Carbide Tools Market Report Scope & Overview:

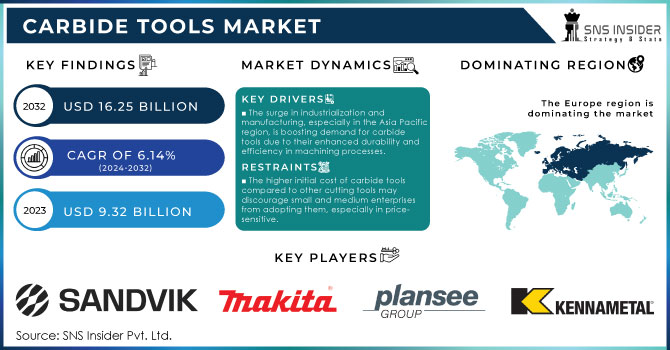

The Carbide Tools Market size was valued at USD 9.89 billion in 2024 and is projected to reach USD 15.93 billion by 2032, growing at a CAGR of 6.14% during 2025-2032. The surge in manufacturing activities across various sectors, particularly in automotive, aerospace, and construction, has fueled the demand for high-performance tools capable of withstanding extreme conditions. In recent years, imports of carbide tools into the United States have been valued at over USD 1 billion annually, showcasing the robust demand for high-quality tools that enhance productivity and precision in manufacturing processes. Statistics indicate that over 80% of manufacturers in the automotive sector have adopted carbide tools for their ability to perform under high stress and heat, improving the overall efficiency of production lines.

To get more information on Carbide Tools Market - Request Sample Report

The introduction of advanced manufacturing technologies, such as automated production lines and precision machining, has further bolstered this region's output, with estimates suggesting an annual growth rate of around 7% in carbide tool manufacturing capabilities. Additionally, innovations in carbide tool design and manufacturing processes, such as the introduction of coatings and advanced geometries, have contributed to increased sales. Coated carbide tools, which enhance wear resistance and improve cutting performance, have gained significant traction, with a market penetration rate of about 35%. The ability of carbide tools to provide superior performance in machining and manufacturing operations further solidifies their market position, leading to a notable rise in sales across industries.

Key Carbide Tools Market Trends

-

Intelligent diagnostic systems are applied to enhance anomaly detection, enable instant error identification, and strengthen predictive upkeep in machining operations.

-

Low-power optimization solutions are adopted to cut expenses while ensuring eco-friendly manufacturing performance.

-

Advanced protection mechanisms are evolving to improve operator-equipment synergy, boosting safety in inspection and operational processes.

-

Flexible tooling configurations are being preferred, supporting scalability, quicker setup, and application-specific adaptability across end-use industries.

-

Digital connectivity solutions are growing, allowing remote supervision, asset intelligence tracking, and predictive insights to improve tool dependability.

Carbide Tools Market Growth Drivers:

-

The surge in industrialization and manufacturing, especially in the Asia Pacific region, is boosting demand for carbide tools due to their enhanced durability and efficiency in machining processes.

The rapid industrialization and expansion of manufacturing are pivotal in driving the demand for carbide tools, particularly in regions like Asia Pacific. As industries evolve, the need for precision and efficiency in production processes becomes paramount. Carbide tools are renowned for their exceptional hardness and wear resistance, allowing manufacturers to achieve high levels of precision while minimizing tool wear. This durability translates into longer tool life, reducing replacement frequency and associated costs, which is increasingly important as manufacturers aim to optimize their operational expenditures.

Additionally, carbide tools facilitate faster machining speeds and improved surface finishes, significantly enhancing productivity. Statistics indicate that the global manufacturing output is projected to reach USD 41.6 trillion by 2025, highlighting the scale of the industrial activities driving demand for advanced tooling solutions. Furthermore, a report suggests that approximately 50% of manufacturing companies are investing in automated processes, which often require robust carbide tooling to maintain efficiency and quality. The trend toward automation is also being fueled by the growing focus on reducing downtime and increasing production rates, making carbide tools an essential component in modern manufacturing environments.

Moreover, the increasing complexity of machined components, particularly in sectors such as aerospace and automotive, necessitates tools that can withstand high stress and temperature variations. This trend further solidifies the role of carbide tools as indispensable assets in contemporary manufacturing operations, positioning them as critical contributors to the ongoing industrial revolution.

-

The automotive and aerospace industries are driving high demand for carbide tools due to their necessity for precision machining of tough materials and lightweight alloys that enhance fuel efficiency.

The automotive and aerospace industries are experiencing a significant increase in demand for carbide tools, primarily due to their essential role in precision machining processes. In automotive production, manufacturers are increasingly utilizing carbide tools to machine tough materials such as hardened steel and advanced alloys, which are essential for producing high-performance engine components, transmission systems, and structural elements. These tools enable manufacturers to achieve the required precision and surface finishes, which are critical for ensuring the durability and efficiency of vehicles. Moreover, the growing emphasis on lightweight materials to enhance fuel efficiency is pushing the boundaries of manufacturing capabilities. The materials like aluminum, titanium, and composite materials are being adopted to reduce overall vehicle weight. Carbide tools are particularly well-suited for machining these materials, as they offer excellent wear resistance and maintain sharp cutting edges, resulting in improved productivity and lower operational costs.

In addition, statistics show that around 60% of the total machining time in automotive production is spent on tool changes and maintenance, making the choice of cutting tools crucial for efficiency. The aerospace sector also mirrors this trend, where stringent safety and performance standards necessitate the use of high-quality carbide tools for components such as turbine blades and structural frames. As both industries continue to evolve, the demand for carbide tools is expected to rise, driven by the need for enhanced precision, material adaptability, and operational efficiency in manufacturing processes.

Carbide Tools Market Restraints:

-

The higher initial cost of carbide tools compared to other cutting tools may discourage small and medium enterprises from adopting them, especially in price-sensitive.

High initial investment in carbide tools is a significant barrier for many small and medium enterprises (SMEs), particularly in cost-sensitive markets. While carbide tools offer superior durability and efficiency, their upfront costs can be substantially higher than those of traditional cutting tools made from high-speed steel or other materials. For instance, the price of carbide tools can be two to three times greater than that of conventional tools, which poses a challenge for SMEs operating with limited budgets. These businesses often prioritize lower-cost options to manage expenses and maximize their profit margins, leading them to overlook the long-term benefits of carbide tools.

Furthermore, the reluctance to invest in carbide tools is compounded by the financial risks associated with initial investments. In uncertain economic climates, SMEs may be hesitant to allocate significant funds towards tools that they perceive as non-essential. This mindset can hinder their ability to enhance productivity and compete effectively in the market.

Carbide Tools Market Segment Outlook

By Product Type

The milling tools segment dominated the market share over 38 % in 2024, driven by its high efficiency, rigidness, and hardness. These qualities make milling tools ideal for use in the construction and automotive industries, where precision and durability are critical. Their ability to handle tough materials and deliver consistent performance in demanding environments further strengthens their dominance.

The turning tools segment is expected to experience rapid growth, propelled by the increasing demand for round tools and reamers in CNC and lathe machines. These tools are widely used across multiple industries, including construction machinery, automotive, furniture, carpentry, and healthcare equipment. Their versatility and expanding application in precision manufacturing make them one of the fastest-growing segments in the metalworking tools market.

By Coating Type

The coated segment dominated the market share over 58% in 2024. This dominance is attributed to the widespread application of coated inserts in industries such as automotive and aerospace. Coatings enhance the performance of drills and bits by improving cutting efficiency, which reduces machining time and costs. Specifically, Titanium Nitride (TiN) coatings significantly boost the cutting speed of carbide tools, doubling their effectiveness compared to non-coated options.

By End User

The automotive segment dominated the market share over 32% in 2024. This growth is driven by the increasing number of automotive manufacturers worldwide, which heightens the demand for precision tools essential for vehicle production. Moreover, rapid urbanization in developing regions like India, Brazil, and parts of Africa leads to a surge in vehicle ownership, as more people seek transportation options.

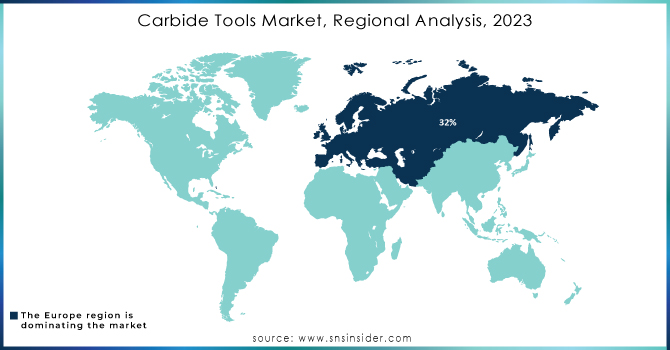

Carbide Tools Market Regional Analysis

North America Carbide Tools Market Insights

North America holds a significant share of the carbide tools market, supported by strong industrialization, a mature automotive sector, and advancements in aerospace and defense manufacturing. The U.S. and Canada lead the demand due to widespread adoption of precision machining and CNC technologies. Increasing investments in smart manufacturing and automation enhance the requirement for high-performance cutting tools. Moreover, the focus on reshoring manufacturing activities to strengthen domestic supply chains is creating growth opportunities. With key players and technological innovators based in the region, North America continues to be a vital hub for carbide tool production and consumption.

Europe Carbide Tools Market Insights

Europe region dominated the market share over 32% in 2024, by robust economic growth in key countries like Germany and the U.K. The region benefits from a well-established infrastructure sector, which requires high-quality cutting tools for construction and manufacturing. The presence of major manufacturers, such as Sandvik and Kennametal, fosters innovation and competitiveness, further solidifying Europe's leadership. Additionally, stringent quality standards and technological advancements in tooling solutions are influencing market dynamics positively. With investments in research and development, European companies are continuously improving their product offerings, catering to various industries including aerospace, automotive, and general engineering.

Asia-Pacific Carbide Tools Market Insights

The Asia Pacific region is anticipated to experience the fastest growth in the carbide tools market, primarily driven by a surge in manufacturing activities in countries like India, China, Indonesia, and Vietnam. The rapid industrialization and urbanization in these developing economies significantly contribute to the increasing demand for advanced machinery and tools. As automotive and construction sectors expand, the need for efficient cutting tools, such as round tools and drill bits, becomes paramount. China's aggressive investments in infrastructure and manufacturing capabilities are particularly influential, propelling the demand for carbide tools. Furthermore, the adoption of CNC machines and lathe machines across various industries fuels market growth by necessitating high-performance cutting tools.

Middle East & Africa Carbide Tools Market Insights

The Middle East & Africa carbide tools market is growing steadily, driven by expanding oil & gas, construction, and mining industries. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing infrastructure upgrades and industrial diversification programs that create demand for precision machining. With governments investing in manufacturing hubs and industrial projects, the adoption of carbide tools is rising across energy, automotive, and heavy engineering sectors. Although the market is relatively nascent compared to Europe and Asia, rising technological adoption and increasing partnerships with global toolmakers are expected to accelerate growth in the coming years.

Latin America Carbide Tools Market Insights

Latin America’s carbide tools market is gaining momentum with strong industrial activities in Brazil, Mexico, and Argentina. The automotive industry, a key growth driver, is pushing the demand for advanced machining solutions to support vehicle production and exports. Infrastructure development projects, particularly in Brazil and Mexico, are boosting the requirement for high-quality construction and engineering tools. Additionally, the mining sector in Chile and Peru contributes to market expansion through the need for durable cutting tools in extraction and processing operations. Although challenges like economic instability exist, increasing foreign investments and rising manufacturing competitiveness strengthen growth prospects.

Need any customization research on Carbide Tools Market - Inquiry Now

Carbide Tools Companies:

-

OSG Corporation

-

Makita Corporation

-

Plansee Group

-

Kennametal Inc.

-

Sumitomo Electric Industries Ltd.

-

Guhring Ltd.

-

Fullerton Tool Company Inc.

-

YG-1 Co Ltd

-

Allied Machine & Engineering Corp

-

Mitsubishi Materials Corporation

-

Walter AG

-

Iscar Ltd.

-

CERATIZIT Group

-

Tungaloy Corporation

-

Ingersoll Cutting Tools

-

Seco Tools AB

-

ATI Stellram

-

IMCO Carbide Tool Inc

Competitive Landscape for Carbide Tools Market:

Kennametal Inc., founded in 1938 and headquartered in Pittsburgh, Pennsylvania, USA, is a global leader in metal cutting tools, tooling systems, and advanced materials. The company serves industries such as aerospace, automotive, energy, transportation, and general engineering with high-performance tooling solutions. Kennametal’s expertise lies in delivering productivity, precision, and sustainability through its cutting-edge innovations in metal cutting and wear-resistant solutions. With decades of expertise, it continues to drive advancements in machining efficiency, enabling industries to optimize operations.

-

In 2024: Kennametal introduces the HARVI Ultra 8X shoulder mills, designed for heavy-duty milling applications, offering enhanced performance and tool life in metalworking. This tool is optimized for aggressive cutting operations, providing higher productivity.

Sandvik AB, founded in 1862 and headquartered in Stockholm, Sweden, is a multinational engineering company specializing in advanced manufacturing solutions, mining equipment, metal-cutting tools, and materials technology. The company operates through divisions such as Sandvik Machining Solutions, Sandvik Mining and Rock Solutions, and Sandvik Materials Technology, serving industries ranging from mining to aerospace. Known for innovation and sustainable technology, Sandvik emphasizes automation, digitalization, and productivity improvement in industrial operations.

-

In 2024: Sandvik Coromant launched a new generation of carbide grades for turning tools, aimed at improving wear resistance and productivity in difficult-to-machine materials like titanium alloys.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.89 billion |

| Market Size by 2032 | USD 15.93 billion |

| CAGR | CAGR of 6.14% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Drilling Tools, Milling Tools, Turning Tools, Others) • By Coating Type (Coated, Non-coated) • By Configuration (Hand Based, Machine Based) • By End User (Automotive, Construction, Metal Fabrication, Electronics & Electrical, Aerospace, Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

OSG Corporation, Sandvik AB, Makita Corporation, Plansee Group, Kennametal Inc., Sumitomo Electric Industries Ltd., Guhring Ltd., Fullerton Tool Company Inc., YG-1 Co Ltd, Allied Machine & Engineering Corp, Mitsubishi Materials Corporation, Walter AG, Iscar Ltd., Kyocera Corporation, CERATIZIT Group, Tungaloy Corporation, Ingersoll Cutting Tools, Seco Tools AB, ATI Stellram, IMCO Carbide Tool Inc. |