Wi-Fi as a Service Market Key Insights:

To Get More Information on Wi-Fi as a Service Market - Request Sample Report

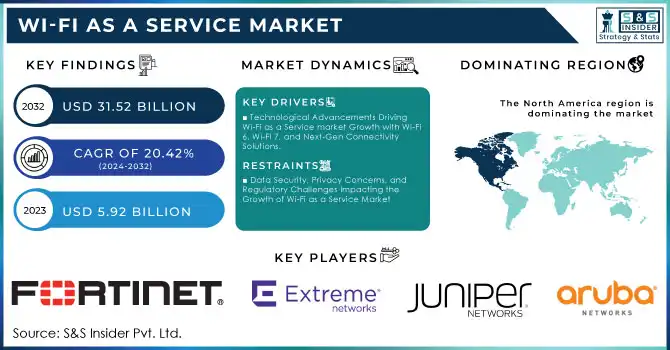

The Wi-Fi as a Service Market size was valued at 5.92Billion in 2023 and is projected to reach USD 31.52 Billion by 2032 with a growing CAGR of 20.42% Over the Forecast Period of 2024-2032.

The Wi-Fi as a Service (WaaS) market is witnessing substantial growth due to increasing demand for seamless connectivity across various industries, especially as businesses embrace digital transformation. With the advent of technologies like the Internet of Things (IoT), Wi-Fi 6, and Wi-Fi 7, enterprises are adopting more reliable and scalable Wi-Fi solutions for IoT applications, remote work, real-time data transmission, and collaboration tools. In parallel, private 5G and satellite connectivity are complementing Wi-Fi, providing businesses with customized, high-performance solutions. Wi-Fi as a Service offers a cost-effective alternative to traditional network setups, enabling businesses to outsource network management to third-party providers, thus reducing infrastructure costs. With growing reliance on wireless connectivity for applications like e-commerce and smart cities, Wi-Fi as a Service is becoming integral to the broader digital infrastructure. By 2032, the Wi-Fi as a Service market is projected to experience robust growth, becoming a cornerstone of digital networks. In Canada, Voicecom, a telecom disruptor, is leveraging its founder’s decades of expertise to address the growing need for affordable and reliable wireless connectivity. With average monthly internet costs ranking fifth globally for 100Mbps plans and over 53% of small businesses experiencing connectivity downtime, Voicecom is aiming to reduce this burden by offering high-touch, personalized services.Similarly, Boldyn Networks is driving innovation with private 5G as a service. Their offerings support advanced technologies like AR/VR, smart machines, and robotics, providing customizable connectivity solutions to meet specific business needs. Already boasting 60 private network deployments, Boldyn’s €300 million investment will further propel the adoption of private networks, with services structured across four levels—Innovation, Digitalisation, Automation, and Mission-Critical. This trend is echoed globally; with mobile broadband usage, soaring and 5G subscriptions in Thailand expected to reach 45 million, with a forecast of 94% of mobile subscriptions being 5G by 2030. This highlights the pivotal role Wi-Fi and private 5G play in unlocking new opportunities across sectors such as healthcare, automotive, and manufacturing.

Market Dynamics

Drivers

- Technological Advancements Driving Wi-Fi as a Service market Growth with Wi-Fi 6, Wi-Fi 7, and Next-Gen Connectivity Solutions.

Technological advancements, particularly the roll-out of Wi-Fi 6 and Wi-Fi 7, are major drivers for the Wi-Fi as a Service (WaaS) market. These technologies provide significantly higher speeds, lower latency, and enhanced scalability, addressing the growing demand for more robust and efficient wireless networks. Industry leaders, such as Samsung and Verizon, are exploring next-generation wireless solutions to improve connectivity, paving the way for greater Wi-Fi adoption across sectors. In sectors like aviation, companies like Air France are enhancing in-flight Wi-Fi services using Starlink, a testament to the increasing need for seamless, high-speed wireless connectivity. Additionally, the introduction of Wi-Fi 7 access points by companies like Edgecore, which promise faster and more reliable services, highlights the market’s focus on delivering next-level wireless experiences. These advancements not only improve connectivity but also optimize operational efficiency across industries, fueling the WaaS market growth. As businesses and consumers alike demand faster, more reliable connectivity, Wi-Fi as a Service continues to evolve as a crucial enabler of digital transformation.

Restraints

- Data Security, Privacy Concerns, and Regulatory Challenges Impacting the Growth of Wi-Fi as a Service Market

The Wi-Fi as a Service (WaaS) market faces key restraints, particularly concerning data privacy and security. As the demand for connected devices grows, vulnerabilities in Wi-Fi networks increase, making robust encryption and VPN solutions essential. Public Wi-Fi usage, in particular, is a risk factor, with users often neglecting necessary security measures. Moreover, with the rise of smart homes and IoT devices, maintaining secure networks becomes even more challenging. Advanced encryption methods and network security integration are needed to safeguard sensitive data. Additionally, regulatory compliance with increasingly stringent data protection laws adds complexity to WaaS implementation. These factors, alongside growing concerns over cyber threats, create obstacles for businesses seeking to adopt WaaS solutions, hindering market growth despite its potential. The need for personal responsibility in managing digital risks is crucial, as the evolving landscape demands constant vigilance against emerging security threats.

Segment Analysis

By Component

The infrastructure segment in the Wi-Fi as a Service (WaaS) market captured the largest revenue share of approximately 45% in 2023, driven by the increasing need for robust wireless connectivity across sectors. This segment includes Wi-Fi routers, access points, and network switches, which are essential for enabling seamless Wi-Fi experiences in both consumer and enterprise environments. Companies like Edgecore Networks have launched advanced Wi-Fi 7 access points to cater to the growing demand for high-speed and low-latency networks. Additionally, countries like the U.S. and regions in Europe are actively investing in smart city infrastructure and public Wi-Fi initiatives to expand their digital connectivity, further fueling market growth. These infrastructure developments ensure that businesses and governments meet the increasing demand for reliable and scalable network solutions.

By Location

In 2023, the indoor segment of the Wi-Fi as a Service (WaaS) market captured the largest revenue share of approximately 69%, driven by the growing demand for reliable, high-speed wireless networks within homes, offices, and commercial buildings. As remote work and digital services become integral to daily life, the need for seamless indoor connectivity has surged. Businesses are increasingly investing in advanced infrastructure to support bandwidth-heavy applications, such as video conferencing and cloud-based services. The indoor segment benefits from innovations like Wi-Fi 6 and Wi-Fi 7, which offer enhanced speeds and lower latency, further boosting their adoption. Furthermore, companies are focusing on providing tailored solutions to meet the unique requirements of indoor environments, with improved coverage and security measures.

Regional Analysis

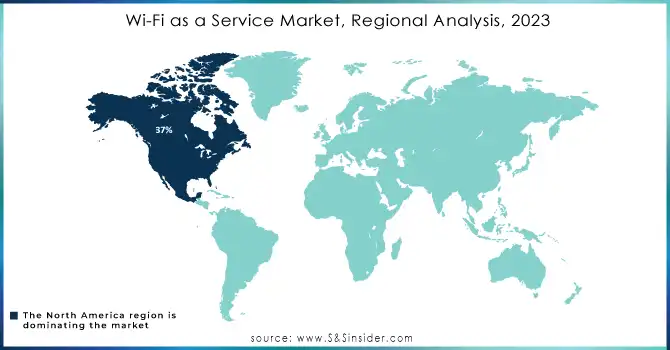

In 2023, North America dominated the Wi-Fi as a Service (WaaS) market with a revenue share of 37%, driven by rapid digital transformation and the high demand for robust wireless networks. Companies in the region, such as Cisco, Verizon, and Ruckus Networks, are continually advancing product development with innovations like Wi-Fi 6 and Wi-Fi 7 technologies, enhancing speeds, security, and network scalability. The U.S. is at the forefront of WaaS adoption, with businesses increasingly leveraging WaaS solutions to meet growing bandwidth and connectivity needs across industries like healthcare, education, and enterprise sectors. This ongoing evolution is expected to further solidify North America's market leadership.

Asia Pacific is the fastest-growing region in the Wi-Fi as a Service (WaaS) market due to several key factors. The region is experiencing rapid digital transformation, with increasing internet adoption and the proliferation of smart devices. Additionally, governments are investing heavily in infrastructure and smart city initiatives, further fueling demand for reliable and scalable Wi-Fi solutions. Countries like China, India, and Japan are embracing advanced technologies, and companies such as Huawei and Netgear are driving innovation. The rise of e-commerce, IoT, and cloud services is also accelerating WaaS adoption across industries in the region.

Do You Need any Customization Research on Wi-Fi as a Service Market - Inquire Now

Key Players:

Some of the major key players in Wi-Fi as a Service Market with product in brackets:

-

Cisco Systems, Inc. (Cisco Meraki)

-

Aruba Networks (Hewlett Packard Enterprise) (Aruba Central)

-

Juniper Networks, Inc. (Mist AI)

-

Extreme Networks, Inc. (ExtremeCloud IQ)

-

Fortinet, Inc. (FortiAP Cloud)

-

Ruckus Networks (CommScope) (Ruckus Cloud WiFi)

-

Huawei Technologies Co., Ltd. (Huawei CloudCampus)

-

Ubiquiti Inc. (UniFi Cloud)

-

Cambium Networks, Ltd. (cnMaestro)

-

Mojo Networks, Inc. (Arista Networks) (Cognitive WiFi)

-

Aerohive Networks, Inc. (Extreme Networks) (HiveManager)

-

TP-Link Technologies Co., Ltd. (Omada Cloud Controller)

-

Telstra Corporation Limited (Telstra WiFi-as-a-Service)

-

Superloop Limited (Superloop Managed WiFi)

-

ADTRAN, Inc. (ADTRAN ProCloud WiFi)

-

Tata Communications Limited (WiFi+ Managed Service)

-

Orange Business Services (Orange WiFi as a Service)

-

Comcast Business (Comcast Business WiFi Pro)

-

Deutsche Telekom AG (Business WiFi Managed Solution)

-

Verizon Communications Inc. (Verizon Managed WiFi)

-

NETGEAR(WBE710 Tri-band WiFi 7 Access Point)

List 20 potential customers for the WiFi as a Service (WaaS) market across various industries:

-

Walmart (Retail)

-

Target (Retail)

-

McDonald's (Foodservice)

-

Starbucks (Foodservice)

-

Amazon (E-commerce and Logistics)

-

The Home Depot (Retail)

-

Hilton Worldwide (Hospitality)

-

Marriott International (Hospitality)

-

Best Buy (Retail)

-

Apple (Retail and Corporate Offices)

-

Tesla (Automotive and Showrooms)

-

Ford Motor Company (Automotive and Showrooms)

-

University of California, Berkeley (Education)

-

Harvard University (Education)

-

Cognizant Technology Solutions (Corporate Offices)

-

Bank of America (Financial Services)

-

Wells Fargo (Financial Services)

-

American Airlines (Transportation and Airports)

-

Singapore Changi Airport (Transportation)

-

Dubai Metro (Transportation and Public Services)

Recent News

-

On November 5, 2024, the U.S. Department of Defense announced the rollout of free Wi-Fi to remote barracks as part of its “Taking Care of Our People” initiatives, focusing on providing reliable internet access in challenging locations, including through building retrofits.

-

On October 28, 2024, WMS showcased its advanced Wi-Fi and cellular connectivity solutions at the Interferry2024 Conference, offering faster speeds, tailored plans, and seamless integration with satellite providers like Starlink to enhance the passenger experience on ferries.

-

On October 28, 2024, Delta Airlines announced the expansion of its free Wi-Fi service, powered by T-Mobile, to most domestic mainline routes, with plans to offer streaming-quality connectivity on nearly 700 aircraft by the end of 2024 and select international routes by 2025.

-

On September 16, 2024, United Airlines announced a partnership with SpaceX to offer free in-flight Wi-Fi via Starlink, with plans to roll out the service across its entire fleet by 2025.

Recent Developments

-

January 9, 2024 – TP-Link unveiled its next-generation Wi-Fi 7 solutions at CES 2024, featuring the new Deco Mesh Wi-Fi systems, next-gen Archer routers, and the world’s first Wi-Fi 7 client adapter. These products promise faster speeds, lower latency, and enhanced capacity, with the flagship Deco BE95 offering speeds up to 33 Gbps across 16 streams and 4 bands.

-

August 6, 2024 – NETGEAR launched the WBE710 Insight Manageable Tri-band WiFi 7 Access Point, expanding its WiFi 7 solution portfolio for businesses. The WBE710 offers up to 9.4Gbps throughput, enhanced multi-link operation, and seamless roaming, making it ideal for businesses scaling their networks with WiFi 7-enabled devices.

-

January 8, 2024 – Ubiquiti Inc. launched UniFi 7, a scalable Wi-Fi 7 solution designed to provide wired-like user experiences. The U7 Professional PoE Access Point (U7 Pro), priced at $189 MSRP, integrates cutting-edge Wi-Fi technology with the UniFi full-stack IT software platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.92 Billion |

| Market Size by 2032 | USD 31.52 Billion |

| CAGR | CAGR of 20.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Infrastructure, Software, Services) • By Location (Indoor, Outdoor) • By Organization Type (Large Enterprise. Small & Medium Enterprises) • By Vertical (Banking, Financial Services, and Insurance (BFSI), Retail, Information Technology, Manufacturing, Transportation & Logistics, Education, Healthcare, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Aruba Networks (Hewlett Packard Enterprise), Juniper Networks, Extreme Networks, Fortinet, Ruckus Networks (CommScope), Huawei Technologies, Ubiquiti, Cambium Networks, Mojo Networks (Arista Networks), Aerohive Networks (Extreme Networks), TP-Link Technologies, Telstra Corporation, Superloop, ADTRAN, Tata Communications, Orange Business Services, Comcast Business, Deutsche Telekom, and Verizon Communications,NETGEAR |

| Key Drivers | • Technological Advancements Driving Wi-Fi as a Service Growth with Wi-Fi 6, Wi-Fi 7, and Next-Gen Connectivity Solutions |

| Restraints | • Data Security, Privacy Concerns, and Regulatory Challenges Impacting the Growth of Wi-Fi as a Service Market |