Woodworking Machinery Market Report Scope & Overview:

To get more information on Woodworking Machinery Market - Request Free Sample Report

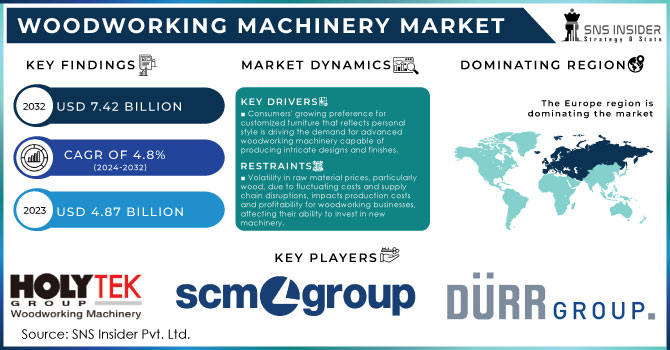

The Woodworking Machinery Market size was estimated at USD 4.87 billion in 2023 and is expected to reach USD 7.42 billion by 2032 at a CAGR of 4.8% during the forecast period of 2024-2032.

The increase in construction projects, especially in housing and business sectors, greatly boosts the need for woodworking machinery. The growing need for top-quality wood products and components for modern construction projects is driving this increased demand. In June 2024, the seasonally adjusted annual rate of construction spending was approximately USD 2.14 trillion, showing a slight drop of 0.3% from the revised May of USD 2.15 trillion. The strong increase in construction expenditure highlights the growing demand for woodworking machinery, with builders and manufacturers looking for more advanced equipment to keep up with the rising need for high-quality wooden components in building projects.

An increase in residential and commercial structures and consumer preference to ensure a pleasant look for their buildings is driving the demand for the woodworking machines market. Further, the consumers in the last few years have replaced their old furniture and they are buying a new wooden furnished so that their home or office would look attractive. As per information provided by Home Furnishings Business, in 2022, the wooden furniture business saw sales rising by 21.8% and profits by 13.2% for traditional retailers.

The growing e-commerce channels, which have enabled customers to have a vast array of furniture products and customers’ changing preference toward home décor products such as wood-based furniture, has increased the demand for these machines. With reference to ComScore Digital Commerce Measurement, one of the most rapidly growing categories in digital commerce in the U.S. in 2021 was furniture and appliances. It is crucial to monitor online sales trends as nearly half (49%) of all furniture purchases in 2022 were done on the internet. In contrast to last year, online furniture purchases have increased to 48%. The aforementioned are some of the key factors expected to boost demand for woodworking machines, thereby providing lucrative market opportunities in the near future.

MARKET DYNAMICS

DRIVERS

Consumers' growing preference for customized furniture that reflects personal style is driving the demand for advanced woodworking machinery capable of producing intricate designs and finishes.

The increasing trend for consumers to buy custom furniture, allowing them to express their own unique style in home decor is predicted be a major factor that amplifies the need advanced woodworking machinery which can produce detailed cuts and finishes. Personalization & Individuality the customization has become one of the main buying buttons prevalent in today's market where consumers want furniture not only to fulfill basic functional requirements but also has to adhere with their aesthetic appeal and individual taste. This behavior is most noticeable among millennials and Gen Z, who place a high value on individuality - they want something that represents their personality similarly to how artwork can define living space. In turn, furniture manufacturers are now making substantial investments in advanced woodworking machinery to accommodate those needs.

CNC (Computer Numerical Control) technology revolutionizes woodworking by enabling precise, complex cutting, drilling, and shaping of wood, leading to high-speed production and consistent quality, thereby driving widespread industry adoption.

Technology like CNC (Computer Numerical Control) has revolutionized woodworking allowing unprecedented precision in previously labor-intensive work. This wonderful technology affords very domain cutting perforation and contouring of the wood, so far which could not easily accomplish before or was on high throughput with traditional resultant technologies. A CNC machine follows a specific set of computer-programmed instructions which enable it to perform precision cutting, crafting and moulding almost exactly the same way every time resulting in uniformity across all products as well. This automation diminishes the likelihood of human error, which expedites production speed exponentially and gives way to mass production with no loss in detail or handcrafted quality. CNC technology is invaluable in the modern woodwork sector as it allows woodworking businesses satisfy consumer demand keeping quality at a high level.

This technology has created many changes in industry so that, the adoption CNC technology. Works of custom woodwork that in the past took brain-numbing manual labor can now be performed quickly and accurately. This is precision cutting become a reality, which might allow for new design ideas and bespoke pieces enriched with complex patterns carvings or joinery. Additionally, the programmable nature of CNC machines enables you to program and reprogram them as necessary for different projects which serves to ensure maximum efficiency while minimizing downtime. These benefits are driving the extensive industry adoption of CNC, as businesses look to gain or hold a competitive edge while fulfilling consumer needs for fine wood products. Computer Numerical Control (CNC) technology enhances production capacities and decreases: material waste, cost of manufacturing and safety hazards from the reduction in manual labor depended on unsafe jobs. In conclusion, CNC is integral to the future of woodworking in general and a way woodworkers can blend their past experience with evolving technology bringing new products to market faster maintaining high quality requirements.

RESTRAIN

Volatility in raw material prices, particularly wood, due to fluctuating costs and supply chain disruptions, impacts production costs and profitability for woodworking businesses, affecting their ability to invest in new machinery.

Volatility in raw material prices, especially wood, significantly impacts production costs and profitability for woodworking businesses. Fluctuating costs, driven by unpredictable supply chain disruptions, make it challenging for these companies to maintain stable pricing strategies and manage budgets effectively. This instability often leads to higher operational expenses and reduced profit margins, hindering the ability of woodworking businesses to invest in new machinery and technology. Consequently, firms may struggle to enhance productivity, innovate, and stay competitive in the market. Moreover, the uncertainty surrounding raw material availability and pricing can lead to inconsistent production schedules, further affecting customer satisfaction and long-term business growth. To mitigate these issues, companies may need to adopt more flexible procurement strategies and explore alternative materials, though these solutions also come with their own set of challenges.

KEY SEGMENTATION ANALYSIS

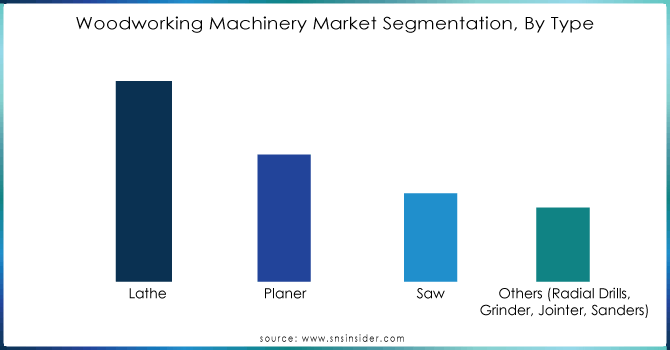

By Type

The lathe segment dominated the market with more than 44% in 2023. Lathe machines have a great reputation for their precision work and versatility. Lathes can carry out various kinds of operations, like turning, boring and threading which are essential in many industries. This generally contributes to the lathe being able to manipulate a wide array of materials such as metals and plastics oriented towards woodworking applications.

The planer segment is projected to grow at the fastest CAGR due to rising popularity of high performance, lightweight planer machines. They have become more efficient and increased in performance. High-efficiency planers in use today are built specifically to deliver fast production rates while providing pinpoint precision. Such efficiency is vital for industries that need to have a reliable and fine finish on their surfaces like woodworking or construction.

Need any customization research on Woodworking Machinery Market - Enquiry Now

By Application

The furniture segment dominated the revenue share of more than 42.06% in 2023 on account of impressive demand for wooden furniture from residential, commercial and institutional applications. This segment is characterized by high production volumes, in addition to the need for specific machinery that cater varying furniture products.

The construction segment is expected to record the highest CAGR during the forecast period. Growth has been driven by the increased use of engineered wood products and other structural lumber in recent construction. With building regulations and the demand for environmentally friendly materials growing, more advanced woodworking machinery is now being used in construction.

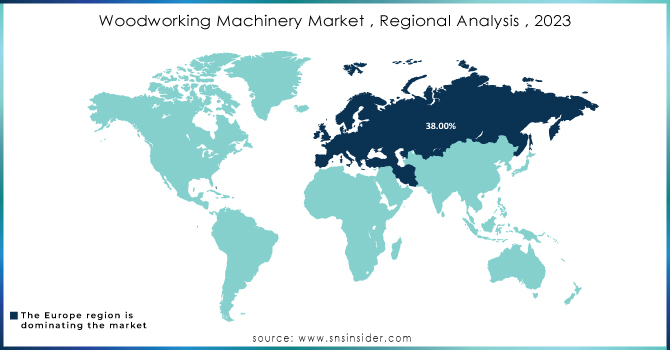

REGIONAL ANALYSIS

Europe dominated the market with more than 38% in 2023. The heavy sustainable and environmental guidelines in place across the region mean businesses are investing to reduce waste any way they can by purchasing some of most advanced technologies that allow them do so while creating carbon neutral solutions. European furniture manufacturers are increasingly turning to modern CNC machines, which help ensure efficiency and precision while also satisfying rigorous sustainability mandates. The segment has witnessed significant growth in Europe, attributed to the rising applications of engineered wood in premium sectors such as building and interior designing that demands for high-quality personlized wood products. The use of woodworking technology, which is at the core here, has seen a rise for the same.

Asia-Pacific is projected to grow at the highest CAGR during the forecast period. This has been driven by expanding population rate, households and demand requirements; the increase in forest products consumption rates of end-users. The benefits of the market have entered India, China and other Southeast markets, by pitching good sales realization for small and mid-sized manufacturers.

Key Players

The major key players are Biesse Group, HOLYTEK INDUSTRIAL CORP, SCM Group, Durr Group, Gongyou Group Co., Ltd., IMA Schelling Group GmbH, Michael Weinig AG, CKM, Cantek America Inc., KTCC WOODWORKING MACHINERY, Oliver Machinery Company, and others

RECENT DEVELOPMENT

In April 2023: Dezhou Rumao offers even more favourable custom packages for different industries, including a new range of CNC router machine by one of the industry leaders that deliver excellent performance and accuracy specifically for woodworkers. These machines use intuitive interfaces and automation to achieve the best results. These machines being flexible make a promise to suit the needs of woodworkers from different trades whether they work in large-scale or small-scale environments.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.87 Bn |

| Market Size by 2032 | US$ 7.47 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lathe, Planer, Saw, Others (Radial Drills, Grinder, Jointer, Sanders) • By Application, (Furniture, Construction, Others (Shipbuilding) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Biesse Group, HOLYTEK INDUSTRIAL CORP, SCM Group, Durr Group, Gongyou Group Co., Ltd., IMA Schelling Group GmbH, Michael Weinig AG, CKM, Cantek America Inc., KTCC WOODWORKING MACHINERY, Oliver Machinery Company |

| Key Drivers |

• Consumers' growing preference for customized furniture that reflects personal style is driving the demand for advanced woodworking machinery capable of producing intricate designs and finishes. |

| Market Opportunity | • Volatility in raw material prices, particularly wood, due to fluctuating costs and supply chain disruptions, impacts production costs and profitability for woodworking businesses, affecting their ability to invest in new machinery. |