Radar Sensors Market Size & Overview

Get More Information on Radar Sensors Market- Request Sample Report

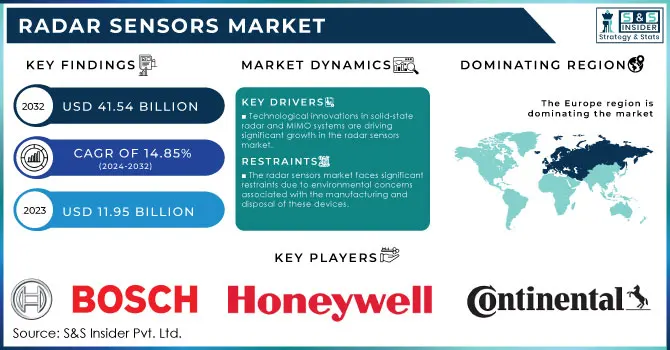

The Radar Sensors Market Size was valued at USD 11.95 Billion in 2023 and is expected to grow to USD 41.54 Billion by 2032 and grow at a CAGR of 14.85% over the forecast period of 2024-2032.

The radar sensors market is experiencing substantial growth, fueled by rapid technological advancements and increasing demand for enhanced automotive safety and automation features. Integral to advanced driver assistance systems (ADAS) and autonomous vehicles, radar sensors enable critical functionalities such as adaptive cruise control, collision avoidance, and parking assistance. These innovations significantly elevate vehicle safety, convenience, and the overall driving experience, prompting automakers to integrate more radar sensors into their designs. As the automotive industry transitions toward electric vehicles (EVs) and automated driving technologies, the demand for sophisticated radar solutions intensifies. Manufacturers are focusing on miniaturizing radar systems to improve performance while maintaining cost-effectiveness, making them well-suited for various automotive applications. Breakthroughs in solid-state radar and multi-input multi-output (MIMO) technology enhance detection accuracy and range, essential for navigation and obstacle detection, as well as future connected vehicle applications. Additionally, advancements in artificial intelligence (AI) and machine learning are optimizing radar data processing, enhancing decision-making capabilities in autonomous vehicles. Industry leaders are heavily investing in research and development to create efficient radar systems that seamlessly integrate with LiDAR and camera technologies, ensuring comprehensive environmental perception. In light of recent events, such as the National Highway Traffic Safety Administration (NHTSA) investigation into 2.4 million Tesla vehicles equipped with Full Self-Driving (FSD) software after reports of crashes—including a fatal incident—there is heightened scrutiny on the integration of advanced driver assistance technologies. The NHTSA's inquiry reflects broader industry concerns regarding safety regulations and technology performance, with the potential for recalls if deemed necessary. Moreover, the ongoing strike involving 45,000 dockworkers could impact the supply chain, with losses in the automotive sector estimated at nearly $340 million daily. As the radar sensors market continues to expand, it remains critical for stakeholders in the automotive industry to navigate challenges posed by regulatory scrutiny and supply chain disruptions while meeting growing consumer demands for safer, more efficient driving experiences.

The radar sensors market is witnessing robust growth driven by the escalating demand for Advanced Driver Assistance Systems (ADAS) in modern vehicles. Technologies such as adaptive cruise control, lane-keeping assist, and automated parking are becoming standard features, significantly increasing the integration of radar sensors, which are essential for their functionality. A recent report by J.D. Power revealed that vehicle alerts account for the most complaints about ADAS, highlighting the need for improved systems, which drives further innovation in radar technology. As of 2024, with the anticipated rise in electric vehicle (EV) production, especially from companies like Toyota, which emphasizes safety through its ADAS technologies, the demand for radar sensors is expected to surge. Additionally, the shift towards 5G infrastructure is set to enhance connectivity and safety features in vehicles, further amplifying the need for sophisticated radar systems. A study from Automotive News projects that revenues from driver assist and EV charging services could skyrocket by 2035, underlining the market's potential. With increasing regulatory focus on vehicle safety, automakers are prioritizing the integration of advanced radar sensors to comply with safety standards and meet consumer expectations for enhanced driving experiences.

Radar Sensors Market Dynamics

Drivers

-

Technological innovations in solid-state radar and MIMO systems are driving significant growth in the radar sensors market.

The radar sensors market is experiencing rapid growth, driven by technological innovations that enhance performance and capabilities. Developments such as solid-state radar technology, Multi-Input Multi-Output (MIMO) systems, and miniaturization are making radar sensors more efficient and adaptable for various automotive applications. For example, solid-state radar systems enhance reliability while reducing size and costs, which is essential for the integration of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles. Recent reports indicate that the demand for ADAS is set to significantly influence the automotive market, with projections suggesting that revenues from ADAS-related technologies could reach up to USD 40 billion by 2035, driven by stricter safety regulations and a shift in consumer preferences towards smarter driving systems. Innovations in MIMO technology improve object detection accuracy by allowing multiple antennas to transmit and receive signals simultaneously, which is crucial for features like adaptive cruise control and collision avoidance. Additionally, miniaturization allows manufacturers to integrate these sensors into smaller vehicle designs without compromising performance. As regulatory safety standards become more stringent and advanced safety features gain traction, demand for radar sensors is expected to grow. With the automotive industry continually innovating and prioritizing safety, the radar sensors market is poised for continued success, bolstered by ongoing technological advancements and market demand.

Restraints

-

The radar sensors market faces significant restraints due to environmental concerns associated with the manufacturing and disposal of these devices.

As the demand for advanced radar technology rises, manufacturers face the challenge of ensuring sustainability and eco-friendliness in their production processes. Many radar sensors utilize materials that may not be environmentally friendly, prompting increased scrutiny from regulators and consumers about their environmental impact. Numerous studies emphasize the importance of sustainable practices in technology manufacturing, especially as consumer awareness of environmental issues grows. Companies that fail to prioritize eco-friendly materials could find themselves at a competitive disadvantage, as consumer preference shifts toward greener technologies. This trend is becoming a crucial factor in purchasing decisions, making it essential for radar sensor manufacturers to innovate with sustainability in mind. With regulations aimed at reducing electronic waste and promoting the use of sustainable materials on the rise, the radar sensors market must adapt or risk facing compliance costs and reputational damage. Consequently, environmental concerns could restrict market growth, driving manufacturers to implement more sustainable practices while meeting the increasing demand for radar technology across various sectors, including automotive and robotics.

Radar Sensors Market Segment Analysis

by Type

Based On Type, Pulse Radar is captured the largest share revenue in Radar Sensors market of around 45% in 2023. primarily due to its high precision and reliability in measuring distances and speeds through short bursts of radio waves, making it essential for advanced driver assistance systems (ADAS) and autonomous vehicles where accurate detection is critical for safety; the automotive industry has significantly driven this growth, as manufacturers increasingly integrate advanced radar systems into vehicles for features like adaptive cruise control, collision avoidance, and parking assistance, exemplified by Bosch's recent launch of a new generation of radar sensors designed for ADAS, which enhance vehicle safety and facilitate autonomous capabilities; moreover, pulse radar technology excels in challenging environmental conditions, such as fog, rain, and snow, making it a preferred choice for various sectors beyond automotive, including industrial automation, aerospace, and security, highlighted by NXP Semiconductors’ introduction of a robust pulse radar sensor capable of operating in harsh environments; ongoing technological advancements, such as miniaturization and improved signal processing, are driving down costs and encouraging wider adoption of pulse radar systems among manufacturers, with companies like Infineon Technologies developing compact solutions for integration with smart devices; additionally, an increasing focus on safety regulations globally compels automakers to adopt advanced radar technologies to meet stricter standards, as seen with Aptiv's collaborations with automotive OEMs to advance pulse radar systems; thus, the substantial market share of pulse radar sensors in 2023 is a testament to their precision, adaptability, and ongoing innovations, particularly in the automotive sector.

by Range

The short-range segment of the radar sensors market has established itself as the dominant category, accounting of around 55% of total revenue in 2023. This growth is driven by several key factors highlighting the significance of short-range radar applications across various sectors. The automotive industry plays a pivotal role in the rise of short-range radar technology, particularly in safety features such as parking assistance, blind-spot detection, and collision avoidance systems. As vehicles increasingly integrate advanced driver assistance systems (ADAS), the demand for short-range radar sensors has surged. Notably, suppliers like Continental have developed systems that enhance safety by accurately detecting nearby objects, crucial for urban driving conditions. Additionally, Valeo launched its latest short-range radar sensor, designed to improve vehicle perception capabilities, thereby enhancing overall safety in dense traffic environments. Beyond automotive applications, short-range radar sensors find extensive use in industrial automation, robotics, and security systems. Their capability to detect objects at short distances makes them ideal for manufacturing environments, assisting automated guided vehicles (AGVs) and conveyor systems. Companies like Siemens have successfully incorporated short-range radar into their solutions, boosting operational efficiency and safety in various industrial applications. Recently, SICK AG introduced its short-range radar sensor for industrial automation, offering reliable object detection in challenging environments. Technological advancements, including improved signal processing and miniaturization, have further enhanced the performance and versatility of short-range radar sensors. This evolution enables manufacturers to create compact and cost-effective radar solutions suitable for diverse applications. For example, Texas Instruments has introduced innovative short-range radar technologies designed for smart home devices and consumer electronics, expanding their market potential. With a growing emphasis on safety and security, industries are increasingly seeking reliable technologies that improve detection capabilities, leading companies like Bosch to continually innovate short-range radar solutions to comply with evolving safety standards. In 2023, Bosch unveiled its latest short-range radar system, which enhances detection accuracy and integrates seamlessly with existing vehicle safety features, further solidifying its position in the market.

Radar Sensors Market Regional Outlook

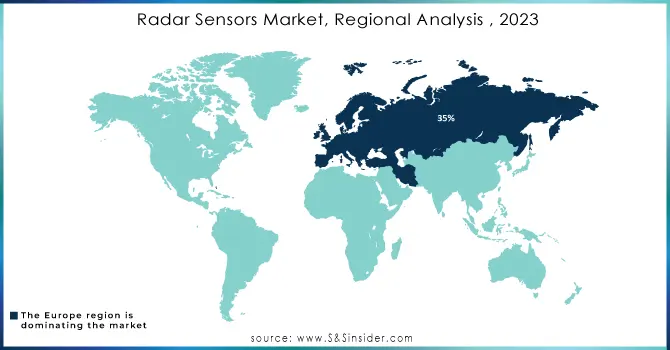

In 2023, Europe established itself as a dominant player in the radar sensors market, capturing approximately 35% of the total revenue. This significant market presence is driven by several critical factors, underscoring the region's leadership in radar technology and its broad applicability across various sectors. A key contributor to this growth is the robust automotive industry, where major manufacturers like Volkswagen, BMW, and Mercedes-Benz are increasingly incorporating advanced driver assistance systems (ADAS) that heavily depend on radar sensors for features such as adaptive cruise control, lane-keeping assistance, and collision avoidance. The European Union’s strict safety regulations, particularly the recent implementation of the General Safety Regulation (GSR), mandate that all new vehicles must be equipped with advanced safety systems, thereby elevating the demand for radar sensors. Moreover, Europe is at the cutting edge of radar technology innovations, with substantial investments in research and development. Countries like Germany, France, and the UK are leading advancements in radar sensor technologies, including solid-state radar and Multi-Input Multi-Output (MIMO) systems. Companies such as Infineon Technologies and Bosch are consistently enhancing radar performance and reliability while driving down costs; for instance, Bosch has introduced a new radar sensor platform focused on automotive applications, highlighting improved detection capabilities. In addition to automotive uses, radar sensors are extensively employed in industrial automation, aerospace, and security sectors. Their versatility allows applications in automated guided vehicles (AGVs), drone systems, and perimeter security solutions. European governments actively support radar technology development through funding and initiatives like Horizon Europe, which fosters research in smart mobility and intelligent transport systems. Overall, Europe’s impressive share in the radar sensors market is supported by its automotive strength, technological innovation, diverse applications, and robust regulatory frameworks, positioning the region for continued leadership in the sector.

In 2023, the Asia-Pacific region has emerged as the fastest-growing market for radar sensors, propelled by rapid industrialization, technological advancements, and substantial investments across various sectors. China leads this growth, driven by its expanding automotive sector and government initiatives supporting advanced driver assistance systems (ADAS) and autonomous vehicles. Major companies like Huawei and Baidu are developing radar solutions for smart transportation. Japan follows closely, with automotive giants such as Toyota and Honda investing in radar technology for enhanced vehicle safety. Meanwhile, India is experiencing significant growth, fueled by the "Make in India" initiative, promoting local manufacturing and increasing radar adoption in both the automotive sector and Defense applications. South Korea is also advancing its radar technologies, with firms like Samsung and LG integrating these sensors into smart home devices, supported by government R&D initiatives. In Australia, a focus on transportation safety and infrastructure modernization is driving demand for radar sensors, with companies like Thales Australia creating advanced solutions. Overall, the Asia-Pacific region’s rapid growth in the radar sensors market is characterized by robust demand in automotive, Defense, and smart city initiatives, positioning it as a key player in the global radar technology landscape.

Need Any Customization Research On Radar Sensors Market - Inquiry Now

Key Players

Some of the major key Players in Radar Sensors Market with product:

-

Bosch (Automotive Radar Sensors)

-

Continental AG (Long Range Radar Sensors)

-

Honeywell (Industrial Radar Sensors)

-

Texas Instruments (RF Radar Sensors)

-

NXP Semiconductors (Automotive Radar Solutions)

-

Infineon Technologies (Radar Microcontrollers)

-

Teledyne Technologies (Marine Radar Systems)

-

Thales Group (Airborne Radar Systems)

-

Lockheed Martin (Military Radar Systems)

-

Raytheon Technologies (Defense Radar Systems)

-

Kongsberg Gruppen (Naval Radar Systems)

-

Northrop Grumman (Aerospace Radar Systems)

-

Bae Systems (Surveillance Radar Systems)

-

Toshiba (Automotive Radar Modules)

-

ADLINK Technology (Radar Data Processing Solutions)

-

OmniVision Technologies (Imaging Radar Sensors)

-

Aptiv (Automotive Advanced Driver Assistance Systems)

-

STMicroelectronics (Automotive Radar Transceivers)

-

Echodyne (Compact Radar Systems)

-

Rohde & Schwarz (Test & Measurement Radar Solutions)

List suppliers of raw materials used in the manufacturing of radar sensor components:

-

Rohm and Haas (now part of Dow Chemical Company)

-

BASF

-

3M

-

Saint-Gobain

-

Mitsubishi Chemical Corporation

-

SABIC

-

Henkel

-

Dupont

-

Wacker Chemie AG

-

GlobalWafers Co., Ltd.

Recent Development

-

On October 29, 2023, a report highlighted the pivotal role of high-resolution radar systems in advancing autonomous mobility. These radars are essential for improving obstacle detection and classification, especially as vehicles approach higher levels of autonomy, such as Level 3 and beyond.

-

On September 11, 2024, it was highlighted that radar sensors are significantly enhancing vehicle safety and convenience in the automotive industry. This growth is driven by increasing demand for advanced driver-assistance systems (ADAS) and government regulations promoting safety features in vehicles

-

On September 10, 2024, Ryme Worldwide and Rohde & Schwarz unveiled a groundbreaking solution at Automechanika 2024 that integrates radar target simulation into existing workshop environments. This innovation enables comprehensive testing of advanced driver-assistance systems (ADAS) during periodic technical inspections (PTI), ensuring the continuous functionality and safety of autonomous vehicles throughout their lifecycle

-

On August 27, 2024, Bosch announced its use of deep learning radar technology to enhance automated driving functions by accurately identifying objects, such as vehicles and pedestrians, from radar point clouds. This innovative approach aims to improve road safety and traffic flow by integrating data from various vehicle sensors, including radar, camera, and LiDAR systems.

-

On June 19, 2024, Technidrive highlighted the advantages of radar sensors over traditional ultrasonic sensors in quarrying applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 11.95 Billion |

| Market Size by 2032 | USD 41.54 Billion |

| CAGR | CAGR of 14.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pulse Radar, Continuous-Wave Radar, Radar Altimeter, and Others) • By Range (Short-range, Medium-Range, and Long-Range) • By Application (Air Traffic Control, Remote Sensing, Ground Traffic Control, Space Navigation and Control, Others) • By End User (Automotive, Aerospace and Defense, Environment and Weather Monitoring, Industrial, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Continental AG, Honeywell, Texas Instruments, NXP Semiconductors, Infineon Technologies, Teledyne Technologies, Thales Group, Lockheed Martin, Raytheon Technologies, Kongsberg Gruppen, Northrop Grumman, Bae Systems, Toshiba, ADLINK Technology, OmniVision Technologies, Aptiv, STMicroelectronics, Echodyne, and Rohde & Schwarz. |

| Key Drivers | • Technological innovations in solid-state radar and MIMO systems are driving significant growth in the radar sensors market. |

| RESTRAINTS | • The radar sensors market faces significant restraints due to environmental concerns associated with the manufacturing and disposal of these devices. |