Vision Controller Market Size Analysis:

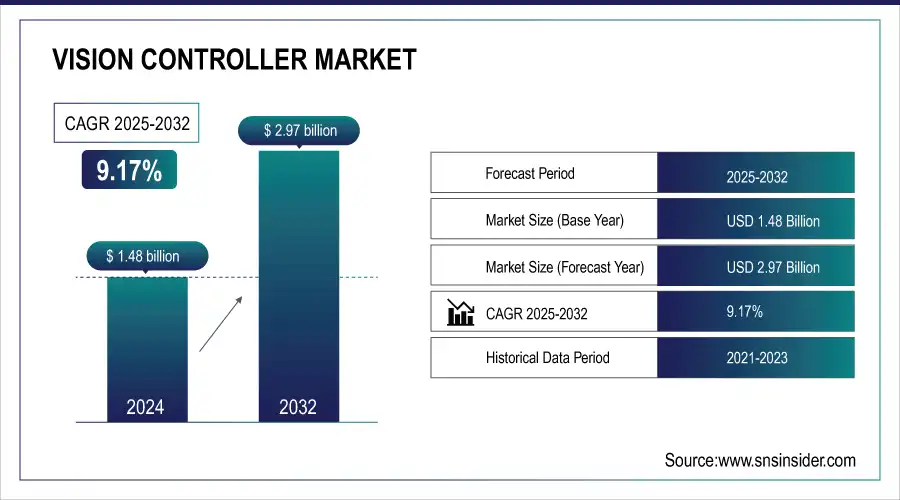

The Vision Controller Market Size was valued at USD 1.48 billion in 2024 and is expected to reach USD 2.97 billion by 2032 and grow at a CAGR of 9.17 % over the forecast period 2025-2032.

To Get more information On Vision Controller Market - Request Free Sample Report

The Worldwide vision controller market demand for vision controllers in various industries, Automation across industries, Demand for precision and real time industrial processes and Evolution in Technology of Machine Vision are the key aspects that are anticipated to drive the market. Market structure details have been provided along with detailed analysis of segments such as gates valves, butterfly valves and globe valves in the overall global and regional market.

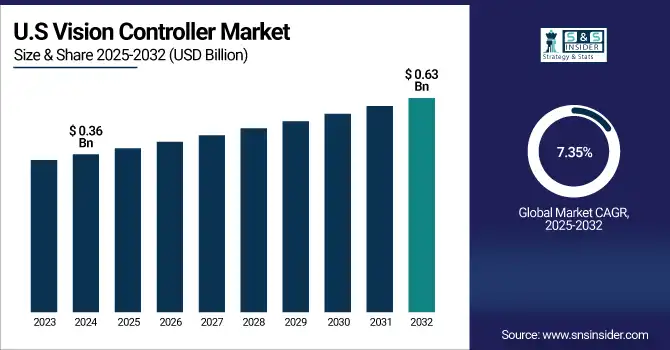

The U.S. Vision Controller Market size was USD 0.36 billion in 2024 and is expected to reach USD 0.63 billion by 2032, growing at a CAGR of 7.35 % over the forecast period of 2025–2032.

The US vision controller market growth is driven by the high adoption of industrial automation technologies in the region and due to a significant period of investment coming in smart manufacturing. Industry 4.0 projects in the U.S. and growing need of advanced vision systems in automotives & aerospace to contribute to the content of the report. Moreover, the advent of technologies and advancements in the adoption of AI-based vision controllers further fuel the market growth.

According to research, Over 60% of U.S. manufacturing companies have initiated Industry 4.0 projects incorporating smart vision systems for quality control and robotics automation

Vision Controller Market Dynamics

Key Drivers:

-

Increasing Adoption of Automated Systems in Manufacturing Enhances Vision Controller Demand

Rising adoption of automation in production process have increased the penetration of vision controllers. The controllers improve production efficiency by allowing for in-line, real-time visual inspection, defect identification and quality control, which minimizes human error. As industries look for increased productiivty and shorter time-to-market, vision controllers are vital in robotics system, packaging and Line Control. They offer accurate image processing and control functionality which is leading to better decision support, so these products have received great attention and the market proliferation is significant worldwide.

According to research, Use of vision controllers has been shown to reduce defect rates by up to 30% and increase production line efficiency by 20-25%.

Restrain:

-

Integration Challenges with Legacy Systems Hinder Market Growth

Compatibility and integration problems with the existing legacy systems are challenges for vision controller market. Most industries run with aging equipment and control platforms, and even though it may be feasible, the leap to a modern vision controller, usually is not practical or financially viable without major re-engineering. These integrations can result in more downtime, greater cost, and inefficient operations. In addition, the absence of standardized communication protocols and interoperability is an additional factor, making adoption more difficult and consequently reduces the growth potential of the market, especially in the case of traditional manufacturing industry that is hesitant to changes in technology.

Opportunities:

-

Expansion of Vision Controller Applications in Healthcare and Pharmaceuticals

Rising application of vision controllers in medical and pharmaceutical industries can support market expansion. These controllers are used to support highprecision tasks such as robot-assisted diagnosis, robot surgery, and drug quality in the drug manufacturing. Market Demand for Non-Invasive, Reliable Visual Inspection Equipment in Medical Labs and Pharmaceutical Production Lines to Propel Growth. With an increasing degree of healthcare automation, and focus on quality of the products, vision controllers are expected to gain a stronger presence in the four industries, thus expanding their application areas and driving the market influence.

According to research, Automated visual inspection in drug production lines can increase throughput by up to 20% while maintaining compliance.

Challenges:

-

Data Security and Privacy Concerns Affect Adoption Rates

Visual data is typically highly sensitive, and the capturing, storing, and processing of these visual data by vision systems can potentially lead to the risks in data leaking and security challenges. Certain industries, such as healthcare, defense, and transportation are subject to strict regulations with respect to protecting data. Guaranteeing safe transmission and storage without compromising system function, however, will require a strong focus on cybersecurity. Complexity and high expenses for data protection measures can scare off some users, reducing market growth and development.

Vision Controller Market Segment Analysis:

By Type

Digital Vision Controllers segment dominated the Vision Controller Market with the highest revenue share of about 52.27% in 2024 because of their sophisticated image processing abilities, flexibility, and the possibility of interfacing with digital networks. The ability to scale such systems has allowed companies like Cognex Corporation to deploy high-precision systems. Their higher accuracy and more rapid data processing are critical for robotics and quality control applications. The fact that digital controllers can be scaled and updated via software upgrade has made them favourite among manufacturers.

Hybrid Vision Controllers segment is expected to grow at the fastest CAGR of about 10.11% from 2025-2032 due to the advantages offered by their combination of analog and digital signal processing. Important players, like Omron Corporation, are offering hybrid controllers in which the products guarantee a higher reliability and better performances under various situations. Their ability to perform complex vision tasks with moderate capability at low cost is attractive to new applications, leading to extremely rapid adoptions and market growth.

By Application Area

Automotive segment dominated the Vision Controller Market with the highest revenue share of about 32.38% in 2024 due to growing adoption of vision controllers for autonomous driving, driver assistance and production quality control. Firms such as Bosch are making huge investment in vision controller to make vehicle safer & more efficient. The industry's pressure to comply with regulation drives adoption faster to allow for accurate monitoring and run-time decision support.

Aerospace segment is expected to grow at the fastest CAGR of about 10.42% from 2025-2032 because of increasing need for vision-based inspection and navigation in the aircraft manufacturing and maintenance applications. Honeywell, a global pioneer in the development of automotive and aviation technology, has announced a major breakthrough in vision controllers that will lead to increased safety and improved precision. Aerospace innovation is further invigorated by escalating investments, which facilitate robust growth of the industry.

By Technology Type

Computer Vision Systems segment dominated the market with the highest revenue share of about 36.44% in 2024 due to their powerful computation of the detailed image analysis, the pattern recognition, and the advanced information processing. One of those is NVIDIA is a significant provider of powerful vision computing platforms in these systems. With implementations running through quality inspection, security and automation driving enormous demand, they are powered by integration of AI and machine learning.

Machine Vision Systems segment is expected to grow at the fastest CAGR of about 10.22% from 2025-2032 due to rising utilization in robotics, manufacturing and logistics for industrial testing and guidance. Vision controllers companies such as Conveyco turn to leading companies such as Keyence Corporation for great machine vision solutions that enhances operations and accuracy.

By End-user Industry

Industrial Automation segment dominated the market with the highest revenue share of about 39.41% in 2024 due to a significant integration of automated production systems that use the vision controllers for inspection, robotic guidance and predictive maintenance. Siemens, a global powerhouse in the field of industrial automation, provides factories of all kinds with innovative automation technology and offers it services. Increasing emphasis on the process and factory automation, as well as smart manufacturing is a significant factor leading to the demand for these systems in production units globally.

Logistics and Transportation segment is expected to grow at the fastest CAGR of about 10.28% from 2025-2032 as the use of vision controllers increases in automated sorting, tracking and vehicle navigation systems, such as those found in warehouses and delivery centers. In smart logistics, DHL applies vision technologies in a wide range of areas to help optimize processes, enhance worker safety, and enable real-time tracking. Rising demand for last-mile automation and demand forecast is a drive for quick market growth in this fast-paced segment.

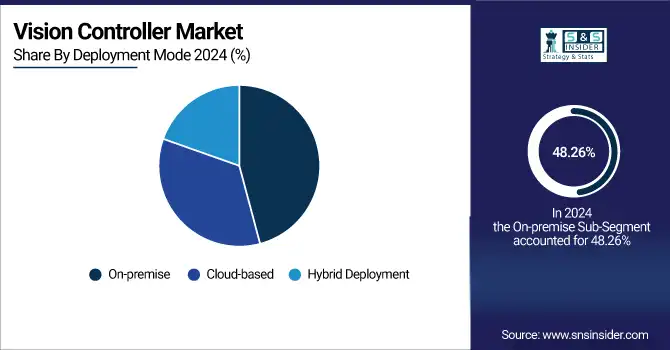

By Deployment Mode

On-premise segment dominated the Market with the highest revenue share of about 48.26% in 2024 because of the desire to have control over data, security and latency in mission critical applications that cannot afford to have downtime. Firms such as Rockwell Automation prefer to maintain on premises working for speed and regulatory requirements which guarantee uptime of the system as well in industrial environment, in the fields of pharmaceuticals as well as in car production. The increasing demand to own the full infrastructure and receive real-time analytics also adds to the embrace of this deployment model.

Hybrid Deployment segment is expected to grow at the fastest CAGR of about 10.07% from 2025-2032 due to the amalgamation of cloud scalability and on-premise control advantages, especially in multi-location industrial scenarios. Azure cloud services of Microsoft are extensively incorporated with hybrid deployment models that provide flexibility, cost-effectiveness and more data accessibility to cross-border teams. There remains a strong need for flexible infrastructures for remote diagnostics, intelligent updating, decentralized control points, which promotes an accelerated uptake of hybrid architectures.

Vision Controller Market Regional Outlook:

North America dominated the highest Vision Controller Market share of about 34.22% in 2024 due to the high concentration of electronic manufacturing factories, high rates of automation technology usage, and large scale advancements in factory production processes. The area has an excellent technical infrastructure and stringent quality requirements, which lead to a demand for accurate vision-based inspection systems. Furthermore, the support of government policies towards smart manufacturing and ongoing development in clouds, robots, and AI enhance the regional position in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The US is the largest market in the region as the industrial infrastructure in the country is quite robust and companies are focusing on automating their existing infrastructure, which is driving the use of vision controllers to increase productivity. Rapid embrace of technology in manufacturing, automotive, and aerospace contributes to sustained sales growth for vision controller systems.

Asia Pacific segment is expected to grow at the fastest CAGR of about 10.62% from 2025–2032 rising industrialization, high demand for automation in developing countries and surging emphasis on manufacturing efficiency. Government schemes advocating smart factory application and Industry 4.0 are fostering a conducive landscape for technology implementation. Low cost of labor and growing foreign investments for industrial sector is also accelerating the growth of the applications of vision controller across various end‐user industries in the region.

-

China is the Leader in the Market driven by a huge manufacturing industry, high speed of industrial automation and a robust Govt support for smart factory projects. Growing adoption to surge from electronics, automotive, machinery industries.

The European market continues to grow due to increasing applications of high precision manufacturing and automation in pharmaceutical, packaging, and food processing sectors. The growing shift toward sustainability and efficiency in the region supports the adoption of smart vision systems. Advancements in technology, qualified workforce, and rising use of robots in production lines are also bolstering market growth.

-

The Germany dominates the Vision Controller in Europe owing to development of industrial base, focus on automation and Industry 4.0 adoption authority. Strong demand from the automotive and industrial sectors are keeping the market propelled forward.

The Middle East & Africa and Latin America are growing regions in the Market. Industrial modernization and smart factory adoption are pushing the UAE to the forefront in the Middle East, while Brazil is leading the Latin American market with the increasing automotive and electronics sector and the surge in demand for automation solutions.

Vision Controller Companies are:

Major Key Players in Vision Controller Market are Cognex Corporation, Keyence Corporation, Omron Corporation, Teledyne Technologies, Basler AG, Sick AG, TKH Group, Vitronic GmbH, Hikrobot Co., Ltd., Baumer Group and others.

Recent Development:

-

In October 2024, Keyence Corporation launches the XG-X Series Vision System, offering high-speed image processing and advanced inspection capabilities for diverse industrial applications.

-

In June 2025, Teledyne Technologies introduced the GEVA 4000 Vision System, a high-performance industrial controller designed for multi-camera applications, offering significant processing improvements over previous models.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.48 Billion |

| Market Size by 2032 | USD 2.97 Billion |

| CAGR | CAGR of 9.17% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog Vision Controllers, Digital Vision Controllers, Hybrid Vision Controllers) • By Application Area (Manufacturing, Aerospace, Automotive, Healthcare, Consumer Electronics, Robotics) • By Technology Type (Machine Vision Systems, Computer Vision Systems, Facial Recognition Systems, Optical Character Recognition (OCR)) • By End-user Industry (Industrial Automation, Logistics and Transportation, Retail, Security and Surveillance, Telecom) • By Deployment Mode (On-premise, Cloud-based, Hybrid Deployment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Cognex Corporation, Keyence Corporation, Omron Corporation, Teledyne Technologies, Basler AG, Sick AG, TKH Group, Vitronic GmbH, Hikrobot Co., Ltd., Baumer Group. |