Dodecanedioic Acid Market Key Insights:

Get More Information on Dodecanedioic Acid Market - Request Sample Report

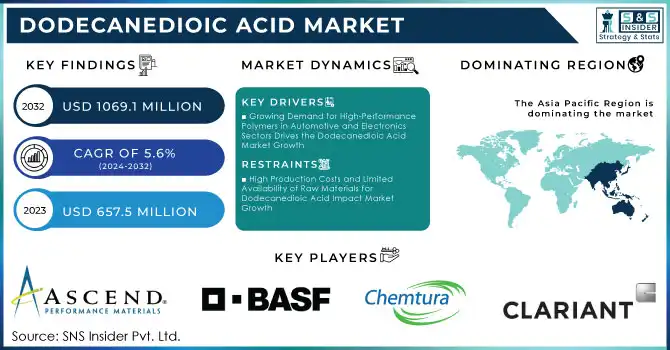

The Dodecanedioic Acid Market Size was valued at USD 657.5 Million in 2023 and is expected to reach USD 1069.1 Million by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032.

The Dodecanedioic Acid market is experiencing steady growth driven by its expanding applications in industries such as automotive, electronics, textiles, and consumer goods. Dodecanedioic Acid, primarily used in the production of high-performance nylon and other polymers, is crucial in enhancing the durability and chemical resistance of end products. The growing demand for bio-based, sustainable chemicals has further boosted its use, as Dodecanedioic Acid is produced from renewable sources like castor oil. The increasing focus on reducing environmental impacts across industries, particularly in the automotive and electronics sectors, has fueled the adoption of Dodecanedioic Acid in the production of eco-friendly nylon and plastics. Companies in the market are making significant strides to meet these trends, with innovations in manufacturing processes and applications.

In recent months, several companies have reported developments aimed at expanding their product offerings and production capabilities. For instance, in September 2024, Evonik Industries announced the expansion of its high-performance polymers portfolio by introducing a new grade of VESTAMID, a polymer derived from Dodecanedioic Acid. This new product is designed to meet the growing demand for lightweight, durable materials in automotive applications, specifically in engine components and fuel systems. This development is part of Evonik’s strategy to support sustainability goals by offering more sustainable alternatives to traditional plastics. In the same month, Kraton Corporation unveiled a new series of bio-based styrene block copolymers, which incorporate Dodecanedioic Acid in their formulation. These copolymers offer enhanced performance in consumer goods and packaging, offering a more environmentally friendly alternative to petroleum-based products. Meanwhile, BASF, in October 2024, highlighted the use of Dodecanedioic Acid in its bio-based plastics range, particularly focusing on applications in automotive and electronics. The company has ramped up production of its bio-based Polybutylene Terephthalate using Dodecanedioic Acid as a key monomer, meeting the demand for materials that offer high strength, and chemical resistance, and are derived from renewable sources. These developments not only illustrate the growing versatility of Dodecanedioic Acid but also reflect the ongoing shift toward more sustainable industrial practices across multiple sectors.

Dodecanedioic Acid Market Dynamics

Drivers:

-

Growing Demand for High-Performance Polymers in Automotive and Electronics Sectors Drives the Dodecanedioic Acid Market Growth

The automotive and electronics industries are experiencing an increasing need for high-performance polymers that offer superior chemical resistance, strength, and durability. Dodecanedioic Acid plays a crucial role in the production of bio-based high-performance polymers like nylon, which are essential in the manufacturing of automotive parts, fuel systems, and electrical components. These polymers are gaining popularity due to their ability to withstand extreme conditions, reduce weight, and offer better thermal stability compared to traditional materials. The rising demand for lightweight vehicles with enhanced fuel efficiency, as well as the need for high-quality components in electronics, is driving the market growth for Dodecanedioic Acid, which is used in the production of polymers such as nylon 6,12, and other resins.

-

Increasing Preference for Sustainable and Bio-Based Chemicals to Meet Environmental Regulations Boosts Market Demand

-

Expanding Applications of Dodecanedioic Acid in Textiles and Consumer Goods Fuel the Market’s Growth

-

Growing Focus on Bio-Based and Sustainable Nylon Production Leads to Higher Adoption of Dodecanedioic Acid

-

Rising Demand for Lightweight Materials in Automotive and Aerospace Industries Fuels the Dodecanedioic Acid Market

Restraint:

-

High Production Costs and Limited Availability of Raw Materials for Dodecanedioic Acid Impact Market Growth

Opportunity:

-

Expansion of Dodecanedioic Acid Use in 3D Printing and Additive Manufacturing Opens New Market Possibilities

-

Increasing Adoption of Bio-Based Polymers in Packaging Industry Creates Significant Market Opportunities

The packaging industry is increasingly adopting bio-based and sustainable materials as consumers and regulators push for eco-friendly solutions. Dodecanedioic Acid plays a key role in the production of bio-based plastics and polymers, which are ideal for packaging applications that require both sustainability and performance. With governments implementing stricter regulations on plastic waste and companies seeking to reduce their environmental footprint, Dodecanedioic Acid offers a viable solution for producing biodegradable and recyclable packaging materials. The rising demand for sustainable packaging presents significant opportunities for Dodecanedioic Acid producers to expand their market presence and contribute to the circular economy.

-

Rising Demand for Durable and High-Performance Materials in Electric Vehicle Production Presents New Growth Opportunities

-

Supply Chain and Raw Material Analysis for the Dodecanedioic Acid Market

The pie chart illustrates the Supply Chain and Raw Material Analysis for the Dodecanedioic Acid market, highlighting the various factors influencing market dynamics. Raw materials account for the largest segment at 25%, emphasizing their critical role in production, particularly the reliance on renewable sources like castor oil and petrochemical feedstocks. Supply chain disruptions and production capacity each contribute 20%, reflecting the significant impact of geopolitical issues and manufacturing limitations on market stability. Transportation and logistics represent 15%, underscoring the importance of efficient shipping and delivery in maintaining supply flow. Finally, technological advancements also make up 20%, showcasing the potential for innovation to optimize resource use and enhance sustainability in production processes. Together, these factors provide a comprehensive overview of the complexities within the Dodecanedioic Acid supply chain.

Dodecanedioic Acid Market Segmentation Analysis

By Production Process

The synthetic production segment dominated the Dodecanedioic Acid market in 2023, with an estimated market share of around 65%. Synthetic production remains the preferred method due to its cost-effectiveness and the established infrastructure for large-scale manufacturing. This process utilizes petroleum-based feedstocks to produce Dodecanedioic Acid efficiently. Despite the growing interest in biotech production, which is seen as more sustainable, the synthetic method continues to lead due to lower production costs and the availability of raw materials. Companies such as BASF and Evonik Industries predominantly use synthetic production processes, reflecting their widespread adoption in the market.

By Application

The nylon 6,12 production segment dominated the Dodecanedioic Acid market in 2023, holding an estimated market share of around 55%. Nylon 6,12, produced using Dodecanedioic Acid as a key monomer, is widely used in high-performance applications, especially in the automotive and electronics industries. Its superior properties, such as strength, chemical resistance, and heat resistance, make it ideal for components like fuel tanks, engine parts, and electrical connectors. As demand for lightweight and durable materials in these sectors grows, nylon 6,12 production remains the dominant application for Dodecanedioic Acid.

By End-use Industry

The automotive industry was the dominant segment in the Dodecanedioic Acid market in 2023, with a market share of around 40%. This is primarily due to the increasing use of high-performance polymers derived from Dodecanedioic Acid in automotive applications. The demand for lightweight, durable, and fuel-efficient vehicles has driven the adoption of Dodecanedioic Acid-based materials in the production of components such as fuel systems, engine parts, and interior components. The automotive industry continues to be a key consumer of Dodecanedioic Acid due to the need for materials that improve performance while reducing environmental impact.

Dodecanedioic Acid Market Regional Analysis

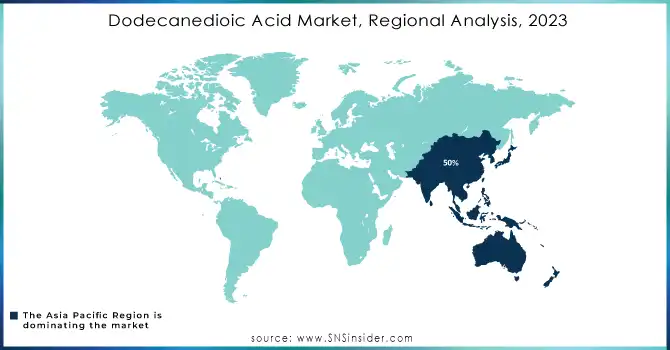

The Asia Pacific region dominated the Dodecanedioic Acid market in 2023, capturing a market share of around 50%. This dominance can be attributed to several factors, including the rapid industrialization and growing manufacturing capabilities in countries such as China, India, and Japan. China, as the largest producer and consumer of Dodecanedioic Acid, has been significantly investing in its chemical production infrastructure to meet the increasing domestic demand for high-performance polymers, particularly in the automotive and electronics sectors. For instance, the Chinese automotive industry has been expanding at a remarkable pace, with reported production of over 27 million vehicles in 2023, driving the need for lightweight and durable materials, including Dodecanedioic Acid-derived nylon. India is also emerging as a significant player in this market, with the government's initiatives to boost the manufacturing sector under the "Make in India" program facilitating growth in the chemicals market. Additionally, Japan's focus on advanced manufacturing and technology, coupled with its automotive and electronics industries, further contributes to the demand for Dodecanedioic Acid. Furthermore, the region's increasing emphasis on sustainable practices and bio-based chemicals has led to a gradual shift towards Dodecanedioic Acid as a preferred raw material for producing eco-friendly polymers, enhancing its market presence across various applications.

Moreover, the North American region is the fastest-growing region in the Dodecanedioic Acid market in 2023, with a CAGR of approximately 7%. This growth is driven by the rising demand for high-performance materials in the automotive and aerospace industries, where the need for lightweight and durable components is paramount. The United States, being a leading hub for automotive innovation and production, is witnessing significant investments in developing advanced materials, including those derived from Dodecanedioic Acid. With the electric vehicle market booming—projected to reach over 6 million units sold by 2025 manufacturers are increasingly turning to Dodecanedioic Acid for producing high-performance polymers that enhance vehicle efficiency and performance. Moreover, Canada’s growing emphasis on sustainability and green chemistry initiatives aligns with the use of bio-based materials like Dodecanedioic Acid, further supporting market growth. Additionally, the United States focus on renewable resources and reducing reliance on petroleum-based chemicals is encouraging the adoption of bio-based nylon and other polymers, driving demand for Dodecanedioic Acid. The combination of technological advancements, regulatory support for sustainable practices, and increasing investments in the chemical sector positions North America as a dynamic player in the Dodecanedioic Acid market.

Need Any Customization Research On Dodecanedioic Acid Market - Inquiry Now

Recent Developments

January 2023: Merck KGaA introduced a new product line of Dodecanedioic Acid, specifically developed for a range of applications, including nylon production, coatings, and adhesives.

Key Players

-

Ascend Performance Materials LLC (Aegis, Zytel)

-

BASF SE (Ultramid, PBT)

-

Chemtura Corporation (Cirex, Sytron)

-

Clariant International Ltd. (Hostalux, Exolit)

-

DIC Corporation (Terephthalic Acid, Saran)

-

Evonik Industries AG (VESTAMID, VESTOSINT)

-

Huntsman Corporation (Vitamins, Polyurethanes)

-

Indorama Ventures Public Company Limited (PET, PTA)

-

Kraton Corporation (Kraton Polymers, Styrene Block Copolymers)

-

Lanxess AG (PBT, Durethan)

-

Mitsubishi Chemical Corporation (Durabio, Bio-based Nylon)

-

Merck KGaA (Laminin, Thio-UREA)

-

Nippon Shokubai Co., Ltd. (Acrylic Acid, Super Absorbent Polymer)

-

Penta Manufacturing Company (Pentaerythritol, Alkyd Resins)

-

SABIC (LNP Compounds, Polycarbonate)

-

Shandong Haili Chemical Industry Co., Ltd. (Nylon 12, Dodecane)

-

Shenzhen Esun Industrial Co., Ltd. (PLA, ABS Filaments)

-

Sumitomo Chemical Co., Ltd. (Sumikaexcel, Sumilite)

-

Teijin Limited (Teijinconex, Polyester Resin)

-

Zhejiang Jianye Chemical Co., Ltd. (Nylon 12, Dodecylamine)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 657.5 Million |

| Market Size by 2032 | US$ 1069.1 Million |

| CAGR | CAGR of 5.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Production Process (Synthetic Production, Biotech Production) • By Application (Nylon 6,12 Production, Plasticizers, Lubricants, Adipic Acid Derivatives, Others) • By End-use Industry (Automotive, Electronics, Textiles, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Evonik Industries AG, BASF SE, Mitsubishi Chemical Corporation, Kraton Corporation, Merck KGaA, Lanxess AG, DIC Corporation, Zhejiang Jianye Chemical Co., Ltd., Penta Manufacturing Company, Ascend Performance Materials LLC and other key players |

| Key Drivers | • Increasing Preference for Sustainable and Bio-Based Chemicals to Meet Environmental Regulations Boosts Market Demand • Expanding Applications of Dodecanedioic Acid in Textiles and Consumer Goods Fuel the Market’s Growth |

| Restraints | • High Production Costs and Limited Availability of Raw Materials for Dodecanedioic Acid Impact Market Growth |