Alkyl Polyglucosides Market Report Scope & Overview:

Get E-PDF Sample Report on Alkyl Polyglucosides Market - Request Sample Report

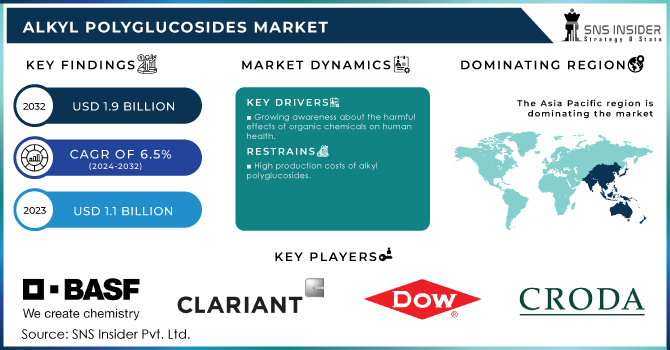

The Alkyl Polyglucosides Market size was valued at USD 1.1 Billion in 2023. It is expected to grow to USD 1.9 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

Alkyl Polyglucosides are derived from renewable resources such as corn, wheat, and coconut oil. APGs are widely used in personal care products, household detergents, industrial cleaners, and agricultural formulations due to their mildness, low toxicity, and compatibility with various ingredients. In household cleaning products, APGs are employed as surfactants, providing effective cleaning power while being safe for the environment. Additionally, Alkyl Polyglucosides find applications in the agricultural sector, where they are used as adjuvants in pesticide formulations, enhancing their efficacy and reducing environmental impact.

According to the U.S. Environmental Protection Agency APGs are recognized for their low toxicity and biodegradability, meeting the EPA’s Safer Choice standards, which promote safer chemical products for consumers and the environment.

The Alkyl Polyglucosides market growth is driven by increasing consumer awareness regarding the harmful effects of traditional surfactants on human health and the environment. The increasing adoption of alkyl polyglucosides in various industries, including personal care, household cleaning, and industrial applications, has contributed to this growth.

In 2023, Dow introduced EcoSense GL surfactants, an APG-based product line, for home and personal care applications. The company emphasized the product's excellent cleaning performance combined with biodegradability and low environmental impact, in line with Dow’s broader commitment to sustainability.

The use of natural ingredients has been a relevant trend in many fields, such as personal care, cosmetics, and household cleaning. In recent years, the increasing awareness of the potential health hazards and environmental outcomes of relying on synthetic chemicals has urged people to incorporate naturally occurring, plant-based, and biodegradable ingredients. The trend is based on the growing significance of wellness, transparency, and environmental sustainability in modern society.

According to a report by the U.S. Department of Agriculture (USDA), the global demand for natural and organic personal care products is growing at a rate of over 10% annually, driven by consumers seeking alternatives to synthetic chemicals.

Drivers

-

Increasing adoption of eco-friendly and biodegradable surfactants

-

Stringent regulations imposed by governments and environmental agencies to reduce the use of harmful chemicals

-

Growing awareness about the harmful effects of organic chemicals on human health

Consumers’ growing consciousness of hazards connected with synthetic chemicals for humans and the environment is the push for a consumer shift to safer alternatives. In personal care products, such as shampoos, body washes, facial cleansers, and others, alkyl polyglucosides are perfect solutions due to their mild and gentle properties. They have gained high popularity among customers because of their natural origin and the ability to interact with all types of skin, which makes them great t alternatives for those who prefer safer and milder skin formulas.

The EPA’s Safer Choice label identifies products containing safer chemicals, including non-toxic, biodegradable surfactants like APGs. The program encourages manufacturers to use environmentally friendly and health-conscious ingredients. In 2023, the EPA reported that over 2,000 certified products carried the Safer Choice label, reflecting the rising demand for safer alternatives in household and personal care products.

Restraint

-

High production costs of alkyl polyglucosides

-

Limited availability of raw materials

The Alkyl Polyglucosides Market faces a challenge due to the scarcity of raw materials. The limited supply of raw materials hampers the production of Alkyl Polyglucosides. These materials, which are derived from renewable sources such as corn, wheat, or coconut oil, are not readily available in large quantities. As a result, manufacturers face difficulties in meeting the growing demand for Alkyl Polyglucosides. Moreover, the high demand for these raw materials from other industries further exacerbates the issue. As the demand for eco-friendly and sustainable products increases across various sectors, the competition for these limited resources intensifies. This heightened demand leads to price fluctuations and potential supply shortages, making it challenging for Alkyl Polyglucosides manufacturers to secure a stable supply chain.

Opportunity

-

Expanding applications in various industries such as personal care, household cleaning, and agriculture

-

Potential for innovation and development of new alkyl polyglucosides formulations.

Market segmentation

By Raw Material

The glucose product segment dominated the market and accounted for a share of 45% in 2023. Glucose is a fundamental ingredient used in APG production for a variety of reasons. First, it is natural and can be easily derived from renewable plant sources, such as corn, wheat, and potatoes. This contributes to the relative inexpensiveness of glucose and makes it the most preferred material for APGs. The fact that glucose is naturally occurring also means that APGs that are formulated with their use do not pose any harm to the environment or human health as they are easily biodegradable. Finally, glucose is the most popular raw material option for APG production because of its mildness and overall non-toxic nature. It makes the APGs based on glucose useful for a range of applications from personal care products, such as shampoos, facial cleansers, and baby care items, which are becoming increasingly popular among consumers who seek natural and sustainable materials.

By Product Type

The coco alkyl held the largest market share around 32% in 2023. Among the different types of products found in the alkyl polyglucoside market, coco alkyl is the most prominent due to its exceptional surfactant properties, mildness, and versatility with its use in multiple applications. With the increasing concern for eco-friendly and biodegradable ingredients among consumers, the popularity of coco alkyl in personal care products, such as hair care, body care, and cosmetic formulation applications is expected to remain high with such features. There is, thus, a significant preference by formulators to use coco alkyl to meet the growing demands for more sustainable and greener products. Moreover, coco alkyl provides efficient cleansing and foaming capabilities that are gentle on the skin leveraging its appeal to the personal care industry. There is also formulator preference for this product with its high compatibility with numerous other ingredients that offer room for formulation flexibility.

By Application

The Home Care Product application segment held the largest revenue share of about 40% in 2023. This growth is attributed to the increasing adoption of products in laundry detergents, dishwashing liquids, and surface cleaners. This surge in popularity is due to their exceptional cleaning performance, low toxicity, and biodegradability. The use of APGs in homecare products, particularly laundry detergents, is on the rise. A notable example is the ECOS laundry detergent by Earth Friendly Products, which has gained significant popularity for utilizing APGs as its primary surfactant.

Regional Analysis

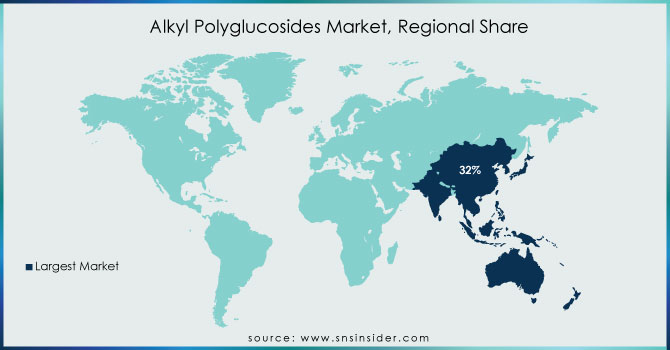

Asia Pacific dominated the Alkyl Polyglucosides Market with the highest revenue share of about 32% in 2023. The textile market in this region is the largest market across the globe which drives the growth of the Alkyl Polyglucosides Market in this region. This region has a robust industrial sector, with countries like China, Japan, and India leading the way in manufacturing and production. These nations have witnessed significant growth in various industries, including personal care, household cleaning, and agriculture, all of which heavily rely on alkyl polyglucosides as a key ingredient. Furthermore, the Asia Pacific region has experienced a surge in population and urbanization, leading to an increased demand for consumer goods. This rise in disposable income, coupled with changing lifestyles and preferences, has fueled the demand for eco-friendly and sustainable products. Alkyl polyglucosides, being derived from renewable resources and offering excellent biodegradability, have gained immense popularity among environmentally conscious consumers in the region. Additionally, the availability of raw materials and the presence of established manufacturers in the region have contributed to its dominance in the Alkyl Polyglucosides Market. The Asia Pacific region benefits from abundant supplies of glucose and fatty alcohols, which are the primary components used in the production of alkyl polyglucosides. This accessibility to raw materials, combined with the presence of well-established manufacturers, has created a favorable ecosystem for the growth of the market in the region.

North America also held a considerable revenue share in 2023 and is expected to grow with a CAGR of about 6.7% during the forecast period. Due to the rising demand for personal care and cosmetics products, the market for alkyl polyglucoside is expected to experience significant growth, particularly in the United States. Alkyl polyglucoside is increasingly being utilized in soaps, detergents, and other cleaning products, thanks to its superior lather and mildness. Leading soap manufacturers in the U.S., including Procter & Gamble, Church & Dwight, and Colgate-Palmolive heavily rely on alkyl polyglucoside in their production processes. Moreover, the North American market is being driven by the expansion of the cosmetics industry. According to Forbes, the United States accounted for approximately 21% of the global cosmetics market in 2021. Additionally, the skincare segment represented over 24% of the total U.S. beauty and cosmetics market, as reported by Toptal, LLC. The increasing adoption of alkyl polyglucoside in various skincare products, such as sunscreen, moisturizers, and anti-aging creams and lotions, combined with the overall growth of the beauty and cosmetics market in the United States, is expected to have a positive impact on the North American market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

BASF SE (Plantacare 1200)

-

Clariant (Glucotain)

-

Dow (DOWTM 3M Biodegradable Surfactants)

-

Shanghai Fine Chemical Co. Ltd. (APG 0814)

-

Croda International Plc (Crodasurf)

-

Airedale Chemical Company Limited (Airedale APG)

-

SEPPIC (MONTANOV 68)

-

APL (APL-Clean APG)

-

Kao Corporation (Kao A-Gel)

-

LG Household & Health Care Ltd. (LG APG)

-

Evonik Industries AG (Tegosoft)

-

AkzoNobel (Hercoblock)

-

Huntsman Corporation (Surfactants E-Series)

-

Brenntag AG (Brenntag Biosector)

-

SABIC (SABIC Surfactants)

-

Rohm and Haas Company (Rhodasurf)

-

Solvay S.A. (AquaSense)

-

Mitsubishi Chemical Corporation (Mitsubishi Surfactants)

-

Wilmar International Ltd. (Wilpar)

-

Sasol Limited (Sasol Surfactants)

Recent Development:

-

In 2023, Launched a new line of sustainable surfactants under the Plantacare brand, emphasizing biodegradable properties suitable for personal care applications.

-

In 2023, Airedale Chemical Company Limited focusing on eco-friendly formulations and emphasizing performance in household cleaning products.

-

In 2023, BASF made an exciting announcement regarding the expansion of its global alkyl polyglucosides (APGs) production capacity. This expansion will take place at two of its prominent sites, one located in Bangpakong, Thailand, and the other in Cincinnati, Ohio.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.06 Billion |

| Market Size by 2032 | US$ 1.86 Billion |

| CAGR | CAGR of 6.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Glucose, Fatty Alcohol, and Others) • By Product Type (Coco Alkyl, Decyl Alkyl, Capryl Alkyl, Lauryl Alkyl, and Others) • By Application (Personal Care & Cosmetics, Industrial Cleaners, Home Care Products, Textiles, Agricultural Chemicals, Oil & Gas, Water Treatment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | BASF SE, Clariant, Dow, Shanghai Fine Chemical Co. Ltd., Croda International Plc, Airedale Chemical Company Limited, SEPPIC, APL, Kao Corporation, LG Household & Health Care Ltd. |

| Key Drivers | • Increasing adoption of eco-friendly and biodegradable surfactants • Stringent regulations imposed by governments and environmental agencies to reduce the use of harmful chemicals • Growing awareness about the harmful effects of synthetic chemicals on human health |

| Market Opportunity | • Expanding applications in various industries such as personal care, household cleaning, and agriculture • Potential for innovation and development of new alkyl polyglucosides formulations. |