Warehouse Automation Market Report Scope and Overview:

The Warehouse Automation Market size was valued at USD 21.84 billion in 2025 and is expected to reach USD 71.25 billion by 2033 and grow at a CAGR of 15.93% over the forecast period 2026-2033.

The Warehouse Automation Market has been growing significantly due to the development of technologies and the need for efficient logistics and supply chain operation. Such automated systems as robotics, automated guided vehicles, and warehouse management software have been utilized in automation, encompassing the fulfillment of orders and the enhancement of accuracy, productivity, and cost-efficiency. Smart warehouses equipped with the Internet of Things and Artificial Intelligence technologies are disrupting the industry through the utilization of real-time data for enhanced productivity and cut costs. Amazon takes the lead in this by possessing more than 11,000 smart warehouses in North America, with a 40% increase in the deployment of over 750,000 robots in 2023 over the previous year. The expectation of the rise of automation and robotics is predicted by 52% of warehouse managers, and significant investment is made in response to the demand.

One of the major factors driving this trend is the growing popularity of the e-commerce sector to the requirement for accurate and fast order fulfillment. E-commerce is thriving globally, with over 2.71 billion shoppers and 2024 sales expected to exceed USD 6.3 trillion. More individuals opt for online shopping as 34% of them buy weekly, and 99% rely on reviews to select goods and services. These data are reflected in the growing share of online retail purchases, set to reach 22.6% by 2027. The trend is affected by 26.6 million online stores in the world and consumers’ growing interest in international shopping. In addition, the use of technologies enables warehouses to employ less space and workforce to the same efficiency level. The perspectives for the Warehouse Automation Market involve the further development of AI and machine learning technology.

Warehouse Automation Market Size and Forecast:

-

Market Size in 2025E: USD 21.84 Billion

-

Market Size by 2033: USD 71.25 Billion

-

CAGR: 5.82% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Warehouse Automation Market - Request Sample Report

Warehouse Automation Market Highlights:

-

E-commerce growth is increasing the need for fast, accurate, and scalable warehouse operations, fueling adoption of automation systems

-

Robotics, AI, IoT, and automated guided vehicles are increasingly deployed to improve efficiency, reduce errors, and optimize workflow

-

IoT enables real-time monitoring of digital and physical assets, improving operational performance, security, and supply chain efficiency

-

Automation reduces labor dependency, operational costs, and error rates, making warehouses more productive and competitive

-

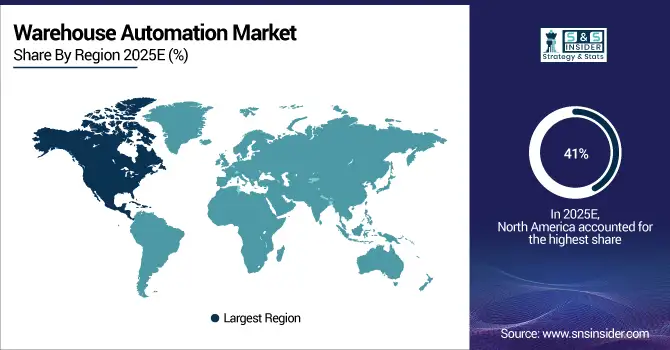

North America leads with 41 percent market share due to advanced technology adoption, followed by growing markets in Asia-Pacific, Europe, Latin America, and MEA

-

Regular maintenance and system downtime can increase operational costs and disrupt warehouse activities, limiting complete reliance on automation

Warehouse Automation Market Drivers:

-

E-commerce Surge Fuels Warehouse Automation Market Growth

Warehouse automation has been qualitatively influenced by the process of the e-commerce market growth. It is difficult to argue with the fact that the development of online business projects is closely associated with the evolution of shopping worldwide, and, thus, it has led to the necessity of order delivery systems improvement. For the e-commerce market, such principles of work as order placement, receipt, and delivery remain the basis; however, they require ultimate reasonable performance for the e-commerce companies to remain in demand for the audience. Nowadays, an array of automation options has been developed specifically for the e-commerce sector, such as storage and retrieval complex automation systems, conveyor types, robotics, etc., which allows them to handle a large influx of orders in the shortest possible time and at a minimum error rate. Given the customer orientation on speed and perfection of order delivery, it is logical that e-commerce companies are the main customers and the warehouse automation sector will develop proportionally with the development of the e-commerce market.

-

The IOT is a key driver shaping the dynamics of the warehouse automation market.

IoT technology has significantly impacted people’s lives and daily labor by helping machines do heavy tasks and providing routine to automate the whole working process. Broadly using IOT at work and daily life stimulates market growth and provides organizations with innovative performance and security solutions. This technology helps to constantly keep an eye on both digital and physical infrastructure. Ensuring the possibility of automated storing assists in cutting operational and labor costs, which leads to a more efficient customer supply chain performance.

Warehouse Automation Market Restraints:

-

Regular maintenance is essential for the smooth operation of automated systems in warehouses.

The automated systems require maintenance and load support. Maintenance is required to find and resolve any issues that the system has and to prevent possible disasters. An automated system that needs to be taken down for maintenance for a few days or even weeks will increase the costs and time required to keep the system operational. Moreover, automated systems cannot be used during maintenance, which can cause significant losses, as the system is often responsible for most or the entirety of the activity of the warehouse. Downtime and malfunctions require developing an entirely new plan of action and learning to work with a secondary, usually manual, system that will be used to pick up the slack. These concerns make companies wary of complete reliance on automatic systems.

Warehouse Automation Market Segment Analysis:

By Component

The hardware segment held a major market share of more than 58% in 2025. Warehouse automation uses a wide range of hardware to improve efficiency, accuracy, and productivity in warehouse processes. Important hardware includes automated storage and retrieval systems, robotic picking, automated guided vehicles, conveyor systems, and sensor technology. Automated storage and retrieval systems are used in modern-day warehouses to stack and pull goods from warehouses.

The software segment is accounted to grow at the fastest CAGR during the forecast period 2026-2033. The software component of the warehouse automation system serves as a solution capable of significantly improving efficiency, accuracy, and productivity in modern warehouse management. This system segment is realized through a complex of programs the unfolded functionality of which is focused on the efficient control of inventory, order fulfillment, and real-time performance monitoring. Technological systems related to the software level are based on the use of such capabilities as Artificial Intelligence, Machine Learning, and the Internet of Things.

By Technology

The retrieval systems & automated storage (AS/RS) segment led the market in 2025 with a market share of more than 30%. AS/RS are highly automated systems that leverage advanced robotics, conveyors, and software to optimize goods storage and retrieval. Automated storage and retrieval systems are used in modern-day warehouses to stack and pull goods from warehouses. Implementation of AS/RS increases space of the warehouse by up to 40% and 99.9% order picking accuracy. Besides, this technology allows the processing of many orders at the same time. For example, some systems can make over 1000 picks per hour, which is essential given the exponential growth of rapid order delivery in e-commerce.

The automatic mobile robots (AMR) segment is to have the fastest CAGR during 2026-2033. the implementation of AMRs in warehouses is determined by the growing need for faster order processing and the desire to cut labor expenses. In the United States, their utilization allowed for achieving a 30% decrease in operational costs and a 25% increase in order procession. Such prominent industry representatives as Amazon and Walmart have implemented AMRs in their supply lines for the improvement of their logistics capacities. At the same time, with the need to manage their representatives’ workloads, the employer’s implementation of AMRs has seen significant growth.

Warehouse Automation Market Regional Analysis:

North America Warehouse Automation Market Trends:

North America dominated the market in 2025 with a market share of about 41%, owing to advancements in technology such as artificial intelligence and machine learning leading to enhanced efficiency and an increase in productivity. In North America, warehouse automation is gaining a significant increase as the demand for efficiency in the logistics and supply chain field is on the way. The major factor leading this industry’s growth is the technology innovation. Emerging systems of automation such as robotics, artificial intelligence, and the Internet of Things devices are getting integrated at an increasing rate. Adopting Automated Guided Vehicles, conveyor belts, and robotic arms systems in this sector is becoming more popular to make operations more efficient at a lower cost.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia-Pacific Warehouse Automation Market Trends:

The Asia-Pacific region is to see a gradual growth in the CAGR during the forecast period. The expansion of the e-commerce and retail industry in the broader market leads to drive the need for warehouse which is efficient and cost-effective. Countries such as China, Japan, and India are the first to mind when thinking about adopting and implementing warehouse automation. Chinese warehouse automation will go beyond USD 5 billion by 2025 against the background of the development of such industry giants as Alibaba and JD.com. Japan, in turn, has long been a dominant player in the field of robotics, and various automated systems often become a part of the practice of warehouse work aimed at increasing efficiency.

Europe Warehouse Automation Market Trends:

Europe is witnessing steady adoption of warehouse automation, driven by the need to optimize logistics and reduce labor costs. Germany, the UK, and France are leading the region in deploying robotics, automated guided vehicles, and AI-driven warehouse management systems. The emphasis on Industry 4.0 initiatives, smart factories, and digital supply chain integration is pushing the market forward, with Germany dominating due to its strong manufacturing base and advanced industrial automation infrastructure.

Latin America Warehouse Automation Market Trends:

The Latin America warehouse automation market is expanding gradually, driven by the growth of e-commerce and retail sectors. Brazil is the dominant country in this region, with major investments in automated storage, robotic systems, and conveyor technologies. The need to reduce operational costs and improve efficiency in logistics and distribution centers is a key driver, while other countries such as Mexico and Argentina are beginning to adopt automation systems at a moderate pace.

Middle East & Africa Warehouse Automation Market Trends:

The Middle East and Africa (MEA) region is experiencing moderate growth in warehouse automation, largely due to rising e-commerce demand, modern retail expansion, and infrastructure development. The UAE and Saudi Arabia are leading the adoption of robotics, automated guided vehicles, and smart warehouse management solutions. Investments in logistics hubs and free zones, coupled with government initiatives to modernize supply chains, are driving the region’s gradual shift toward automation.

Warehouse Automation Market Competitive Landscape:

Honeywell International Inc. (Established 1906) is a global technology and industrial leader specializing in automation, aerospace, and energy-efficient solutions. Through its Honeywell Intelligrated division, the company delivers advanced warehouse automation, robotics integration, and execution software that enhance productivity, safety, and operational efficiency for distribution centers and supply chain operations worldwide

-

In Jan 2024, Honeywell partnered with Hai Robotics to deliver high-density ACR-based storage and retrieval systems, integrating Hai’s 32-ft-reach robots (500 pph throughput vs. 100–250 pph without robotics) with Honeywell’s Momentum WES to boost space efficiency, productivity, and rapid time-to-value in distribution centers.

Swisslog Established 1900 is a global leader in warehouse automation and intralogistics solutions, specializing in robotics, AS/RS systems, and data-driven warehouse software. The company delivers scalable, efficient, and future-ready automation for industries such as retail, e-commerce, pharmaceuticals, and food distribution, helping businesses enhance productivity, reduce costs, and optimise fulfillment performance worldwide.

-

In February 2025, Swisslog highlights rising brownfield automation with scalable retrofits, growing adoption of micro-fulfillment and hub-and-spoke models, driven by high land costs, labour challenges, and the need for faster, space-efficient, AI-enabled intralogistics operations in 2025.

Warehouse Automation Market Key Players:

-

Honeywell Intelligrated

-

Daifuku Co. Ltd

-

SSI Schaefer

-

Swisslog

-

Geek+

-

GreyOrange

-

KION Group (Dematic)

-

Amazon Robotics

-

ABB Ltd

-

Fanuc Corporation

-

Yaskawa Electric Corporation

-

KUKA AG

-

Siemens AG

-

Schneider Electric

-

Omron Corporation

-

Bastian Solutions LLC

-

Fetch Robotics Inc.

-

Interroll

-

Kardex Remstar

-

Viastore Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 21.84 Billion |

| Market Size by 2033 | USD 71.25 Billion |

| CAGR | CAGR of 5.82% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Warehouse System, Mechanized Warehouse, Advanced Warehouse, Basic Warehouse) • By Components (Software & Hardware) • By Technology (Retrieval Systems & Automated Storage, Automatic Guided Vehicles, Autonomous Mobile Robots, Voice Picking & Tasking, Automated Sortation Systems) • By Application (Apparel, Food & Beverage, Pharmaceutical, Automotive, E-Commerce, Grocery) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Honeywell Intelligrated; Daifuku Co. Ltd; SSI Schaefer; Swisslog; Geek+; GreyOrange; KION Group (Dematic); Amazon Robotics; ABB Ltd; Fanuc Corporation; Yaskawa Electric Corporation; KUKA AG; Siemens AG; Schneider Electric; Omron Corporation; Bastian Solutions LLC; Fetch Robotics Inc.; Interroll; Kardex Remstar; Viastore Systems |