Air Data Systems Market Report Scope & Overview:

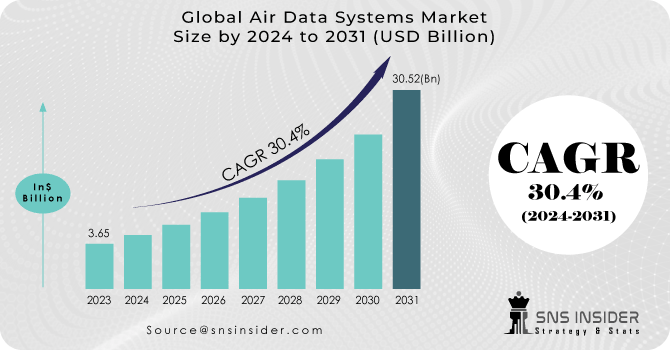

The Air Data Systems Market size was valued at USD 851.36 Million in 2023 & is estimated to reach USD 1329.53 Million by 2031 and increase at a compound annual growth rate (CAGR) of 5.74% between 2024 and 2031.

The need for the Air Data Systems market is anticipated to be fueled by factors such as rising industrial exploration risk, replacement of historic architecture, and increased awareness of the value of security. Protecting the general population and vital infrastructure is known as Air Data Systems, and it is typically handled by specialized departments across different departments, including EMS, police, and other civil groups. Due to the growing security risks, Air Data Systems authorities need to cooperate and share information about potential dangers to develop a preventative mechanism that would assure maximum safety.

To get more information on Air Data Systems Market - Request Free Sample Report

Economic growth and societal well-being depend on Air Data Systems and security. The concern over the safety of people, assets, and processes has grown, which is a motivating element, as a result of the rising number of catastrophic incidents, crime rates, and terrorist activities on a global scale. The industry is anticipated to be driven by the government's efforts to create clever mitigation strategies that would reduce the reaction time and damage brought on by natural and man-made catastrophes. Additionally, it made all of the world's governments reevaluate their regulatory frameworks.

As modern technologies like the Internet of Things (IoT), machine learning (ML), artificial intelligence (AI), and network technology devices become more widely used, communities may better secure their essential infrastructure, increase Air Data Systems and security, and improve the lives of their citizens. Additionally, factors including escalating urbanization and globalization, a shortage of security personnel with the necessary skills, rising environmental concerns and demands, and the development of smart cities are anticipated to have an impact on the market's expansion in the years to come.

The Air Data Systems market, however, may be constrained by expensive installation and maintenance costs, a lack of modern infrastructure in impoverished nations or areas, and a lack of compatibility across Air Data Systems and security systems. Governments invest a significant amount of money in critical communication networks, biometric security, surveillance, scanning, and screening systems, as well as emergency and disaster management systems, all of which have high installation and maintenance costs.

MARKET DYNAMICS

DRIVERS:

-

Drones can be deployed quickly to survey disaster areas, assess damage, and identify potential hazards.

-

Enhanced Situational Awareness is the driver of the Air Data Systems Market.

Drones provide real-time aerial views of emergencies, disaster-stricken areas, and crime scenes. This enhanced situational awareness allows first responders to make more informed decisions and allocate resources effectively.

RESTRAIN:

-

Operating drones effectively requires skilled personnel who are trained in piloting, data analysis, and maintenance.

-

Regulatory Hurdles is the restraint of the Air Data Systems Market.

Despite regulatory advancements, navigating complex and evolving regulations for drone operation, airspace restrictions, and privacy concerns can limit the deployment of drones in Air Data Systems operations.

OPPORTUNITY:

-

Drones can serve as communication relays in areas with damaged or disrupted infrastructure.

-

Global Market Expansion is an opportunity for the Air Data Systems Market.

The adoption of Air Data systems is not limited to a single region or country. There is a growing opportunity to expand the market globally, especially in regions with emerging economies and evolving disaster response capabilities.

CHALLENGES:

-

Acquiring drones, training personnel, and maintaining the necessary infrastructure can be expensive.

-

Regulatory Complexity is the challenge of the Air Data Systems Market.

Navigating the evolving and sometimes complex regulations for drone operation, airspace access, and privacy can be a significant challenge for Air Data Systems agencies looking to integrate drones into their operations.

IMPACT OF RUSSIA-UKRAINE WAR

The country of Ukraine, which is well-known for its heavy industries and agriculture, is not an apparent location for drone innovation. However, the demands of war have transformed the nation into a sort of super lab of creation, luring investment from renowned corporate figures such as the former CEO of Google. To strengthen drones' capacity to kill and spy on the enemy, more than 200 Ukrainian enterprises that produce drones are currently collaborating closely with military units on the front lines.

Over the past year, the initiative has helped private businesses teach more than 10,120 drone operators, and it aims to train another 10,120 over the coming six months. According to estimates, Russia possesses an air force that is ten times greater than Ukraine's, but Kyiv has kept much of it grounded as a result of shooting down several fighter jets in the early stages of the conflict. Drones have increased the precision of Ukraine's conventional artillery while enabling it to monitor and attack delicate targets far behind enemy lines.

IMPACT OF ONGOING RECESSION

In 2020, businesses will still be spending money on drone technologies. This is true despite the pandemic and lockdown-related worldwide slump. Recently, it was written about how businesses had grown over the previous year and how many investments and collaborations there had been. Here's an example of how businesses all over the world are continuing to invest in drones. With US$2.338 billion, the amount of money poured into the drone sector set a new high in 2020. The amount from the previous year (US$1.295 billion), which was already a record in and of itself, is virtually doubled by this.

Here are the most important findings per sector and segment from the investment database, which displays all investment rounds from all participants. Hardware sales skyrocketed to 2.12 billion dollars. With 62% of the global investment value in drones, North America is still the region to invest in. However, this is a decline from the 71% proportion of drone investments made the previous year, so more money is being invested in other areas.

KEY MARKET SEGMENTATION

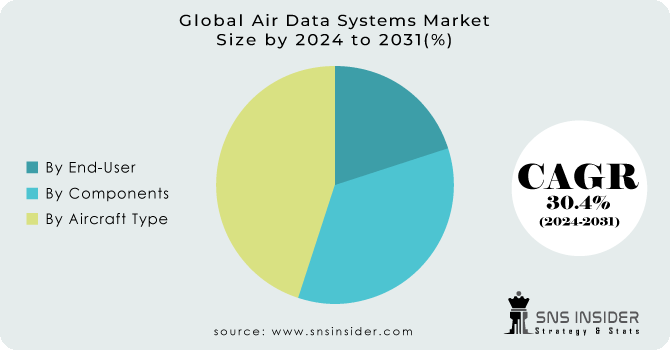

By Components

-

Sensors

-

Electronic Unit

-

Probes

By Aircraft Type

-

Fighter Aircraft

-

General Aviation

-

Narrow Body Aircraft

-

Rotary Wing Aircraft

-

Regional Transport Aircraft

-

Unmanned Aerial Vehicle (UAV)

-

Very Large Aircraft

-

Wide-Body Aircraft

By End-User

-

Commercial

-

Military

Need any customization research on Air Data Systems Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

REGIONAL ANALYSIS

North America: During the projected period, North America is anticipated to dominate the market for Air Data Systemss. North America's biggest market for Air Data Systemss is the US. The use of Air Data Systemss in North America has been hastened by cooperation between Air Data Systems organizations and private drone service companies. Public-private partnerships have made it easier for Air Data Systems organizations to access cutting-edge drone technologies, knowledge, and operational assistance. The substantial demand for Air Data Systemss in North America has been largely attributed to a strong focus on Air Data Systems, supportive regulatory frameworks, technological innovation, diversified landscapes, and cross-sector cooperation.

Asia Pacific: Market share was accounted for by the Asia Pacific region. The advantageous regulatory environment, particularly among industrialized nations, is credited with regional domination. Many governments are nevertheless eager to explore new rules for the use of commercial drones. The expansion of commercial drone applications among start-up businesses is fuelling the regional commercial drone industry's growth even more.

KEY PLAYERS

The major Players are Honeywell International, Inc., United Technologies Corporation, Rockwell Collins, Inc., Curtiss-Wright Corp., AMETEK Inc., Astronautics Corporation of America, Shadin Avionics, Meggit Avionics, Thommen Aircraft Equipment, Aeroprobe Corp., and Other Players

Indrones Solutions-Company Financial Analysis

RECENT DEVELOPMENT

In 2023: For the field and wide area network (FAN/WAN) requirements of Air Data Systems and power utilities, Nokia introduced new, improved Core network software solutions. This news underlines Nokia's deeper push to maintain its leadership in private wireless and broadens the portfolio options available to major, mission-critical organizations and governments.

In 2022: Digi SAFE, an all-in-one connectivity solution for Air Data Systems and transportation agencies, was introduced by igi International, a leading global provider of Internet of Things (IoT) connectivity devices and services. With Digi SAFE, IT support teams can remotely monitor, control, and upgrade field devices from the command center of an intelligent Air Data Systems network. It allowed for quick deployment, made location data visible, and made sure that the devices had the most recent security and software updates.

In 2022: In order to give Air Data Systems agencies access to real-time information in the event of an emergency on the ride-sharing platform, Uber and Telangana Police worked together on a software connection. As part of this partnership, drivers or passengers might tap a button on the Uber app to instantly share their name, live location, and contact information with the authorities. For Uber drivers and passengers, the integration was operational in Hyderabad. Uber intended to extend this connectivity with additional state police agencies and provide this technologically enhanced safety integration to multiple Indian cities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 851.36 Million |

| Market Size by 2031 | US$ 1329.53 Million |

| CAGR | CAGR of 5.74% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Components (Sensors, Electronic Unit, Probes) • By Aircraft Type (Fighter Aircraft, General Aviation, Military Transport Aircraft, Narrow Body Aircraft, Rotary Wing Aircraft, Regional Transport Aircraft, Unmanned Aerial Vehicle (UAV), Very Large Aircraft, Wide-Body Aircraft) • By End-User (Commercial, Military) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Honeywell International, Inc., United Technologies Corporation, Rockwell Collins, Inc., Curtiss-Wright Corp., AMETEK Inc., Astronautics Corporation of America, Shadin Avionics, Meggit Avionics, Thommen Aircraft Equipment, Aeroprobe Corp. |

| Key Drivers | • Drones can be deployed quickly to survey disaster areas, assess damage, and identify potential hazards. • Enhanced Situational Awareness is the driver of the Air Data Systems Market. |

| Market Opportunity | • Drones can serve as communication relays in areas with damaged or disrupted infrastructure. • Global Market Expansion is an opportunity for the Air Data Systems Market. |