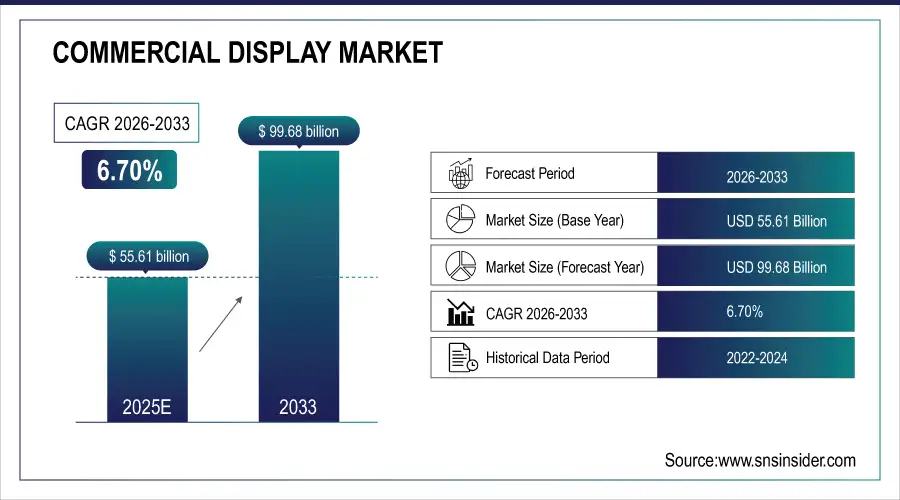

Commercial Display Market Size Analysis:

The Commercial Display Market Size is estimated at USD 55.61 Billion in 2025E and is expected to reach USD 99.68 Billion by 2033 & grow at a CAGR of 6.70% by 2026-2033.

The Commercial Display Market analysis report provides a comprehensive overview of display hardware, processing architectures, packaging technologies, and enterprise-grade deployment trends across digital signage, interactive displays, video walls, and mission-critical visualization platforms. Rising adoption of high-resolution displays, AI-enabled content processing, edge computing, and real-time data visualization across enterprise, industrial, healthcare, and automotive environments is expected to drive sustained market growth during the forecast period.

Commercial displays are increasingly deployed across retail networks, transportation hubs, smart factories, hospitals, command centers, and connected vehicles, driven by demand for immersive visualization, real-time analytics, and content personalization. By 2025, over 9.2 million commercial display units are estimated to be operational globally, supported by advances in processing performance, heterogeneous computing, and advanced packaging technologies.

Market Size and Growth Projection: 2025E

-

Market Size in 2025E USD 55.61 Billion

-

Market Size by 2033 USD 99.68 Billion

-

CAGR of 6.70% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

To Get more information on Commercial Display Market - Request Free Sample Report

Commercial Display Market Trends:

-

Rising investment in digital content creation and management systems driving demand for commercial displays.

-

Increasing need for high-definition visuals, videos, and animations to enhance customer engagement.

-

Adoption of IoT-enabled displays for remote management, control, and monitoring across multiple locations.

-

Growing use of cloud-based solutions for real-time content updates and centralized content synchronization.

-

Expansion of commercial display applications in hospitality, entertainment, banking, transportation, and education for enhanced customer experiences and operational efficiency.

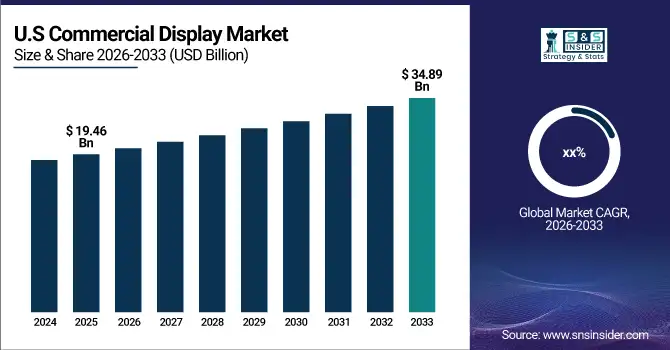

The U.S. Commercial Display Market Size Analysis:

The U.S. Commercial Display Market size is projected to grow from USD 19.46 Billion in 2025E to reach USD 34.89 Billion by 2033. Growth is primarily driven by the sustained investment in digital-out-of-home (DOOH) advertising and the proliferation of large-format LED video walls in retail, stadiums, and public venues. The transition to 4K/8K and finer pixel pitch displays further stimulates refresh cycles, while rising adoption across corporate offices for collaboration and in the hospitality sector for dynamic customer experiences provides additional momentum. Increased deployment in transportation hubs for real-time information and wayfinding solutions also contributes significantly to market expansion.

Commercial Display Market Growth Drivers:

-

Driving Growth in the Commercial Display Market through Enhanced Digital Content Creation and Real-Time Engagement.

The trend toward increased investment in digital content creation and management systems creates an imperative for growth within the Commercial Display market. As businesses shift away from conventional means of running and search for digital means to communicate, the demand for strong, real-time content has increased phenomenally. With this would come the demand for vibrant, high-definition visuals, videos, and animations on commercial displays. Businesses affected most are hospitality and entertainment because they employ these displays to offer people unique experiences, advertise their services, and draw attention through new artistic displays

Commercial Display Market Restraints:

-

Overcoming Content Management Challenges and Durability Issues in the Evolving Commercial Display Market.

One of the major challenges of the Commercial Display market is content management and personalization complexity. Most businesses face the challenge of building and managing real-time, dynamic content that matches their respective needs. A typical example of those facing such issues is the education and healthcare industry, which often requires updating content with very useful information from time to time. It is much more challenging as it is also critical but cannot be efficiently implemented in a large organization with a presence at multiple locations.

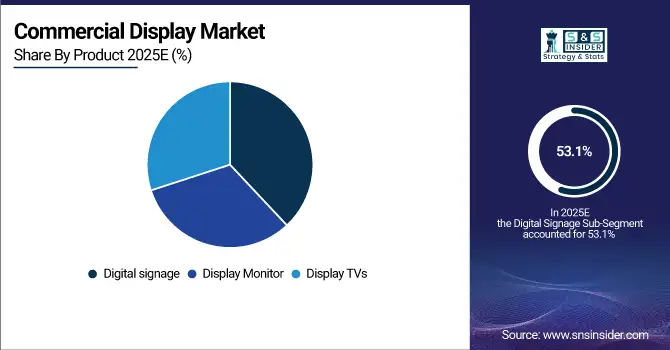

Commercial Display Market Segment Analysis:

By Product

Digital signage segment dominated the market with 53.1% in terms of revenue for the year 2025E. This is because digital signs are widely used nowadays in various industries. Digital signage is highly versatile. Businessmen in the retail, hospitality, transportation, and healthcare industries can now woo their target audience with live time-to-time information. The application comes in areas like advertising, promotions, way-finding, and customer engagement, hence making this a key enabler for the enhancement of the customer experience as well as brand awareness, thus making it a significant value proposition tool. The flexibility in the deployment of video, animations, and interactive content serves as a welcome muse for companies seeking innovative avenues for engaging their audience, hence furthering the growth of the segment's revenue.

By Technology

The LED segment dominated the total market share, which accounted for 48.3% in 2025E, mainly due to its higher efficiency in energy, longer lifespan, and high brightness levels. LED displays are extremely common in sectors like retail, hospitality, entertainment, and transportation due to the brighter and more vibrant visuals they tend to produce, even in outdoor or highly illuminated settings. Furthermore, the flexibility that LED technology offers in form, curve, and even transparency makes it an attractive option for innovative installations in public spaces, sports fields, and corporate events. Since businesses also take an interest in low-maintenance energy-efficient solutions.

The LCD segment is expected to witness a high CAGR of 6.9%, mainly due to advances in display technology and the cost-effectiveness it leads to. As LCDs are used largely indoors, such as office spaces, learning institutions, and health care centers, where contrast and color sensitivity are vital, recent advancements in the technology of the LCD that facilitate better image quality and a thinner with lighter weights lead present as well as future applications solely depend on the ease of cost-effectiveness without the loss of performance. As high-quality digital content is always in high demand, especially for corporate and medical purposes and in the education domain, the LCD segment is going to experience significant growth over the forecast period.

By Component

In 2025E, the Hardware segment dominated with a revenue share of 54.6%. Commercial displays mainly rely on hardware components that power and enable digital displays, including LED and LCD panels, projectors, media players, and mounting systems for commercial displays' operation in various industries. Rising demand for high-resolution displays within retail, transportation, corporate, and healthcare sectors has driven the demand for hardware components. The line of improvement in their display systems to higher resolutions, greater interactivity, and longer lifespan calls for the perpetual obsolescence of existing hardware

By Display Size

The below 32-inch segment dominated the Commercial Display market with a revenue share of 37.7% in 2025E, due to its wide use across sectors wherein space is a constraint and compact, cost-effective displays are required. Retail, hospitality, healthcare, and education industries commonly deploy these smaller displays for point-of-sale systems, information kiosks, digital menu boards, and patient communication tools, among others. Their ease of installation and affordability make them suitable for use in multiple display units and indoor conditions.

The above 75-inches segment will record the highest CAGR of 7.6% over the forecast period, due to growing demand from sectors like entertainment, corporate environments, stadiums, and transportation hubs, for immersive, large-format displays. Large displays look very good, with great visual impact, and, therefore are highly suitable for applications such as advertising, presentation, and public information systems. Technological advances like a higher resolution from 4K to 8K, plus the better quality of the display, are also making large displays look more appealing since it would mean a greater depth perception and finally a more immersive and visually engaging experience. The strong growth of the above 75-inch segment is driven by the growth in digital billboards, large format video walls, and interactive displays.

By Application

The retail segment dominated the market share with 17.4% in the year 2025E. Visual merchandising and advertising are a major part of how retailers attract customers and enhance sales. Digital displays are increasingly being accepted for eye-catching advertisements, products on promotion, and interactivity with customers to enhance the shopping experience. These digital displays are updated in real-time, thus the retailers always react promptly to trends, seasonal demand, and other related promotions. This agility and the opportunity to capture customer attention has firmly entrenched the retail sector as a main revenue contributor in the market.

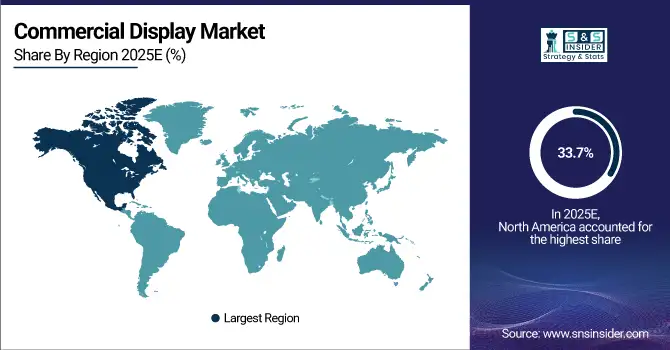

Commercial Display Market Regional Analysis:

North America Commercial Display Market Insights

North America dominated the market with a revenue share of 33.7% in 2025E, mainly owing to its strong technological infrastructure and significant digital signage adoption rates across various sectors. It houses many major retailers, corporations, and entertainment venues that make use of commercial displays for marketing and customer engagement. One of the significant uses of digital signage by large retail chains like Walmart and Target is dynamic promotions and information for customers, which makes their shopping experience more enjoyable. In addition, high-profile events such as trade shows occurring within cities like Las Vegas and New York City boost demand for innovative display solutions and further strengthen North America's position at the top.

Need Any Customization Research On Commercial Display Market - Inquiry Now

Asia Pacific Commercial Display Market Insights

The Asia Pacific region will have the highest growth rate of 7.1% in the forecast period. The primary reason for the high growth rate is fast urbanization, increasing consumer spending, and rising interest in digital transformation across diverse industries. In this region, countries such as China and India invest heavily in infrastructure and technology to fuel demand for commercial displays in retail, transport, and corporate sectors. For instance, the rapidly emerging e-commerce market in China compels retailers to experiment with digital signage for interactive advertising and consumer engagement. As the urban centers grow and technology integration gains pace, the Asia Pacific region is all geared up for growth in the commercial display market.

Europe Commercial Display Market Insights

The European commercial display market is driven by rising adoption of digital signage across retail, transportation, banking, and education sectors. High demand for interactive displays, video walls, and advanced digital content solutions supports market growth. Integration of IoT and cloud-based management enables centralized control and real-time updates. Additionally, increasing focus on enhancing customer experiences, brand engagement, and operational efficiency is fueling the adoption of high-definition and interactive commercial display systems across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Commercial Display Market Insights

The LATAM and MEA commercial display markets are witnessing steady growth due to expanding retail, hospitality, and transportation sectors. Demand for digital signage, interactive displays, and high-quality visuals is rising as businesses focus on customer engagement and brand visibility. Cloud and IoT-enabled solutions facilitate remote content management across multiple locations, while increasing investments in modern infrastructure and digital transformation initiatives further drive the adoption of commercial display systems in these regions.

Commercial Display Companies are:

-

Samsung Electronics (QLED Signage, The Wall)

-

LG Electronics (Ultra Stretch Display, OLED Digital Signage)

-

Sony Corporation (BRAVIA Professional Displays, Crystal LED Display System)

-

Panasonic Corporation (High Brightness Projectors, Professional Displays)

-

Sharp Corporation (4K UHD Professional Displays, PN-R Series)

-

NEC Display Solutions (MultiSync Series, NEC InfinityBoard)

-

Epson (BrightLink Projectors, Professional Displays)

-

BenQ (ST Series, RP Series Interactive Display)

-

ViewSonic (VG Series, TD Series Interactive Display)

-

Cisco Systems (Webex Board, Cisco Spark Board)

Competitive Landscape for Commercial Display Market:

ViewSonic is a global provider of commercial display solutions, specializing in interactive displays, digital signage, and high-definition visual systems. The company focuses on delivering innovative, reliable, and scalable solutions for education, corporate, and retail sectors, enabling enhanced engagement, real-time content management, and improved operational efficiency.

-

In June 2024, ViewSonic unveiled a cutting-edge 92-inch ultra-wide commercial display featuring a stunning 5K resolution, designed specifically to enhance collaboration in Microsoft Teams Rooms and elevate digital signage experiences.

MAXHUB is a leading provider of commercial display and collaboration solutions, offering interactive displays, digital signage, and smart meeting systems. The company focuses on enhancing workplace productivity, real-time content sharing, and seamless communication across corporate, education, and enterprise environments with innovative, user-friendly, and scalable display technologies.

-

In May 2024, MAXHUB Unveils UW92NA Ultra-Wide 92-Inch Display offers an ultra-wide aspect ratio and high resolution, perfect for enhancing presentations and collaborative environments in various settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 55.61 Billion |

| Market Size by 2033 | USD 99.68 Billion |

| CAGR | CAGR of 6.70% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Digital Signage, Display Monitor, Display TVs), • By Technology (LCD, LED, Others), • By Component (Hardware, Software, Services), • By Display Size (Below 32 inches, 32 to 52 inches, 52 to 75 inches, Above 75 inches) • By Application (Retail, Hospitality, Entertainment, Stadiums & Playgrounds, Corporate, Banking, Healthcare, Education, Transportation) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Samsung Electronics, LG Electronics, NEC Display Solutions, Sony Corporation, Panasonic Corporation, Sharp Corporation, ViewSonic, Epson, BenQ and Cisco Systems. |