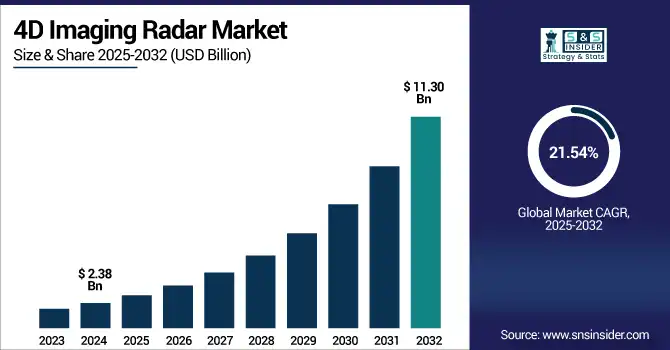

4D Imaging Radar Market Size & Growth:

The 4D Imaging Radar Market Size was valued at USD 2.38 billion in 2024 and is expected to reach USD 11.30 billion by 2032 and grow at a CAGR of 21.54% over the forecast period 2025-2032. The Global Market report provides a detailed analysis of the key segments by range, application, end-user, and region. Market for 4D Imaging Radar is expanding fast as adoption in autonomous vehicles continues to rise along with technology advancements, healthcare, and surveillance systems. The increasing focus on safety, precision, and environment-aware real-time sensing applications is speeding up its proliferation across various industries such as automotive, defense, industrial automation, and smart infrastructure projects. 4D Imaging Radar market analysis highlights transformative trends across critical industry sectors.

To Get more information on 4D Imaging Radar Market- Request Free Sample Report

For instance, more than 60% of newly launched Level 2+ vehicles in 2025 are equipped with radar-based sensing systems, with 4D radar gaining traction.

The U.S. 4D Imaging Radar Market size was USD 0.63 billion in 2024 and is expected to reach USD 2.86 billion by 2032, growing at a CAGR of 20.98% over the forecast period of 2025–2032.

The U.S. Market is projected to grow tremendously due to increased demand for autonomous driving technologies, government safety regulations, and growing smart mobility and defense investments in the region. The presence of key OEMs & sensor manufacturers in addition to the constant R&D activities being undertaken are further establishing 4D radar competencies in the nation as a key dominator. These aspects are allowing for mass-market integration of 4D imaging radar across both mass volume automotive applications and high-performance, defense grade systems.

For instance, around 72% of vehicles manufactured in the U.S. are now equipped with ADAS features supported by radar technologies.

4D Imaging Radar Market Dynamics:

Key Drivers:

-

Rising Demand for ADAS and Autonomous Vehicles is Accelerating Adoption of Real-Time 4D Radar for Accurate Perception and Safety

Global demand for the automotive 4D imaging radar systems is extremely rising as an indispensable part of autonomous driving, as they provide 4D spatial awareness data, which are important in all weather and light situations. Unlike with traditional radar, 4D imaging radar could detect the elevation, as well as the speed, distance, and direction, of objects, enabling better classification of objects and real-time reaction time. The various capabilities offered here are pivotal for lane-keeping, collision avoidance, and pedestrian detection which are crucial for a myriad of modern mobility solutions catering to automotive OEMs and mobility tech firms on the outset and hence, are great driving forces for ADAS market in the region.

For instance, 4D radar systems maintain over 95% object tracking accuracy in adverse weather conditions where cameras and LiDAR often fail.

Restraints:

-

High Cost of Deployment and Integration is Limiting Widespread Adoption Among Price-Sensitive Sectors and Emerging Economies

While it inherently has technical strength, proliferation of 4D imaging radar systems suffers due to high manufacturing and installation costs. Such systems demand high-end and advanced signal processors, antenna arrays, and large software development for live interpretation, thus driving up start-up costs. In many cost-sensitive markets and lower-end vehicle segments, OEMs have been leaning toward LiDAR or traditional radar substitutes. Moreover, integration into existing vehicle platforms and system architecture requires re-engineering, increasing costs, especially in low volume production markets or industries with strict budget control.

Opportunities:

-

Expansion of Smart City and Infrastructure Surveillance Projects Enhances Demand for Wide-Area, High-Resolution Radar Coverage

The increasing adoption of smart cities and intelligent infrastructure initiatives across the world is expected to boost the demand for 4D radar integration in public safety, traffic control, and perimeter surveillance systems. By offering better object detection and tracking in crowded and obstructed urban environments, these radars give larger skills. They facilitate monitoring movement in multi dimenstion that increases response efficiency at the time of emergencies. Government spending on next-generation radar solutions for urban safety, autonomous transportation tracking, and smart traffic management are creating considerable growth opportunities in civil infrastructure and municipal surveillance networks. 4D Imaging Radar market growth is driven by intelligent urban infrastructure demand.

For instance, 4D radar platforms have achieved up to 92% accuracy in detecting unusual movement patterns in crowded public areas, improving threat detection.

Challenges:

-

Complex Calibration and Integration with Multi-Sensor Platforms Increase Time-To-Market and Technical Barriers for Manufacturers

Integrating 4D imaging radar with cameras, LiDARs and ultrasonic sensors into vehicles and systems is a demanding technical challenge. Sensor fusion for accurate object recognition and advanced decision-making is only practical when you have sensor calibration and synchronization along with a custom software development. If the placement of different sensors is not aligned, it can still cause false positives or missed positive detections. Multitasking Approach: This non-viable integration challenge extends the product development time, increases cost and often requires dedicated engineering teams. In addition, there are always compatibility issues with the platforms and continual needing of firmware update just to keep up with the network operational.

4D Imaging Radar Market Segmentation Analysis:

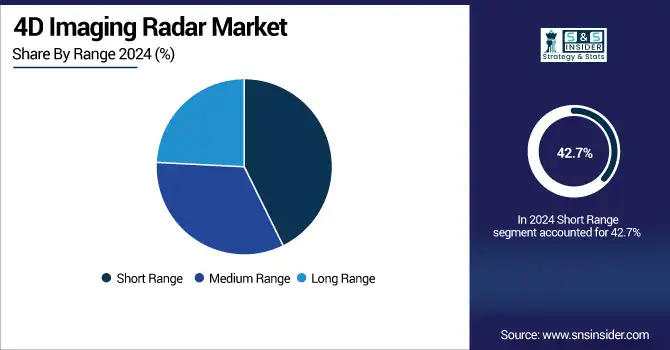

By Range

The Short Range segment led the 4D Imaging Radar Market share by 42.7% in 2024. This is mainly due to its wide application in ADAS features like parking assistance, blind-spot detection, and low-speed maneuvering. Short-range 4D radars are economical and reliable for close-proximity detection, which is why the automobile industry favors them. Meanwhile, companies such as NXP Semiconductors have been instrumental in the production of small, integrated radar chips that allow these functions to be deployed in mass-market vehicles.

The Long Range segment is anticipated to register the fastest CAGR of almost 22.36% over the forecast period 2024–2032 due to increasing adoption in autonomous driving applications that require long-distance detection range on highways. Long-range 4D radars accurately track objects and use lane-level positioning with precise speed to improve self-driving safety and navigation. Arbe Robotics is working on ultra-high-resolution 4D radar systems for distant and multi-object detection for use in autonomous mobility platforms.

By Application

In 2024, the ADAS segment led to the revenue share of the 4D Imaging Radar Market with a share of about 66.4% owing to increasing integration of radar-based safety features in vehicles. However, with regulations and the role of autonomy playing an important part, 4D radar has taken its role by OEMs into lane assist, collision warning, and adaptive cruise control due to mandatory safety standards. Continental AG which have been a pioneer, supplying scalable 4D radar platforms specifically tailored for advanced driver assistance systems in both premium and mid-segment vehicles. 4D Imaging Radar market trends highlight the shift toward enhanced vehicle autonomy.

The Patient Diagnostics & Monitoring segment will grow at the highest penciled CAGR of nearly 23.15% over the forcast period 2025–2032, on account of surging demand for contactless monitoring of vital signs in a homecare setting and hospitals. 4D imaging radar has the ability of obtaining respiration and heartbeat without contact, and thus it becomes very important in neonatal and elderly care and many other applications. Vayyar Imaging providing radar-based health monitoring systems is also a key innovator in this space, capable of providing continuous, privacy-preserving, camera-free and wearable-free tracking.

By End-User

In 2024, the Automotive segment led the 4D Imaging Radar Market in terms of revenue, holding approximately 62.9% of the overall market share. With the increasing demand for autonomous vehicles and advancement in safety features integration, automotive OEMs have been the early adopters of 4D radar. Such systems provide improved detection of obstacles, tracking at the lane level, and adaptive control functions. This area has seen Bosch gaining widespread influence as a provider of next-gen 4D radar sensors for ADAS and highway pilot systems in passenger cars.

The Healthcare segment is expected to witness the highest CAGR of nearly 24.31% over the period 2024–2032 due to growing application of Internet of Thing in patient monitoring, fall detection, and chronic disease management. With ability to constantly monitor health parameters using radar without physical contact such systems are useful for ICUs and elder living homes. One of the key players pushing this technology is Xandar Kardian, with their 4D radar systems that track patients' vitals without direct contact, increasing both safety and comfort.

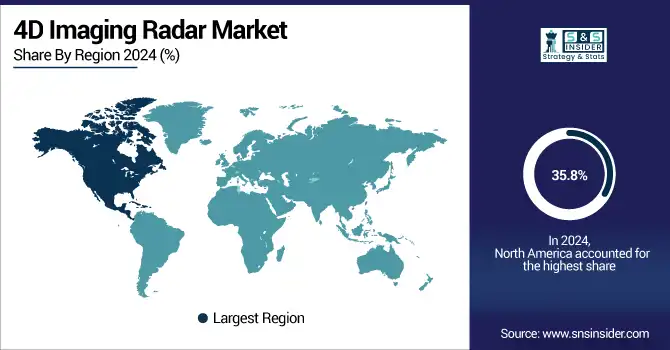

4D Imaging Radar Market Regional Outlook:

In 2024 North America held the highest revenue share of 35.8% due to its strong technological infrastructure, fast-paced adoption of autonomous driving systems, large investment in defense sector. The advantage of well-established automotive ecosystem with focus on ADAS innovations over the region coupled with strong presence of radar sensor manufacturers is driving the market in this region. These elements, when considered in conjunction, bolster North America's dominance in the deployment of cutting-edge 4D radar technologies within both commercial and military markets.

-

The U.S. dominates the North American 4D Imaging Radar Market due to its advanced automotive sector, strong defense spending, and leadership in autonomous vehicle R&D. Major OEMs and radar technology firms headquartered in the U.S. accelerate market growth.

Asia Pacific region is anticipated to reach the fastest CAGR of 23.23% during the forecasted time span of 2024 to 2032 with the increasing vehicle manufacturing and rising integration of these system structures in economies such as China, Japan and South Korea. Smart City Development and Public Infrastructure Surveillance – Rapid investment is also going toward smart city development and public infrastructure surveillance in the region. Driven by governmental policies for a safe and gradually automated future of transport, the Asia Pacific now sees the region as a major business opportunity for high-volume deployment of low-cost 4D radar systems.

-

China leads the Asia Pacific 4D Imaging Radar Market owing to its massive vehicle production, rapid smart city expansion, and strong government support for ADAS adoption. Local manufacturers and tech firms are heavily investing in radar-enabled mobility and infrastructure solutions.

Europe holds a substantial position as it is a hub for automotive manufacturers, it has implemented various regulations concerning ADAS at addition to being inclined towards road safety. Radar manufacturers based in Germany, France and UK are some of the trendsetters adopting radar sensors into vehicles. In addition to that, increasing investment in defense and surveillance systems also drives the steady growth of that market space in the region.

-

Germany dominates the European 4D Imaging Radar Market due to its strong automotive industry, advanced ADAS integration, and presence of leading OEMs. High R&D investments and collaborations with radar technology providers further strengthen its leadership in adopting next-generation radar systems.

UAE dominates the Middle East & Africa 4D Imaging Radar Market propelled by smart city projects and defense modernization. Brazil leads the Latin America region owing to its growing automotive industry, strengthening safety standards, and increasing radar adoption for transportation and industrial monitoring applications in various metropolitan cities.

Get Customized Report as per Your Business Requirement - Enquiry Now

4D Imaging Radar Companies are:

Major Key Players in 4D Imaging Radar Market are Arbe Robotics, Uhnder, Oculii, Zendar, Aptiv, Texas Instruments, NXP, Analog Devices, Smartmicro, Mistral Solutions, Echodyne, Bitsensing, Vayyar, Aeva, Ainstein, GhostWave, Steradian, RoboSense, Uhnder Automotive Radar, and Retina AI Radar.

Recent Developments:

-

In September 2024, Arbe’s chipset was selected by Sensrad to supply 4D imaging radar systems to China-based Tianyi Transportation Technology, with deliveries starting Q3 2024.

-

In May 2025, NXP unveiled its third-generation S32R47 imaging radar processors, offering twice the performance, reduced power consumption, and targeted at Level 2+ to Level 4 autonomous driving systems.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.38 Billion |

| Market Size by 2032 | USD 11.30 Billon |

| CAGR | CAGR of 21.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Range (Short Range, Medium Range, Long Range) • By Application (ADAS, Security & Surveillance, Patient Diagnostics & Monitoring) • By End-User (Automotive, Aerospace & Defense, Healthcare, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Arbe Robotics, Uhnder, Oculii, Zendar, Aptiv, Texas Instruments, NXP, Analog Devices, Smartmicro, Mistral Solutions, Echodyne, Bitsensing, Vayyar, Aeva, Ainstein, GhostWave, Steradian, RoboSense, Uhnder Automotive Radar, and Retina AI Radar. |