6G Market Size & Trends:

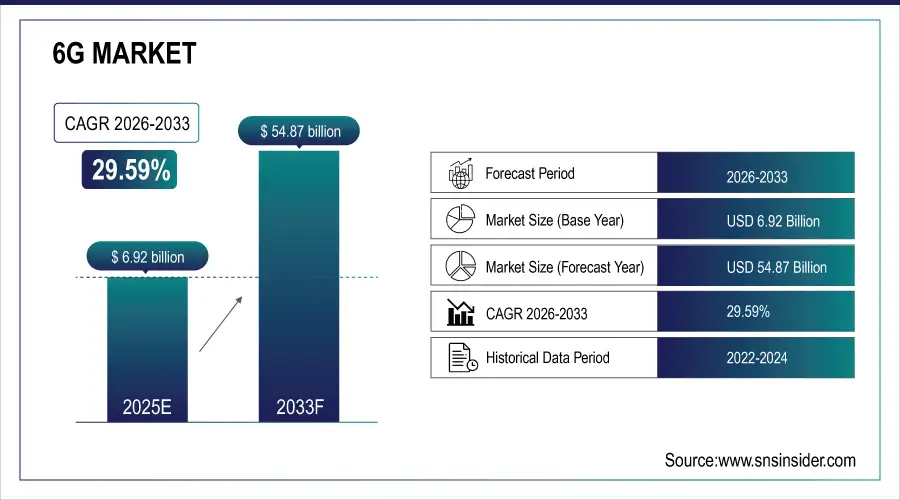

The 6G Market size was valued at USD 6.92 billion in 2024 and is expected to reach USD 54.87 billion by 2032, growing at a CAGR of 29.59% over the forecast period of 2025-2032. 6G market trends are focused on integrating AI-native networks, terahertz spectrum, and advanced edge computing. These innovations aim to enable immersive experiences such as holography, digital twins, and autonomous systems at scale. Growing demand for ultra-fast-, low-latency connectivity to keep pace with advancing technologies such as holographic communication, extended reality (XR), autonomous systems, and digital twins is expanding the 6G(6G technology) market. The development of 6G is being accelerated by artificial intelligence (AI), edge computing, and terahertz communication. To sustain the global race, nations and the tech titans are investing heavily in 6G technology research and testbeds. Furthermore, huge demand for next-gen wireless communication solutions is driven by the exponential growth in IoT and smart infrastructure.

Samsung announced a successful 6G terahertz (THz) wireless data transmission at 6.2 Gbps over 15 meters in a lab environment (2024), showcasing early 6G speed capabilities.

To Get more information on 6G Market - Request Free Sample Report

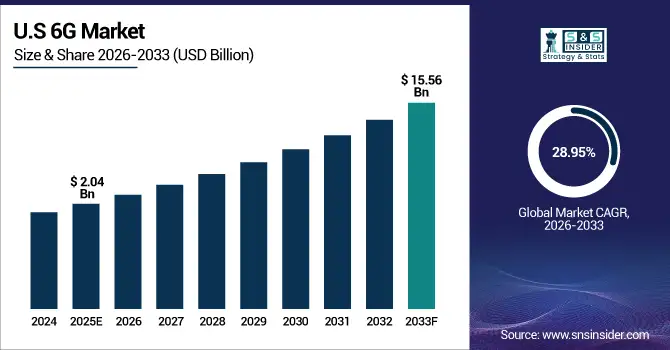

The U.S. 6G market size was valued at USD 2.04 billion in 2024 and is expected to reach USD 15.56 billion by 2032, growing at a CAGR of 28.95% over the forecast period of 2025-2032. The U.S. 6G market is witnessing growth from strong relative performance in federal R&D funding, burgeoning private sector innovation, AI-driven network development, and increasing demand for high-speed, low-latency connectivity across sectors.

6G Market Dynamics:

Drivers:

-

Rising Demand for Intelligent High Speed Networks is Driving the Strategic Shift Toward Global 6G Adoption

Growing demand for ultra-fast, low-latency communication that can support next-gen applications (autonomous vehicles, XR, holographic calls, and digital twins) is fueling the global 6G market growth. Growing demand for intelligent, self-optimizing networks is accelerating the integration of AI and machine learning into network management. Moreover, increasing adoption of IoT devices and smart infrastructure projects are stretching the boundaries of existing networks, prompting the need for a strategic pivot to 6G.

Nokia Bell Labs demonstrated a 6G AI-powered dynamic spectrum sharing system in 2024, enabling real-time bandwidth reallocation based on network load a key step toward intelligent, self-optimizing networks

Restraints:

-

Lack of Global Standards and Complex Deployment Challenges Restrain Early Growth of the 6G market

The absence of global standardization and spectrum allocation for terahertz frequencies is one of the key restraints in the 6G market. Interoperability: Regulatory bodies between countries still remain out of sync with unified protocols, posing significant barriers to the interoperability at this early stage. Furthermore, with the ambitious plans for 6G, such as ultra-dense networks and space-air-ground integration, the overhead of deployment is extremely complicated from a technical and logistical standpoint.

Opportunities:

-

Unlocking 6G Potential Through Terahertz AI Native Networks and Global Innovation Driven Infrastructure Programs

Huge growth space in terahertz spectrum utilization, AI-native architecture and a whole new area of edge intelligence. Investment in 6G research and infrastructure to address the digital divide in emerging economies In addition to national development initiatives, the potential of public-private partnerships, at-scale testbeds, and government (G2I) backed innovation programs across the globe to create a vibrant eco-system for 6G development and commercialization cannot be over-stated.

In 2025, EU’s Hexa-X-II initiative expanded to 44 partners across 16 countries, focusing on 6G edge intelligence, sustainability, and trust-based AI-native architectures.

Challenges:

-

Overcoming Hardware Barriers and Building Secure Sustainable 6G Networks for a Hyperconnected Future

The big challenge is in breaking the limits of existing hardware/semiconductor technology to deliver ultra-high data rates and low latency. Although in AI-native and decentralized 6G architectures, the recent advances in ensuring network security and data privacy are also gradually becoming a new challenge. In addition to this, there is still an urgent need for the global ecosystem to tackle energy efficiency & environmental sustainability concerns, especially with large scale 6G rolled out globally.

6G Market Segmentation Analysis:

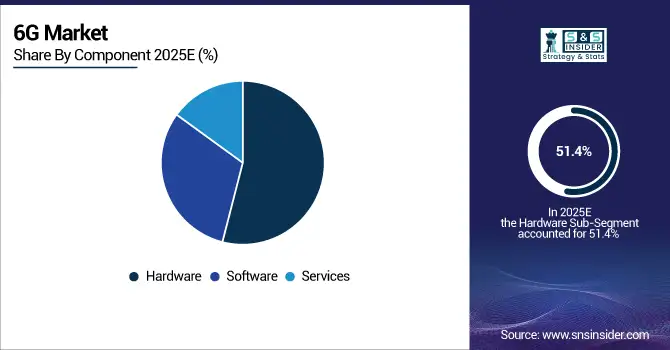

By Component

The hardware segment accounted for 51.4% of revenue in the global 6G market in 2024, as infrastructure components (including terahertz transceivers, base stations, advanced antennas and RF front-end modules) are being widely invested. Phase-1 6G development to date has concentrated largely on physical infrastructure development to house ultra-high-speed and low-latency connectivity in testbed and pilot deployments globally and in major economies.

Due to the rising requirement for AI-native network management, virtualization, and real-time analytics, the software segment is expected to register for the fastest CAGR from 2025 to 2032. Since 6G is progressively becoming an intelligent network capable of autonomously optimizing its own performance through the reliable and efficient communication of software-defined information, software will play an essential role as a component supporting versatile, scale-independent and protection-oriented communication systems in a wide range of use cases.

By Communication Infrastructure

The wired communications segment dominated the global 6G market with a 43.4% share in 2024 and will have a huge increase during the forecast period. The strong position is supported by substantial information on terahertz-based wireless communication, enormous MIMO deployment, and very-dense network architecture. Most of the telecom operators and tech vendors weight their focus on wireless access capabilities for early 6G testbeds and pilot rollouts appearing in urban and high-density areas.

The edge computing infrastructure segment locked the fastest CAGR from 2025 to 2032, with growing both the demand for real-time data processing and ultra-low latency as major contributors. With 6G driving latency-sensitive applications such as autonomous mobility, digital twins, and immersive XR, edge computing will be essential for distributing network intelligence and optimizing system-level efficiency.

By Application

In 2024, eMBB held the dominant share of 6G global market of 38.5% owing to its fundamental nature to provide ultra-high-speed connectivity that enables various data-heavy applications. Key use cases in the initial deployment phase of 6G infrastructure are eMBB, which enables seamless 4K/8K video streaming, high-speed downloads, and immersive mobile experiences. In fact, based on the growing needs for a higher speed and stable mobile data network, telecom providers are being placed higher on the list of effort for eMBB.

Holographic communication is expected to register the highest compound annual growth rate (CAGR) between 2025 and 2032, owing to the growing demand for immersive telepresence and real-time 3D rendering. The unique challenges of holographic display and AR content will need to be addressed in conjunction with 6G core ultra-low latency and ultra high capacity capabilities as industries explore next-generation solutions for remote work, remote education delivery, and remote healthcare delivery, in the quest for scalable, real-time, and almost ubiquitous holographic experiences.

By End-Use Industry

The telecommunications segment accounted for the largest share of 41.4% in 2024 as most telecom operators have already initiated investments for developing infrastructure, trial of the required spectrum, and the optimization of networks. Testbed deployment, high speed mobile broadband and network efficiency to support 5G to 6G transition have been in the spotlight of the industry for some time, as telecom companies are centric to supporting the infrastructure development for ultra-reliable and higher capacity communication networks across the globe.

The media and entertainment industry will have the highest CAGR between 2025 and 2032, with demand coming for various immersive content experiences including XR streaming, holograph entertainment, and real-life virtual environments. With ultra-low latency and extremely fast data transmission, 6G will change the way users consume content, allowing access to fully interactive and multi-sensory media experiences.

6G Market Regional Insights:

North America was the top region in global 6G market with a 37.4% share of revenue in 2024 on the back of extensive R&D investment, initial testbed deployments, and locally-resident technology ecosystems and leaders. These include some of the biggest telecom giants, chipmakers, and cloud service providers in the region, all of which are driving 6G infrastructure development and AI-native networks. Government programs such as the Next G Alliance and U.S. Department of Defense-funded research programs are spurring development in multiple wireless, edge and AI domains. The combination of an innovation friendly environment and public collaboration with the private sector places North America at the leading-edge of global efforts to commercialize 6G technologies.

Get Customized Report as per Your Business Requirement - Enquiry Now

In 2024, the North American 6G market share is led by the U.S., which, thanks to generous federal funding, extensive testbed deployments and the high profile of industry leaders Qualcomm, Intel, AT&T, and Verizon.

The Asia Pacific region is projected to garner the fastest CAGR during the forecast period, owing to active government initiatives, investments in early-stage infrastructure, and strong ability to adopt these technologies. The area is a hotbed for terahertz communication, AI-based networking, and semiconductor design. Major economies are trialing 6G and creating large-scale testbeds with public and private participants. The establishment of interoperability and further infrastructure is only complemented by the presence of global telecom giants and electronics manufacturers establishing interoperability and infrastructure. The growing need for smart cities, autonomous systems, and digital infrastructure in the region is also fuelling fast-paced 6G experimentation and rollout within verticals.

The China 6G market asserted dominance across the Asia Pacific area by virtue of government funding, satellite-based 6G experiments, nationwide R&D programs. In addition, the China 6G market took the lead in 6G patents and infrastructure rollout cycle over the past year.

Europe stands out over 2024 with solid policy backing, collaboration research systems, and sustainable and safe network advancement. Hexa-X-II is the European Union's flagship 6G initiative bringing together telecom operators, technology companies and academics to deliver AI-native architectures, edge intelligence and terahertz communication. Pilot projects and spectrum efforts have been spearheaded by countries ranging from Germany, Finland and France. In the vision of Europe, such a hyperconnected world will be supported by human-centric 6G networks developed based on open standards, with respect to data privacy and green technologies, in line with the European Union wide initiatives on digital sovereignty and sustainability for the sustainable hyper-connected society.

Latin America and the Middle East & Africa are potential growth regions in the global 6G market in 2024. Governments and telecom operators are exploring early-stage research and drafting policy frameworks to support the capabilities and demand being created in their countries. Although large-scale deployments are still rare, growing investments in digital infrastructure, smart-city projects, and public-private partnerships are paving the way for future 6G readiness. The objective of these areas is to utilize 6G as a means to connect the unconnected and enable economic growth through advanced connectivity solutions.

6G Companies are:

The Key Players in 6G Market are Samsung, Huawei, Nokia, Ericsson, Qualcomm, NTT Docomo, ZTE, Intel, Apple, Google, Microsoft, AT&T, Verizon, China Mobile, SK Telecom, LG, Meta, Orange, Keysight, and Vodafone.

Recent Developments:

-

In February 2025, Samsung released a white paper titled “AI‑Native & Sustainable Communication,” revealing its strategic vision for embedding AI across telecom networks, advancing energy efficiency, ubiquitous coverage, and secure resilient 6G systems.

-

In 2025, Huawei joined the EU-funded EXIGENCE consortium with Telefónica and others to tackle the environmental impact of 6G systems, focusing on standardizing energy consumption metrics and green optimization in network design.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.92 Billion |

| Market Size by 2032 | USD 54.87 Billion |

| CAGR | CAGR of 29.59% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, and Services) • By Communication Infrastructure (Wireless Infrastructure, Mobile Core Network, Backhaul & Transport, and Edge Computing Infrastructure) • By Application (Enhanced Mobile Broadband, Massive Machine-Type Communication, Ultra-Reliable Low-Latency Communication, Holographic Communication, and Digital Twins and Extended Reality) • By End-Use Industry (Telecommunications, Automotive & Transportation, Healthcare, Industrial Manufacturing, Government & Defense, and Media & Entertainment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Samsung, Huawei, Nokia, Ericsson, Qualcomm, NTT Docomo, ZTE, Intel, Apple, Google, Microsoft, AT&T, Verizon, China Mobile, SK Telecom, LG, Meta, Orange, Keysight, and Vodafone. |