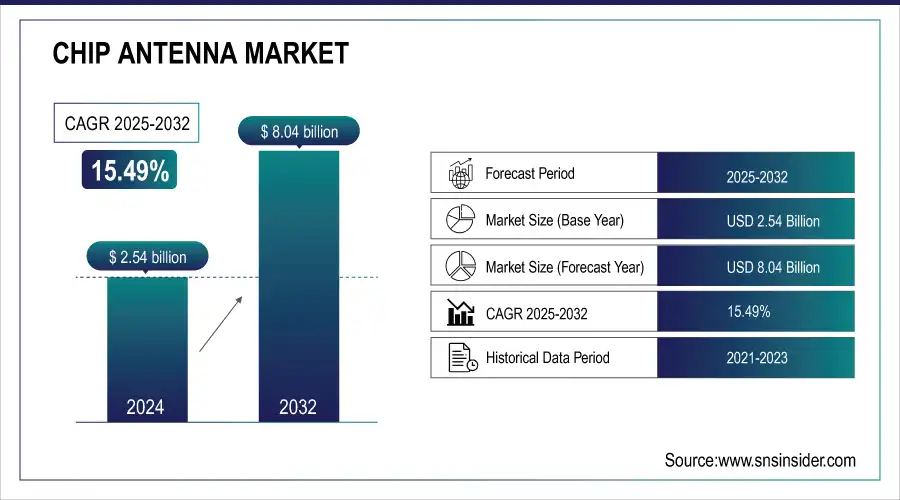

Chip Antenna Market Size & Growth:

The Chip Antenna Market size was valued at USD 2.54 Billion in 2024 and is projected to reach USD 8.04 Billion by 2032, growing at a CAGR of 15.49% during 2025-2032.

Growing demand for compact, high-efficiency RF components for use in IoT, smart metering, industrial monitoring and connected consumer devices is expected to remain a key driving factor for solid growth of the chip antenna market. With the anticipated evolution of smaller, more integrated devices, chip antennas surpass other designs as they are designed to consume minimal volume/area, be cost-effective, and support multi-band wireless standards. New features including integrated impedance matching, harmonic filtering, and protection are improving performance, simplifying printed circuit board (PCB) layouts, and reducing bill-of-materials costs. Chip antennas are versatile across use cases due to support for low-band and high-band sub-GHz frequencies and different PCB layouts. This trend is supported with increasing adoption in smart agriculture, smart cities, and asset-tracking applications that require reliable long-range wireless communication.

To Get more information on Chip Antenna Market - Request Free Sample Report

Ultra-Miniature Antenna-Matching Chips for STM32WL33 MCUs Offered by STMicroelectronics Let IoT Designs Process More RF Efficiency, While Cutting BoM Costs

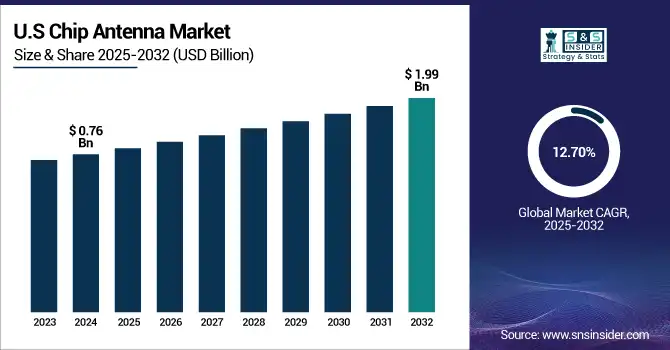

The U.S Chip Antenna Market size was valued at USD 0.76 Billion in 2024 and is projected to reach USD 1.99 Billion by 2032, growing at a CAGR of 12.70% during 2025-2032. The Chip Antenna Market is growing due to rising need for small, high-bandwidth components in consumer electronics, automotive, industrial IoT and healthcare devices. The growing adoption of 5G, Wi-Fi 6/7, Bluetooth, and other wireless technologies as well as miniaturization trends are encouraging manufacturers to incorporate chip antennas into future devices. Furthermore, the rise of smart homes, wearables, and connected infrastructure creates more opportunities for deployment, and there are advances in material science and antenna design for improved gains and better economics.

The chip antenna market trends include rising demand for miniaturized and integrated RF components, driven by growth in IoT, smart devices, and wearables. Adoption of multi-band and multiprotocol antennas supporting Wi-Fi 6/7, Bluetooth, Zigbee, and UWB is accelerating. System-in-Package (SiP) integration, cost optimization, and compact PCB layouts are shaping design priorities. Material innovations like LTCC and ceramic are enhancing performance and thermal stability. The market also sees increasing use in automotive electronics, including wireless battery systems and TPMS. Overall, high efficiency, space-saving form factors, and rapid design cycles are central to ongoing development.

Chip Antenna Market Dynamics:

Drivers:

-

Rising demand for miniaturized devices is driving the adoption of SiP-optimized chip antennas for compact, high-efficiency wireless solutions.

The growing demand for smaller, more efficient electronic devices is driving the adoption of chip antennas optimized for System-in-Package (SiP) modules in the chip antenna market. The rapid development of ultra-compact & highly-integrated electronic modules for IoT devices, wearables, and smart electronics is forcing manufacturers to adopt high-performance & multiprotocol chip antennas with the capability of size reduction tradeoff with RF performance. Antenna type – This type of antenna will support major wireless protocols such as Bluetooth, Zigbee, Wi-Fi in 2.4GHz band along with designing for space-constrained integration. All these features make them vital elements for the benefit of next-generation devices due to their ability to increase design flexibility, enable a shorter time-to-market, and allow affordable large-scale mass production. A contributing factor that is propelling chip antenna innovation and adoption is this movement toward SiP-compatible components

KYOCERA AVX Chip Antennas are uniquely optimized for a family of SiP modules, making possible ultra-compact, high-efficiency wireless IoT, wearable and smart device designs.

Restraints:

-

Design Constraints and Performance Trade-offs Limiting Chip Antenna Deployment

Despite growing demand, several key restraints are limiting broader deployment of chip antennas in compact wireless systems. One major challenge is the sensitivity of chip antenna performance to PCB layout, size, and surrounding components, which can significantly affect signal quality and consistency. Achieving optimal impedance matching and radiation efficiency in space-constrained designs often requires complex tuning and expert RF engineering, increasing development time and cost. Additionally, chip antennas typically offer lower gain and narrower bandwidth compared to external antennas, limiting their suitability for high-performance or long-range applications. Regulatory compliance, thermal stability at extreme temperatures, and integration difficulties with metal enclosures also pose hurdles, particularly in automotive and industrial-grade environments.

Opportunities:

-

AI-Driven Design Platforms and Virtual Antenna Technologies Unlock New Chip Antenna Market Opportunities

Advancements in AI-powered design tools and virtual antenna technologies are creating significant growth opportunities in the chip antenna market. These innovations simplify antenna design, reduce development time, and enable seamless multi-band, multi-radio connectivity across diverse IoT applications. The ability to support various frequencies, device sizes, and form factors allows manufacturers to accelerate time-to-market and lower costs, meeting the rising demand for smarter, scalable, and sustainable wireless solutions. Expanding adoption across automotive, industrial IoT, and asset-tracking sectors further drives demand, fostering widespread deployment of advanced chip antennas and enabling industry-wide transformation.

Ignion’s Virtual Antenna technology and AI-powered Oxion platform simplify multi-band IoT device connectivity, accelerating design and reducing time-to-market.

Challenges:

-

Complex Integration Challenges and Performance Limitations Hinder Chip Antenna Market Growth

The chip antenna market faces key challenges that impede faster adoption and broader application. The main challenge of integration complexity still exists, as antenna performance is a very sensitive parameter to PCB layout, neighboring components, and device form factors which usually means to have a lot of RF expertise needed to do the tuning process. This leads to longer design time and costs, which make it difficult to scale to mass production. Moreover, chip antennas are typically also lower gain with a narrower bandwidth than an external antenna, limiting their use for high-performance, long-range applications. For automotive and industrial applications, this is further complicated by the need for regulatory compliance and thermal stability in harsh environments. All of these factors together cause a market slowdown, as they set up technical and pricing barriers for widespread chip antenna use across a range of wireless devices.

Chip Antenna Market Segmentation Analysis:

By Type

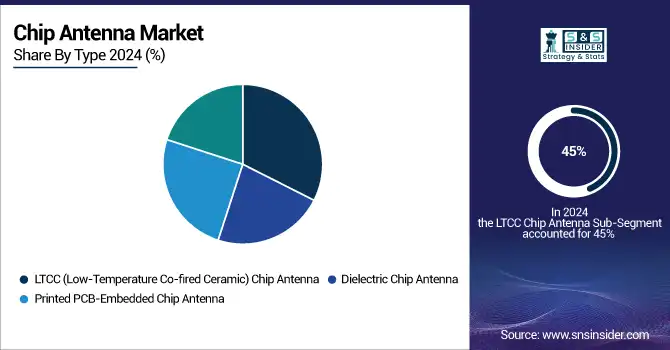

In 2024, the LTCC (Low-Temperature Co-fired Ceramic) Chip Antenna segment accounted for approximately 45% of the Chip Antenna Market share, highlighting its prominence in high-performance wireless applications. LTCC technology offers superior thermal stability, low signal loss, and excellent durability, making it ideal for compact and reliable antenna designs. Its ability to support multi-band and high-frequency operations drives adoption across consumer electronics, automotive, and industrial IoT sectors. Continuous advancements in LTCC materials and manufacturing techniques are further improving antenna efficiency and reducing costs, reinforcing its leading position. As demand for miniaturized, high-quality wireless connectivity grows, the LTCC chip antenna segment is expected to maintain strong market dominance in the coming years.

The Dielectric Chip Antenna segment is expected to experience the fastest growth in Internet Radio Market over 2025-2032 with a CAGR of 16.93%. The growth is proposed by the rising demand for ultra-compact, low-cost antennas in wearable devices, smart home gadgets, and 5G IoT solutions. Dielectric chip antennas provide high efficiency, high integration, and stable performance in wide multi-band applications, which is particularly useful in dense PCB designs and miniaturized devices. An increasing number of applications in consumer electronics, medical monitoring devices, and asset tracking systems is anticipated to continue driving the growth of the segment. Dielectric chip antenna technology is ready to support seamless low-profile connectivity in budding technology ecosystems as product designs shrink and wireless functionality expands.

By Frequency Band

In 2024, the 1–2.4 GHz Chip Antenna segment accounted for approximately 40% of the Chip Antenna Market share, due to relatively higher usage of these Chip Antenna for Bluetooth, Wi-Fi, Zigbee, and other low-power wireless communication protocols. This frequency range is still the column of short-range connectivity among consummer electronics, smart home gadgets, acnd modern technology IoT application sites. Its strength, which comes from being easy to plug into ISM bands that are adopted in all parts of the world, provides an optimum combination of range, efficiency, and low competition. In addition, growing adoption of connected devices such as wearables and asset trackers is another factor expected to bolster demand in this band. This frequency remains vital for scalable, high-performance wireless systems, backed by continuous innovation for compact and efficient designs by manufacturers.

The Above 5 GHz segment is expected to experience the fastest growth in Chip Antenna Market over 2025-2032 with a CAGR of 22.82%. This surge is driven by the expanding deployment of 5G, Wi-Fi 6E/7, and millimeter-wave (mmWave) applications, which require high-frequency performance and low-latency connectivity. As next-generation communication networks demand higher bandwidth and faster data rates, antennas operating above 5 GHz are becoming essential in smartphones, automotive radar systems, and advanced IoT infrastructure. The miniaturization of devices and the integration of high-speed wireless modules in compact consumer electronics further boost adoption. This frequency range supports ultra-fast transmission, making it vital for real-time data-intensive applications such as AR/VR, autonomous vehicles, and industrial automation.

By Application

In 2024, the WLAN/Wi-Fi Chip Antenna segment accounted for approximately 35% of the Chip Antenna Market share, represented high adoption wireless-enabled devices with consumer, enterprise, and industrial applications. Its dominance is due to the exponential growth in need for seamless wireless connectivity in smartphones, tablets, smart home systems, and IoT gateways. Growth in WiFi6 & WiFi 6E deployments—especially in commercial infrastructure as well as smart home and smart office networks, has greatly driven the usage of high efficiency WLAN optimized chip antennas. In addition, the trend toward telecommuting, remote education, and streaming-based entertainment has further fueled demand for on-chip Wi-Fi components that are high-gain, efficient, multi-band, and space-constrained.

The Dual-Band/Multi-Band segment is expected to experience the fastest growth in Chip Antenna Market over 2025-2032 with a CAGR of 21.00% The need for antennas that can operate with multiple wireless protocols (Bluetooth, Wi-Fi, Zigbee, LTE, etc.) at the same time within smaller and more compact devices is driving the growth of the segment. With the rise of compact, multifunctional IoT devices — including smartphones, wearables, and industrial sensors — the demand for compact but versatile antenna solutions has grown. Connection of devices over different frequency bands is a major requirement for connected applications that must communicate without disruption across short- and long-range wireless networks, while maintaining low design complexity and component count, and maximizing energy efficiency, which is why dual-band and multi-band chip antennas are essential.

By End-User Industry

In 2024, the Consumer Electronics Chip Antenna segment accounted for approximately 35% of the Chip Antenna Market share, driven by the widespread integration of wireless connectivity in smartphones, tablets, wearables, smart TVs, and AR/VR devices. The surge in demand for compact, high-performance antennas in increasingly miniaturized electronics has made chip antennas a preferred solution due to their small size, ease of integration, and reliable performance. With consumers prioritizing devices that support Wi-Fi, Bluetooth, and NFC, manufacturers are adopting chip antennas to meet both technical and aesthetic requirements. As smart home ecosystems and portable electronics continue to expand, the role of chip antennas in consumer devices is expected to remain a significant contributor to overall market growth.

The IT and Telecommunications Infrastructure segment is expected to experience the fastest growth in Chip Antenna Market over 2025-2032 with a CAGR of 18.59%, This growth is driven by expanding 5G deployment, increasing demand for small cell base stations, and the rising integration of wireless connectivity in networking equipment such as routers, modems, and access points. Chip antennas enable miniaturization and improve performance in dense network environments, making them ideal for advanced telecom infrastructure. As global data consumption rises and enterprises invest in digital transformation, the demand for compact, efficient antennas in IT and telecom hardware is expected to accelerate, positioning this segment as a critical growth area for the chip antenna market.

Chip Antenna Market Regional Insights:

North America Chip Antenna Market Trends

In 2024 North America dominated the Chip Antenna Market and accounted for 44% of revenue share, supported by a large number of consumer electronic & automotive manufacturers in the region, increasing implementation of upgraded wireless infrastructure and rising demand for IoT devices. Strong demand for small size and high performance antennas used in devices such as 5G-enabled devices and smart home applications was another factor that consolidated the regions leadership. In addition, addition of the advantageous regulations and high investment in the R&D have played a significant role to boost the market growth across U.S. and the Canada regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Chip Antenna Market Trends

Asia-Pacific is expected to witness the fastest growth in the Chip Antenna Market over 2025-2032, with a projected CAGR of 17.29%. This fast expansion is due to the prospering electronics manufacturing sector, rising smartphone penetration, and quick rollout of 5G infrastructure in countries like China, India, South Korea, and Japan. Regional demand is also being driven higher due to the need for compact, wireless components for use in consumer electronics, automotive, and industrial IoT applications. The massive government programs backing digital transformation and local semiconductor production are giving an extra push to the market, and together with the increase in demand, the region will be one of the main drives of chip antenna in the years to come.

Europe Chip Antenna Market Trends

In 2024, Europe emerged as a promising region in the Chip Antenna Market, supported by growing investments in connected automotive technologies, smart healthcare devices, and industrial IoT infrastructure. Countries like Germany, France, and the UK are advancing in 5G deployment and smart city initiatives, creating demand for high-frequency, miniaturized antennas. The region’s strong emphasis on environmental regulations is also pushing innovation in low-power and sustainable wireless solutions. Additionally, collaborations between telecom providers and electronics OEMs are accelerating R&D, positioning Europe as a key growth contributor to the global chip antenna landscape.

Latin America (LATAM) and the Middle East & Africa (MEA) Chip Antenna Market Trends

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Chip Antenna Market, due to rising mobile connectivity, growing investments for IoT deployments, and increase in miniaturization of wireless components for consumer and industrial applications. Chip antennas are becoming popular in LATAM due to the investments in telecom infrastructure and smart city development by the governments of different countries including Brazil and Mexico. At the same time, MEA is growing from expanding 4G/5G networks and digital transformation efforts in the Gulf states and some African nations. While places like this usually have their struggles in manufacturing bases, they are proving to show long-term growth promise.

Chip Antenna Companies are:

The Key Players in Chip Antenna Market are Vishay Intertechnology, Yageo Corporation, Johanson Technology, Inc., Mitsubishi Materials Corporation, Antenova Ltd., Fractus Antennas, Pulse Electronics, Patron Co. Ltd., Taoglas, Linx Technologies, Murata Manufacturing Co., Ltd., TDK Corporation, TE Connectivity Ltd., Skyworks Solutions, Inc., Samsung Electro-Mechanics, Amphenol Corporation, Würth Elektronik, INPAQ Technology Co., Ltd., Sunlord Electronics, Abracon LLC. and Others.

Recent Developments:

-

In May 2024 ,Masan High-Tech Materials has agreed to sell 100% of HC Starck Holding GmbH to Mitsubishi Materials Corporation, strengthening MMC’s tungsten portfolio.

-

In June 2024, Samsung and LG Display will dominate iPhone 16 OLED panel supply with 90M and 43M units respectively, boosting Korean component makers.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.54 Billion |

| Market Size by 2032 | USD 8.04 Billion |

| CAGR | CAGR of 15.49% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(LTCC (Low-Temperature Co-fired Ceramic) Chip Antenna, Dielectric Chip Antenna and Printed PCB-Embedded Chip Antenna) • By Frequency Band(Sub-1 GHz, 1–2.4 GHz, 2.4–5 GHz and Above 5 GHz) • By Application(WLAN/Wi-Fi, Bluetooth/BLE, Dual-Band/Multi-Band, GPS/GNSS, LPWAN (NB-IoT, LoRa, Sigfox)) • By End-User Industry(Automotive, Consumer Electronics, Healthcare and Medical Devices, IT and Telecommunications Infrastructure, Industrial and Retail IoT and Smart Grid and Smart Home) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Chip Antenna Market Companies are Vishay Intertechnology, Inc., Yageo Corporation, Johanson Technology, Inc., Mitsubishi Materials Corporation, Antenova Ltd., Fractus Antennas, Pulse Electronics, Patron Co. Ltd., Taoglas, Linx Technologies, Murata Manufacturing Co., Ltd., TDK Corporation, TE Connectivity Ltd., Skyworks Solutions, Inc., Samsung Electro-Mechanics, Amphenol Corporation, Würth Elektronik, INPAQ Technology Co., Ltd., Sunlord Electronics, Abracon LLC. and Others |