powder consists of irregular particles that are about 4 to 10 microns. It is also used in the manufacturing of zinc-rich paint formulations and in the production of chemicals such as sodium hydrosulfite, zinc phosphide, and others. The traits of fine powder ZnO are mainly used in the varied purpose industries.

By Application

Automotive Applications held the largest market share in 2023. The tire industry’s growth has been majorly responsible for increased utilization as most of the rubber produced is used in automobiles or in the manufacturing of the tire. It is used for vulcanization. Further, it is used as a cross-linking or curing agent for halogen-containing elastomers such as polysulfides and neoprene.

Ceramics is the second major application of the product used in the tiles industry. It is an accepted choice for the production of ceramics as it has some of properties such as low coefficient of expansion, high heat capacity, high-temperature stability, and thermal conductivity.

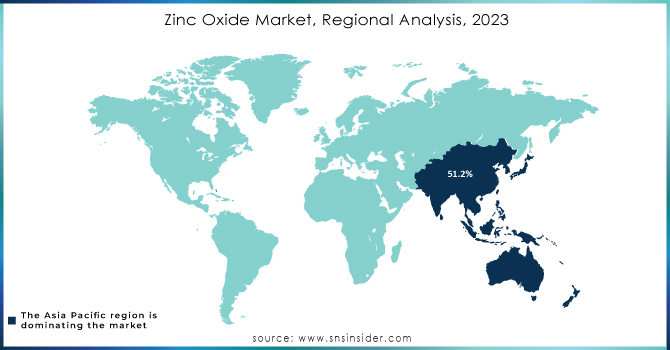

Regional Analysis

Asia Pacific dominated the Zinc Oxide Market with the highest revenue share of about 51.2% in 2023. In India, China, Japan, and South Korea, the automobile industry is witnessing substantial growth, fueled by increasing consumer demand and technological advancements. Zinc oxide is widely used in the production of tires, rubber components, and industrial coatings, making it an essential ingredient in the automotive sector. The construction industry in these countries is also booming, driven by urbanization, infrastructure development, and government initiatives. Zinc oxide finds extensive application in paints, coatings, and ceramics, contributing to the growth of the construction sector. Furthermore, the personal care and cosmetics industries are experiencing a surge in demand for products that offer protection against harmful UV rays.

Additionally, the expanding pharmaceutical industry is expected to drive the demand for ZnO due to its various beneficial properties, including anti-inflammatory, antiseptic, drying, and ultraviolet protection capabilities. According to the India Brand Equity Foundation, the pharmaceuticals industry in India currently fulfills more than 51% of the global demand for different vaccines, making it the third-largest pharmaceuticals industry worldwide. Furthermore, the Indian Economic Survey reveals that the domestic pharmaceuticals market in India reached a value of USD 43 billion in 2021, and this figure is projected to reach USD 67 billion by the end of 2024.

North America is expected to grow with a CAGR of about 5.6% in the Zinc Oxide Market during the forecast period. The presence of a vast manufacturing industry, including various sectors such as automotive, construction, and electronics drives the demand for zinc oxide in this region. Zinc oxide finds extensive application in these industries, primarily due to its exceptional properties, including UV protection, anti-corrosion capabilities, and conductivity. As a result, the demand for zinc oxide in North America has witnessed a significant surge, propelling the zinc oxide market in this region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

LANXESS (Zinc Oxide Activator ZOA)

-

Zochem (ZnO HP Zinc Oxide)

-

EverZinc (Zano Zinc Oxide)

-

U.S. Zinc (USP Zinc Oxide)

-

Neo Zinc Oxide (Nano Zinc Oxide Powder)

-

Tata Chemicals Ltd. (ZincOx Zinc Oxide)

-

Upper India (Zinc Oxide – Active Grade)

-

Pan-Continental Chemical Co. Ltd. (Zinc Oxide Powder)

-

Zinc Oxide Australia (Ultra-Fine Zinc Oxide)

-

Rubamin (Zinc Oxide - White Seal)

-

Ace Chemie Zynk Energy Limited (High Purity Zinc Oxide)

-

Akrochem Corporation (Zinc Oxide - Feed Grade)

-

Weifang Longda Zinc Industry Co. Ltd. (Rubber Grade Zinc Oxide)

-

AG CHEMI GROUP (Zinc Oxide 99.7%)

-

Yongchang Zinc Industry Co., Ltd. (Pharmaceutical Grade Zinc Oxide)

-

Zinc Nacional (Zinc Oxide Premium)

-

Global Chemical Co., Ltd. (Zinc Oxide 99% Industrial Grade)

-

Industrias Peñoles (Zinc Oxide Feed Grade)

-

Grillo-Werke AG (Zinc Oxide Battery Grade)

-

J.G. Chemicals Pvt Ltd. (Zinc Oxide – White Seal)

Recent Development:

-

In 2023, Zochem, a prominent player in the French process zinc oxide (ZnO) production industry, has revealed their plans to expand production capacity at their facility in Dickson, TN.

-

In July 2022, Tata Chemicals successfully developed nano zinc oxide (nZnO), an innovation that boasts enhanced anti-fungal, anti-microbial, and UV-blocking properties. This remarkable advancement has significant implications for various sectors, including industrial and cosmetic applications such as cosmetics, paints/coatings, adhesives, plastics, and personal care products.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.5 Bn |

| Market Size by 2032 | US$ 9.03 Bn |

| CAGR | CAGR of 5.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Standard, United States Pharmacopeia (USP), Treated, Food and Chemical Codex (FCC), and Others) • By Process (Direct (American) Process, Indirect (French) Process, Wet Chemical Process, and Others) • By Form (Powder, Liquid, and Pellets) • By Application (Rubber, Chemical, Paints & Coatings, Ceramics, Cosmetics and Personal Care, Automotive, Construction, Agriculture, Pharmaceuticals, Electronics & Semiconductors, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | LANXESS, Zochem, EverZinc, U.S. Zinc, Neo Zinc Oxide, Tata Chemicals Ltd., Upper India, Pan-Continental Chemical Co. Ltd., Zinc Oxide Australia, Rubamin, Ace Chemie Zynk Energy Limited, Akrochem Corporation, Weifang Longda Zinc Industry Co. Ltd., AG CHEMI GROUP, Yongchang zinc industry Co., Ltd. |

| Key Drivers | • Rising demand for rubber products, especially in the automotive industry • Growing awareness regarding the benefits of zinc oxide in personal care products |

| Market Restraints | • Fluctuating prices of raw materials, particularly zinc metal • Stringent regulations regarding the use of zinc oxide in certain applications, such as in food and pharmaceuticals |