Military Transport Aircraft Market Report Scope & Overview:

To get more information on Military Transport Aircraft Market - Request Free Sample Report

The Military Transport Aircraft Market Size was valued at USD 33.08 billion in 2023 and is expected to reach USD 41.71 billion by 2032 with a growing CAGR of 2.61% over the forecast period 2024-2032.

Military transport aircraft and helicopters are specially designed cargo transport aircraft and helicopters with a high payload capacity and are intended to transport military cargo, military troops, and military vehicles efficiently. Military transport aircraft have a large cargo storage space that can hold a wide variety of products. Furthermore, numerous types of helicopters have been designed in such a way that they can transport military tanks, small trucks, and armored vehicles without much human effort from military or other required locations or base stations to war sight. Furthermore, numerous industry players have developed and introduced massive payload aircraft and helicopters for defense applications, resulting in global market growth. The market is growing due to factors such as increased demand for rotorcraft Aeroplan’s and rapid technological advancements in air transportation services. However, the high maintenance and upgrade costs associated with the existing aircraft fleet prove to be a market constraint. Conversely, a rise in the need to replace aging fleets and a surge in global defense spending are expected to create lucrative opportunities for market growth during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

-

New Agreements between Player

-

Replacement of old Aircraft

RESTRAINTS

-

The rise in Demand for Rotorcraft Airplanes

-

Upgradation Cost

OPPORTUNITIES:

-

Expansion of Airforce fleet

-

Strengthening of defense system

CHALLENGES

-

High maintenance

THE IMPACT OF COVID-19

The outbreak of COVID-19 had a profound effect on the aerospace industry, leading to significant reductions in aviation sales, shortages of raw materials, and delays in aircraft delivery.

Players in the aviation industry are faced with problems such as the complete cessation of production activities and government-sanctioned shut down operations, which have had a devastating effect on the entire market.

The various companies operating in the aviation industry are stepping up by redesigning their chain of supply, production, and delivery services of essential medical services.

However, by the beginning of 2021, markets are slowly opening up to full potential.

The number of domestic airlines has been returning to pre-epidemic levels, especially in developing countries such as China and Russia.

This situation is expected to improve as the government begins to loosen its grip on the rest of the world in order to restart businesses.

By Type Analysis

The market is divided into fixed-wing and rotary blade segments. The fixed-wing segment is expected to be the market's largest due to increased defense budgets for combat aircraft and increased demand for air force fleet expansion.

The rotary-wing segment is expected to grow at the fastest rate. According to the Leonardo Company, 14,000 military helicopters will be built around the world over the next 20 years. Military helicopters are in higher demand in Asia, the Middle East and Africa, and Eastern Europe. As a result, rising military helicopter deliveries around the world are propelling this market.

By Application Analysis

Based on the application, the market is divided into military transport, combat, reconnaissance & surveillance, multirole aircraft, maritime patrol, and more. Part of the multirole aircraft is expected to respond with the largest share in the market followed by the military transport segment. Fighter jets are the most important category in terms of delivery value and associated value.

Part of the military transport is dominated by American manufacturers and sales are expected to continue to stabilize during the forecast period. The heavy military transport segment is expected to grow as the heavier Airbus A400M takes over.

The multi-functional and transport aircraft are in high demand by key financiers such as the U.S., U.S., Russia, and China. The reconnaissance and surveillance segment are predicted as an important market segment followed by a segment of monitoring aircraft.

The testing and surveillance sector finds a growing market in developing countries such as India. The demand for aviation training has increased due to the growing demand for skilled pilots from a variety of aviation powers around the world.

By System Analysis

The market is divided into airframe, engine, avionics, landing gear system, and weapon system segments. Because of increased research and development activities by key players, the engine segment is expected to dominate the market. Engine manufacturers are conducting research and development for hybrid engines. Fuel price increases will increase demand for hybrid propulsion systems.

The avionics segment is expected to grow significantly in the market due to increased demand for autonomous applications in the military aircraft segment. During the forecast period, the demand for real-time data exchange and complexity in the development of military aircraft avionics is expected to propel the growth of this market.

KEY MARKET SEGMENTATION

By Type

-

fixed wing

-

rotary blade

By Application

-

military transport

-

airborne early warning & control

-

reconnaissance & surveillance

By System

-

Airframe

-

Engine

-

landing gear system

-

weapon system

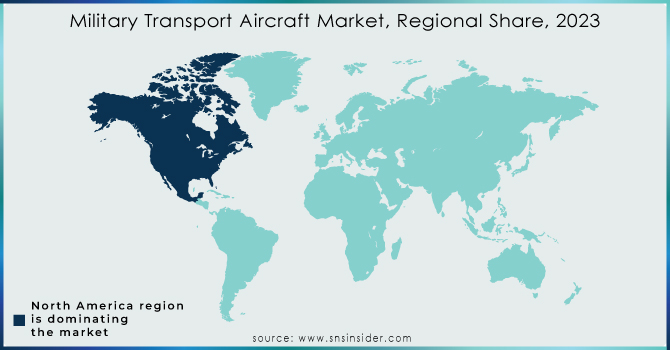

Regional Analysis:

Geographically, this report is divided into several key countries, each with its own market size, growth rate, import and export of Military Transport Aircraft. These countries include North America, the United States, Canada, Europe, the United Kingdom, Germany, France, Spain, Italy, ROE, Asia Pacific, China, India, Japan, Australia, South Korea, Ro APAC, Latin America, Brazil, Mexico, and the Rest of the World.

Need any customization research on Military Transport Aircraft Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

KEY PLAYERS

The Key Players are Airbus S.A.S., The Boeing Company, Dassault Aviation SA, Lockheed Martin Corporation, Saab AB, Embraer S.A., GE Aviation, Hindustan Aeronautics Limited, Bell Textron Inc. Sukhoi Corporation & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.08 Billion |

| Market Size by 2032 | US$ 41.71 Billion |

| CAGR | CAGR of 2.61% From 2024 to 2032 |

| Base Year |

2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fixed Wing, Rotary Blade) • By System (Airframe, Engine, Avionics, Landing Gear System, Weapon System) • By Application (Combat, Military Transport, Airborne Early Warning & Control, Reconnaissance & Surveillance) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Airbus S.A.S., The Boeing Company, Dassault Aviation SA, Lockheed Martin Corporation, Saab AB, Embraer S.A., GE Aviation, Hindustan Aeronautics Limited, Bell Textron Inc. Sukhoi Corporation |

| DRIVERS | • New Agreements between Player • Replacement of old Aircraft |

| RESTRAINTS | • The rise in Demand for Rotorcraft Airplanes • Upgradation Cost |