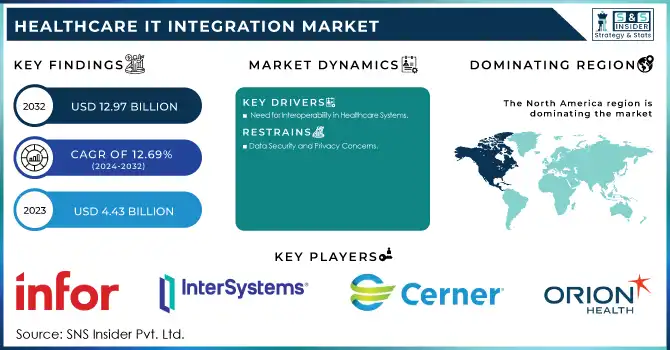

Healthcare IT Integration Market Size and Forecast:

The healthcare IT integration market was valued at USD 4.43 billion in 2023 and is expected to reach USD 12.97 billion by 2032, growing at a CAGR of 12.69% during the forecast period 2024-2032.

The Healthcare IT Integration Market is growing due to the increasing adoption of digital technologies in healthcare organizations. Integrating various IT platforms has become essential as healthcare systems strive for improved patient outcomes and operational efficiencies. Integrated IT solutions enable seamless data exchange between electronic health records, laboratory information systems, telemedicine platforms, and pharmacy management systems. This interoperability is critical for enhancing clinical decision-making, streamlining operations, and optimizing healthcare delivery.

Get more information on Healthcare IT Integration Market - Request Sample Report

A key driver of this market is the widespread adoption of electronic health records (EHRs), which are now a standard part of modern healthcare systems. Over 95% of hospitals in the United States have implemented certified EHR systems, according to HealthIT.gov. These systems play a vital role in unifying patient data, improving care coordination, and facilitating better clinical outcomes. The need for integration between EHRs and other healthcare systems is essential to ensure efficient data exchange. Governments around the world have promoted healthcare IT adoption through initiatives such as the HITECH Act in the U.S., which incentivizes healthcare providers to adopt and meaningfully use EHR systems. Standards such as Health Level Seven (HL7) and Fast Healthcare Interoperability Resources have emerged as critical frameworks to achieve effective interoperability between different healthcare systems.

The rise of telemedicine and remote patient monitoring has further accelerated the demand for integrated IT solutions in healthcare. During the COVID-19 pandemic, the healthcare industry witnessed a surge in telemedicine usage, as hospitals and clinics adapted to remote care. In 2020, the global telemedicine market grew exponentially, highlighting the increasing reliance on integrated digital health solutions. Telemedicine platforms must integrate seamlessly with existing EHR systems, laboratory systems, and other healthcare management tools to ensure smooth operations and deliver high-quality care. Similarly, RPM systems, which provide continuous monitoring of patients outside of clinical settings, require integration with healthcare platforms to transmit real-time data for better patient management.

Advancements in artificial intelligence and machine learning have further emphasized the need for integrated IT solutions. These technologies are increasingly used for tasks such as diagnostic imaging, predictive analytics, and personalized treatment plans. The integration of AI with healthcare IT systems allows for real-time analysis of vast data sets, ultimately improving the accuracy of diagnoses and patient outcomes.

Despite the market's rapid growth, there are challenges that need to be addressed, such as data security concerns, high implementation costs, and achieving interoperability between diverse healthcare systems. A survey conducted by the Healthcare Information and Management Systems Society found that 68% of healthcare providers reported struggling with the lack of interoperability between different healthcare IT systems, which can hinder effective data sharing and care coordination.

Healthcare IT Integration Market Dynamics

Drivers

-

Need for Interoperability in Healthcare Systems

One of the primary drivers of the Healthcare IT Integration Market is the growing need for interoperability among diverse healthcare systems. Healthcare providers use a variety of systems, including electronic health records, telemedicine platforms, and laboratory information systems, which often operate in silos. For effective care delivery, these systems must communicate with one another, allowing for seamless data exchange. Without proper integration, the healthcare system may face challenges such as delayed diagnoses, errors in treatment, and redundant testing. Integrated IT solutions ensure that all these platforms share and exchange critical patient data, enabling healthcare providers to make informed decisions quickly. Furthermore, efficient integration reduces the risk of human errors and enhances patient safety. Governments and regulatory bodies are also pushing for interoperability through standards like HL7 and FHIR, which provide frameworks for seamless data exchange, further fueling the market's growth.

-

Patient-Centered Care and Personalized Treatment

The growing shift toward patient-centered care is a major driver for the healthcare IT integration market. Healthcare systems are increasingly focusing on providing personalized treatment plans tailored to individual patient needs, requiring a 360-degree view of a patient's medical history, real-time health data, and ongoing treatment. Integrated IT systems allow healthcare providers to access comprehensive patient records, which enables them to deliver more accurate diagnoses and customized care. For instance, integrating patient data from wearables, telemedicine consultations, and hospital visits gives clinicians a clearer picture of the patient's health status, leading to more targeted treatment. This integration is particularly essential in chronic disease management, where continuous monitoring and coordinated care can prevent complications and hospital readmissions. Moreover, the increasing adoption of personalized medicine, which leverages genetic data to inform treatment plans, further necessitates seamless integration of IT systems for efficient data sharing across various healthcare platforms.

-

Advancements in AI, Data Analytics, and Cost Efficiency

Advances in artificial intelligence and data analytics have significantly contributed to the demand for healthcare IT integration solutions. AI algorithms are capable of analyzing vast datasets to identify patterns, predict patient outcomes, and suggest treatment plans based on real-time information. By integrating AI with healthcare systems, clinicians can receive timely insights that improve decision-making and clinical outcomes. Additionally, data analytics can be used to analyze patient histories and treatment effectiveness, facilitating more informed decisions that enhance patient care. As healthcare organizations strive for cost reduction and operational efficiency, integrated IT systems provide a solution by streamlining workflows, automating administrative tasks, and minimizing redundant testing and procedures. The ability to manage large volumes of data effectively also helps providers allocate resources more efficiently, ultimately leading to improved resource management, reduced operational costs, and better financial performance. AI and data analytics, combined with seamless IT integration, enable healthcare systems to operate more efficiently while improving patient care.

Restraints

-

Data Security and Privacy Concerns

One of the significant restraints impacting the growth of the Healthcare IT Integration Market is the ongoing concern surrounding data security and privacy. Healthcare organizations handle sensitive patient information, and as these systems become more interconnected, the risk of cyberattacks and data breaches increases. The integration of multiple healthcare IT platforms raises the potential for unauthorized access, data leaks, and malicious attacks, putting patient privacy at risk. Furthermore, the complexity of maintaining compliance with various regulations such as HIPAA in the U.S. and GDPR in Europe adds a layer of challenge for healthcare providers. These regulatory frameworks require healthcare organizations to implement stringent security measures, making integration efforts more costly and time-consuming. As the healthcare sector moves towards more connected systems, addressing these security challenges becomes crucial, and failure to do so could result in legal repercussions, financial losses, and damage to patient trust.

Healthcare IT Integration Market Segmentation Insights

By Products & Services

In 2023, the services segment dominated the Healthcare IT Integration Market, accounting for over 62.1% of the market share. This dominance is due to the increasing need for specialized implementation and integration services that enable healthcare organizations to seamlessly integrate a wide range of systems such as Electronic Health Records (EHR), telemedicine platforms, and AI-driven diagnostic tools. The integration of these technologies requires expert services to ensure smooth functionality across platforms, reduce operational risks, and enhance system performance.

On the other hand, the products segment is the fastest-growing within the Healthcare IT Integration Market. In 2023, products like Electronic Health Records, Laboratory Information Management Systems, and Clinical Decision Support Systems were instrumental in driving growth. The widespread adoption of EHR systems, in particular, remains central to integrated healthcare solutions, facilitating streamlined data flow, reducing errors, and improving patient outcomes.

By End User

In 2023, hospitals dominated the Healthcare IT Integration Market, contributing over 72.3% of the total market share. Hospitals are major adopters of integrated IT systems to enhance patient care, optimize workflows, and comply with regulatory requirements. These systems enable seamless data exchange across departments, helping improve clinical decision-making and operational efficiency. The ongoing need for improved patient outcomes and cost reductions in hospitals continues to fuel the adoption of integrated healthcare IT solutions.

The laboratories segment is the fastest growing in the Healthcare IT Integration Market. Laboratories are increasingly adopting integrated IT systems like LIMS to streamline workflows, enhance data management, and improve diagnostic accuracy. Integration ensures faster, more accurate test results, facilitating better clinical decision-making. As laboratory operations become more complex and the demand for precision medicine grows, the need for efficient IT integration systems is expected to continue to rise throughout the forecast period, making this segment the fastest-growing in the market.

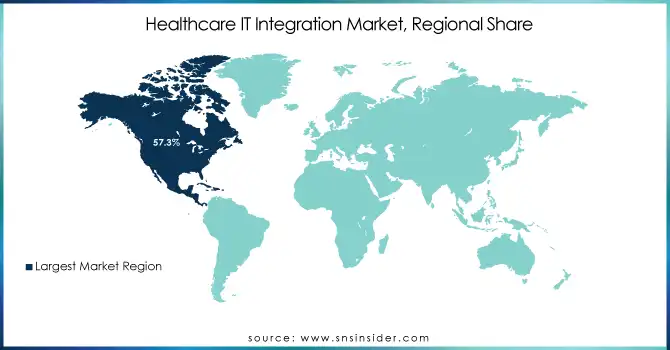

Healthcare IT Integration Market Regional Analysis

North America dominated the Healthcare IT Integration Market with a 57.3% share in 2023, driven by the widespread adoption of digital health solutions like Electronic Health Records and Health Information Exchange systems. The United States, in particular, is the leading market, supported by robust healthcare regulations such as the Health Information Technology for Economic and Clinical Health Act and a highly developed healthcare infrastructure. The growing need for enhanced patient outcomes, along with operational efficiencies in hospitals and clinics, further fuels the adoption of healthcare IT solutions, boosting market growth in the region.

In Europe, the Healthcare IT Integration Market is steadily expanding, backed by government policies promoting digital health innovation and interoperability. Key countries such as the UK, Germany, and France are making substantial investments in healthcare IT integration, with a strong focus on improving patient care through advanced technologies like telemedicine and clinical decision support systems. The European Union’s ongoing commitment to data interoperability and standardized practices is also accelerating the region's market growth.

The Asia-Pacific region is poised for rapid growth in the coming years. With increasing healthcare expenditures, rising awareness of digital health technologies, and the growing demand for efficient healthcare delivery, countries like China, India, and Japan are driving the expansion of IT integration in healthcare systems. Additionally, the rising prevalence of chronic diseases and the need for comprehensive, integrated healthcare solutions are major factors propelling the adoption of IT solutions in hospitals and laboratories throughout the region. This momentum makes Asia-Pacific the fastest-growing market for healthcare IT integration globally.

Need any customization research on Healthcare IT Integration Market - Enquiry Now

Key Players in the Healthcare IT Integration Market

-

Infor - Cloverleaf Integration Suite

-

InterSystems Corporation - HealthShare, TrakCare

-

Cerner Corporation - Millennium, PowerChart

-

Orion Health - Integration Engine, Concerto

-

NextGen Healthcare, Inc. - EHR, Healthcare Interoperability

-

iNTERFACEWARE, Inc. - Iguana

-

Allscripts Healthcare Solutions, Inc. - Sunrise, Open Platform

-

Epic Systems Corporation - EpicCare EHR, Bridges

-

AVI-SPL, Inc. - Healthcare Integration Solutions

-

Corepoint Health (Lyniate) - Corepoint Integration Engine

-

Oracle Corporation - Health Sciences Cloud, Cerner

-

General Electric Company (GE Healthcare) - Centricity

-

IBM Corporation - Watson Health

-

Siemens Healthcare GmbH - Healthineers Teamplay

-

Summit Healthcare - Summit Integration Software

Recent Developments

In Nov 2024, HealthPlix Technologies announced an integration with Google to enhance healthcare accessibility. This collaboration allows patients to book appointments directly with doctors through HealthPlix’s EMR software, linked to clinics with a Google business profile.

In July 2024, Ontrak, Inc., a leader in AI-powered behavioral healthcare, adopted the Comprehensive Healthcare Integration (CHI) framework to enhance its care delivery model. This integration aims to provide high-quality, holistic care by combining physical health, behavioral health, and social determinants of health.

| Report Attributes | Details |

| Market Size in 2023 | USD 4.43 Billion |

| Market Size by 2032 | USD 12.97 Billion |

| CAGR | CAGR of 12.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Products & Services [Products (Interface/Integration Engines, Medica Device Integration Software, Media Integration Software, Other Integration Tools), Services, Support and Maintenance Services, Implementation and Integration Services (Training and Education Services, Consulting Services)] • By End User [Hospitals, Laboratories, Clinics, Diagnostic Imaging Centres, Other] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Propeller Health, Hewlett-Packard (HP), Medtronic, AstraZeneca, Becton Dickinson (BD), Mylan Pharmaceuticals, Biocorp, Teva Pharmaceutical Industries, Insulet Corporation, Sonova, Roche, Johnson & Johnson, Novo Nordisk, Meda Pharmaceuticals, Biogen, Eli Lilly and Co., Sandoz (Novartis), Philips Healthcare, F. Hoffmann-La Roche, Xhale. |

| Key Drivers | • Need for Interoperability in Healthcare Systems • Patient-Centered Care and Personalized Treatment • Advancements in AI, Data Analytics, and Cost Efficiency |

| Restraints | • Data Security and Privacy Concerns |