AI-Powered Storage Market Size & Growth Trends:

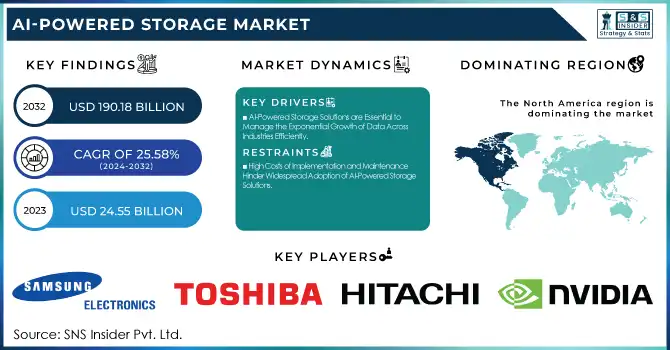

The AI-Powered Storage Market Size was valued at USD 24.55 billion in 2023 and is expected to reach USD 190.18 billion by 2032, growing at a CAGR of 25.58% from 2024-2032. This report provides a detailed examination of the market's demographics, adoption rate, technology trends, and investment trends. It emphasizes the increasing demand for data-driven solutions, the use of AI technologies for optimal storage management, and the rising investments in AI infrastructure. The market is propelled by the demand for scalable, efficient, and smart storage systems to deal with the exponential growth of data in different industries, such as healthcare, finance, and IT.

Get more information on AI-Powered Storage Market - Request Sample Report

AI-Powered Storage Market Dynamics

Drivers

-

AI-Powered Storage Solutions are Essential to Manage the Exponential Growth of Data Across Industries Efficiently

The exponential growth of data production in different industries is pushing the demand for better and more efficient storage systems. With companies producing enormous amounts of data from IoT devices, social media, and other sources, conventional storage solutions are unable to handle, process, and protect it efficiently. AI-based storage systems solve these issues by providing automated data management, space optimization, and improved performance. These technologies can scale rapidly to meet increasing data demands and minimize manual intervention, enhance efficiency, and save costs. With data emerging as a key asset for decision-making, sectors need storage systems that not only keep pace with expansion but also support quicker access and enhanced security, making AI-based storage technologies vital for the future.

Restraints

-

High Costs of Implementation and Maintenance Hinder Widespread Adoption of AI-Powered Storage Solutions

The adoption of AI-driven storage systems has major cost hurdles. Creating and integrating such sophisticated systems involves high hardware and software infrastructure investment, which may prove costly for low-budget organizations. Additionally, AI-based algorithms utilized in storage management are sophisticated and need continuous training and optimization, which necessitates expert skills. This results in high maintenance and operational expenses in the long run. Smaller organizations, especially, might not be able to afford the initial cost and ongoing updates and monitoring. For this reason, most organizations are slow to embrace AI-enabled storage systems, despite the benefits, for fear of the cost of deployment and ongoing maintenance.

Opportunities

-

Advancements in AI and Machine Learning Drive the Development of Smarter, More Efficient Storage Solutions

Continuous advancements in machine learning algorithms and AI are opening doors to new opportunities for more sophisticated, efficient, and cost-effective storage systems. AI-powered storage systems can become increasingly intelligent, adapting to evolving data requirements, streamlining processes, and maximizing performance with these innovations. With organizations seeking scalable, secure, and high-performance storage solutions, incorporating AI provides the means to process large volumes of data while speeding up and making it more secure. In addition, ongoing innovation in AI offers prospects for lowering operating expenses and enhancing user experience. Such technological improvements are not only expanding the applications of AI-driven storage but also increasing its prospects across sectors like healthcare, finance, and retail, fueling market growth.

Challenges

-

Ensuring Data Privacy and Compliance Remains a Major Challenge for AI-Powered Storage Solutions

AI-driven storage systems manage huge amounts of sensitive information, triggering serious issues of data privacy and regulatory compliance. Ensuring these systems comply with strict data privacy laws, like GDPR, can be difficult and tricky. Organizations handling very sensitive data, like healthcare or finance, are under greater scrutiny when they implement AI-based storage solutions. Protecting this data from breaches or unauthorized access and, at the same time, complying with local and international regulations is paramount. These compliance and privacy issues need constant surveillance, auditing, and revamping of storage infrastructure, increasing complexity in implementing them and their day-to-day management. For companies, remaining compliant with emerging data protection legislation using AI-based storage technologies continues to be a big challenge for them in the marketplace.

AI Powered Storage Market Segment Analysis

By Storage Architecture

The file-based segment held the largest market share of approximately 59% in terms of revenue in 2023, thanks to its extensive use across enterprises. File-based storage finds extensive use owing to its ease of use and compatibility with the current systems. It provides an easy-to-use method of managing data, and hence it finds extensive use across industries such as healthcare, finance, and education, where file management and structured data are highly important. Its established infrastructure and ease of integration into legacy systems make it a preferred choice.

The object-based segment will expand at the fastest CAGR of approximately 27.85% during 2024-2032 because of its scalability and flexibility. With more companies embracing cloud-based solutions, object storage's capacity to manage unstructured data, such as multimedia content and big data, is increasingly valuable. Being cost-effective, highly scalable, and having better data management features, object-based storage is ideal for companies that want to store large volumes of data securely and efficiently.

By Storage Medium

The Hard Disk Drive (HDD) segment led the AI-driven storage space with the largest revenue share of approximately 59% in 2023 owing to its affordability and large storage capacity. HDDs have been the norm for data storage at a large scale for years, providing huge amounts of data at a relatively low cost per gigabyte. They are still widely used for applications that demand lots of storage with no high-speed performance requirements, and thus are well suited to markets like backup and archiving, where affordable storage is key.

The Solid State Drive (SSD) segment will register the highest CAGR of around 27.06% during the forecast period of 2024-2032 based on its faster speed, reliability, and lower energy consumption. With the increasing need for AI and data-intensive applications that need quicker data access, SSDs are gaining importance in high-performance computing environments. As the price is reducing and SSD technology continues to advance, companies are increasingly implementing SSDs for important workloads, thus witnessing huge growth in this segment during the forecast period.

By End-User

Enterprise segment led the AI-based storage market with a largest revenue contribution of around 31% by 2023 because of mounting dependence on AI-based solutions to handle large volumes of business-related data. Organizations in various industry verticals including retail, health, and banking create huge amounts of structured data and unstructured data, the storage of which needs to be efficient and speedier retrieval is needed. Storage solutions based on AI assist in maximizing data management, improving security, and facilitating scalability, thus becoming the first choice for enterprises looking for high-performance and dependable storage systems.

The Government Bodies segment is projected to expand at the fastest CAGR of around 27.85% during 2024-2032 owing to the growing demand for secure and effective data management systems. Governments are implementing AI-based storage solutions to manage large volumes of public sector data, enhance decision-making, and maintain data security. Furthermore, government organizations are more interested in digitization, regulatory compliance, and increased data accessibility, which is promoting the demand for sophisticated storage solutions that cater to these requirements.

By Storage System

The Hard Disk Drive (HDD) segment led the AI-driven storage space with the largest revenue share of approximately 59% in 2023 owing to its affordability and large storage capacity. HDDs have been the norm for data storage at a large scale for years, providing huge amounts of data at a relatively low cost per gigabyte. They are still widely used for applications that demand lots of storage with no high-speed performance requirements, and thus are well suited to markets like backup and archiving, where affordable storage is key.

The Network Attached Storage (NAS) market is anticipated to expand at the fastest CAGR of approximately 23.43% during the period 2024-2032 owing to its scalability, centralized storage support, and network access. As companies continue to focus on sharing data and collaborating, NAS offerings are increasingly used for their potential to offer numerous users access to shared storage over a network. With the advent of cloud computing and remote work, NAS systems present a secure and flexible solution to expanding data storage requirements.

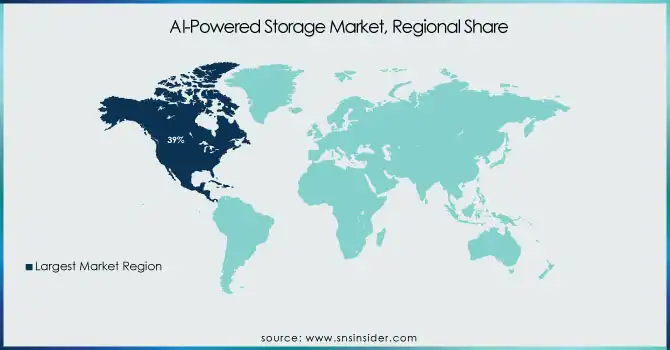

AI-Powered Storage Market Regional Landscape

North America dominated the AI-powered storage market with the highest revenue share of about 39% in 2023 due to its advanced technological infrastructure, early adoption of AI technologies, and a strong presence of leading IT and cloud storage companies. The region has a high demand for AI-driven solutions across industries such as healthcare, finance, and retail, where data management and performance optimization are critical. Additionally, significant investments in research and development and the presence of major technology players further fuel the region's dominance.

Asia Pacific is expected to grow at the fastest CAGR of approximately 27.40% during 2024-2032 owing to high-speed digitalization, higher data generation, and growing uptake of AI solutions in nations such as China, India, and Japan. Greater emphasis on smart cities, IoT, and cloud computing in the region is promoting demand for storage solutions powered by AI. Also, the rising number of startups and businesses adopting AI-based systems will further lead to the strong market growth in this region.

Need any customization research on AI-Powered Storage Market - Enquiry Now

Key Players

-

Samsung Electronics (Samsung SSDs, Samsung PM1733)

-

Toshiba (XG6 SSD, MG08 Series HDD)

-

Hitachi (Virtual Storage Platform, Data Systems)

-

Lenovo (ThinkSystem DM Series, ThinkSystem Storage)

-

NVIDIA (DGX A100, BlueField Data Processing Unit)

-

Dell Inc. (PowerMax, VxRail)

-

Intel Corporation (Optane SSD, 3D NAND SSD)

-

NetApp (ONTAP, AFF A400)

-

IBM Corporation (FlashSystem, Cloud Object Storage)

-

Micron Technology Inc. (9300 SSD, 5100 Series)

-

Hewlett Packard Enterprise Development LP (Nimble Storage, 3PAR StoreServ)

-

Huawei Technologies Co. Ltd. (OceanStor, FusionStorage)

-

Pure Storage, Inc. (FlashArray, FlashBlade)

-

Infortrend Technology Inc. (EonStor GS, EonStor RAID Storage)

-

CISCO Systems Inc. (HyperFlex, UCS)

-

Microsoft Corporation (Azure Storage, Data Box)

-

Alphabet (Google Inc.) (Cloud Storage, Persistent Disk)

-

Advanced Micro Devices (EPYC Processors, Radeon Instinct)

-

Amazon Web Services (S3, EBS)

Recent Developments:

-

At FMS 2024, Samsung introduced cutting-edge memory and storage solutions designed for ultra-high capacity and performance, specifically aimed at supporting AI and data-intensive applications. These innovations are set to revolutionize data handling for AI workloads in 2024

-

In 2024, Intel outlined its enterprise AI strategy, focusing on maximizing growth and return on investment by integrating AI across platforms like data centers, cloud, and edge devices to accelerate AI adoption.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.55 Billion |

| Market Size by 2032 | USD 190.18 Billion |

| CAGR | CAGR of 25.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Storage System (Direct Attached Storage, Network Attached Storage, Storage Area Network) • By Storage Architecture (File Based, Object Based) • By Storage Medium (Hard Disk Drive, Solid State Drive) • By End-User (Enterprise, Telecom Companies, Cloud Service Providers, Government Bodies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics, Toshiba, Hitachi, Lenovo, NVIDIA, Dell Inc., Intel Corporation, NetApp, IBM Corporation, Micron Technology Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co. Ltd., Pure Storage, Inc., Infortrend Technology Inc., Cisco Systems Inc., Microsoft Corporation, Alphabet (Google Inc.), Advanced Micro Devices, Amazon Web Services |