MEMS Speaker Market Size Analysis:

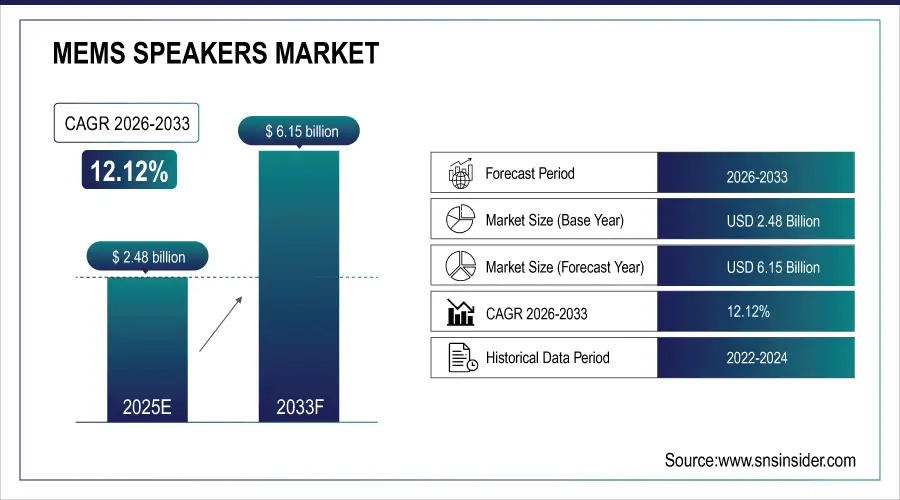

The MEMS Speakers Market size was valued at USD 2.48 billion in 2025E and is expected to reach USD 6.15 billion by 2033, growing at a CAGR of 12.12% over the forecast period of 2026-2033. MEMS speaker market trends are shifting toward miniaturization, low power consumption, and integration into ultra-thin devices. Advancements in piezoelectric and electrostatic technologies are enabling high-performance audio in compact consumer electronics.

The MEMS speaker market growth is driven by the need for miniaturized, power-efficient and high-quality audio components in modern consumer electronics including smartphones, true wireless stereo (TWS) earphones, wearables, and Internet of Things (IoT) devices. MEMS speakers are more durable, consume less power, and can be more easily integrated into a sleek device design than traditional speakers. In addition, increasing shift toward voice-powered applications, growing adoption of smart devices, and improvements in MEMS fabrication technologies, are laying a foundation for the MEMS microphone market to expand, over the forecast years, across end-use industries.

MEMS Speaker Market Size and Forecast:

-

Market Size in 2025E: USD 2.48 Billion

-

Market Size by 2033: USD 6.15 Billion

-

CAGR: 12.12% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on MEMS Speakers Market - Request Free Sample Report

In 2024, global shipments of true wireless stereo (TWS) earbuds reached over 320 million units, with major players including Apple, Samsung, and Xiaomi integrating MEMS speakers for thinner, lighter designs.

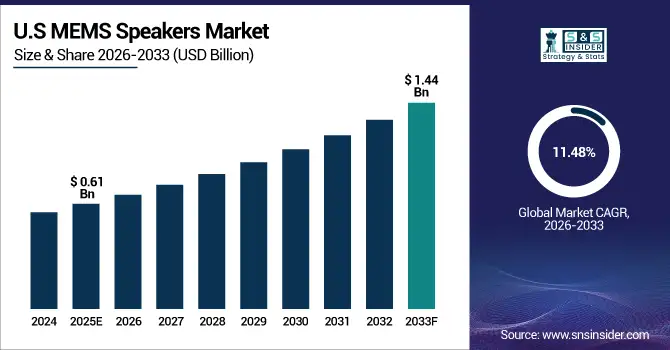

The U.S. MEMS speaker market size was valued at USD 0.61 billion in 2025E and is expected to reach USD 1.44 billion by 2033, growing at a CAGR of 11.48% over the forecast period of 2026-2033. The U.S. MEMS speaker market is being driven by increasing demand for advanced audio components in smart consumer electronics, rising adoption of TWS earphones and wearables, coupled with integration of MEMS speakers in new applications including AR/VR and IoT devices.

MEMS Speakers Market Dynamics:

Drivers:

-

Rising Demand for Compact High Performance Audio Drives Global MEMS Speaker Market Growth

The major driver for the MEMS speaker market globally lies in the increasing demand for small-sized, high-performance, and low-power audio devices for consumer electronics over the past few months with the increase in demand for smartphones, TWS earphones, and wearables. Increase in consumer demand for sleek devices with improved acoustic performance are pushing manufacturers to adopt MEMS-based solutions in place of conventional speakers. Furthermore, the rise of embedded voice assistants and audio-enabled IOT devices is expected to incrementally benefit MEMS speakers, due to advantages, such as compactness, low power, and high reliability.

Internal testing by xMEMS Labs in 2024 revealed that their silicon-based MEMS speakers operated with over 20% lower power consumption compared to miniature electrodynamic speakers, with superior thermal tolerance and resistance to dust/humidity.

Restraints:

-

Low Frequency Limits and Integration Barriers Restrain MEMS Speaker Adoption in High Volume Audio Devices

The limited acoustic output compared to conventional electrodynamic speakers, especially at low frequencies, acts as a key restraint in MEMS speaker market and thus the growth is expected to be slow until more breakthroughs are made. As a result, it is difficult for MEMS speakers to find their niche in high-volume audio applications including tablets, laptops, and portable speakers. Furthermore, incorporation complexities in traditional audio systems and a requirement for native amplifier circuitry may also prevent device makers who have not implemented function for MEMS configurations from embracing the technology on a wide scale.

Opportunities:

-

Polymer MEMS Advancements and Emerging Markets Boost Growth in Wearables Smart Glasses and AR VR

The gradual improvement in the MEMS fabrication technology and new polymer MEMS speakers will allow them to act as flexible electronics for use in combination with flexible electronics such as smart glasses and AR/VR headsets. In Asia Pacific and Latin America, emerging markets also provide substantial growth potential as domestic manufacturers ramp up production of wearable and IoT devices.

India and China together saw over 100 million wearable devices shipped in 2024, supported by growing health awareness and local tech manufacturing expansion.

Challenges:

-

Challenges in MEMS Speaker Market Include Lack of Standards and Environmental Reliability Concerns

Standardization and the relative performance of MEMS speaker technologies are other challenges the market faces. The fact that the industry is still maturing means there are not standard test protocols and this can cause some hesitation among OEMs. Moreover, maintaining reliable operation under different environmental conditions (humidity, vibration, and thermal stress) presents a technical barrier for manufacturers.

MEMS Speakers Market Segmentation Analysis:

By Type

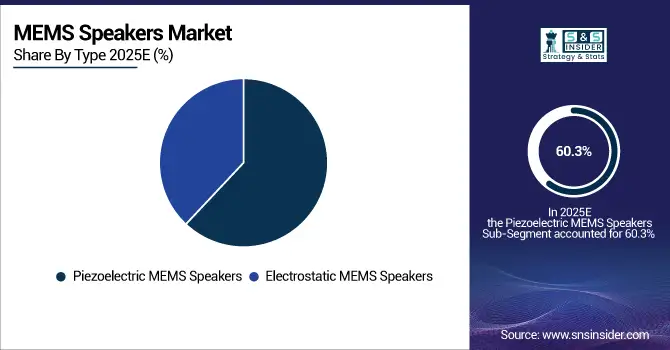

In 2025, piezoelectric MEMS speakers accounted for the largest market share of 60.3% - owing to their simple structure, low cost, and integration capabilities into small devices. These are the speaker types which provide durability, low power consumption and moderate acoustic performance, and they are often employed in smartphones, wearables and IoT devices. Due to their compatibility with the existing MEMS manufacturing ecosystems, they have become one of the best options for mass production.

Demand for electrostatic MEMS speakers is projected to exhibit the fastest CAGR during the period between 2026 and 2033 owing to increasing demand for high-quality audio in consumer electronics such as mobile phones, portable speakers and hearing aids. The excellent frequency response, low distortion and improved audio fidelity of these speakers can be leverage for next-gen hearables, AR/VR headsets and high-res audio applications.

By Application

Smartphones led the MEMS speaker market in revenue in 2025 with a 41.4% share, supported by very high production volumes, consumer preference for thinner and lighter devices, and voice assistant integration. MEMS speakers are emerging as the perfect solution for manufacturers looking to improve audio output without adding excess thickness to ultra-thin smartphone designs, as the demand grows for small, performance speakers.

The largest CAGR among device types over 2026-2033 will be for earphones and hearables, driven by globally uptake of true wireless stereo (TWS) earbuds and smart audio wearables. Audio brands driven by consumer demands for more accurate sound in the tight confines of the ear, along with increased battery efficiency, and miniaturization (such as the rising use of MEMS), are migrating away from speaker technology and focusing on MEMS solutions that provide enhanced integration and increased reliability.

By Technology

In 2025, silicon-based MEMS speakers accounted for a 66.7% market share due to their mature manufacturing processes, high reliability, and ability to be fabricated with existing semiconductor processes. These are extensively used in consumer electronics, such as smartphones, hearables, and smartwatches due to their small footprint and relatively stable acoustic performance. Their strength and functionality in diverse conditions reinforce their usage by premier OEMs.

Polymer based MEMS speakers are anticipated to register the highest CAGR of 14.6% over 2026-2033, owing to rising demand for customizable audio products that offer flexibility and less weight audio solutions. The newly released speakers allow integration in flexible electronics for AR/VR headsets and smart glasses, and feature fundamentally new product designs with increased spatial audio performance and low power consumptions.

By End-Use Industry

The consumer electronics segment had the biggest MEMS speaker market share at 70.2% in 2025 owing to growing penetration of MEMS speakers in smartphones, TWS earphones, smartwatches and tablets. As customer demand grows for thinner and more efficient audio components that supply better sound quality, manufacturers have begun using MEMS-based solutions. MEMS speakers are particularly well-suited for mass-market consumer devices where all the elements of a design need to take up as little space as possible and still deliver the maximum sound performance. Their compact form factor, low power requirements and integration employable with many of the technologies that make up a modern device.

The healthcare segment is expected to witness highest CAGR during the forecast period, attributed to increasing adoption of advanced hearing devices, wearable diagnostic devices, and tele-health devices. In medical applications where continuous operation and comfort for the end-user are important all substantial benefits of MEMS devices, which also offer small size and low power consumption.

MEMS Speakers Market Regional Growth Outlook:

In 2025E, a MEMS speaker market held 34.9% of the total MEMS speaker market in Asia Pacific and anticipated the highest CAGR over 2026-2033. The rapid adoption of smartphones, hearables and IoT devices, coupled with a solid domestic manufacturing base and favorable government initiatives across the region, are driving this growth. Presence of prominent OEMs, accelerating investments in consumer electronics and advancements in MEMS fabrication technologies are significantly contributing for regional growth. Similarly, growing need for compact audio devices in wearables and AR/VR applications further enhances the regional market scene in APAC region.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific market was dominated by China, backed by its well-developed electronics manufacturing ecosystem and presence of a number of MEMS technology innovators.

The MEMS speaker market in North America is characterized by maturity of the market along with high innovation potential led by early adoption of advanced consumer electronics, strong R&D infrastructure and well-established IoT ecosystem. Rising demand for high-end audio quality in smartphones, TWS devices, and AR/VR can boost the region. MEMS speakers are integrated by leading tech companies and OEMs for small form factor and better sound fidelity. Furthermore, the healthcare and industrial applications are slowly facilitating the market growth by deploying the smart miniaturized audio-enabled devices.

The market for North America was more dominated by the U.S., on account of its leading consumer electronics innovations, the established tech giants, and surging investments regional wearable and medical audio technologies.

Europe is another key market for MEMS speakers, where the company notes high-quality audio components are sought after in premium consumer electronics, smart wearables, and automotive infotainment systems. Key Innovators, such as USound GmbH are located within the region which has strong R&D capabilities with excellent government support for microelectronics. Increased adoption of smart healthcare devices and AR/VR technologies is another major factor boosting MEMS speaker adoption. On top of that, the European place demand for miniaturization and power-performing systems strengthens the transformation to MEMS audio throughout sectors.

Latin America and Middle East & Africa are two regions for MEMS speakers, which continue to grow at a slower pace catering to the increasing penetration of smartphones, rising deployment of wearable devices, and expansion of IoT infrastructure. To meet increasing consumer demand, local manufacturers are now integrating compact audio components with low-cost smart devices. Despite uneven technological adoption post-COVID, digital initiatives led by governments and entry of global electronics brands are opening up new opportunities for MEMS speakers in consumer electronics, healthcare, and smart home applications across both regions.

MEMS Speaker Market Key Players:

-

xMEMS Labs

-

USound GmbH

-

TDK Corporation

-

Sonitron

-

Robert Bosch GmbH

-

GraphAudio

-

AudioPixels Ltd.

-

SonicEdge

-

Sonion

-

AAC Technologies

-

Knowles Corporation

-

STMicroelectronics

-

Infineon Technologies

-

Goertek Inc.

-

Cirrus Logic

-

Broadcom Inc.

-

Qualcomm

-

Harman International

-

Bestar Electronics

-

MEMSensing Microsystems

Competitive Landscape of MEMS Speakers Market

xMEMS Labs

xMEMS Labs is a U.S.-based semiconductor company specializing in solid-state MEMS speaker technology built entirely on silicon. The company replaces traditional dynamic speakers with piezoelectric MEMS speakers that deliver higher sound fidelity, faster response, smaller form factors, and improved durability. xMEMS plays a critical role in the MEMS Speakers Market by enabling next-generation audio performance in true wireless stereo (TWS) earbuds, smart wearables, AR/VR headsets, and compact consumer electronics. Its technology supports thinner designs and improved acoustic consistency compared to conventional speakers.

-

In 2025, xMEMS Labs expanded commercialization of its Sycamore and Cowell MEMS speaker platforms, targeting AI-enabled wearables and premium TWS devices.

USound GmbH

USound GmbH is an Austria-based company focused on piezoelectric MEMS speaker solutions for ultra-compact audio applications. The company’s MEMS speakers are designed for low power consumption, high precision, and minimal distortion, making them suitable for TWS earbuds, smartwatches, hearing devices, and AR/VR systems. USound holds a strong position in the MEMS Speakers Market by offering scalable, thin-profile speakers that support advanced acoustic performance and ultrasonic capabilities. Its technology enables manufacturers to reduce device thickness while maintaining high sound quality.

-

In 2024, USound advanced its MEMS speaker portfolio for mass production, strengthening partnerships with consumer electronics manufacturers for next-generation earbuds.

TDK Corporation

TDK Corporation is a Japan-based global electronics manufacturer with a strong presence in sensors, passive components, and MEMS technologies through its InvenSense and Micronas divisions. While widely known for MEMS microphones, TDK is increasingly expanding its MEMS acoustic ecosystem, supporting compact audio solutions for smartphones, wearables, automotive, and IoT applications. In the MEMS Speakers Market, TDK benefits from deep semiconductor manufacturing expertise, global supply chains, and integration capabilities across sensing and audio platforms.

-

In 2025, TDK increased R&D investments in MEMS-based acoustic components to support emerging AR/VR, smart glasses, and spatial audio applications.

Sonitron

Sonitron is a Belgium-based manufacturer specializing in piezoelectric acoustic components, including piezo speakers, buzzers, alarms, and transducers. The company serves industrial, medical, automotive, and defense markets, offering robust and reliable sound solutions designed for harsh operating environments. In the MEMS and piezo speaker landscape, Sonitron contributes through its expertise in thin, energy-efficient piezo speaker designs that complement MEMS-based audio systems. Its products are valued for durability, consistency, and broad frequency response.

-

In 2024, Sonitron expanded its flat piezo speaker product lines to address growing demand for compact and rugged audio solutions in industrial and embedded electronics.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.48 Billion |

| Market Size by 2033 | USD 6.15 Billion |

| CAGR | CAGR of 12.12% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Smartphones, Earphones & Hearables, Wearables (e.g., smartwatches, and fitness trackers), and IoT Devices) • By Technology (Silicon-Based MEMS, and Polymer-Based MEMS) • By Type (Piezoelectric MEMS Speakers, Electrostatic MEMS Speakers) • By End-Use Industry (Consumer Electronics, Automotive, Healthcare, and Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles |

xMEMS Labs, USound GmbH, TDK Corporation, Sonitron, Robert Bosch GmbH, GraphAudio, AudioPixels Ltd., SonicEdge, Sonion, AAC Technologies, Knowles Corporation, STMicroelectronics, Infineon Technologies, Goertek Inc., Cirrus Logic, Broadcom Inc., Qualcomm, Harman International, Bestar Electronics, and MEMSensing Microsystems. |