3D Printing Robot Market Size & Trends:

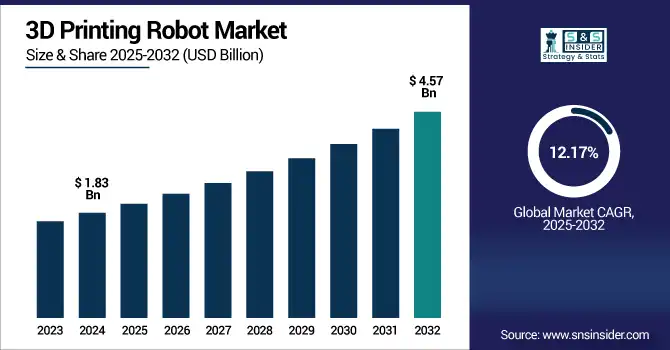

The 3D Printing Robot Market Size was valued at USD 1.83 billion in 2024 and is expected to reach USD 4.57 billion by 2032 and grow at a CAGR of 12.17% over the forecast period 2025-2032. The global market provides insights regarding the dynamics of the market, performance of various segments, trends in the regions and competitive landscape. The growing need for precision, speed and affordable manufacturing in the automotive, aerospace and healthcare segments is expected to drive the global market for 3D printing robots. Quickly lately, robots that accompany additive advances in advances are driving the way toward automatic 3D printing systems to take full advantage of the potential advantages of further developing production horizon and expanding the design flexibility while reducing the time-to-market highly complex and customized components.

To Get more information on 3D Printing Robot Market - Request Free Sample Report

For instance, over 70% of manufacturers globally are integrating robotics into their production lines as of 2024, with additive applications rising rapidly.

The U.S. 3D Printing Robot Market size was USD 0.43 billion in 2024 and is expected to reach USD 1.04 billion by 2032, growing at a CAGR of 11.71% over the forecast period of 2025–2032.

The U.S. market continues to expand due to the increasing adoption for industrial automation, supported by a solid base of aerospace and automotive giants and continuous investment for smart manufacturing projects. Moreover, the acceptance of robotics and artificial intelligence technologies at an earlier stage along with government policy implementations of advanced manufacturing is reducing the markets reach. Recent 3D Printing Robot Market analysis highlights growing tech adoption trends. With these forces at work the U.S. is well on the way to being a center for 3D printing robotic innovation and deployment to commercial sectors.

For instance, approximately 48% of U.S. manufacturers have integrated AI into their production systems to improve real-time decision-making and process optimization.

3D Printing Robot Market Dynamics:

Key Drivers:

-

Integration of Robotics and AI into Additive Manufacturing Workflows to Enhance Production Efficiency

Integrating AI with robotic 3D printing is fundamentally transforming production lines by facilitating real-time error detection, predictive maintenance, and adaptive printing tactics. AI algorithms can help smart robots improve tool path workflows, adjust to unexpected design changes without manual reprogramming, and reduce downtime. This has gained attention from big manufacturers, with the aim to put these innovative technologies into scalable processes and get better quality while reducing the dependence on manual labor.

For instance, AI-powered 3D printing systems can reduce print errors by up to 45% through real-time monitoring and adaptive correction algorithms.

Restraints:

-

High Initial Investment and Integration Costs for Robotic 3D Printing Infrastructure

One of Robotic 3D printing system implementation hurdle is the massive sum of money in the name of initial capital equipment to be spent on hardware, software and trained manpower. SMEs, in particular, find it difficult to justify that level of investment in a short space of time. In addition, incorporating these systems for into current production processes could involve rethinking factory space and new data standards, increasing expenditures and complicating implementation. Such financial and operational challenges are a big deterrent for many potential adopters particularly in areas where capital and technical expertise are hard to come by to adopt the technology.

Opportunities:

-

Expanding Use of 3D Printing Robots in Aerospace, Healthcare, and Defense Application

Aerospace, healthcare, and defense sectors are quickly adopting these 3D printing robots for the manufacturing of customized, high-strength, and lightweight components. Robotic additive manufacturing is used in aerospace to build lightweight complex engine parts and airframe components. Applications in the Health sector include prosthetics, dental implants and surgical planning models. The technology is utilized by various sectors including defense for parts and drones that are field-ready. Increased sector demand is fueling 3D Printing Robot Market growth rapidly. Thereby opening up huge market opportunities for players with industry-specific robotic 3D solutions.

For instance, robotic 3D printed aerospace parts can reduce component weight by up to 55%, directly improving fuel efficiency and payload capacity.

Challenges:

-

Technical Limitations in Printing Large-Scale and Complex Multi-Material Structures

3D printing robotics have come a long way, but still face challenges in the ability to consistently print large, complex parts with more than one material. Challenges include print head synchronization, compatibility, and maintaining dimensions over long prints. These limitations create adoption barriers in industries that need more structural complexity and hybrid-material assemblies: construction or aerospace. Addressing these challenges will necessitate considerable research and development in areas such as hardware design for additive intrinsically safe process, motion control algorithms, and real-time process monitoring systems that are suitable for high throughput of complex builds.

3D Printing Robot Market Segmentation Analysis:

By Type

Articulated Robots held the largest share in terms of revenue of 41.2% in 2024 owing to their flexibility, multiple degrees of freedom, and large deployment in automotive and aerospace industries. For instance, these robots are perfect for manufacturing complex parts and printing in multiple orientations. However, companies such as ABB Ltd have taken up the challenge by introducing state-of-the-art articulated robotic arms designed for additive manufacturing. This is why they are preferred for industrial 3D printing where we need seamless integration and precise motion.

The Collaborative Robots (Cobot) segment is projected to register the fastest compound annual growth rate (CAGR) of 13.66% from 2024–2032, owing to increasing demand from small and medium-sized enterprises. These all robots which could be safely operated by working side by side with the human operator without safety geriatric cages making inexpensive to deploy. Universal Robots has led the charge of cobot adoption with small, easy-to-use systems for 3D printing applications.

By Component

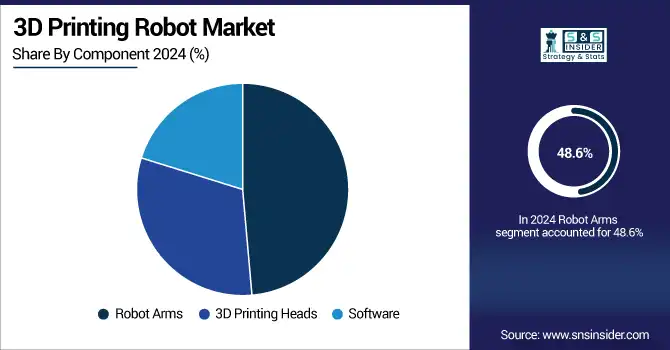

Robot Arms dominated the 3D Printing Robot Market by 48.6% share in 2024, primarily driven by the fact that they are an essential part of a 3D printer, which helps to move the 3D printing heads and maintain precision. They are essential for large format printing and getting into complex geometries and provide multi-axis movement. KUKA AG is a primary player in this area, providing robotic arms dedicated to additive applications. Current 3D Printing Robot Market trends highlight increasing robotic arm adoption.

The Software segment is projected to witness the highest CAGR over the forecast period from 2024–2032, with a CAGR of 13.23%, which is mainly attributed to the upgrading of existing manufacturing systems through advanced AI integration, enabling digital twin simulations, and real-time process control. With the growing complexity of the motion path optimization task, the role of software is becoming more and more such as the brains of a robotic 3D printing setup. Companies such as Autodesk Inc. are pushing this segment forwards with smart platforms that support slicing, error prediction, and adaptive print path control. Robotic 3D printing capabilities are improving product quality, efficiency, and automation features across sectors.

By Technology

In 2024, Fused Deposition Modeling (FDM) dominated the 3D Printing Robot Market with a 36.8% revenue share, owing to its low costs and the availability of a variety of thermoplastic materials that can be used. FDM has a broad ecosystem support with its development targeting prototyping and functional parts. Stratasys Ltd. a leader in FDM has partnered with industrialization of the technology with robotic compatible solutions

The Direct Metal Laser Sintering (DMLS) segment is anticipated to portray the fastest CAGR of 13.28% during the forecast period 2024–2032 owing to increase in application in aerospace, defense and medical implants that require high strength and precision parts. DMLS can achieve complex geometries with high mechanical properties, while saving materials. This growth has been driven, in particular, by EOS GmbH, which provides systems for metal 3D printing that can be integrated with robotics.

By Application

In 2024, prototyping accounted for the largest 3D Printing Robot Market share at 33.5% due to prototyping being the first and the most commonly used application of 3D printing robots. Rapid prototyping helps to accelerate product development cycles, costs, and also enables design validation. Robotic prototyping systems provided by 3D Systems Corporation have been an essential tool for performing design processes at accurate, controllable, and iterative increases in scale.

Aerospace & defense is expected to escalate at the highest compound annual growth rate (CAGR) of 14.73 % during the 2025 to 2032, owing to a growing demand through lightweight, high-strength, and durability components, along with a rapid turnaround time. Robotic 3D printing is a technology that is highly valued in the sector, due to the production of parts with shorter lead times and optimized performance. Lockheed Martin is working to integrate robotic additive manufacturing to create strong components for space and defense missions.

By End User

Large Enterprises dominated the 3D Printing Robot Market with a 58.2% share in 2024 owing to large capital, infrastructure and technical know-how. These organisations incorporate 3D printing robots into their Industry 4.0 strategies to drive up personalisation and efficiency. Siemens AG — Specialize in Implementing Robotic 3D Printing Solutions on a Broad Scale within Smart Factories Their technologies enable enterprises to reduce cycle and production times, and ensure quality across different types of manufacturing functions.

Small and Medium Enterprises (SMEs) are forecasted to witness the fastest CAGR of 13.09% during 2024–2032 on account of making robotic 3D printing modular and affordable. Compact robotic solutions are flexible, inexpensive, and have a low maintenance cost which is why they are used by the SMEs. The third trend is small-scale innovation, and an example of this is Voodoo Manufacturing, which leverages robotic 3D printing technology to provide on-demand mass customization services.

3D Printing Robot Market Regional Analysis:

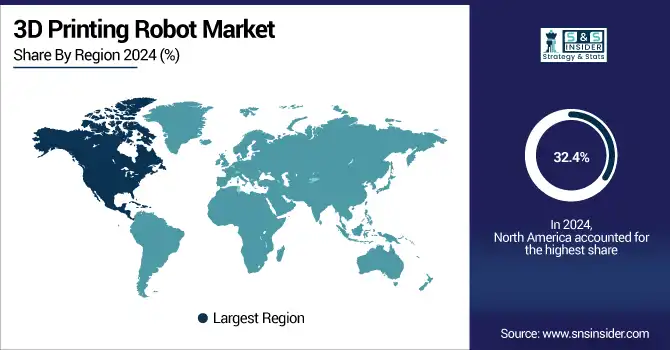

In 2024, North America led the 3D Printing Robot Market, accounting for 32.4% of revenue share, owing to the high evolution and establishment of several end-use sectors such as automotive, aerospace and defense, coupled with the advanced manufacturing ecosystem, and enhancing R&D base in the region. The U.S. continues to be the center for innovation, with high levels of investment and industry-wide collaborations to drive technology adoption.

-

The U.S. dominates North America’s 3D printing robot market due to its strong industrial infrastructure, early adoption of automation technologies, robust R&D investment, and the presence of major players such as GE Additive, driving innovation across aerospace, automotive, and healthcare sectors.

Asia Pacific is anticipated to be the fastest growing region with CAGR of 13.38% during the forecast period 2024–2032 owing to rapid industrialization, favorable government policies, and increasing manufacturing bases in China, Japan, South Korea and India. The rising automotive and consumer electronics demand, increasing awareness about advanced manufacturing, and higher robotics adoption by mid-sized firms in the region are contributing to Robotics Market Research in the region.

-

China leads the Asia Pacific 3D printing robot market owing to its massive manufacturing base, government-backed smart factory initiatives, rapid robotics integration, and support for domestic innovation. Companies including FANUC and local startups accelerate adoption across automotive, electronics, and consumer goods industries.

Europe holds a substantial position in the 3D Printing Robot Market due to the extensive automotive and aerospace industries, developed R&D infrastructure, and the prevalence of Industry 4.0 practices. Manufacturing sectors in countries including Germany, France and the UK are innovating with robotic automation and additive manufacturing.

-

Germany leads the European 3D Printing Robot Market due to its strong industrial base, dominance in automotive and engineering sectors, and significant investments in robotics and additive manufacturing technologies. Companies including KUKA and Siemens drive innovation and widespread adoption across industries.

UAE dominates the Middle East & Africa 3D Printing Robot Market with the smart manufacturing initiatives along with government supported 3D printing programs. Brazil leads the market in Latin America on the back of its booming industrial automation, adoption in automotive & healthcare sector & growing investment on additive manufacturing technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

3D Printing Robot Companies are:

Key Players in 3D Printing Robot Market are ABB Ltd., KUKA AG, Universal Robots A/S, FANUC Corporation, Stratasys Ltd., EOS GmbH, Autodesk Inc., 3D Systems Corporation, Siemens AG and GE Additive and others.

Recent Developments:

-

In July 2025, ABB has expanded its large industrial robot portfolio with the IRB 6730S, 6750S, and 6760 series powered by the OmniCore controller, offering up to 20% lower energy consumption and high accuracy—vital for additive manufacturing tasks.

-

In May 2025, KUKA unveiled its new robot OS iiQKA.OS2 and KR TITAN ultra at Automatica 2025, enhancing additive manufacturing capabilities with AI-supported programming and modular safety.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.83 Billion |

| Market Size by 2032 | USD 4.57 Billion |

| CAGR | CAGR of 12.17% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Articulated Robots, Cartesian Robots, SCARA Robots, Collaborative Robots) • By Component (Robot Arms, 3D Printing Heads, Software) • By Technology (Fused Deposition Modeling, Stereolithography, Selective Laser Sintering, Direct Metal Laser Sintering) • By Application (Prototyping, Tooling, Manufacturing, Healthcare, Aerospace & Defense, Automotive) • By End User (Large Enterprises, Small and Medium-sized Enterprises, Research Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB Ltd., KUKA AG, Universal Robots A/S, FANUC Corporation, Stratasys Ltd., EOS GmbH, Autodesk Inc., 3D Systems Corporation, Siemens AG and GE Additive. |