Water Soluble Pods Packaging Market Size & Overview:

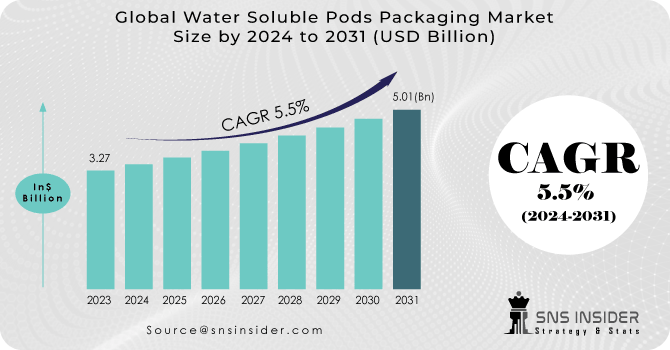

The Water Soluble Pods Packaging Market size was USD 3.27 billion in 2023 and is expected to Reach USD 5.01 billion by 2031 and grow at a CAGR of 5.5% over the forecast period of 2024-2031.

The packaging for water soluble pods is intended to reduce global waste disposal. These pods are environmentally safe and water soluble. Increasing awareness of the environment, increasing domestic product consumption and concerns about non decomposable waste accumulation are all reported to be a driving force behind the worldwide market for Water Soluble Pod Packaging.

Get More Information on Water Soluble Pods Packaging Market - Request Sample Report

As these films are water soluble and dissolve in both hot and cold water, poly vinyl alcohol is expected to be the fastest growing material segment. The characteristics of water pods which encourage many packaging industries to put them in containers, are expected to lead to an increased worldwide market for Water Soluble Pods.

MARKET DYNAMICS

KEY DRIVERS:

-

Personal care and cosmetic products have an increasing demand for organic packaging.

Increasing awareness about health and environmental issues is an important factor likely to drive market growth. Manufacturers of organic cosmetics seek an eco-friendly and green packaging option for its products to sell in shops as all natural. In order to develop an efficient packaging solution for their products, cosmetic companies are also cooperating with the packaging industry. The water soluble pod packaging is expected to gain more acceptance over the projection period due to its biodegradability. In the forecast period, these factors are expected to have a positive impact on market growth.

-

Due to industrial benefits, the demand for water soluble pod packaging is increasing.

RESTRAIN:

-

The high cost of raw materials to restrain the market growth.

Water soluble pods packaging technology appears to have the potential to offer a new environmentally friendly packaging choice with a better end-of-life solution. However, certain obstacles must be taken into account. PVA has a complex manufacturing process that leads to higher costs. Additionally, the profitability of water-soluble packaging manufacturers is significantly impacted by the rising cost of raw materials such as vinyl acetate monomer. The growth of this market will be hindered by these factors.

OPPORTUNITY:

-

The growing presence of an ecological and sustainable cleaning product

All over the world, concerns about pollution of the environment are increasing. In addition, the use of chemical based laundry detergents may be harmful to consumers' skin and deteriorate their quality and softness for a long time. Environmentally friendly products are generally organic and are made from natural additives or substances rather than chemicals, artificial preservatives, artificial additives and other synthetics that are harmful to human health. Due to the toxic effects of unnaturally manufactured detergents, consumers are opting for eco friendly and organic detergents that contain natural additives which will create huge growth opportunities over the forecast period.

CHALLENGES:

-

Compared to traditional packaging materials, water soluble packaging may be more expensive to produce.

It is a challenge to find cost effective alternatives that do not sacrifice the quality and safety of products but, in particular, when aimed at widespread adoption.

IMPACT OF RUSSIAN UKRAINE WAR

Due to the Russia Ukraine war producers should be worried about rising resin prices as oil prices have risen to their highest level in 14 years and gasoline prices have risen to $4 a gallon or more. The volatility in the company is caused by a growing Russian aggressive war with Ukraine.

The war has been devastating to Europe, where the main market for water dissolving containers is already suffering from reduced demand. Consequently, there has been a decrease in demand for water soluble pods packaging in the region. It had resulted in production disruptions due to rising energy prices.

Poly vinyl alochol prices have increased by more than 50% in the period since the outbreak of war and are a key ingredient for water soluble pods packaging. This is also leading to higher production costs.

IMPACT OF ONGOING RECESSION

It could reduce global consumption of water soluble pods packaging by up to 1% if the recession persists until 2023. Advanced economies are feeling the most pronounced impact of the recession. The developed countries are the biggest user of water soluble pods. Due to the economic downturn, consumption in advanced countries is declining and this leads to a decrease in demand for water soluble pods.

Demand for water soluble pods packaging is expected to drop by 1% within the detergents sector during 2023. The reason for this can be attributed to a decrease in detergents consumption by consumers during the recession.

The demand for water soluble pod containers in the hand wash industry is expected to fall by 0.5%. This is due mainly to the fact that, during recessions, consumers postpone or avoid healthcare procedures.

KEY MARKET SEGMENTS

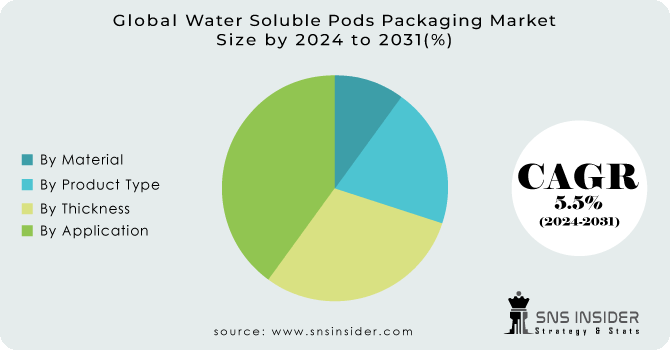

By Material

-

Poly Vinyl Alcohol

By Product Type

-

Single Layer Water Pods

-

Multi Layer Water Pods

-

Dual Layer Water Pods

Multi Layer Water Pods is likely to hold the maximum market share of around 65% in the year 2023.

By Thickness

-

Less Than 30 micro meter

-

31-60 micro meter

-

61 micro meter

Based on the thickness segment, 31-60 micro meter is expected to hold the maximum market share. Development of detergent pods which this thickness will drive the market growth.

By Application

-

Hand Wash

-

Detergents

-

Dish Wash

-

Others

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

The North American region accounted for over 35% of the water soluble pods packaging market by 2023. In terms of market shares and revenues, North America has been dominating the water soluble pods packaging market due to growing demand in this region. As a result of growing demand for packaging in the region and an increased preference for organic cosmetics, North America is also leading the market.

Due to the growing demand for household products and consumer goods in that region, Asia Pacific is projected to be the most dynamic developing regions over the forecast period. Countries such as China, India, South Korea and Japan are major contributors to the growth in the market given their high demand for detergents and hygiene products. Moreover, the ban on plastic packaging in many countries has led to a significant growth of the Regional Market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Water Soluble Pods Packaging market are Mitsubishi Chemical Corporation, Cortec Corporation, Mondi Group Plc, Noble Industries, AquaPak Ltd, MSD Corporation, Arrow Greentech Limited, White Industries, Amtrex Nature Care Pvt Ltd, MonoSol LLC and other players.

Cortec Corporation-Company Financial Analysis

RECENT DEVELOPMENT

-

In December 2021, The Invisible Company, a Hong Kong based company offering sustainable and innovative packaging solutions, announced the completion of its project for developing revolutionary packaging solutions known as 'Invisibility Bag'.

-

Ecologic solutions a company specializing in environmentally friendly cleaning solutions, has introduced sachet of water soluble cleaning concentrate.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.27 Bn |

| Market Size by 2031 | US$ 5.01 Bn |

| CAGR | CAGR of 5.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Poly Vinyl Alcohol) • by Product Type (Single Layer Water Pods, Multi Layer Water Pods, Dual Layer Water Pods) • by Thickness (Less Than 30 micro meter, 31-60 micro meter, 61 micro meter) • by Application (Hand Wash, Detergents, Dish Wash, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Mitsubishi Chemical Corporation, Cortec Corporation, Mondi Group Plc, Noble Industries, AquaPak Ltd, MSD Corporation, Arrow Greentech Limited, White Industries, Amtrex Nature Care Pvt Ltd, MonoSol LLC |

| Key Drivers | • Personal care and cosmetic products have an increasing demand for organic packaging. • Due to industrial benefits, the demand for water soluble pod packaging is increasing. |

| Key Restraints | • The high cost of raw materials to restrain the market growth. |