Softgel Capsule Market Size Analysis:

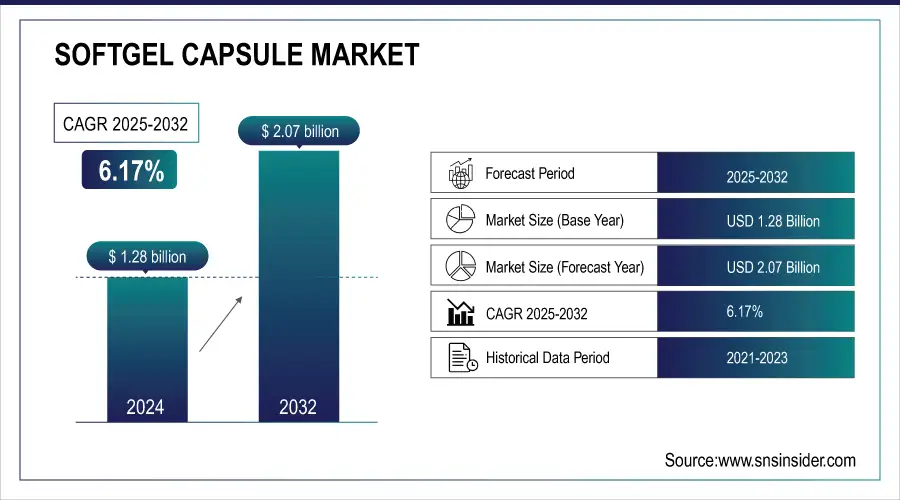

The Softgel Capsule Market size was estimated at USD 1.28 billion in 2024 and is expected to reach USD 2.07 billion by 2032, growing at a CAGR of 6.17% from 2025 to 2032.

The Softgel Capsule market is growing rapidly, driven by technological advancements and changing consumer preferences in pharmaceuticals and nutraceuticals. Softgels enhance bioavailability, improve absorption, and allow precise dosing, making them ideal for fat-soluble vitamins, essential oils, and certain drugs. Innovations like 3D capsule printing enable personalized formulations, while improved encapsulation techniques increase stability and reduce costs. Rising demand in dietary supplements, chronic disease management, and aging populations further fuels growth. Companies such as Catalent are leveraging cost-efficient, sustainable production methods to expand accessibility and popularity of softgel capsules.

Additionally, the rising prevalence of chronic diseases and the aging population are significant drivers of softgel consumption. According to a study published in the Journal of Clinical Epidemiology, the global population of people aged 60 and older is projected to reach 2.1 billion by 2050.

Get more information on Softgel Capsule Market - Request Sample Report

Softgel Capsule Market Size and Forecast

-

Market Size in 2024: USD 1.28 Billion

-

Market Size by 2032: USD 2.07 Billion

-

CAGR: 6.17% from 2025 to 2032

-

Base Year: 2023

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Softgel Capsule Market Trends

-

Rising demand for dietary supplements, nutraceuticals, and pharmaceutical products is driving softgel capsule adoption.

-

Advancements in encapsulation technology are improving bioavailability and stability of active ingredients.

-

Increasing focus on convenient, easy-to-swallow dosage forms is boosting consumer preference.

-

Growth of e-commerce and OTC healthcare products is expanding market reach.

-

Rising awareness of preventive healthcare and wellness trends is fueling demand.

-

Innovations in plant-based and gelatin-free capsules are catering to vegan and specialty segments.

-

Collaborations between pharmaceutical, nutraceutical, and contract manufacturing organizations are accelerating product development and distribution.

Softgel Capsule Market Growth Drivers

-

Increasing Demand for Natural and Organic Supplements

The growing preference for natural and organic products is a major driver for the softgel capsule market. Consumers are becoming more health-conscious and are increasingly seeking plant-based and herbal supplements for their wellness needs. Softgel capsules are well-suited to encapsulate these ingredients, ensuring better bioavailability and efficacy, which boosts their popularity in the nutraceutical industry. For example, softgels are widely used for delivering plant extracts like turmeric, ginseng, and ashwagandha, which have significant health benefits. As consumer awareness about the potential side effects of synthetic supplements increases, the demand for natural alternatives continues to rise, positioning softgel capsules as the ideal choice. This trend is particularly prevalent in regions where health-conscious lifestyles are gaining traction, creating a favorable environment for growth in the softgel segment.

-

Rising Chronic Disease Prevalence and Long-Term Medication Needs

The increasing prevalence of chronic diseases like cardiovascular diseases, diabetes, and arthritis are contributing significantly to the demand for softgel capsules. These conditions often require long-term medication, and softgel capsules provide an ideal solution for consistent, effective treatment delivery. Softgels allow for the encapsulation of both solid and liquid forms of medication, making them highly versatile in pharmaceutical applications. Moreover, their controlled-release formulations help ensure that medications are delivered gradually, improving patient compliance and reducing the frequency of dosing. As the global population ages and the incidence of chronic illnesses rises, the need for easy-to-use, efficient drug delivery systems like softgel capsules continues to grow. This trend highlights softgel capsules as a preferred option in long-term treatments, thus expanding their role in the healthcare and pharmaceutical sectors.

Softgel Capsule Market Restraints

-

High Manufacturing Costs and Complexity

One of the key restraints for the softgel capsule market is the relatively high manufacturing costs and complexity involved in production. Softgel capsules require specialized equipment, skilled labor, and precise quality control to ensure proper encapsulation, which can lead to higher production costs compared to other dosage forms like tablets or powders. Additionally, the need for high-quality raw materials, such as gelatin or vegetarian alternatives, further contributes to increased costs. The production process for softgels is also more time-consuming due to the need for precise formulation, drying, and packaging, making it less cost-effective for manufacturers with budget constraints. Small-scale manufacturers, in particular, may struggle to meet the demand for softgel capsules due to these high operational costs, which can limit the overall market growth. Consequently, the affordability and cost-effectiveness of alternative delivery forms may hinder softgel market expansion, particularly in price-sensitive regions.

Softgel Capsule Market Segmentation Analysis

By Type

-

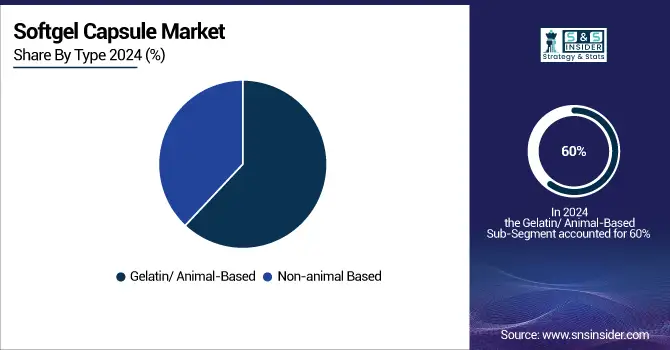

Gelatin-based softgel capsules dominated while Non-animal-based softgel capsules are projected to grow fastest

In 2024, gelatin-based or animal-based softgel capsules continued to dominate the market, accounting for over 60% of the total share. The high dominance of this segment can be attributed to gelatin's widespread use due to its established manufacturing processes, cost-effectiveness, and ability to provide stable, easily digestible capsules. Gelatin capsules are highly versatile and capable of encapsulating both solid and liquid formulations. This makes them ideal for a variety of applications, including pharmaceutical products and dietary supplements. Despite growing concerns over animal-based products, gelatin remains the preferred choice for manufacturers and consumers due to its reliability and performance.

The non-animal-based segment is experiencing the fastest growth. This growth is largely driven by the increasing demand for vegan and plant-based products, particularly as more consumers adopt ethical and sustainable lifestyles. The non-animal-based softgel market, made from materials such as hydroxypropyl methylcellulose (HPMC), is becoming increasingly popular due to its compatibility with vegan and vegetarian diets.

By Application

-

Vitamins & Dietary Supplements led while Health Supplements are expected to grow fastest

In 2024, the Vitamins and Dietary Supplements segment was the dominant application for softgel capsules, capturing 32.3% of the market share. This dominance is attributed to the growing consumer demand for essential vitamins such as Vitamin D, Omega-3 fatty acids, and other fat-soluble nutrients. Softgel capsules are preferred in this segment because of their superior bioavailability, ensuring effective absorption of fat-soluble vitamins, which are difficult to absorb in other forms. With an increasing focus on preventive healthcare, immunity, and overall wellness, consumers are turning to softgel capsules for convenient, high-quality supplementation.

The Health Supplements segment is the fastest-growing application for softgel capsules, reflecting the increasing global demand for general wellness products. As more consumers adopt healthier lifestyles and focus on proactive health management, the need for daily health supplements is on the rise. Softgel capsules are favored in this category due to their ease of consumption and ability to encapsulate a wide variety of ingredients, including herbal extracts, probiotics, and multivitamins. This growth is particularly noticeable in regions with aging populations, where individuals are seeking products to support overall health, vitality, and longevity. The growing shift toward natural health solutions and personalized nutrition further propels the expansion of the health supplements segment, making it the fastest-growing in the softgel capsule market.

Regional Insights

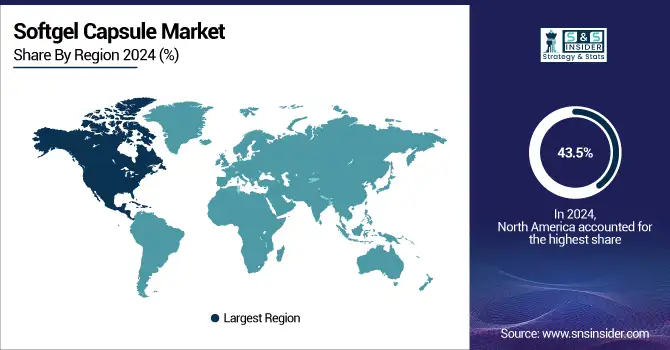

North America Softgel Capsule Market

North America was the largest market with 43.5% for softgel capsules in 2023, primarily driven by the robust demand for health supplements and vitamin products. The region’s dominance was largely attributed to the presence of leading pharmaceutical companies and a growing base of health-conscious consumers, particularly in the United States. The rising focus on preventive healthcare and the aging population further amplified the demand for softgel capsules, particularly for daily vitamins and supplements.

Need any customization research on Softgel Capsule Market - Enquiry Now

Asia Pacific Softgel Capsule Market

The Asia-Pacific region is witnessing the fastest growth in the softgel capsule market, fueled by the rapid development of the nutraceutical industry across countries like India, China, and Japan. A growing middle class with rising disposable income and increased health awareness are key drivers of the region’s growth. Additionally, the increasing adoption of vegan and plant-based supplements has led to a surge in demand for non-animal-based softgels, further accelerating the market’s expansion. As consumers in the region lean toward healthier lifestyle choices, Asia-Pacific is poised to become a significant force in the softgel capsule market.

Europe Softgel Capsule Market

Europe holds a significant share in the Softgel Capsule market, driven by high demand for dietary supplements, vitamins, and pharmaceutical softgels. Growing health awareness, an aging population, and strong nutraceutical adoption contribute to market expansion. Advanced manufacturing infrastructure, strict regulatory standards, and technological innovations in encapsulation and 3D printing further support the growth of softgel capsules across European countries.

Middle East & Africa and Latin America Market

The Middle East & Africa and Latin America are emerging markets for softgel capsules, fueled by increasing health awareness, rising disposable incomes, and growing demand for dietary supplements and pharmaceuticals. Government initiatives supporting healthcare infrastructure, along with expanding retail and e-commerce channels, are driving adoption. These regions present significant growth opportunities for manufacturers focusing on nutraceutical and pharmaceutical softgel products.

Competitive Landscape:

Catalent, Inc.

Catalent, Inc. is a leading player in the Softgel Capsule market, offering advanced manufacturing solutions for dietary supplements, vitamins, and pharmaceuticals. The company focuses on high-quality softgel production, including customized formulations and nutraceutical products. With state-of-the-art technologies, Catalent enhances bioavailability, stability, and patient compliance, supporting global demand for efficient, convenient, and effective softgel capsule delivery across pharmaceutical and nutraceutical sectors.

-

2025: Catalent introduces OptiGel DR: A delayed-release softgel for both pharmaceutical and nutritional supplements that supports a wide range of ingredients and formulations, enhancing targeted delivery.

-

2025: Catalent offers OptiShell Technology: A gelatin-free, plant-polysaccharide shell enabling “hot-filling” of highly viscous or semi-solid drug formulations.

-

2025: Catalent unveils Vegicaps Capsules: A plant-derived shell softgel capable of handling more APIs and higher fill temperatures, avoiding gelatin-related cross-linking issues.

Fuji Capsule

Fuji Capsule is a prominent manufacturer in the Softgel Capsule market, specializing in high-quality softgels for dietary supplements, nutraceuticals, and pharmaceutical applications. The company focuses on precision dosing, enhanced bioavailability, and improved ingredient stability. Leveraging advanced manufacturing technologies, Fuji Capsule delivers reliable and effective softgel solutions that meet global standards, catering to growing consumer demand for convenient, easy-to-swallow, and efficient health and wellness products.

Key Players in the Softgel Capsule Market:

-

Fuji Capsul

-

CAPTEK Softgel International Inc

-

Thermo Fisher Scientific Inc.

-

EyePoint Pharmaceuticals, Inc

-

Catalent, Inc.

-

Aenova Group

-

Lonza Capsules & Health Ingredients

-

ProCaps Laboratories, LLC

-

Soft Gel Technologies, Inc.

-

ACG

-

Bright Pharma Caps

-

CapsCanada Corporation

-

Roxlor

-

SNAIL Pharma Industry

-

SUHEUNG Co., Ltd.

-

Sunil Healthcare Limited

-

QUALICAPS

-

Nectar Lifesciences Ltd

| Report Attributes | Details |

| Market Size in 2024 | USD 1.28 Billion |

| Market Size by 2032 | USD 2.07 Billion |

| CAGR | CAGR of 6.17% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Gelatin-Based/Animal-Based, Non-Animal-Based] • By Application [Antacid and Anti-Flatulent Preparation, Anti-Anemic Preparations, Anti-Inflammatory Drugs, Antibiotic and Antibacterial Drugs, Cough and Cold Preparations, Health Supplement, Vitamin and Dietary Supplements, Pregnancy] • By End-use [Pharmaceutical Companies, Nutraceutical Companies, Cosmeceutical Companies, Contract Manufacturing Organization] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fuji Capsule, Sirio Pharma Co., Ltd., CAPTEK Softgel International Inc., Thermo Fisher Scientific Inc., EyePoint Pharmaceuticals, Inc., Catalent, Inc., EuroCaps, Aenova Group, Lonza Capsules & Health Ingredients, ProCaps Laboratories, LLC, Soft Gel Technologies, Inc., Gelita AG, PB Leiner (part of Tessenderlo Group), Nitta Gelatin, Inc., Sterling Gelatin and Croda Colloids, Narmada Gelatines Limited, Italgel S.r.l., Darling Ingredients Inc., Lapi Gelatine S.p.a., Trobas Gelatine B.V., Weishardt, India Gelatine & Chemicals Ltd., Xiamen Gelken Gelatin Co., Ltd., Gelco International, Boom Gelatin, Geliko LLC, Kenney & Ross Limited Marine Gelatin, Baotou Dongbao Bio-Tech Co., Ltd., Jellice Gelatin & Collagen, Athos Collagen Pvt. Ltd., Kubon Biotechnology Co., Ltd., C.J. Gelatine Products Limited, American Gelatin, and Geltech. |