Commercial Printing Market Size & Overview

Get More Information on Commercial Printing Market - Request Sample Report

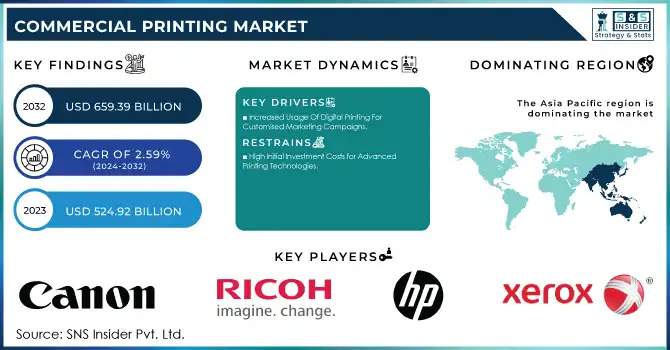

The Commercial Printing Market Size was valued at USD 524.92 Billion in 2023 and is expected to reach USD 659.39 Billion by 2032 and grow at a CAGR of 2.59% over the forecast period 2024-2032.

The Commercial Printing Market has gone through tremendous growth in 2023 and 2024, with many key players from countries such as the United States, Japan, China, France, Germany, and India. Evidently, the industry has been embracing digital transformation and green practices under the support of changing government policies. It is now common to notice the reduction of carbon footprints across the European Union, especially in the context of the adoption of environmentally friendly inks and recyclable paper.

Also in India, Penguin Random House India (PRHI) has announced moving its books to production on 100% recycled paper. The paper is manufactured from raw material certified according to the Forest Stewardship Council (FSC) standards, an international, non-profit organisation that caters to promoting responsible management of the world's forests. However, the United States has turned to tax incentives to drive investments in advanced printing technologies. Vast changes in the market are also being driven by technological advances, which are creating opportunities for speed and cost-effectiveness in AI-driven automation and digital and lithographic printing.

Some of the significant launches of 2023-24 are high-speed digital presses and biodegradable ink solutions to cater to the ever-growing demand for environmentally conscious printing. For example, for the year 2024, Landa Digital Printing has unveiled the newest version of its market leader in B1 digital print technology in the form of the Landa S11 and S11P Nanographic Printing Presses. The new Landa models deliver extreme production flexibility, with print speeds going as high as 11,200-sph. This innovation is especially suitable in light of the soaring need for on-demand printing and personalized packaging due to growing e-commerce and change in consumer preferences.

High-quality customized packaging has become highly sought after globally, and companies have turned to innovative ways of packaging their products to increase product appeal and branding. Also, personal marketing campaigns have extended digital printing to dynamic and variable data requirements. As revealed by the government and industry reports, in 2023, 60% of businesses around the world focused on personalized and sustainable printing solutions.

Commercial Printing Market Dynamics

Key Drivers:

-

Growing Demand for Eco-friendly And Sustainable Printing Solutions.

Governments and companies continue embracing green initiatives, such as Japan's 2023 policy of reduced carbon emissions, to provide subsidies for environmentally-friendly printing technologies. The consumer-friendly appeal of sustainable practices-from the use of biodegradable inks to recycled paper-can be aligned with ESG goals for corporations, boosting demand. In 2023, 60% of U.S.-based businesses reported prioritizing suppliers that are eco-friendly. This change also brings with it possibilities of innovations such as waterless printing and energy-saving machinery, which will push the market towards a greener future.

-

Increased Usage Of Digital Printing For Customised Marketing Campaigns.

The demand for customized printing solutions has increased due to targeted marketing. As digital printing enables large volume print runs of variable data prints in a time and cost effective manner, it is essential in case of promotional campaigns that demand customization. In 2023 e-commerce is also on the rise, and therefore 48% of businesses in India are investing in personalized packaging and marketing materials. These advances — ranging from AI integration to cloud-based printing technologies — are increasing turnaround time and lowering cost, making widespread implementation of digital printing in retail and healthcare more common.

Restrain:

-

High Initial Investment Costs for Advanced Printing Technologies.

Innovation is expensive and particularly when it comes to printing equipment, investment becomes a serious concern for SMEs. This results in a high initial cost for high end technologies such as digital press and AI-based systems, thus it is a capital-intensive investment. The cost of equipment is one of them, for instance, a high-end digital press may cost more than USD 250,000 and hence may not be in reach for smaller businesses. This is a huge disabler in the context of Indian and Chinese markets, even in the situations, where the governments offer hefty incentives to drive green transitions among SMEs.

Another source of financial pressure is the maintenance and operation costs of such equipment. This constraint is hampering the speed of technological assimilation and hence depriving such markets from growth potential, particularly in price-sensitive economies. Exploration of leasing models and public-private partnerships to help address the problem are ongoing but not enough to close the gap entirely.

Commercial Printing Market Key Segments

by Technology

In 2023, Commercial Printing Market remained dominated by Lithography segment, which accounted for 39% of the share in the market due to the cost-effectiveness and efficiency in delivering high-quality outputs for large-scale projects. It’s established use in various industries such as publishing and packaging further cements its prominence.

The Digital Printing segment is expected to see fasted growth at a projected CAGR of 3.97% from 2024-2032. This growth is facilitated by digital printing versatility, where printing variable data quickly and on demand with fast turnaround times is achievable. More so than ever before, this is desired for advertising, packaging, and e-commerce applications. With consumers steadily leaning towards customization, digital printing is dynamically ramping in the industry.

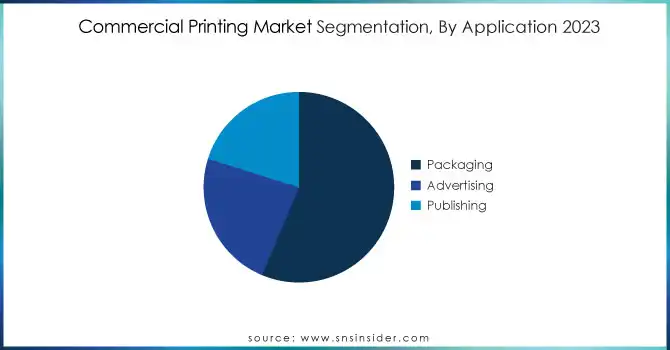

by Application

Packaging segment dominated the Commercial Printing Market in 2023 with 56% of the market share, indicating the increasing demand for environmentally friendly and aesthetically appealing packaging solutions across industries. Notably, the growth of e-commerce and FMCG sectors in countries such as China and India has enhanced packaging innovations.

It is anticipated that the Advertising segment will register the highest CAGR of 2.91% during the forecast period (2024-2032), owing to the growing investment on targeted marketing campaigns and large format advertisements.

All segments continue to innovate, with advances in printing technologies — including faster digital presses and improvements in ink formulations —meeting the evolving demands of the market.

Commercial Printing Market Regional Outlook

In 2023, Asia Pacific region held the largest share of the Commercial Printing Market with a 35% share. That derives from the robust manufacturing sectors of China, India, and Japan and the increasing employment of high-tech printing processes. These countries promise innovation: India's "Make in India" program from 2023 means investment in printing technology in India.

Asia-Pacific to register highest CAGR of 2.95% during forecast period (2024-2032) due to rise in e-commerce and sustainable printing solutions. Research shows that North America and Europe collectively share a healthy percentage supported by the adoption of technological advancements, along with increasing sustainability efforts.

Need any customization research on Commercial Printing Market - Enquiry Now

Key Players

Some of the major players in the Commercial Printing Market are

-

Xerox Corporation (Digital Printing, Managed Print Services)

-

HP Inc. (Wide-Format Printers, Ink Cartridges)

-

Canon Inc. (Production Printers, Imaging Solutions)

-

Ricoh Company, Ltd. (Digital Production Systems, Workflow Solutions)

-

Eastman Kodak Company (Printing Plates, Digital Printing Solutions)

-

Fujifilm Holdings Corporation (Offset Printing Plates, Inkjet Systems)

-

Konica Minolta, Inc. (Industrial Printers, Color Management Software)

-

R.R. Donnelley & Sons Company (Commercial Printing, Publishing Solutions)

-

Quad/Graphics Inc. (Packaging Solutions, Marketing Services)

-

Deluxe Corporation (Checks, Promotional Products)

-

Dai Nippon Printing Co., Ltd. (Photocatalytic Printing, Functional Printing)

-

Toppan Printing Co., Ltd. (Packaging Materials, Security Printing)

-

Cimpress (Custom Printing, Online Print Solutions)

-

Vistaprint (Business Cards, Marketing Materials)

-

Transcontinental Inc. (Flexible Packaging, Print Media)

-

Multi-Color Corporation (Label Printing, Decorative Packaging)

-

WestRock Company (Corrugated Packaging, Folding Cartons)

-

Mondi Group (Specialty Papers, Sustainable Packaging)

-

Flexprint LLC (Managed Print Services, Workflow Automation)

-

Printful (On-Demand Printing, Custom Merchandise)

Major Suppliers (Components, Technologies)

-

BASF SE (Printing Inks, Specialty Chemicals)

-

DuPont (Printing Plates, Specialty Polymers)

-

Flint Group (Inks, Printing Consumables)

-

Sun Chemical (Pigments, Coatings)

-

Siegwerk Druckfarben AG (Printing Inks, Coatings)

-

Dow Chemical Company (Adhesives, Printing Resins)

-

3M Company (Adhesive Tapes, Coatings)

-

ArjoWiggins (Specialty Papers, Substrates)

-

UPM-Kymmene Corporation (Paper Products, Pulp)

-

International Paper (Paperboard, Packaging Materials)

Recent Trends

-

March 2023: Kodak showcased its Prosper Ultra 520 press at the Hunkeler Innovation Days in late February 2023, the next generation of its continuous inkjet technology. Kodak is the only one of the major single pass inkjet press manufacturers to use continuous inkjet and the company claims that this allows it to get greater ink coverage for more demanding jobs while still achieving high print speed.

-

December 2024: Konica Minolta has recently-launched new model of industrial inkjet printhead KM800, which series supports the numerous types of ink with internal heating.

-

January 2024: Kodak Moments, a leader in photo products and services globally, has announced it is extending its partnership with multi-national retailer Carrefour in France. The firms have introduced a cross-channel photo website designed, operated, and managed by Kodak Moments entirely with Carrefour's cooperation in co-branding and marketing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 524.92 Billion |

| Market Size by 2032 | USD 659.39 Billion |

| CAGR | CAGR of 2.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Digital Printing, Lithography Printing, Flexographic, Screen Printing, Gravure Printing, Others), • By Application (Packaging, Advertising, Publishing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Xerox Corporation, HP Inc., Canon Inc., Ricoh Company, Ltd., Eastman Kodak Company, Fujifilm Holdings Corporation, Konica Minolta, Inc., R.R. Donnelley & Sons Company, Quad/Graphics Inc., Deluxe Corporation, Dai Nippon Printing Co., Ltd., Toppan Printing Co., Ltd., Cimpress, Vistaprint, Transcontinental Inc., Multi-Color Corporation, WestRock Company, Mondi Group, Flexprint LLC, Printful. |

| Key Drivers | • Growing Demand For Eco-friendly And Sustainable Printing Solutions. • Increased Usage Of Digital Printing For Customised Marketing Campaigns. |

| Restraints | • High Initial Investment Costs For Advanced Printing Technologies. |