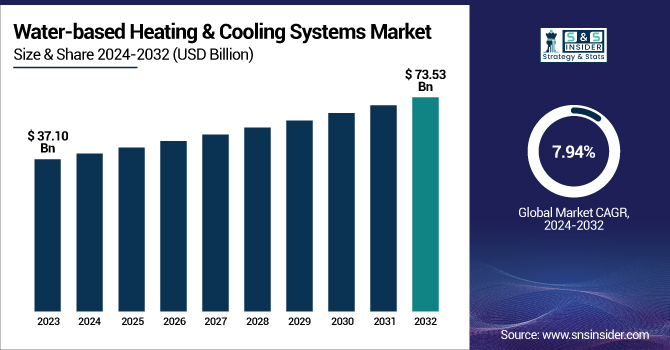

Water-based Heating & Cooling Systems Market Size Analysis:

The Water-based Heating & Cooling Systems Market Size was valued at USD 37.10 Billion in 2023 and is expected to reach USD 73.53 Billion by 2032 and grow at a CAGR of 7.94% over the forecast period 2024-2032.

To Get More Information About Water-based Heating & Cooling Systems Market - Request Free Sample Report

Increasing demand for smart heating and cooling systems and especially water-based heating & cooling systems has become an important factor in the growth of the global water-based heating & cooling systems market. Sustainability trends are driving the use of water from sources such as groundwater and surface water; Such systems are highly compatible with various building types, including residential, commercial, and industrial buildings. This also means manufacturers are scaling system capacity to meet the needs of every type of building, which is improving performance and cost-efficiency from small-single-family homes to large-multifamily units and infrastructure projects.

The U.S. Water-based Heating & Cooling Systems Market is estimated to be USD 7.11 Billion in 2023 and is projected to grow at a CAGR of 8.29%. A growing number of factors are leading to the growth of the U.S. water-based heating system or cooling system market. This demand is driven in part by the increasing use of heat pumps, which are both energy-efficient and more environmentally friendly. Renewable energy sources can also be combined with hydronic systems for water heating to complement sustainability aims. Similarly, growing urbanization and population trends have propelled the construction sector, which in turn, accentuated the demand for these systems. In addition, aging HVAC infrastructure or equipment provides many opportunities for retrofitting and replacement which is a factor, again, driving the market.

Water-based Heating & Cooling Systems Market Dynamics

Key Drivers:

-

Rising Demand for Smart Sustainable Water Heating and Cooling Systems Drives Market Expansion

One of the major factors driving the water-based heating and cooling systems market includes accelerating demand for energy-efficient and sustainable climate control solutions. Energy efficiency regulations are becoming strict around the world with governments providing advantages for the adoption of sustainable systems especially for residential and commercial. Moreover, the rising construction of green buildings and the growing utilization of heat pumps and hybrid HVAC systems are further expected to accelerate market growth. Technological improvements including smart thermostats, IoT-enabled controls, and efficiency in heat exchange are boosting system performance and providing water-based solutions with greater appeal than their more traditional air-based counterparts.

Restrain:

-

Integration Challenges and Regulatory Gaps Limit the Growth of Water Based Heating and Cooling Systems Market

The major limitation in the water-based heating and cooling systems market is the complicated integration of the system in the existing buildings. Inherent in the retrofitting of older infrastructures are substantial and structural adaptations that can present challenges in space-limited regional heritage or heavily built urban environments where system compatibility is a necessity. Moreover, the absence of uniform legislation in all countries may lead to ambiguity and delay in adoption. Development of building codes, performance standards, and certification requirements in different jurisdictions may stall in this stage due to the very individual character of implementation in those areas, especially for multi-national manufacturers and service providers.

Opportunity:

-

Retrofitting Demand and Green Innovations Unlock Growth Opportunities in Global Water-Based HVAC Systems Market

There are vast opportunities in the retrofitting of the installed base of aged infrastructure, particularly in North America and Europe, where much of the older HVAC equipment is being supplanted to meet sustainability objectives. Rapid urbanization, promotion by governments of energy conservation, and the rising demand for cooling in dry, hot parts of the world will provide huge opportunities for this new Indian technology and similar green technologies in the Asia Pacific (APAC) region. In addition, awareness of indoor air quality and environmental impact is rising, driving demand for low-emission and water-based solutions in commercial and industrial applications. For instance, firms that are either compact design, modular systems or renewables integration innovators can leverage new opportunities in both developed and developing markets.

Challenges:

-

Lack of Awareness and Technical Challenges Hinder Adoption of Water-Based Heating and Cooling Systems

One of the biggest hurdles is the lack of awareness and technical knowledge of end-users and installers for sophisticated water-based systems. The HVAC workforce in many regions lacks experience with water-based systems, particularly in developing economies; mistakes during installation can lead to poor performance. In addition, the effectiveness of water-based systems can be limited by water quality concerns like scale, corrosion, or biofouling, all of which may cause a reduction in performance that necessitates specialized maintenance. Secondly, design precision required to ensure year-round efficiency in these systems, so that they can perform their heating/cooling function effectively, may be difficult to achieve in projects that are built in a short period or in densely populated urban areas where the "footprint" of a building has a great influence on the efficiency of the system.

Water-based Heating & Cooling Systems Market Segment Analysis

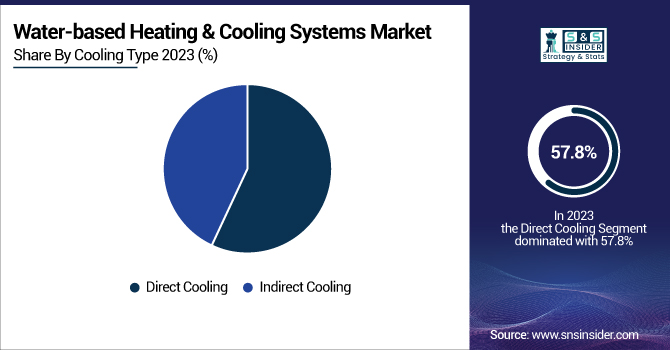

By Cooling Type

The Direct Cooling segment dominated the water-based heating and cooling systems market, accounting for a significant 57.8% market share in 2023. Due to its simplicity with systems, lower installations, and direct heat exchange, it's widely used in residential and small commercial settings. In addition to this, its market position is fortified by its capability to offer quick and effective cooling, especially in narrow areas.

The Indirect Cooling segment is estimated to be the fastest growing from 2024 to 2032, due to higher energy efficiency and higher control of indoor environmental quality. This procedure reduces the chances of contamination and also consumes less water, making it suitable for industrial and wide-scale commercial enterprises that have sustainability targets. Especially in regions with high dedication to carbon emission reduction and efficient HVAC operation, indirect cooling systems have been on the rise due to stricter environmental rules and the need for long-term operational efficiency.

By Implementation Type

New Construction accounted for the highest share of 60.7% in 2023 in the water-based heating and cooling systems market. The dominance is due to the integration of energy-efficient HVAC solutions in new residential, commercial, and institutional buildings. Modern-day construction is being planned to be eco-friendly and installation is done in the form of high-end water-based systems that comply with green building norms and regulations. Moreover, the system installation process during the forebear phase is also very easy due to the reason which firm belief that only boosts this segment, leadership, too.

The retrofit segment is anticipated to experience the fastest CAGR in-between 2024 to 2032. The increase is driven by the worldwide requirement to modernize deteriorating infrastructure, especially in North America and Europe, mature markets. Building owners are looking for water-based solutions to replace aging HVAC systems that are being retired from service and to improve energy efficiency while meeting changing environmental requirements.

By Component

Heat Pumps ranked as the most widely used water-based heating and cooling systems in 2023 accounting for a robust 24.5% market share. The heat pump market is dominated by these two combined heating and cooling options — when it comes to efficiency and space-saving, they cannot be beaten. The increased focus on low-carbon and all-electric solutions in residential and commercial applications is driving heat pump penetration in leading markets such as Europe and North America, with regulatory agencies laying the ground for clean energy transitions while phasing out fossil fuel-based systems.

Chillers are projected to witness a peak CAGR from 2024 to 2032, on account of growing demand in larger commercial and industrial industries. Whether for high-rise buildings, data centers, or manufacturing units looking for efficient cooling solutions, chillers provide high efficiency and energy savings, especially when combined with smart controls and variable-speed technologies. These attributes have made them excellent for scaling with urban infrastructure and in climates with variable/temperamental environments where temperature control is crucial.

By Vertical

The Residential segment led the global water-based heating and cooling systems market, accounting for 47.4% market share in 2024. The growing demand for energy-efficient climate control solutions in residential units, along with increased consumer awareness regarding sustainable living, primarily drives this leadership. The rise of government incentives and regulatory mandates; and the recent adoption of more stringent green building standards for some residential construction projects also spurred this further adoption of systems that utilize water. They are favored by homeowners because they offer consistent comfort while using less energy.

The Commercial is expected to exhibit the fastest CAGR over the forecast timeframe (2024 to 2032), owing to the swift expansion of office space, retail centers, and academic & medical buildings. The shift towards sustainability and a healthy indoor environment has created a need for scalable and efficient HVAC solutions increasing focus on sustainability by businesses. In combination with smart building technologies and more stringent energy codes, these components are prompting developers to consider more sophisticated water-based systems for commercial properties as well.

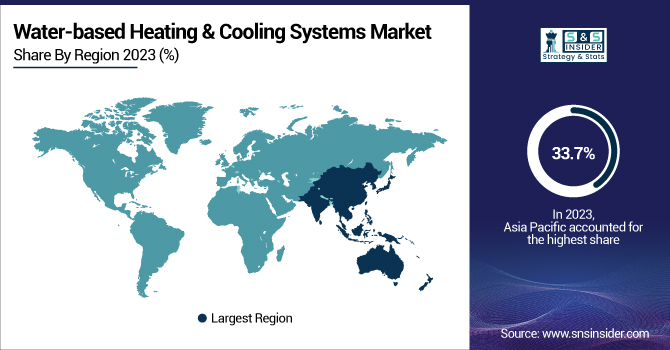

Water-based Heating & Cooling Systems Market Regional Insights

In 2023, Asia Pacific held the largest market share of water-based heating and cooling systems, at 33.7%. Such dominance is attributed to the rapid urbanization, infrastructure development, and increase in demand for energy-efficient climate control systems in densely populated countries such as China, India, and Japan. Water-based HVAC technologies are frequently integrated into the many sustainable building initiatives and smart city projects that regional governments are making heavy investments in. Japan, for instance, spearheaded energy-efficient hydronic systems for residential and commercial buildings, and India's ECBC promotes the use of water-based cooling systems in newly constructed buildings.

North America is expected to register the fastest CAGR during the forecast period from 2024 to 2032. A wave in the U.S. is shifting decisively toward electrification and decarbonization in buildings spurred by policies such as the Inflation Reduction Act that promotes energy-efficient improvements such as low-carbon heated or cooled water. Many large commercial applications in cities like New York and Toronto are turning to low-carbon, low-cost, electric heat pump-technology-based advanced chilled water systems to satisfy their environmental objectives and lower operating costs. Such developments are paving the way for wider proximity-based adoption in the region.

Get Customized Report As Per Your Business Requirement - Enquiry Now

Key Players Listed in Water-based Heating & Cooling Systems Market are:

-

Daikin Industries (Altherma Hydrosplit)

-

Trane Technologies (AquaTherm Water Source Heat Pump)

-

Carrier Global Corporation (AquaSnap Water-Cooled Chiller)

-

Bosch Thermotechnology (Compress 7000i AW)

-

Mitsubishi Electric (Ecodan Hydrodan)

-

Viessmann Group (Vitocal 300-G)

-

Vaillant Group (flexoTHERM exclusive)

-

Grundfos (MAGNA3 Circulator Pump)

-

NIBE Industrier AB (F1355 Ground Source Heat Pump)

-

Lennox International Inc. (Hydrotherm Boilers)

-

Danfoss (Hydronic Balancing Valves)

-

Rheem Manufacturing Company (Prestige Series Hybrid Water Heater)

-

Panasonic Corporation (Aquarea T-CAP)

-

Uponor Corporation (Ecoflex Pre-Insulated Pipe System)

-

Armstrong Fluid Technology (Design Envelope Pump)

Recent Trends

-

In December 2024, Daikin India and Taiwan’s Rechi Precision formed a joint venture, DAIKIN-RECHI India Pvt. Ltd., to manufacture rotary compressors in Andhra Pradesh. The plant will support Daikin’s "Make in India" push and is set to begin operations by FY2025.

-

In January 2025, Carrier launched new air-to-water heat pumps for residential and commercial use, enhancing energy efficiency and sustainability. The residential unit offers integrated home comfort, while the commercial AquaSnap 61AQ uses eco-friendly R-290 refrigerant.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 37.10 Billion |

| Market Size by 2032 | USD 73.53 Billion |

| CAGR | CAGR of 7.94% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Cooling Type (Direct Cooling, Indirect Cooling) • By Implementation Type (New Construction, Retrofit) • By Component (Heat Pump, Convector Heater, Radiator, Boiler, Chiller, AHU, Cooling Tower, Expansion Tank) • By Vertical (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries, Trane Technologies, Carrier Global Corporation, Bosch Thermotechnology, Mitsubishi Electric, Viessmann Group, Vaillant Group, Grundfos, NIBE Industrier AB, Lennox International Inc., Danfoss, Rheem Manufacturing Company, Panasonic Corporation, Uponor Corporation, Armstrong Fluid Technology. |