Smart Robot Market Report Scope & Overview:

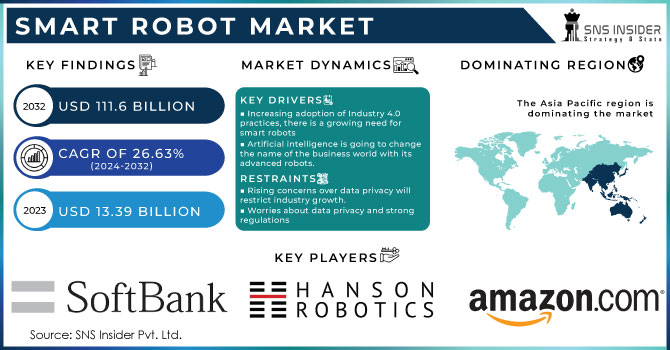

The Smart Robot Market size was valued at USD 13.39 billion in 2023. It is expected to hit USD 111.6 billion by 2032 and grow at a CAGR of 26.63% over the forecast period of 2024-2032. Intelligent robots are willing to reform supply chain processes. This increased production is essential to manufacturing in that it reduces reliance on humans and allows for scale. The rapid advancements in robotics technology create new opportunities for increased efficiency and reduction of human labor. This, combining with the expanding preference for local production and consumption is likely to propel phenomenal expansion in smart robot market. Industrialization affects the adoption of robots which is then accelerated by automation. Manufacturers of any size can be positively impacted by automated robotics, because they are more accessible and affordable than ever before.

Get E-PDF Sample Report on Smart Robot Market - Request Sample Report

The 2024 World Intelligence Expo boasted the newest in high-tech gadgetry - highlighting robotics as a tool for production. This should have been my fate, but inexplicably I ended up marrying procreation and all its promises instead of the robots in Men-only Heaven with whom guests are encouraged to mess around - bionic robots and human-like ones as well as robotic dogs.

The show also featured remarkable aerial tech, like drones and flying vehicles of all sizes including a cargo-carrying helicopter from a German firm. While robotics are notably more than just the industrial arm off their old and new applications, robotic arms use 5G, AI along with many of today's latest technology to produce some incredibly sharp camera work. But the exhibition was more than a showcase - it also played host to events showcasing what these technologies are capable of, such as the Asia-Pacific Robotics World Cup andtheWorld Intelligent Driving Challenge. This event gave companies the chance to show off their new solutions and explore how far-reaching business opportunities are enabled by smart technology, including digital transformation.

Hyundai Motor Group is boosting smart offices with robots! The DAL-e delivery robot from Hyundai and Kia operating at Factorial Seongsu in Seoul, South Korea features AI facial recognition (claimed to be accurate up to 99.9%) for autonomously traveling inside building premises and delivering parcels directly into the hands of residents The Hyundai WIA Parking Robot parks itself as well, taking control of the wheel to park the car in multiple rows and save space. There is a Max of 50 they can handle for their Smart Parking Control System and in the future, will partner with Hyundai & Kia's Automatic Charging Robot service for EV charging. Hyundai plans to expand the "Robot Total Solution" in more buildings where evolution of workplaces begins with robotic transformation.

Market Dynamics

Drivers

-

Increasing adoption of Industry 4.0 practices, there is a growing need for smart robots

-

Increasing demand for smart robotics in the Non-Industrial sector will drive the global service and industrial robots market.

Those smart robots are now longer contained in factory walls anymore. The developers are building robots for different industries resulting in a boom of the market. Robots are a helping hand today while artificial intelligence (AI) and machine learning is taking over better than humans! You truly read this right, it's not sci-fi. Our healthcare sector has already started new surgeries with the help of these robots and they're becoming a part day-by-day in livesages folks. Imagine robots performing complex missions in the future! Robeta is just one more example of an area where robots will be prevalent in the future, with agriculture seeming to have particular promise for an industry that has trouble finding workers willing or able and also spends lots on. Money's no free. At the moment, cyborgs are harvesting crops where they carefully pick fruits and vegetables without damaging them. Ultra-intelligent robots and the best vision technology out there, only a robot with an excellent knowledge can make an accurate call on where produce is ripe. Drones and autonomous tractors are the now-common reality of the robotic revolution, buzzing overhead and checking on crops. Purpose-built robots are also fueling growth in the robot market outside factories, but to an extent rarely seen for automation products.

-

Artificial intelligence is going to change the name of the business world with its advanced robots.

AI is sort of a power booster for robots. This allows the robots to learn, adapt and deal with complex situations by simulating human-like intelligence. Imagine photo-realistic AI training grounds doing hundreds of challenges in seconds, one after the other whose data can be used to train robots more accurate and intelligent. The rising demand for AI in robots is a no brainer. These are as a part of the cognitive area, so that robots can learn to understand natural languages (natural language processing) etc. This is also used in robotics for free interaction with humans. Robots are becoming stringently precise, intelligent and commercially vogue setting a new benchmark in the intelligent robot industry while their upcoming boom is at par with all things future.

Restraints

-

Rising concerns over data privacy will restrict industry growth.

Increasing software services for robots are raising ethical concerns related to the ownership of data, which would hinder market growth. Use of domestic robots in not just for education, recreation, but also chores incremented the number of cloud-based data belonging to the individuals. And that data also leaves the companies premises often bought by unauthorized users or third party such as marketing agencies. The data from robots is access in proprietary way, sometimes enables enterprise confidential getting infringed and misused. In the military, defense and healthcare sectors, data breaches carry heavy consequences. Thus, growing data security is becoming a challenge for robots adoption recently and it could significantly suppress the market growth.

-

Worries about data privacy and strong regulations

With robot helpers appearing higher and better in households for jobs, education, or even simply mere leisure reasons ultimately a privacy alarm is growing. These robots also collect your personal data (such as what time you leave in the morning, or if you have a chronic health condition) that can be uploaded into cloud storage. This could then put your data in danger! It can be bought by third-parties, say marketing agencies for instance and this has led to your privacy being infringed upon directly. Think of voice-controlled robots such Amazon's Lynx and Google's Roomba, they are being recorded all the time. Ensuring data security is paramount. There's also many ethical questions to be considered by governments, as who gather the data that robots do and its possibilities for researching with it.

Segment Analysis

By Type

-

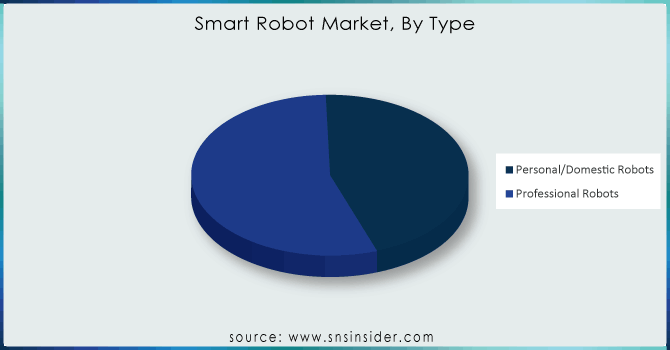

Personal/Domestic Robots

-

Professional Robots

Professional robots presently claim 55% share of the market with respect to smart robots. They are very prevalent in industries like manufacturing, logistics and healthcare where their soundness as well strength is crucial. These robots are ideal for automating dull and dangerous tasks, as they demonstrate good performance in complex assignments at the highest level. A growing demand for these skilled assistants examined the use of automation is increasing, as well there simply are not enough workers. If you see robots in the factories or at hospitals - that's pretty much one of the most demanding things about intelligent robotics field.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Mobility

-

Mobile

-

Fixed/Stationary

At 56% of the smart robot market, fixed robots now lead they have been around longer and many are traditional manufacturing tasks that occurred on the assembly lines. Basic tasks on these understandable yet affordable machines that are proven, hardworking). This is especially true when dealing with very complicated and nuanced movements that require precision and repeatability, something which mobile robots inherently struggle to accomplish due to the limitations of navigation/stability issues. Even so, the dominance of mobile robots is growing. Navigation technology and battery life are improving their capabilities, and new applications in areas such as logistics and healthcare have showcased the advantage of mobility. Well, the current title holder is actually stationary robots; however, mobile robots are holding Court to win it in future!

By Application

-

Inspection and Maintenance

-

Material Handling and Sorting

-

Security and Surveillance

-

Education and Entertainment

-

Sanitation and Disinfection

-

Others

By End-User

-

Manufacturing

-

Healthcare

-

Agriculture

-

Military and Defense

-

Logistics and Warehouse

-

Education and Entertainment

-

Others

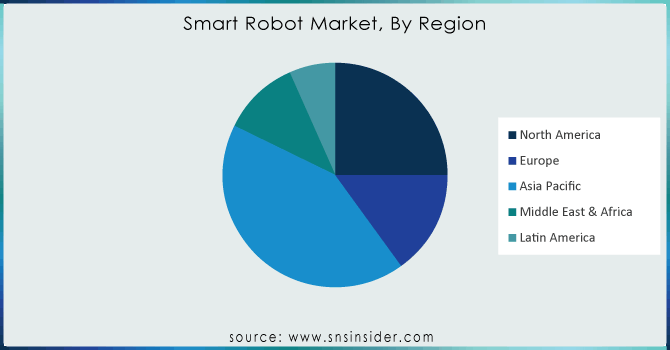

Regional Analysis

Regional Analysis

The Asia Pacific commands the largest share in this market with 45% of total smart robot industry. A rapidly growing industrial base in this region, is accelerating the necessity for robotics as it helps to cater huge requirement especially from manufacturing and logistics sector. In this region, governments are like parents of a prodigy - offering financial and regulatory help to robotics as it grows up. Innovation in technology! Indeed, some of the world's most advanced robotics research is taking place in countries like China, Japan and South Korea. That is how Asia Pacific commands the largest market share in smart robots - they have everything perfect to be ruling as robot overlords damn it!

The leading direct return market of the Smart robot industry in a 25% share, North America has maintained rapid growth as demand for industries such as car manufacturing / healthcare/ food production continues. Growth is primarily being driven by better robotics, trade rules work in countries' favor and the more workers make per hour. Use of automation in the region stimulates local robotic knowledge and appeals to investment

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Hanson Robotics Ltd., KUKA AG, Amazon Inc., SoftBank Corporation, ABB, Honda Motor Company Ltd., OMRON Adept Technology Inc., YASKAWA Electric Corporation, Blue Frog Robotics, DeLaval, Intuitive Surgical, Samsung Electronics Co. Ltd., Hyundai Motor Group and other.

Recent Development

-

In 2024, Hyundai deployed robots for deliveries and parking in a Seoul office building, showcasing their self-driving and AI capabilities.

-

In April 2022, Yaskawa Company developed an industrial robot equipped with artificial intelligence that can accurately identify the color and shape of objects, efficiently transporting them to their designated positions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.39 billion |

| Market Size by 2031 | US$ 111.6 Billion |

| CAGR | CAGR of 26.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Personal/Domestic Robots, Professional Robots) • By Mobility (Mobile, Fixed/Stationary) • By Application (Inspection and Maintenance, Material Handling and Sorting, Security and Surveillance, Education and Entertainment, Sanitation and Disinfection, Others) • By End User (Manufacturing, Healthcare, Agriculture, Military and Defense, Logistics and Warehouse, Education and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hanson Robotics Ltd., KUKA AG, Amazon Inc., SoftBank Corporation, ABB, Honda Motor Company Ltd., OMRON Adept Technology Inc., YASKAWA Electric Corporation, Blue Frog Robotics, DeLaval, Intuitive Surgical, Samsung Electronics Co. Ltd., Hyundai Motor Group |

| Key Drivers | • Increasing demand for smart robotics in the Non-Industrial sector will drive the global service and industrial robots market. • Artificial intelligence is going to change the name of the business world with its advanced robots. |

| RESTRAINTS | • Rising concerns over data privacy will restrict industry growth. • Worries about data privacy and strong regulations |