Vector Database Market Report Scope & Overview:

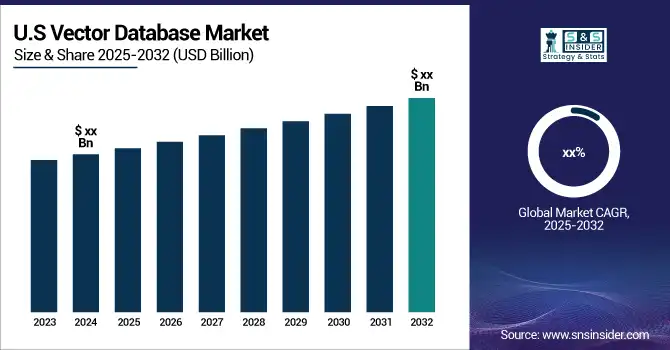

The Vector Database Market was valued at USD 1.97 Billion in 2024 and is expected to reach USD 10.60 Billion by 2032, growing at a CAGR of 23.38% from 2025-2032.

To Get more information on Vector Database Market - Request Free Sample Report

The Vector Database Market is experiencing rising adoption across industries, with sectors like finance, healthcare, and e-commerce leveraging vector search for AI-driven applications. Scalability & performance benchmarks in 2023 emphasize improvements in retrieval speed, real-time search, and indexing efficiency. Integration with AI/ML workloads varies by region, with North America and Asia-Pacific leading in AI-powered implementations. Cloud vs. on-premise deployment trends show a growing preference for hybrid solutions, balancing cost, security, and performance. Additionally, the report highlights advancements in vector search algorithms, increasing investments in open-source databases, and emerging regulatory considerations for AI-driven data storage.

Market Size and Forecast:

-

Market Size in 2024: USD 1.97 Billion

-

Market Size by 2032: USD 10.6 Billion

-

CAGR: 23.38% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Vector Database Market Trends

-

Rising adoption of generative AI and LLMs driving demand for vector databases to support semantic search and embeddings.

-

Increasing use of vector search in recommendation systems, fraud detection, and personalization across industries.

-

Growth of cloud-native and hybrid deployments as enterprises balance scalability with data security needs.

-

Expanding adoption of open-source vector databases like Milvus, Weaviate, and Pinecone for cost efficiency and flexibility.

-

Integration of vector databases with existing relational and NoSQL systems to enable multi-modal data management.

-

Rising importance of real-time search and analytics for chatbots, customer service, and e-commerce applications.

Vector Database Market Growth Drivers

-

The increasing use of AI-driven applications, such as recommendation engines and fraud detection, is fueling the demand for vector databases.

The Increasing adoption of AI and machine learning in industries such as finance, healthcare, e-commerce, and cybersecurity, among others, is one of the key drivers driving the growth of the vector database market. These databases allow for quick and precise similarity search and are key to AI-powered applications such as recommendation engines, fraud detection, and natural language processing. Organizations are focusing on high-performance data storage and retrieval solutions to get real-time insights and predictive analytics. Rapid vector databases adoption driven by demand for vector search from AI applications with large language models. In addition to this, a rise in market growth is being driven by cloud-native deployments and open-source developments.

Vector Database Market Restraints

-

The technical complexity and high costs associated with infrastructure, skilled personnel, and data management limit the widespread adoption of vector databases.

Vector databases offer many benefits, but come with high complexity and implementation overhead, which carries the risk of low adoption. Enterprises need to set aside funds for dedicated infrastructure, talent and data pipelines — ideally for smooth integration with existing AI and big data ecosystems. The need for significant compute resources to maintain and scale vector databases further increases the operational costs. Wider Systems Adoption in Absence of Budgets — Smaller enterprises run on limited budgets and therefore having or using such systems might be something they will find hard to implement. On top of that, the learning curve for vector database architecture and indexing methods is quite steep, which has hindered their adoption to only those companies with developed AI and extensive data processing capabilities.

Vector Database Market Opportunities

-

The need for fast, AI-powered search and retrieval solutions in industries like healthcare, e-commerce, and cybersecurity is driving market growth.

The growing demand for search and retrieval of live data is opening new market opportunities for vector databases in all business sectors. Businesses are using vector search more than ever before for various use cases such as personalized recommendations, anomaly detection, and smart search engines. Such applications, ranging from customer service to drug discovery and autonomous systems, require a data management solution that efficiently handles vector data. Finally, the rise of hybrid cloud environments is enabling organizations to use vector databases in a broader range of settings. With open-source innovation and improved indexing techniques, modern vector databases are becoming more accessible and scalable for diverse use cases.

Vector Database Market Challenges

-

Storing and processing vast amounts of sensitive data in vector databases raises concerns about privacy, security, and regulatory compliance.

Since vector databases manage and analyze enormous amounts of sensitive data, data privacy and security continue to pose major issues. AI-driven applications require large datasets, i.e., user behavior, facial detection, financial records, etc., which are almost always subjected to unauthorized access and data breach. Deploying and managing systems can be challenging with ever-changing data protection regulations like GDPR and CCPA. Adversarial attacks on vector search algorithms can also compromise data integrity, which can cause the AI output to produce biased or manipulated results. To tackle these security challenges, vector databases need solid techniques such as encryption, access control and regulatory compliance.

Vector Database Market Segment Analysis

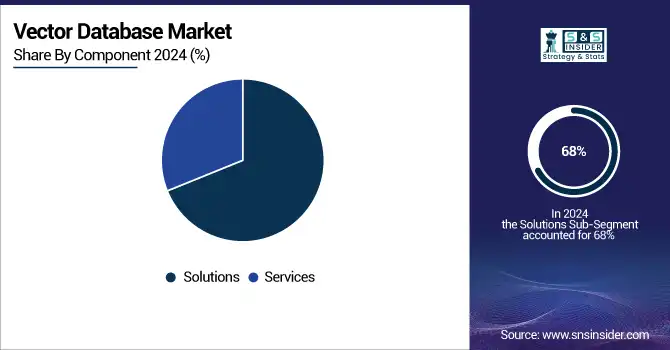

By Component

In 2023, The Solutions segment dominated the market and accounted for 68% of revenue share. These solutions include vector generation tools for crawling and creating data to be embedded, vector search for efficiently searching data, and storage & retrieval solutions to ensure that data is valid and retrievable. The demand for advanced spatial data analytics continues with industries like transportation, logistics, urban planning, and others driving demand ahead.

The services segment is expected to register the fastest CAGR during the forecast period. Vector database consulting and implementation services are critical for organizations to evaluate and implement relevant vector database solutions and integrate them into existing IT infrastructures. These services are important to teach users how to use the solution at its best. Training users and emphasizing their best usage. Continuous operational support services: These services are to help clients in dealing with small technical problems to enhance the overall performance of the solution.

By Technology

In 2023, natural language processing (NLP) segment held the largest revenue share and it is expected to continue its growth trend due to rising demand for efficient textual as well as semantic analysis. Unlike general-purpose databases, vector database solutions are designed to handle vectors for words, phrases, and documents, which are heavily used for tasks across NLP applications like sentiment analysis, language translation, content recommendation systems.

The computer vision segment is expected to register the fastest CAGR during the forecasted period, driven by increasing adoption of machine learning and deep learning models based on vector representations of images. These representations can be stored in most vector database solutions, which will allow these features to be efficiently retrieved and manipulated to support different tasks like image recognition, object detection, and video analysis.

By Vertical

The IT & ITeS segment dominated the market and held the largest revenue share in 2023, with the growing utilization of data-intensive applications in this end-use sector. Vector database solutions provide the capabilities to effectively store, query, and process the complex data structures these applications require, at scale. Some of the key applications are focused on providing enterprise IT infrastructure that includes scalable solutions for managing structured and unstructured data, applications development and testing, cloud computing and big data analytics.

The retail & e-commerce segment is expected to register the fastest CAGR during the forecast period. Vector database solutions play a crucial role in personalized customer experiences driven by data analytics, allowing retailers and e-commerce players to harness the power of text search, and image and video search to efficiently store, analyze, and deploy customer data into meaningful personalized recommendations and promotions.

Vector Database Market Regional Analysis

North America Vector Database Market Insights

The North America dominated the market and accounted for 39 % revenue share in 2023 owing to the early adoption of advanced technologies across various industries including IT, healthcare, finance, and retail. The push for technology in the region feeds the demand for data management solutions like vector databases. The North America vector database market is propelled by the high concentration of major players in cloud computing, artificial intelligence, and big data analytics sectors, that volumes of investment and innovations related to technologies, which require efficient data storage, retrieval, and analysis capabilities provided by vector database solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Vector Database Market Insights

The Asia Pacific region is expected to register the fastest CAGR during the forecasted period. The explosion of e-commerce and digital payments in the region is built around using vector databases to store large amounts of transactional and customer information; power targeted marketing efforts; and improve supply chain efficiency.

Europe Vector Database Market Insights

Europe is expected to account for 28.5% of the global vector database market in 2024, driven by strong adoption in AI-driven applications across various industries, including automotive, financial services, and retail. Countries like Germany, France, and the UK are leading investments in semantic search, recommendation systems, and knowledge graph integrations powered by vector databases. Europe’s strict data sovereignty and GDPR compliance requirements are also pushing enterprises toward hybrid and private cloud deployments. Additionally, significant R&D spending, academic-industry collaborations, and public sector initiatives in AI reinforce Europe’s role as a competitive player in the global market.

United States Vector Database Market Insights

The United States dominates the global vector database market, holding 77.34% share in North Ameria region in 2024, driven by large-scale adoption across hyperscalers, fintech, e-commerce, and healthcare. The rapid rise of generative AI platforms, large language models (LLMs), and enterprise-grade vector search tools has positioned the U.S. as the global leader. Tech hubs such as Silicon Valley, New York, and Boston continue to drive innovation, supported by strong venture capital funding and strategic investments by cloud providers like AWS, Microsoft, and Google. With its advanced AI ecosystem and AI-first enterprises, the U.S. maintains a strong competitive advantage in scaling vector database adoption.

Latin America (LATAM) Vector Database Market Insights

Latin America captures 12.1% of the vector database market in 2024, fueled by accelerating digital transformation in Brazil, Mexico, and Chile. The region is witnessing growing adoption of AI-enabled recommendation engines in e-commerce, fraud detection in banking, and predictive analytics in logistics. Government initiatives promoting AI research and smart infrastructure projects are also creating opportunities for vector database providers. While still in a growth phase compared to Europe and the U.S., LATAM’s expanding tech ecosystem and digital-first enterprises position it as an attractive emerging market.

Middle East & Africa (MEA) Vector Database Market Insights

The Middle East & Africa region is expected to hold 17.1% of the global vector database market share in 2024, driven by increasing investments in AI-driven government digitalization, healthcare analytics, and smart city initiatives. Countries such as Saudi Arabia and the UAE are deploying vector databases for national AI strategies, while South Africa is advancing adoption in fintech and retail. The region’s focus on economic diversification, combined with the rapid development of digital infrastructure, is creating fertile ground for the adoption of vector databases. MEA’s growing emphasis on cloud-first strategies and partnerships with global AI providers further strengthens its market position.

Competitive Landscape for Vector Database Market

Pinecone

Pinecone is a U.S.-based vector database company specializing in scalable and high-performance similarity search solutions for AI-driven applications.

-

In February 2024, Pinecone raised $100 million in a Series B funding round, bringing its valuation to $750 million. The funding is aimed at expanding product capabilities, strengthening enterprise adoption, and accelerating innovation in AI-powered vector search.

Weaviate

Weaviate is a Netherlands-based open-source vector database provider, known for its semantic search and multimodal data management capabilities.

-

In March 2024, Weaviate secured $50 million in Series B funding to enhance its open-source vector search engine. The investment is expected to support R&D in hybrid search capabilities and drive global adoption across enterprise AI ecosystems.

Qdrant

Qdrant is a Germany-based vector search engine startup offering high-performance similarity search solutions tailored for unstructured data.

-

In May 2024, Qdrant was recognized as one of Berlin’s hottest startups, highlighting its rapid growth and innovation in building scalable vector database solutions. The recognition underscores its role in enhancing AI’s ability to handle unstructured and multimodal data efficiently.

Vector Database Market Key Players

The major key players along with their products are

-

Pinecone – Pinecone Vector Database

-

Weaviate – Weaviate Vector Search Engine

-

Milvus – Milvus Open-Source Vector Database

-

FAISS (Facebook AI) – FAISS Library

-

Chroma – Chroma AI-native Vector Database

-

Vespa – Vespa Vector Search Engine

-

Qdrant – Qdrant Vector Similarity Search

-

Redis – Redis Vector Search

-

Zilliz – Zilliz Cloud

-

Annoy (Spotify) – Annoy Approximate Nearest Neighbors Library

-

Vald (Yahoo Japan) – Vald Vector Search Engine

-

ElasticSearch – ElasticSearch k-NN Search

-

Google Vertex AI – Vertex AI Matching Engine

-

Alibaba Cloud – Alibaba Cloud AnalyticDB for AI

-

Microsoft Azure AI – Azure Cognitive Search with Vector Search

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.97 Billion |

|

Market Size by 2032 |

USD 10.60 Billion |

|

CAGR |

CAGR of 23.38% From 2025 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-202 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Solution, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

|

Company Profiles |

Pinecone, Weaviate, Milvus, FAISS (Facebook AI), Chroma, Vespa, Qdrant, Redis, Zilliz, Annoy (Spotify), Vald (Yahoo Japan), ElasticSearch, Google Vertex AI, Alibaba Cloud, Microsoft Azure AI |