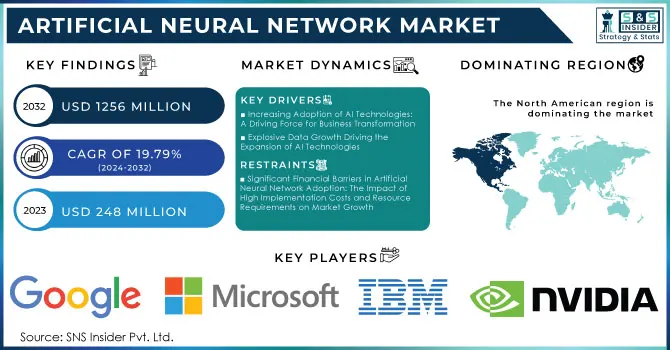

Artificial Neural Network Market Key Insights:

The Artificial Neural Network Market size was valued at USD 248 million in 2023 and is expected to reach USD 1256 million by 2032, growing at a CAGR of 19.79% over the forecast period of 2024-2032.

To Get More Information on Artificial Neural Network Market - Request Sample Report

The artificial neural network (ANN) market is on an upward trend due to the needs of businesses in many industries moving towards the adoption of AI technologies. A growing number of enterprises are analogously integrating AI, machine learning, natural language processing (NLP), and pattern recognition into their practices to strengthen foresight as 85% of businesses prepare to combine the two sectors also boosting worker productivity between 25%. And almost 40% of decision-makers are applying ASO solutions to improve efficiencies in IT operations. With the recognition of data-driven insights by organizations still growing, significant growth in the ANN market is predicted for the upcoming years.

The market for artificial neural networks or ANNs will evolve with the availability of plenty of opportunities due to continuous technological growth and big data. With the rise of automation and artificial intelligence, we will see deeper investments into advanced neural net systems as industries begin to scale up their automation processes. In particular, AI-orchestrated chatbots will transform the span of patient interactions in healthcare by facilitating 24/7 service and managing basic questions, leading to increased engagement. Such is the scope of AI's transformative potential in industries like pharmaceuticals, where it could slash drug discovery costs by as much as 70%. Additionally, AI technologies have been embraced by 58% of companies in the finance sector as of 2024, an increase of 21 percentage points year on year, indicating that there is a wide acceptance and application of AI solutions across many sectors. The high level of opportunities is forming for companies who can innovate specialized ANNs in the areas they target such as autonomous vehicles or smart manufacturing.

The U.S. government is ramping up its artificial intelligence research and development investment, allocating USD 1.7 billion in 2022 for a 13% increase over last year. This influx of investment legitimizes work in deep learning and reinforcement learning, both essential for improving artificial neural networks (ANNs). The integration of AI in numerous sectors not only helps accelerate the ANN market but also ensures collaboration among technology vendors, academia, and end-users. It will not only fast-track innovation in ANN technology but also open new opportunities for both start-ups as well as established companies to provide new market-specific solutions.

MARKET DYNAMICS

DRIVERS

- Increasing Adoption of AI Technologies: A Driving Force for Business Transformation

The increasingly widespread use of AI, especially ones that utilize artificial neural networks (ANN), can be attributed to the pressing need for solutions that enhance operational efficiency and decision-making. Many organizations from healthcare to finance and even retail have businesses realizing how much value ANNs can unlock when it comes to predictive analytics, understanding customers, and automated management. For example, nations such as India (59%), and the United Arab Emirates (58%) are leading this charge with relatively high levels of take-up, whilst Australia (29%), Spain (28%), and France (26%) dwell at the back. With the race to make better use of data developing fast, companies at least those that wish to remain competitive in changing market landscapes. This momentum is likely to carry on and drive the ANN market forward as organizations continue to hunt for disruptive technologies that will help them do more with less.

- Explosive Data Growth Driving the Expansion of AI Technologies

One of the key drivers of the artificial neural network market is the explosive production of data; it is projected to reach 120 zettabytes in 2023. To begin with, videos specifically are responsible for 53.72% of all data traffic, as reported by HPE. Second, this quantity of data can be transcribed into the equivalent of 333.22 billion emails sent and received daily. Also, an increasing number of companies is eager to process their customers’ and general human knowledge, as exemplified by more than 2,500 data centers in the US alone. Therefore, the demand for advanced AI solutions, such as artificial neural networks, is rising as businesses need to employ them for effective data analysis. They can be used for pattern recognition and prediction models to improve decision-making.

RESTRAINTS

- Significant Financial Barriers in Artificial Neural Network Adoption: The Impact of High Implementation Costs and Resource Requirements on Market Growth

High fixed cost barrier in the development and commercialization of artificial neural network (ANN) solutions Then there are costs for advanced hardware, specialized software, and highly-skilled personnel who know how to work with AI technologies. Huge costs are involved, for example training these large-scale AI models; Google’s Gemini Ultra is believed to have used USD 191 million in compute resources while OpenAI’s GPT-4 incurred costs of around USD 78 million. At the same time, purchasing expensive GPUs, such as the Tesla V100 costing around USD 10,000 each would further increase overall AI training costs to anywhere between USD 5K for simple solutions to over USD 500K for complex solutions. The prohibitive costs involved, in turn, will make organizations rethink their ANN investments and thereby freeze innovation and the evolution potential of the market.

SEGMENT ANALYSIS

BY COMPONENT

In 2023, solution dominated the artificial neural network (ANN) market with 64% revenue share and is expected to rise at a strong CAGR of 20.27% between 2024 and 2032. The reason behind this dominance goes back to organizations' tendency to adapt more and more Artificial Intelligence-propelled solutions in diverse industries to refine their functionalities. Along with this, the rising integration of ANN solutions across various applications including predictive analytics, natural language processing, and image recognition is also supporting the demand. More businesses are finding such end-to-end solutions which include the technology, support, and integration services necessary to get it in place more appealing.

BY DEPLOYMENT

In 2023, the cloud segment is dominating the artificial neural network (ANN) market generating around 66% revenue share & expected to grow at a CAGR of 20.70% from 2024-2032. Leading the way is a natural advantage of cloud-based solutions, which provide scalability and flexibility for organizations that can access powerful computing resources without having to pay for large hardware investments upfront. Moreover, the rise of remote work and demand across industries for accessible AI tools is driving the need for the cloud. Additionally, the increased collaboration, fast integration with other systems already in place, and processing of large infinite amounts of data also drive cloud-based ANN technologies to be adopted more easily and become the default choice for businesses that would like to improve their overall efficiency performances.

By Application

In 2023, the artificial neural network (ANN) market maintained a revenue share of 37% in the image recognition segment, with essential applications across several industries including security, healthcare, and e-commerce where analysis of visual data is becoming increasingly critical. This is due to its increasing application in image recognition, such as facial recognition, self-driving cars, and quality control. On the other hand, the data mining segment is projected to attain the highest CAGR of 22.92% during the forecast period 2024 to 2032 as there is a demand for retrieving valuable insights from broader datasets in multiple sectors. The significance of data-driven decision-making, bolstered by ANNs for analytics and predictive model creation, is driving this growth.

By Enterprise

Large enterprises accounted for 68% of revenue share in 2023 and are estimated to grow at a CAGR of 20.45% during the period between 2024 to 2032. The reason behind this dominance is that these organizations have access to significant funding which they can spend on advanced technology, infrastructure, and a large labor workforce to effectively carry out ANNs. In addition, big businesses possess already established data ecosystems and a complex operational landscape that create significant demand for ANN applications of predictive analytics, automation, and decision support. The need to stay ahead of innovation, efficiency, and customer experience also drives firms to go for ANN adoption which leads to long-term growth in this segment.

By END USE

The artificial neural network (ANN) market in 2023 was regulated by healthcare sector reports with a revenue share of 27% due to the ample use of ANN solutions across various domains including diagnostics, medical imaging, personalized treatment, and patient monitoring resulting in accurate results and better patient outcomes. ANN is utilized in such advanced data analysis and pattern recognition tasks, making it ideal for a variety of healthcare organizations. On the other hand, the growing demand for fraud detection, risk assessment & personalization of financial services is expected to drive the BFSI sector with a CAGR of 21.52% from 2024–2032. The rapid adoption of ANN solutions is fueled by the growing reliance of players in this sector on data-driven insights to improve customer experience and operational efficiency.

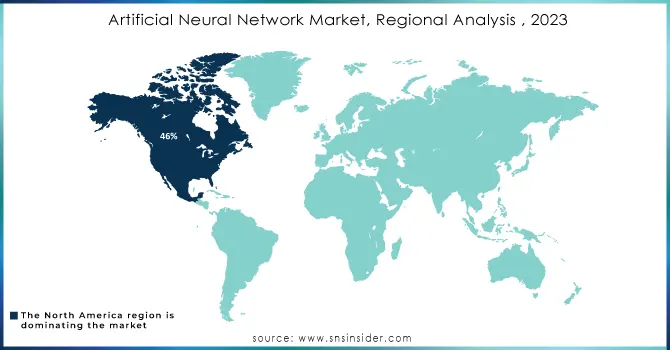

REGIONAL ANALYSIS

North America dominated the artificial neural network (ANN) market and was worth above 46% revenue share in 2023 driven primarily by a high AI adoption rate across sectors, including healthcare, finance, and retail. From predictive analytics for self-driving cars to advanced customer personalization, ANN applications proliferate as a result of the region’s digital infrastructure and access to leading AI technologies. North America will continue its leading position over the long term not just from the big R&D spend but also government support for AI projects.

Asia-Pacific is anticipated to witness the highest growth between 2024-2032, in terms of revenue with a CAGR of 21.04%, due to the adoption of digital transformation transformations across sectors, and increasing tech investments by emerging countries such as China, Japan, and India. An increasing emphasis on automation across industries such as manufacturing, healthcare, and finance in the region is boosting the adoption of ANN solutions. Moreover, this high growth rate in the Asia-Pacific AI music market is mainly driven by government initiatives supporting AI development and growing technology-competent consumers in this region.

Do You Need any Customization Research on Artificial Neural Network Market - Inquire Now

LATEST NEWS

-

In November 2024, IBM announced an expansion of its AI accelerator offerings, a collaboration with AMD to develop the Instinct MI300X accelerators in IBM Cloud. This move is specifically to enhance the performance of its AI models to support very advanced neural network applications generative AI or large-scale computing.

-

At Microsoft Ignite 2024, the NVIDIA and Microsoft Blackwell-powered Azure VMs could be seen accelerating deep learning toward improving AI applications such as natural language processing and computer vision.

KEY PLAYERS

-

Google (TensorFlow, Google Brain)

-

Microsoft (Azure Cognitive Services, DeepSpeed)

-

IBM (Watson Machine Learning, Neural Network Modeler)

-

NVIDIA (CUDA-X AI, DIGITS)

-

Amazon AWS (SageMaker, Deep Graph Library)

-

Intel (Intel Nervana, OpenVINO Toolkit)

-

Meta Facebook (PyTorch, FAIR)

-

Salesforce (Einstein, TransmogrifAI)

-

Apple (Core ML, Create ML)

-

Baidu (PaddlePaddle, ERNIE)

-

Tencent (Angel, Tencent AI Lab)

-

Huawei (MindSpore, Atlas AI Platform)

-

Alibaba (PAI, AliGenie)

-

OpenAI (GPT-4, DALL-E)

-

Samsung (Bixby, Neural Processing Unit)

-

Oracle (Oracle AI Platform, Oracle Machine Learning)

-

SAP (Leonardo, HANA Machine Learning)

-

Adobe (Sensei, Neural Filters in Photoshop)

-

Siemens (MindSphere, Digital Twin)

-

Twitter X (Cortex, Real-Time Content Moderation AI)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 248 Million |

| Market Size by 2032 | USD 1256 Million |

| CAGR | CAGR of 19.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (Cloud, On-premises) • By Application (Image Recognition, Signal Recognition, Data Mining, Others) • By Enterprise (Large Enterprises, Small and Medium Enterprises) • By End-User (BFSI, Retail & E-Commerce, IT & Telecom, Manufacturing, Healthcare, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google, Microsoft, IBM, NVIDIA, Amazon AWS, Intel, Meta Facebook, Salesforce, Apple, Baidu, Tencent, Huawei, Alibaba, OpenAI, Samsung, Oracle, SAP, Adobe, Siemens, Twitter X |

| Key Drivers | • Increasing Adoption of AI Technologies: A Driving Force for Business Transformation • Explosive Data Growth Driving the Expansion of AI Technologies |

| RESTRAINTS | • Significant Financial Barriers in Artificial Neural Network Adoption: The Impact of High Implementation Costs and Resource Requirements on Market Growth |