Defense Electronics Market Size & Growth:

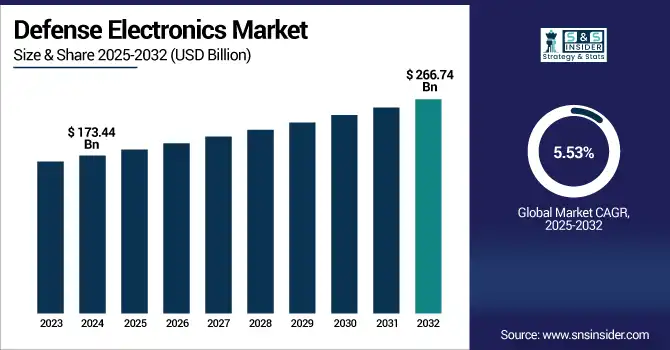

The Defense Electronics Market size was valued at USD 173.44 Billion in 2024 and is projected to reach USD 266.74 Billion by 2032, growing at a CAGR of 5.53% during 2025-2032. The Defense Electronics Market is experiencing rapid growth driven by the advancements and deployment of artificial intelligence, likewise autonomous systems and sensor fusion technologies. Threat detection, face recognition and real time analytics are changing the way physical security works in defense installations like no other. AI-powered surveillance, radar-camera fusion and drone-based base defense systems are a few integrated solutions helping to reduce false alarms; overall improving operational efficiency and providing proactive response capabilities. This is all indicative of a more general pace across the industry, as legacy defenses are modernized with additional investments in smart security capabilities and autonomous threat mitigation solutions.

To Get more information on Defense Electronics Market- Request Free Sample Report

With manpower gaps, accuracy enhancement and the need for rapid situational awareness on their shoulders, agencies and the military are rushing to adopt cutting-edge technology. One of the key drivers for this market is the rising need for enhanced military technology largely in security and surveillance ecosystem expects to create a substantial demand in advanced defense electronics till 2032.

On July 15, 2025, Huntsville Center officials attended a tech demo at Blue Grass Army Depot showcasing AI-driven security innovations to reduce false alarms and enhance threat detection.Key systems like PRISM, Scylla AI, and Radar Vision Sense demonstrated advanced autonomous surveillance, real-time analytics, and multi-sensor fusion for upcoming defense security contracts.

The U.S Defense Electronics market size was valued at USD 52.05 Billion in 2024 and is projected to reach USD 65.91 Billion by 2032, growing at a CAGR of 2.98% during 2025-2032. Defense Electronics Market growth is due to increasing demand for AI-based monitoring technology, sensor fusions, autonomous defense systems and up-gradation and modernization of security infrastructures to improve situational awareness support real-time decision-making reduce false alarms while catering to change in threats environment at Military & government installations.

The Defense Electronics market trends include increasing adoption of AI-driven surveillance, facial recognition, and real-time analytics for threat detection. Autonomous drones, sensor fusion systems, and radar-camera solutions are integrated together to improve efficiency in operation and minimize false alarms. Moreover, increased investment in safe base infrastructure, automated response systems and future wireless technologies are driving smarter, more robust and proactive defense security capabilities for all service branches.

Defense Electronics Market Dynamics:

Drivers:

-

Rising Defense Acquisitions and Backlog Growth Drive Expansion in Aerospace & Defense Electronics Market

Strategic acquisitions and sustained order backlogs are significantly driving growth in the aerospace and defense electronics market. The integration of advanced electronic systems and brands through recent mergers has enhanced product portfolios and expanded global reach. Additionally, strong organic growth across business segments, especially in defense electronics, is fueled by increasing demand for mission-critical technologies. The consistent trend of orders exceeding sales underscores long-term customer confidence and robust pipeline momentum. As defense modernization and global security investments rise, manufacturers are scaling up production and innovation to meet evolving requirements, further accelerating market expansion and solidifying their position in high-performance aerospace and defense electronics solutions.

On April 23, 2025, Teledyne Technologies (TDY) Q1 earnings of $234 million and revenue of $1.45 billion beat Wall Street estimates Aerospace and defense sales, buoyed by robust organic growth as well as more recent acquisitions in defense electronics, jumped 30%, driving what was Teledyne's sixth consecutive quarter of all-time-best backlog

Restraints:

-

Supply Chain Disruptions and Regulatory Barriers Restrain Growth in Defense Electronics Market

The growth of the defense electronics market is being restrained by persistent supply chain disruptions and stringent regulatory frameworks. Manufacturers are experiencing slowdowns and rising costs due to shortages of key components like semiconductors and rare earth materials, which affect when products can be produced. Export control laws, burdensome defense procurement procedures and cybersecurity standards impose major operational hurdles on vendors. Small and mid-sized enterprises the backbone of a modernized economy also face significant barriers to entry to, and expansion within this sector. Additionally, the geopolitical instability that might prevail in different regions may lead to delayed or canceled contracts, which will limit the long-term strategic planning and revenue visibility of companies serving defense electronics.

Opportunities:

-

Rising Global Naval Modernization Spurs Demand for Advanced Underwater Electronics Solutions

The growing demand for advanced submarine systems presents a significant opportunity in the defense electronics market, particularly in sonar, acoustics, and underwater surveillance technologies. With the growth of naval modernization programs worldwide, higher performance sensor suites are being requested for conventionally powered and nuclear submarines across the globe. Nations require improved accuracy detection systems, interoperable with sensors for the complex maritime domain. Also, a good market for defence electronics manufacturers to produce export-able and interoperable technologies as per specific naval requirements. Further, given the trend of nations replacing ageing fleets to reinforce undersea warfare capabilities there is demand for multi-year contracts, strategic partnerships and product development in sonar processing, signal intelligence and underwater threat detection systems powered by AI.

On March 19, 2025, Thales secured a major contract to deliver sonar and acoustics suites for the Royal Netherlands Navy's new Orka-class submarines.Marking its first submarine sonar deal outside core markets in 15 years, Thales aims to use this project as a launchpad for future global submarine system exports.

Challenges:

-

Increasing System Complexity and Integration Demands Challenge Defense Electronics Development

The Defense Electronics Market faces key challenges due to system complexities, multi-domain integration requirements and interoperability standards. Military platforms are increasingly seeking to integrate AI, sensor fusion, cyber security, connectivity with drones and satellites and electronic warfare techniques, which makes it more challenging to develop integrated systems that work across land, sea, air or space. Further, bringing legacy infrastructure into alignment with next-generation technology breeds compatibility challenges that increase both costs and development timelines. The real-time sensors with security concerns such as data integrity, and electronic countermeasures leads a complex system design. The Defense ministries hinder innovation as do the budget constraints and long procurement cycles. These challenges cumulatively make it difficult for manufacturers to offer state-of-the-art, mission-ready products in a timely manner while also ensuring operational efficacy and scalability.

Defense Electronics Market Segmentation Analysis:

By Platform

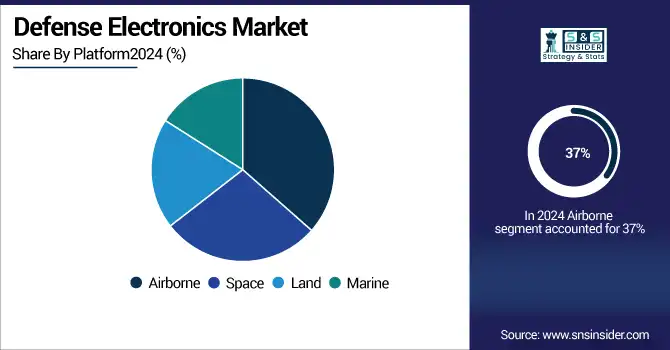

In 2024, the Airborne segment accounted for approximately 37% of the Defense Electronics market share, being followed by Electronic Warfare and Land System. Rising demand for advanced avionics, radar systems and electronic warfare capabilities over combat aircraft, drones, as well as surveillance through aircraft would drive growth of the Airborne segment . A growing investment in stealth technologies, ISR (intelligence, surveillance, reconnaissance) platforms and upgradation of next-generation aircraft modernization programs have also influenced the segment to maintain its significant market presence.

The Space segment is expected to experience the fastest growth in Defense Electronics market over 2025-2032 with a CAGR of 7.40%, driven by rise in defense satellite launches, space-based surveillance, secure communication systems, and investment towards space warfare capabilities. Space Dominance with intense need for advanced electronic payloads, high-end sensors and cyber resilient satellite electronics become the forefront requirement of Nations.

By Type

In 2024, the Hardware segment accounted for approximately 34% of the Defense Electronics market share, driven by higher orders for radars, sensors, control systems and communication modules across land, air force and naval platforms. Leading the segment is continuing military modernization programs, larger deployments of ruggedized electronics, and more investments in mission-critical hardware infrastructure for tactical and strategic operations.

The Embedded Systems segment is expected to experience the fastest growth in Defense Electronics market over 2025-2032 with a CAGR of 9.63%, due to increasing emphasis on real-time computing, autonomous defense systems, and AI-integrated mission platforms. This increase in demand for embedded solutions that are compact, power-efficient, as well as high-performance in nature has boosted the growth of these on sensor and signal processing product markets for UAVs/missiles/smart battlefield devices.

By Technology

In 2024, the Artificial Intelligence (AI) segment accounted for approximately 29% of the Defense Electronics market share, due to a massive requirement among aircraft manufactures for threat detection enabling systems, autonomous systems and decision support. Operational efficiency and response time are improved thanks to AI-enabled surveillance, predictive maintenance, battlefield analytics. Increased expenditure on cognitive computing and machine learning, to meet homeland defense requirements the adoption of artificial intelligence (AI) is accelerating across all military domains.

The Quantum Sensing & Computing segment is expected to experience the fastest growth in Defense Electronics market over 2025-2032 with a CAGR of 8.90%, This growth is fueled by rising demand for ultra-precise navigation, secure communication, and advanced threat detection. Defense agencies are investing heavily in quantum technologies to gain strategic advantages in electronic warfare and next-generation situational awareness systems.

By Vertical

In 2024, the C4ISR segment accounted for approximately 27% of the Defense Electronics market share, due to the surging demand of agelike command, control, communication, and intelligence systems. Growing investments towards network-centric warfare, situational awareness systems, and integrated battlefield management solutions have fueled the segment demand. With increased focus, globally military forces are considering interoperable C4ISR solutions to enable improved command and control capabilities for effective operational synergy in multi-domains.

The Navigation segment is expected to experience the fastest growth in Defense Electronics market over 2025-2032 with a CAGR of 8.12%, due to increasing demand for advanced GPS-denied navigation systems, quantum positioning and Inertial navigation technologies. Current defense strategies demand precision navigation solutions that provide robust performance for missiles, UAVs, submarines and autonomous platforms in challenging or GPS-denied environments.

Defense Electronics Market Regional Outlook:

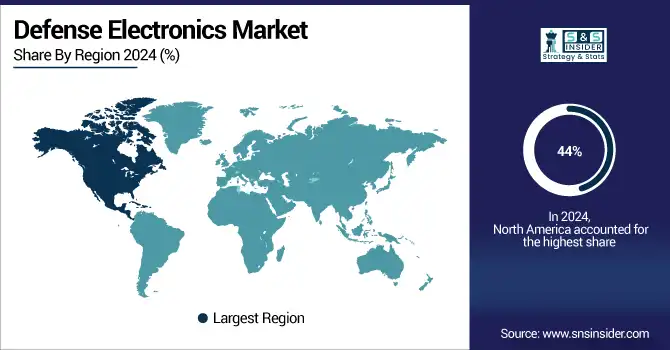

In 2024 North America dominated the Defense Electronics market and accounted for 44% of revenue share. This leadership is attributed to substantial defense budgets, rapid adoption of advanced technologies, and strong presence of key defense contractors. Ongoing investments in AI, electronic warfare, space-based systems, and modernization of military infrastructure continue to drive market growth across the U.S. and Canada.

Asia-Pacific is expected to witness the fastest growth in the Defense Electronics Market over 2025-2032, with a projected CAGR of 7.18%, This surge is fueled by rising defense budgets, territorial tensions, and rapid military modernization across countries like China, India, Japan, and South Korea. The region’s focus on indigenous defense production, cyber capabilities, and advanced surveillance systems is accelerating demand for next-generation defense electronics.

In 2024, Europe emerged as a promising region in the Defense Electronics Market, driven by soaring geopolitical tensions, higher NATO commitments and improving defense collaboration among EU nations. Nations such as France, Germany and the UK are making significant commitments to developing electronic warfare capability, intelligence and surveillance assets and improving cyber defenses. Moreover, joint procurement and indigenous innovation are being further accentuated by programs such as developed in the region which backs the imperative of defense electronics regional role.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Defense Electronics market, driven by regional security challenges, military modernization efforts, and border surveillance needs. Governments are investing in radar systems, communication networks, and electronic warfare capabilities. Additionally, increasing partnerships with global defense OEMs and growing demand for counter-UAV and smart defense systems are contributing to gradual market expansion in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Defense Electronics Companies are:

The Key Players in Defense Electronics market are Aselsan AS, BAE Systems PLC, Bharat Electronics Limited, Curtiss-Wright Corporation, Elbit Systems Ltd., General Dynamics Corporation, Hensoldt, Honeywell International Inc., Indra Sistemas SA, Israel Aerospace Industries (IAI), L3Harris Technologies Inc., Leonardo SpA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, Safran SA, Thales Group., Teledyne Technologies Incorporated. and Others.

Recent Developments:

-

In April 2025, Raytheon (RTX) secured a USD 344 million contract to develop upgraded SM-2 and SM-6 missile variants with shared electronics for faster, scalable production.The new systems will enhance U.S. and allied naval defense capabilities, with deliveries supported by Foreign Military Sales.

-

In March 2025, L3Harris Technologies received a USD 33.5 million U.S. Space Force contract to upgrade its Counter Communications System for advanced SATCOM jamming. The enhancements include multiband antenna upgrades and portable offensive space control capabilities under the Meadowlands program.

| Report Attributes | Details |

| Market Size in 2024 | USD 173.44 Billion |

| Market Size by 2032 | USD 266.74 Billion |

| CAGR | CAGR of 5.53% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform(Airborne, Space, Land, Marine) • By Type(Hardware, Software, Services, Embedded Systems and Ruggedized Electronics) • By Technology(Artificial Intelligence (AI), Internet of Things (IoT), Radio Frequency (RF) Technology, Gallium Nitride (GaN) and Gallium Arsenide (GaAs) Semiconductors, Quantum Sensing & Computing and 5G & Next-Gen Wireless Communication) • By Vertical(Optronics, Communication and Display, C4ISR, Electronic Warfare, Radar and Navigation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Defense Electronics market Companies are Aselsan AS, BAE Systems PLC, Bharat Electronics Limited, Curtiss-Wright Corporation, Elbit Systems Ltd., General Dynamics Corporation, Hensoldt, Honeywell International Inc., Indra Sistemas SA, Israel Aerospace Industries (IAI), L3Harris Technologies Inc., Leonardo SpA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, Safran SA, Thales Group., Teledyne Technologies Incorporated. and Others |