Smartphone Processors Market Size & Trends:

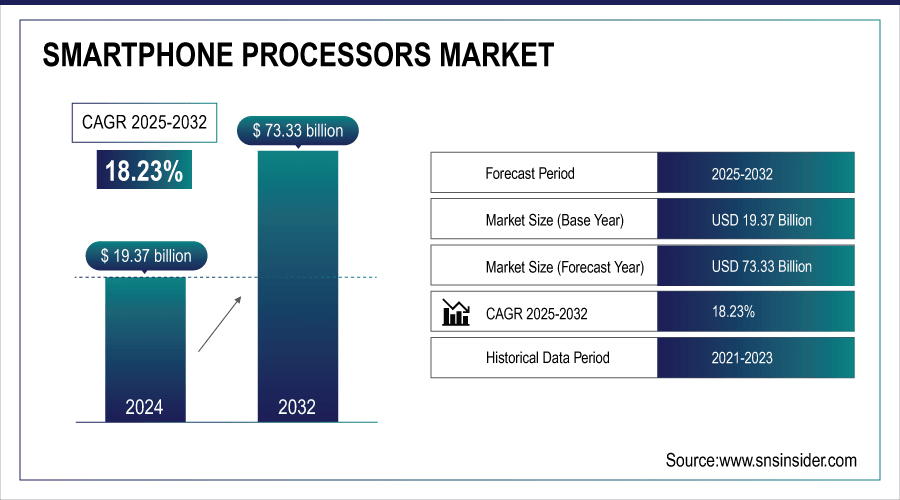

The Smartphone Processors Market Size was valued at USD 19.37 billion in 2024 and is expected to reach USD 73.33 billion by 2032 and grow at a CAGR of 18.23% over the forecast period 2025-2032.

To Get More Information On Smartphone Processors Market - Request Free Sample Report

The global smartphone processors market is growing rapidly because of the increasing demand for more efficient, faster, and intelligent mobile phones. Chip technologies advancements, e.g., AI and 5G enablement, are transforming user experiences. Increased smartphone penetration and demands for better performance and power efficiency are major drivers of the market's further growth globally.

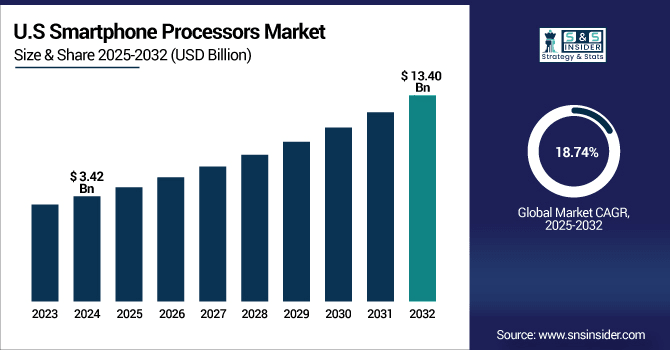

The U.S. Smartphone Processors Market size was USD 3.42 billion in 2024 and is expected to reach USD 13.40 billion by 2032, growing at a CAGR of 18.74% over the forecast period of 2025–2032.

The U.S. market for smartphone processors is dominated by fierce competition between top chip makers and a high focus on innovation. Major technology firms' presence and sophisticated manufacturing facilities spur fast take-up of latest processors. Besides, regulatory aspects and supply chain dynamics directly influence the market, fostering its dynamic development and technological excellence in the region.

According to research, more than 90% of advanced smartphone chips used in the U.S. are still manufactured in East Asia, indicating a high dependency on global supply chains.

Smartphone Processors Market Dynamics

Key Drivers:

-

Rising Adoption of 5G Technology and AI Integration Significantly Drives Global Smartphone Processors Market Expansion

The growing use of 5G technology and AI functionalities on smartphones is a primary trend for the smartphone processors market. These technologies demand stronger, more efficient processors to support faster data rates, real-time artificial intelligence calculations, and improved graphics. As users continue to demand improved performance and intelligent features, companies are heavily investing in creating processors that enable these technologies. This trend fuels market expansion by evoking innovation and expanding applications for next-gen chipsets on different smartphone segments worldwide.

According to research, Modern 5G and AI-enabled smartphones require up to 2x more processing power and 40% better energy efficiency compared to previous-generation devices.

Restrain:

-

Supply Chain Disruptions and Semiconductor Shortages Restrict Growth of the Market Globally

Persistent supply chain interruptions, such as raw material shortages and production delays, are significant detractors impacting the smartphone processors market. The worldwide semiconductor shortage has resulted in longer lead times and higher production costs, reducing processor availability. These issues cause product launch delays and lower manufacturers' capabilities to respond to increasing demand, affecting revenue and curtailing the smartphone processors market growth. Such disturbances also prompt firms to find substitute suppliers or invest in local production to avoid risks, but the market growth as a whole is constrained in the short run.

Opportunities:

-

Emerging Markets’ Expanding Smartphone User Base Presents Significant Growth Opportunities for Processor Manufacturers

Growing markets within the Asia-Pacific, Africa, and Latin America regions provide huge scope for smartphone processor expansion with increased smartphone penetration and growing disposable incomes. Consumers here are migrating from feature phones to smartphones, and therefore, there is enormous demand for cheap, efficient processors. There is also increased investment in network infrastructure and digital services that enable the uptake of sophisticated mobile technologies. The chipmakers who make cost-efficient chips and collaborate with local OEMs can leverage this growing user group to considerably enhance market share.

Challenges:

-

Intense Competition and Rapid Technological Advancements Pose Key Challenges to Sustained Growth in Smartphone Processor Market

The smartphone processor industry is threatened by stiff competition from established players continuously driving new technologies. Fast innovation cycles necessitate high R&D spending and rapid responsiveness to shifting consumer demands. Small players struggle to match the pace of industry leaders, leading to market consolidation. It also becomes tough to balance power efficiency with performance and deal with rising production costs, making it harder to develop products. These conditions make it a challenging business where sustaining competitive edge and profitability is still a major issue for everyone in the market.

Smartphone Processors Market Segment Analysis:

By Technology

System-on-Chip (SoC) Technologies dominated the smartphone processors market with a 42.08% revenue share in 2024 due to their high integration and power efficiency. Top players such as Qualcomm with Snapdragon series and Apple with A-series chips keep on introducing sophisticated SoCs with AI acceleration and 5G connectivity. These advancements help improve performance and power savings, making SoCs the core of smartphone processor development. SoC dominance is a testament to their pivotal role in powering today's smartphones and fueling market expansion.

The System-in-Package (SiP) Technologies segment is expected to have the fastest CAGR of 19.48% from 2025 to 2032, based on its capability of putting several chips together in a small module for enhanced performance and space saving. Samsung and TSMC have introduced innovative SiP solutions with 5G and AI workload support. This trend supports smartphone processors market trends for smaller, yet more powerful components, allowing manufacturers to build thinner devices with greater capabilities.

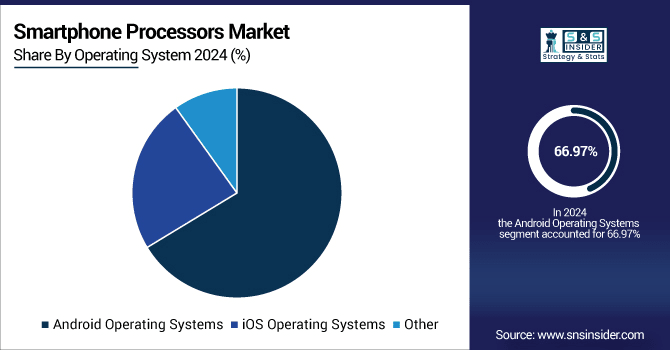

By Operating System

The Android Operating Systems segment dominated the highest smartphone processors market share of 66.97% in 2024 because of widespread usage among different smartphone brands like Samsung, Xiaomi, and OnePlus. These brands are constantly releasing phones fueled by sophisticated processors that are tuned for Android's open platform, supporting customization and extensive app compatibility. The prevalence of Android OS drives demand for adaptable and high-performance smartphone processors, cementing its central position in determining the global smartphone processors market.

The iOS Operating Systems segment is expected to have the fastest CAGR of 20.00%, driven by Apple's relentless innovation with its A-series and M-series processors. New iPhone models frequently come equipped with upgraded SoCs improving performance and energy efficiency specially designed for iOS. This high growth rate in the iOS segment demonstrates robust customer loyalty and Apple's commitment to seamless hardware-software integration that has a profound impact on the market scenario.

By Core Type

The Octa Core processors segment dominated the market with a 42.82% revenue market share in 2024 and are preferred to offer high performance and multitasking efficiency. Device manufacturers like MediaTek have introduced feature-rich octa-core chips like the Dimensity 9200, boosting game and AI functions. This leadership testifies to customers' preferences for processors that equally prioritize speed and power consumption, affirming octa-core's position as the driving force in accelerating innovation and expansion in the global market.

Hexa Core is expected to have the fastest CAGR of 20.10% from 2025 to 2032 due to increasing demand for mid-range smartphones with effective performance at relatively cheaper prices. Smartphone processors companies like Unisoc have launched hexa-core processors such as the T616, which is powered for general activities with enhanced power efficiency. The growth is consistent with increasing smartphone penetration in developing countries, reflecting the growing influence of the hexa-core segment on the overall growth of the market.

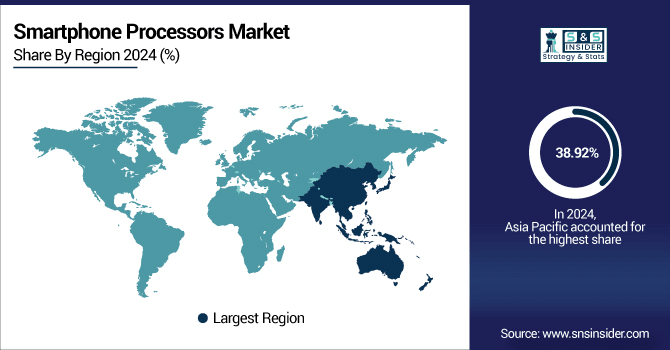

Smartphone Processors Market Regional Outlook:

The Asia Pacific region market dominated the highest revenue share of 38.92% during 2024, owing to increased smartphone penetration and growing digital infrastructure. The local and regional key players emphasize creating affordable, high-performance processors that suit the varied needs of consumers. The high demand coupled with a growing manufacturing ecosystem makes Asia Pacific a critical hotspot for innovation and manufacturing, hugely contributing to the growth and technological advancement of the global market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

China leads the Asia Pacific market with its huge consumer base, cutting-edge semiconductor manufacturing facilities, robust government backing, and presence of top local chipmakers spearheading innovation and adoption of low-cost technology across the region's fast-expanding smartphone market.

The North America region is expected to have the fastest CAGR of 19.46% during the period between 2025 and 2032, driven by rising demand for advanced processors in high-end smartphones and future technologies such as AI and AR. A number of startups and technology companies in the region are pushing processor design with security and power efficiency at the core. The strategic investments coupled with innovation focus enable North America to play a key role in determining the future direction of the market.

-

The US leads the North America market due to being the hub of semiconductor technology, home to most of the largest tech companies, significant R&D investments, and an advanced manufacturing industry, leading to high performance processor advancements and availability of high-end smartphones.

The market in Europe is growing at a steady rate, owing to rise in demand for advanced mobile technologies and surge in smartphone penetration. The area is dominated by innovations in the field of energy-saving and secure processors, with tech companies well placed to collaborate with academics. In addition, the increasing penetration of 5G and adoption of AI-based devices propel market growth.

-

Germany has a monopoly on the market of Europe due to its high tech infrastructure, high R&D spending, and high industrial base. The leadership promotes innovation and manufacturing, and hence the country emerges as the one largest contributor to the rise in the region over France, UK, Italy, and Spain.

The UAE is dominating the Middle East & Africa market, driven by aggressive digitalization and robust tech investment, while Brazil is leading Latin America through its extensive population and increasing smartphone penetration. Both nations contribute to regional expansion through promoting demand for sophisticated, low-power smartphone processors in the context of expanding digital infrastructure.

Smartphone Processors Companies are:

Major Key Players in Smartphone Processors Market are Qualcomm, Apple Inc., MediaTek Inc., Samsung Electronics, Huawei, Unisoc, Intel Corporation, Google, Rockchip, NVIDIA and others.

Recent Development:

-

In January 2024, Samsung Electronics introduced the Exynos 2400, marking a return to high-end processors with a 10-core CPU and RDNA 3-based GPU.

-

In February 2025, Apple Inc. released the A18 Pro debuted with the iPhone 16 series, built on a 3nm process for enhanced performance and energy efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.37 Billion |

| Market Size by 2032 | USD 73.33 Billion |

| CAGR | CAGR of 18.23% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (System-on-chip Technologies, System-in-package Technologies, Multi-chip Module Technologies, Other) • By Operating System (Android Operating Systems, iOS Operating Systems, Other) • By Core Type (Dual Core, Quad Core, Hexa Core, Octa Core, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Qualcomm, Apple Inc., MediaTek Inc., Samsung Electronics, Huawei , Unisoc, Intel Corporation, Google, Rockchip, NVIDIA. |