Virology Specimen Collection Market Report Scope & Overview:

Get more information on Virology Specimen Collection Market - Request Sample Report

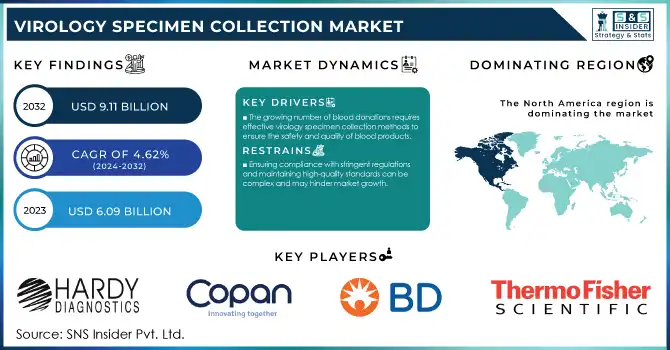

The Virology Specimen Collection Market Size was valued at USD 6.09 billion in 2023 and is expected to reach USD 9.11 billion by 2032 and grow at a CAGR of 4.62% over the forecast period 2024-2032.

The rapid growth of the global virology specimen collection market is primarily attributed to the rising incidence of viral diseases, the continuous occurrence of new viral pathogens, and the rising demand for reliable diagnostic tests. It can be primarily attributed to global health readiness initiatives, the establishment of pandemic response structures, and continuing surveillance and monitoring measures. The growth of the market owes to government funding and grants and such national investments for virology-based research or development of lab diagnostic capabilities have encouraged the establishment of virology testing laboratories in many countries. Owing to the COVID-19 pandemic, the demand for virology specimen collection products has been further enhanced with several manufacturers increasing their production to keep pace with the rising testing needs. For instance, Puritan Medical Products scaled up production of nasal swabs for COVID-19 testing to over 1 million a week. Other viral infections, including HIV/AIDS, have also been gradually on the rise which has additionally driven the market. According to the Joint United Nations Programme on HIV/AIDS, approximately 39.0 million people worldwide will be living with HIV in 2022, emphasizing the continuous demand for efficient methods of collecting virology specimens.

Moreover, the World Health Organization's report of approximately 118.54 million blood donations collected globally in June 2023 highlights the increasing demand for virology specimen collection in blood screening processes. Additionally, rising technological advancements such as self-collection kits, point-of-care specimen collection devices, and built-in digital health platforms are also supporting the growth of the market. This is improving the efficacy and accessibility of viral testing, especially in distant and resource-poor environments. With infectious disease control and pandemic preparedness now a major priority for governments around the globe, we can expect sustained growth for the global virology specimen collection market. Sustained industry growth is projected on account of research and development, healthcare expenditure, and the threat of emerging viral pathogens.

Market Dynamics

Drivers

-

The increasing incidence of viral infections, such as HIV/AIDS and influenza, necessitates efficient specimen collection for accurate diagnosis and treatment.

-

Outbreaks of viruses like Zika and Ebola highlight the need for advanced specimen collection technologies to manage and control the spread of infections.

-

The growing number of blood donations requires effective virology specimen collection methods to ensure the safety and quality of blood products.

The rising prevalence of viral diseases across the globe is a major key factor expected to drive the growth of the virology specimen collection market. The increase in the number of viral infections including influenza, HIV/AIDS, hepatitis, and emerging diseases such as COVID-19 has increased the requirement for a reliable method for specimen collection for accurate diagnostics and research purposes. For instance, according to the World Health Organization (WHO), influenza affects approximately 1 billion individuals annually, with up to 5 million cases categorized as severe. Efficient sample collection is essential for rapid analysis and early treatment, particularly during outbreaks and pandemics. Recently, however, respiratory syncytial virus (RSV) infections have spiked in multiple countries, leading to increased surveillance and diagnostic activity. As an example, a study published in 2023 by the Lancet signaled that global RSV-associated hospitalizations increased by 24% annually and demanded enhanced respiratory specimen collection tools.

Moreover, in the high HIV burden countries in Sub-Saharan Africa, more than 1.5 million new HIV infections occurred in 2022, as described in the UNAIDS report which means further development of specimen collection of viral load monitoring and resistance testing is required. The new wave of effort aiming to generate more efficient and user-friendly specimen collection kits, e.g. saliva-based tests for viral diagnostics, will further help facilitate the collection of specimens in hard-to-reach areas and resource-limited settings. These trends highlight the need for specimen collection and are vital for global intervention in viral diseases.

Restraints:

-

The expense associated with sophisticated virology specimen collection technologies can limit their adoption, particularly in resource-constrained settings.

-

The development and validation of alternative testing methods may pose challenges to the virology specimen collection market.

-

Ensuring compliance with stringent regulations and maintaining high-quality standards can be complex and may hinder market growth.

The high cost of technologies for advanced virology specimen collection is another important factor that limits the adoption of these devices in million-dollar property management facilities. Complex devices and reagents such as automated sample collection devices, specific swabs, and transport media need considerable investment. Although these technologies improve viral diagnostics through accuracy and efficiency, they present cost-related limitations for smaller health facilities, particularly in resource-poor and underfunded countries.

Additionally, this high-tech equipment requires expensive upkeep and operation. Laboratories and clinics often need skilled personnel to operate the equipment, further increasing expenses related to training and hiring. These economic restrictions hamper the retrospective applications of these superior solutions on a broader scale for the advantage of resource-deprived healthcare providers. Public health sectors, limit the reach and accessibility of state-of-the-art specimen collection technologies to address viral outbreaks effectively.

Virology Specimen Collection Market Segmentation Analysis

By Product

In 2023, the virology transport media segment dominated the market with a 31% share, due to its essential role in preserving the viability of clinical specimens for subsequent transport to diagnostic laboratories. Inflect announced that this growth is fueled because the global focus on infectious disease diagnostics has significantly increased in light of the COVID-19 pandemic. This increased use has projected a 200% increase in viral transport media usage during the pandemic highlighting the pivotal role that VTM plays in diagnostic workflows per the Centers for Disease Control and Prevention (CDC). In addition, established governments have imposed numerous stringent guidelines for the travel of specimens thus, increasing the demand. European Centre for Disease Prevention and Control (ECDC) updated its specimen handling guidelines in 2023, emphasizing the use of high-quality transport media to ensure reliable results.

By sample type

The nasopharyngeal segment dominated with the largest share in 2023 and is expected to continue its trend during the forecast period attributed to proven rapidity in the detection of respiratory viruses including SARS-CoV-2 and influenza. Due to the higher sensitivity and specificity of this method, it is considered the gold standard among virology diagnostics. Government data supports this trend; the Indian Ministry of Health and Family Welfare reported that 85% of COVID-19 tests in 2023 utilized nasopharyngeal swabs, highlighting their widespread application. The adoption of nasopharyngeal sampling is further bolstered by advancements in swab design and materials, ensuring patient comfort and sample integrity.

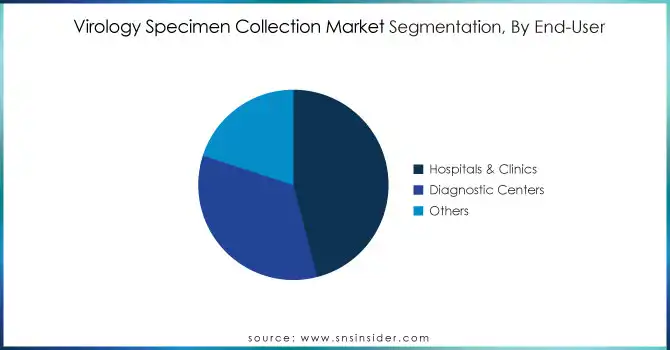

By End-User

In 2023, hospitals and clinics accounted for the largest share 46% of the virology specimen collection market due to their primary involvement in disease diagnosis and treatment. Strong government funding and infrastructure support play an essential role in this regard for these institutions. In the UK the NHS set aside £3 billion for diagnostic equipment and training in 2023, making sure that hospitals can accommodate high testing amounts. Hospitals have also continued to control a majority of revenue because they have historically served as the first place for diagnosis. Past government statistics reveal a consistent trend; in 2020, hospitals conducted over 70% of diagnostic tests for viral infections globally.

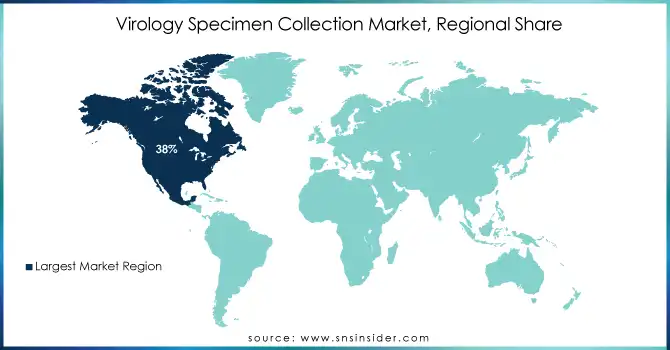

Regional Analysis

North America accounted for the largest share of the global virology specimen collection market in 2023, with a 38% share of the market, due to high diagnostic testing rates and an advanced healthcare infrastructure. The CDC reported that over 500 million viral diagnostic tests were performed in the U.S. in 2023 alone, demonstrating the region's testing capacity. In addition, strong and sustainable government funding including $10 billion allocated by the U.S. Department of Health and Human Services for pandemic preparedness, has bolstered market growth.

On the other hand, the Asia-Pacific region is expected to witness the highest CAGR during the forecast period. This rise is due to the rise in healthcare investments and the rise in awareness of the control of viral diseases. For example, China’s National Health Commission reported a 30% increase in diagnostic infrastructure funding in 2023, while India’s government allocated $2 billion to expand virology labs across the country. High demand for better diagnostic solutions is also contributed by the overcrowded population and the high burden of infectious diseases, such as dengue and hepatitis, in the region. Collectively, the Asia-Pacific region accounted for about 25% of the global market share in 2023.

Recent News and Developments

-

In February 2024, Medical Wire & Equipment updated its SIGMA-VIROCULT® virus transport media, increasing its shelf life to 24 months, from the previous 12 months.

-

In August 2023, Becton Dickinson and Company gained FDA 510(k) clearance for a molecular diagnostic test for the detection of multiple respiratory viruses from the same specimen.

-

In October 2024, Hardy Diagnostics entered into an exclusive agreement with Gradientech for the commercialization of the QuickMIC system.

Key Players

Manufacturers/Service Providers

-

Thermo Fisher Scientific (Viral Transport Medium, Molecular Transport Medium)

-

Becton, Dickinson and Company (BD Universal Viral Transport System, BD Vacutainer)

-

Copan Diagnostics Inc. (UTM® Viral Transport, eSwab® Collection System)

-

Hardy Diagnostics (HEPES Buffer, Viral Transport Kit)

-

Puritan Medical Products (Universal Transport Medium, Sterile Swabs)

-

Quest Diagnostics (Viral Test Kits, Transport Media)

-

Roche Diagnostics (Cobas PCR Media, Viral Specimen Kits)

-

Siemens Healthineers (Viral Load Testing Kits, Diagnostic Media)

-

BioMerieux SA (NucliSens Media, ESwab Solutions)

-

HiMedia Laboratories (HiViral Transport Kit, Universal Transport Medium)

-

Quidel Corporation (Lyra Direct Kits, QuickVue Influenza Test)

-

Cepheid (Xpert Viral Transport Medium, Diagnostic Kits)

-

Medline Industries (Specimen Collection Kits, Viral Transport Media)

-

Cardinal Health (Transport Swab Systems, Diagnostic Media)

-

Meridian Bioscience (Transport Medium, Diagnostic Assays)

-

LabCorp (Viral Transport Media, Nasopharyngeal Swabs)

-

SRL Diagnostics (Specimen Collection Kits, Viral Load Test Kits)

-

Fujirebio Diagnostics (Transport Media Solutions, Specimen Handling Kits

-

Bio-Rad Laboratories (Media Transport Solutions, Viral Load Testing Kits)

-

Abacus Diagnostica (GenomEra Media, Specimen Kits)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.09 Billion |

| Market Size by 2032 | USD 9.11 Billion |

| CAGR | CAGR of 4.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Blood Collection Kits, Specimen Collection Tubes, Viral Transport Media, Swabs) • By Sample (Blood Samples, Nasopharyngeal Samples, Throat Samples, Nasal Samples, Cervical Samples, Oral Samples, Other Samples) • By Application (Diagnostics, Research) • By End User (Hospitals & Clinics, Diagnostic Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Becton, Dickinson and Company, Copan Diagnostics Inc., Hardy Diagnostics, Puritan Medical Products, Quest Diagnostics, Roche Diagnostics, Siemens Healthineers, BioMerieux SA, HiMedia Laboratories, Quidel Corporation, Cepheid, Medline Industries, Cardinal Health, Meridian Bioscience, LabCorp, SRL Diagnostics, Fujirebio Diagnostics, Bio-Rad Laboratories, Abacus Diagnostica |

| Key Drivers | • The increasing incidence of viral infections, such as HIV/AIDS and influenza, necessitates efficient specimen collection for accurate diagnosis and treatment. • Outbreaks of viruses like Zika and Ebola highlight the need for advanced specimen collection technologies to manage and control the spread of infections. |

| Restraints | • The expense associated with sophisticated virology specimen collection technologies can limit their adoption, particularly in resource-constrained settings. • The development and validation of alternative testing methods may pose challenges to the virology specimen collection market. |