Zener Diode Market Size & Growth Analysis:

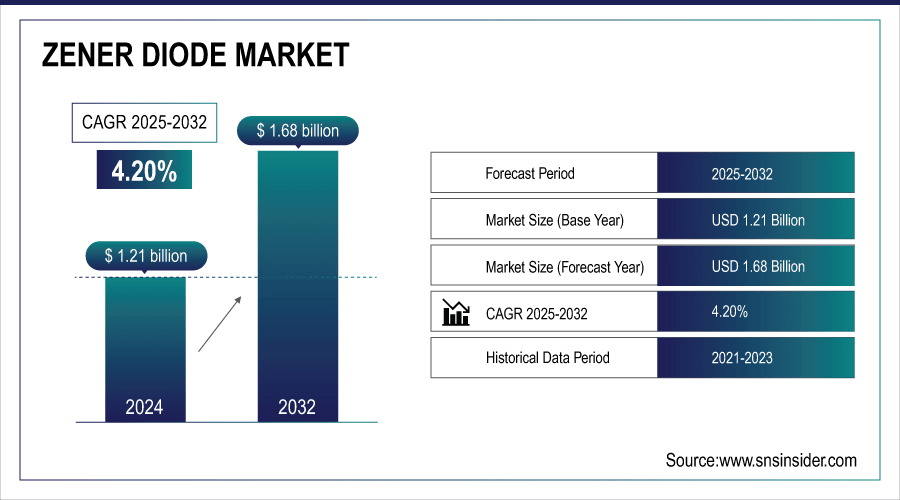

The global Zener Diode Market size was valued at USD 1.21 billion in 2024 and is expected to reach USD 1.68 billion by 2032, growing at a CAGR of 4.20% over the forecast period 2025-2032. The Zener Diode market can be attributed to a rise in demand for voltage regulation in electronic devices, growth in consumer electronics, automotive applications, power management solutions, and a rise in renewable energy systems.

To Get More Information On Zener Diode Market - Request Free Sample Report

The rise of the Zener Diode market is mainly attributed to the usage of Zener Diodes in a variety of electronic circuits, including voltage regulation, surge protection, and voltage clamping. These are essential diodes that find extensive applications in power supplies, automotive electronics, and communication systems. The growing adoption of consumer electronics, including smartphones, computers, and LED lighting, is another major contributing factor to the expansion of the market for this product, with key Zener Diodes Companies leading the innovation in voltage regulation solutions, as they further necessitate dependable voltage regulation. Growing EV and renewable energy demand is also driving the need for Zener diodes in power management applications, aligning with current Zener Diode Market Trends seen across industries.

Toshiba has announced its newest "XCUZ Series" surge-protection Zener diodes, which are qualified per AEC-Q101 for automotive applications. The diodes provide stronger spike voltage protection, ensuring the reliability of automotive electronics.

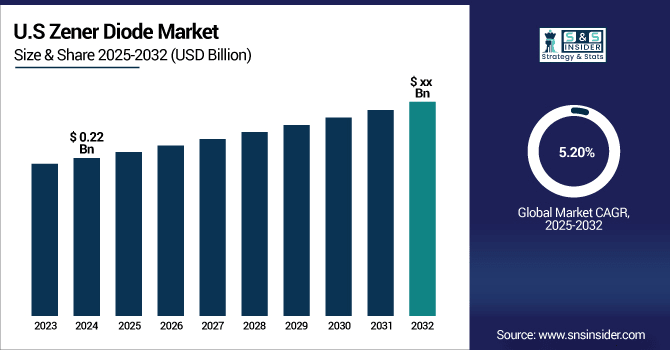

The U.S. Zener Diode Market size is estimated to be USD 0.22 billion in 2024 and is projected to grow at a CAGR of 5.20%. Increasing developments in consumer electronics, such as smartphones, laptops, IoT devices which require good voltage regulation and protection are leading to the growth of the U.S. market.

Zener Diode Market Dynamics

Key Drivers:

-

Rising Demand for Compact Zener Diodes Driven by Growth in Consumer and Miniaturized Electronic Devices

Increasing demand for consumer electronics and miniaturized electronic devices is a major factor contributing to the growth of the market. With the continuing transformation of modern devices, such as smartphones, tablets, wearables, and smart TVs, to contain more features in a very small footprint, there is an increasing demand for small, efficient voltage regulation and protection components.

As per India Brand Equity Foundation (IBEF), the electronics market in India is projected to be USD 300B by 2025, benefiting from local sourcing schemes and higher digital penetration.

Restrain:

-

High EMI Challenges Limit Zener Diode Use in Precision High Speed and Compact Electronic Applications

The most prominent factor restricting the market is high EMI problems faced due to compact circuit boards, especially for high-speed electronic applications. The ever-shrinking nature of devices, as well as the increased frequencies at which they operate, increases the risk of both signal integrity issues as well as noise contamination. In this sense, standard Zener diodes do not provide efficient EMI suppression; therefore, designers choose specific protection solutions enabling voltage regulation together with Electromagnetic Compatibility (EMC). All these qualities make Zener diodes unsuitable for the most demanding, precision applications.

EMI-associated design failures constitute nearly 50% of PCB redesigns in complex electronic devices, according to IEEE, leading to delayed time to market and resulting in poor adoption of Zener diodes in the newly designed products.

Opportunity:

-

Electric Vehicles and ADAS Drive Strong Demand for Reliable Zener Diodes in Automotive Applications

The emergence of Electric vehicles (EVs) as well as Advanced driver-assistance systems (ADAS) automotive sector makes up a significant share of the opportunity for the Zener diode market. Safety and performance require strong electrical protection and voltage regulation for these systems. The growing utilization of Zener diodes in EV battery management systems, lighting modules, and infotainment units is predicted to boost the electric vehicle Zener diode market growth over the projection period. With rapid growth expected in EV sales worldwide due to regulatory mandates and sustainability goals, dependable components like zeners will be in high demand.

Global electric vehicle (EV) sales increased by 35% YoY in 2023, with more than 14 million units sold worldwide by the end of the year, according to the International Energy Agency (IEA).

Challenges:

-

Geopolitical Tensions and Trade Restrictions Disrupt Global Zener Diode Supply Chain and Production Scalability

The supply chain of Zener diodes faces its greatest challenge in the form of geopolitical tensions and trade restrictions. Trade tensions, like the U.S.–China tariff battle and restrictions on the export of semiconductors to China, have created regulatory uncertainties and disrupted the supply of raw materials and finished goods between the large economies. Such delays affect manufacturing continuity and also make it difficult for any global collaboration on the development of chips to proceed further. In addition, it has now become harder to scale local production in certain regions due to the tightening of export controls on semiconductor equipment and technologies.

According to the Semiconductor Industry Association (SIA), since 2023, these U.S. restrictions have significantly impacted international supply chains by limiting access to approximately USD 42 billion (4.17 lakh crore) in annual components; they include substantial attention on China.

Zener Diode Market Segments Analysis

By Type

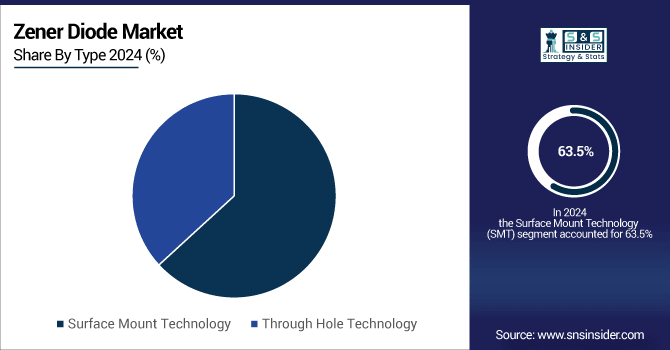

Surface Mount Technology (SMT) led the Zener diode market in 2024, garnering a 63.5% share, and is expected to manifest the highest CAGR through 2025–2032. Strong demand for miniaturized high-performance electronics for smartphones, wearables, and next-generation consumer electronics is driving this dominance. These VZ Digis are significantly more efficient, easily allowing automated assembly, and lend themselves to miniaturizing circuit boards for Zener diodes, providing SMT-based Zener diodes for manufacturing in modern electronics. Moreover, the adoption of high-density PCB designs and surface-mounted components in the automotive and telecom industries accelerates and augments the adoption of SMT worldwide, with long-term growth driven by such technologies.

By End User

The consumer electronics segment in 2024 dominated the Zener diode market share owing to the increasing adoption of tech-savvy, miniaturized, and low-power-consuming devices. With the world becoming more and more dependent on smartphones, wearables, smart TVs, and home automation products, the demand for weightier voltage regulation and protection has grown over the years (years). The devices depend on Zener diodes for preventing fluctuations in circuit currents and circuits from going bad. With the evolution of consumer electronics that continues to come with more capabilities in smaller packages, the world will always need good electronic parts like the Zener diodes.

The automotive segment is predicted to register the fastest growth between 2025 and 2032, due to the increasing penetration of electric vehicles (EVs) and growing adoption of advanced driver-assistance systems (ADAS) in contemporary automobiles. As the automotive industry embraces electrification and automation, the need for dependable and efficient electrical components such as Zener diodes will expand. In the next-gen vehicles, zener diodes are essential in handling battery systems, safety features, and electronic control units.

Zener Diode Market Regional Outlook

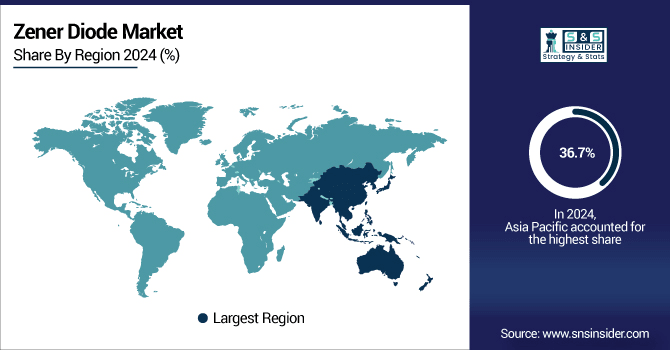

According to Zener Diode Market Analysis, Asia Pacific dominated in the Zener diode market in 2024 (36.7%) owing to the well-established electronics manufacturing base and growing demand for electronic devices in the region With China, Japan, South Korea, and Taiwan being dominant countries for electronics manufacturing, the region takes the lead as a global entity in the realm of electronics products. The market is mainly driven by the high demand of consumer electronics, automotive, and the telecommunication industry, where efficient voltage regulation and protection are essential. The relentless technological advancements and shrinking of electronics components have reinforced the strength of the regional market.

China is the largest producer & consumer of electronic components such as zener diodes in the Asia Pacific countries.

Due to increased adoption of advanced electronics and the growth of EVs, North America is estimated to attain the fastest CAGR between 2025 and 2032. This is attributed to the growing need for high-performance electronic components in automotive, consumer electronics, and industrial automation, among others, in the region.

North America will lead the growth of the U.S. owing to its strong electronics manufacturing presence, automotive market, and due to continuous research in electric vehicle manufacturing and electric mobility smart devices.

Europe holds a significant position in the Zener diode market with strong demand from the automotive, industrial automation, and telecommunications industry verticals. This has led to a higher demand for reliable components for voltage regulation, especially due to the increasing focus of the region on electric mobility and renewable energy systems. Still another factor that supports steady adoption is advances in technology and strict safety requirements.

The market in Europe is dominated by Germany due to its leadership in automotive engineering, industrial electronics, and the presence of many key electronic component manufacturers.

Latin America and the Middle East & and Africa present as emerging markets for Zener diodes in this region due to increasing investment in telecommunications, consumer electronics, and industrial automation. With the further advent of digital infrastructure and urbanization in these regions, the requirement for an emergency voltage security component is slowly increasing.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Zener Diode Companies are:

Some of the major players in the Zener Diode Market are Vishay Intertechnology, ON Semiconductor, STMicroelectronics, NXP Semiconductors, Diodes Incorporated, ROHM Semiconductor, Renesas Electronics, Toshiba Corporation, Texas Instruments, and Infineon Technologies.

Recent Trends

-

In April 2024, ROHM Group’s SiCrystal and STMicroelectronics expanded their silicon carbide (SiC) wafer supply agreement to support growing demand for high-efficiency power devices.

-

In April 2025, ROHM developed new 4-in-1 and 6-in-1 SiC molded modules in the HSDIP20 package, optimized for PFC and LLC converters in onboard chargers for electric vehicles.

-

In December 2024, Toshiba launched 15 products in the "CMZxxA series" of Zener diodes, designed to protect semiconductor devices from switching surges and over-voltage pulses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.21 Billion |

| Market Size by 2032 | USD 1.68 Billion |

| CAGR | CAGR of 4.20% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Surface Mount Technology, Through Hole Technology) • By End User (Communications, Consumer Electronics, Automotives, Computer and Computer Peripherals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Vishay Intertechnology, ON Semiconductor, STMicroelectronics, NXP Semiconductors, Diodes Incorporated, ROHM Semiconductor, Renesas Electronics, Toshiba Corporation, Texas Instruments, Infineon Technologies. |