Membrane Air Dryers Market Size & Growth Trends

The Membrane Air Dryers Market Size was valued at USD 0.88 Billion in 2023 and is expected to reach USD 1.60 Billion by 2032 and grow at a CAGR of 6.9% over the forecast period 2024-2032.

The Membrane Air Dryers market is rapidly expanding in a much larger compressed air treatment industry. Key drivers for the expansion in this market are extensive industrialization, strict environmental regulations, as well as a growing need for energy-efficient solutions. The membrane air dryer removes water vapor from compressed-air systems for use in dry air for a wide range of industrial processes. Dryers use selective permeation through a semi-permeable membrane, such that it allows water vapor to diffuse out of the system while keeping the other components in.

Get More Information on Membrane Air Dryers Market - Request Sample Report

The government of the United States initiated energy efficiency measures, which will help in the understanding of the rising energy, especially for energy-efficient technologies such as membrane air dryers. In August 2022, US Administration proposed new efficiency standards for clothes dryers, which will save nearly USD 20.8 billion in energy costs over the next 30 years. These standards would reduce carbon emissions by 116 million metric tons the same amount each year as 14.6 million residential homes. The U.S. Energy Information Administration, EIA, also recently published March 2023 a report that highlighted that equipment like air dryers could indeed mean significant long-term savings for industries. Energy-efficient systems have minimal long-term cost implications regarding operation and environmental impact. This trend corresponds with the increased uptake of membrane air dryers, which are valued for their capabilities to save energy without the use of electricity to operate. As governments place more emphasis on saving energy, membrane air dryers align with other government goals set to reduce emissions to reach a net-zero carbon output by 2050.

Membrane Air Dryers Market Dynamics

KEY DRIVERS

-

Rising Industrialization and Automation Drive Membrane Air Dryers Demand in Emerging Economies

Rapid industrialization in emerging economies significantly increases the adoption of advanced compressed air systems among industries like food processing, automotive, and pharmaceuticals. On account of the very strong relationship that has been established between air purity and operational efficiency in their automation processes, membrane air dryers assume a very important position.

In the context of the Membrane Air Dryers Market, emphasis on automation in manufacturing has been very well underlined through impressive statistics. Our Research showed that companies can even cut up to 30% of operational costs through effective automation strategies. Moreover, 73% of manufacturers are investing in automation to enhance efficiency and quality. This giant step to automation requires trustworthy solutions in air treatment, including membrane air dryers, to ensure that clean and dry air is maintained during the automated process. For instance, it is noticed that through this process, manufacturers will save much money by optimizing their strategies of automating their processes. For instance, in some organizations, this can go to as high as 30% in terms of saving on the operational cost. Altogether, the above precisely underlines the reason for membrane air dryers because dry air maintenance will always ensure that efficiency and quality products are achieved within an automated system. With increasing Industry 4.0 and the Internet of Things, manufacturing industries have been highly investing in membrane air dryers as they are one of the key advanced air treatment solutions for ensuring proper integration and smooth performance in their automated setups.

-

Regulatory Pressures Drive Demand for Membrane Air Dryers in Key Industries

The industry sectors in pharmaceuticals, healthcare, and food & beverage require very stringent air quality standards wherein the compressed air supplied must be free from contaminants and moisture. The industrial benefits of membrane air dryers are the elimination of water vapor effectively, thus compelling industries to meet such strict air quality standards.

Additionally, accelerating levels of automation in manufacturing are on an upswing and so is the demand for efficient compressed air solutions. As more firms implement automation technologies, many even see productivity improvements; some realize ROI up to 30%. That is essentially because membrane air dryers maintain high air purity. The U.S. According to the Department of Energy, it has been reported that energy efficiency in equipment can reduce costs by as much as 30%. This factor has helped ascertain that membrane air dryers are used widely for several industrial applications. All of these three factors coupled together discuss regulatory compliance, automation requirements, and the desire for energy-efficient measures. Membrane Air Dryers are destined to become an integral part of the future industrial air treatment processes.

RESTRAIN

-

High Initial Investment Costs Hinder Adoption of Membrane Air Dryers Among SMEs

Membrane air dryers tend to have a higher initial purchase and installation cost compared to other air-drying technologies. The upfront investment is very high for desiccant dryers. In such cases, this makes the technology less desirable for small and medium-sized businesses when the end industry is sensitive to price. This can limit market growth because end-users may defer or avoid upgrading systems.

Though refrigerated air dryers have a relatively high beginning cost of between USD 3,000 to USD 8,000, they are associated with relatively higher direct costs of operation over time due to energy use costs and other operational requirements. On the other side, desiccant dryers are said to be more expensive in terms of investment (USD 5,000 to USD 15,000) but tend to be much cheaper over time due to their non-electricity-consuming property.

Membrane Air Dryers Market Segments Outlook

BY APPLICATION TYPE

The industrial segment is responsible for holding the most important revenue share of around 33% in 2023. The industrial segment is further categorized into pneumatic equipment, electronics/semiconductors, feed gas preparation, and others. The demand for membrane air dryers is more and more influenced by the growth in industrial automation. The U.S. Department of Energy reports that compressed air systems account for up to 30% of energy consumption in industrial plants; thus the efficiency and reliability of these systems are paramount. Membrane air dryers ensure steady, reliable performance, keeping automated processes intact and running with no unexpected stoppages. Studies indicate that adopting efficient air treatment solutions can lower operational costs by 20-30%, thus increasing productivity.

The food and beverage industry is expected to grow at the highest CAGR of 8.88% during the forecast period. This is primarily due to the critical need to remove moisture from compressed air or steam in food processing applications, which can result in some serious operational issues. For example, the U.S. Department of Agriculture claims that non-compliance with hygiene standards in food preparation leads to a 20% increase in spoilage and waste. In addition, high standards of hygiene in meat and dairy products not only call for good air treatment methods but also work as further drivers to the demand of this market. To improve quality and safety, these industries would require effective air-drying technologies to maintain the same standards.

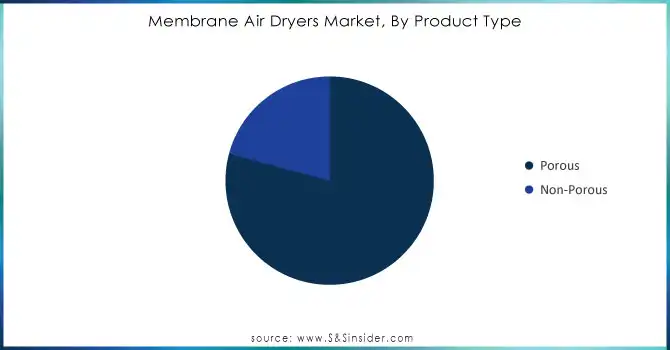

BY PRODUCT TYPE

The Porous Segment of the membrane air dryer market captured around 79% of the total revenue in 2022 and is expected to grow at the fastest CAGR of 7.01% during the forecast period. Increasing emphasis on energy efficiency and sustainability across all industries has fueled the growth of this product. According to a report released by the U.S. The Environmental Protection Agency (EPA) reveals that an average of 30% in terms of energy cost will be saved by installing energy-efficient practices. The key benefits of using porous membranes and membrane air dryers over conventional air drying are minimized energy requirements, compact sizes, and minimum maintenance. For example, membrane air dryers can achieve an efficiency of up to 95% in the removal of moisture. They are particularly appealing to industries wishing to enhance their operation performance while minimizing their ecological load.

The Non-Porous Segment is estimated to grow significantly over the forecast period, it is projected that the demand for the membrane air dryer will surface more strongly in the non-porous part. A growing demand for clean compressed air with low dew points within important industries such as food and beverage, pharmaceuticals, electronics, and automotive is noted to be the major driving factor behind this trend. All these industries require compressed air of high quality to preserve product integrity, prevent contamination, and enhance operational efficiency. As organizations demand the best quality of air and reliability, non-porous membrane air dryers can form an essential part of their process.

Need Any Customization Research On Membrane Air Dryers Market - Inquiry Now

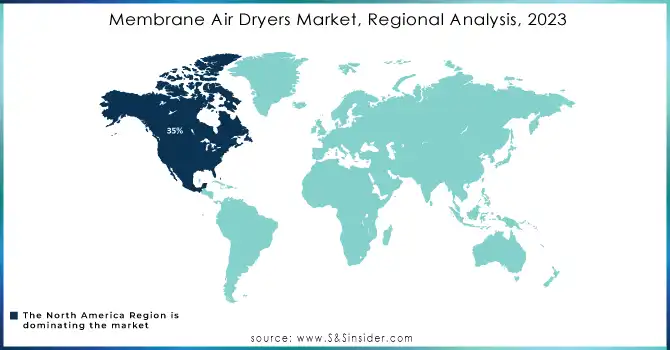

Membrane Air Dryers Market Regional Analysis

North America accounted for the major share of the membrane air dryer market in 2023 at 35% owing to a rise in demand due to the telecommunications segment, medical, and food & beverage sectors. Other factors driving the market include strict regulatory policies 3-A Sanitary Standards and European Hygienic Engineering & Design Group regulations with the U.S. Public Health Service, which contribute to the growth with the imposition of quality in the air used by industries that deal in dairy and food processing. Such regulations define proper filtration for compressed air in contact with food and steam, which boosts the market demand. The 3-A Sanitary Standards play an important role in various industries. Hence, food and beverage manufacturers have to make sure that such stringent requirements are met by the air-drying system; by standardizing in compliance with such standards, the membrane air dryer market benefits. Therefore, more than 75% of the food and beverage manufacturers are likely to consider these standards for safe production in the U.S. by 2024.

The significantly booming electronics industry in the Asia Pacific region is likely to exhibit a CAGR of 8.96% during the forecast period. Since contaminants and moisture lead to short circuits, the demand for contaminant-free and dry compressed air is very high in manufacturing electronic devices such as semiconductors and printed circuit boards, as these guarantee product quality and reliability, especially in telecommunication processes. Furthermore, the industrialization of the region and the rapid economic growth, in particular in countries like China, India, and South Korea, has driven growth in demand for effective and reliable air-drying applications across various industry sectors, which in turn acts as a driver for market growth.

Key Players

Some of the major players in the Membrane Air Dryers Market are:

-

Atlas Copco AB (Atlas Copco MD Series Membrane Dryers, Atlas Copco QD Series Membrane Dryers)

-

Ingersoll Rand (Ingersoll Rand Zero-Loss Membrane Dryers, Ingersoll Rand Energy-Efficient Membrane Dryers)

-

MIKROPOR MAKINA SAN.TIC.A.S. (Mikropor Membrane Dryer Series, Mikropor Energy-Efficient Membrane Dryers)

-

PARKER HANNIFIN CORP (Parker Hannifin Membrane Dryers, Parker Hannifin Energy-Saving Membrane Dryers)

-

Pentair (Everpure Membrane Dryers, Everpure Energy-Efficient Membrane Dryers)

-

Compressed Air Parts Company (CAPCO Membrane Dryers, CAPCO Energy-Saving Membrane Dryers)

-

Donaldson Company, Inc. (Donaldson Ultra-Pure Membrane Dryers, Donaldson Energy-Efficient Membrane Dryers)

-

Gardner Denver (Gardner Denver Membrane Dryers, Gardner Denver Energy-Saving Membrane Dryers)

-

Graco Inc. (Graco Membrane Dryers, Graco Energy-Efficient Membrane Dryers)

-

Hankison (Hankison Membrane Dryers, Hankison Energy-Saving Membrane Dryers)

-

Industrial Air Power (Industrial Air Power Membrane Dryers, Industrial Air Power Energy-Efficient Membrane Dryers)

-

Rainer Lammertz (Rainer Lammertz Membrane Dryers, Rainer Lammertz Energy-Saving Membrane Dryers)

-

Sullair, LLC (Sullair Membrane Dryers, Sullair Energy-Efficient Membrane Dryers)

-

AIRPAX Corp. (AIRPAX Membrane Dryers, AIRPAX Energy-Saving Membrane Dryers)

-

Kaeser Compressors, Inc. (Kaeser Membrane Dryers, Kaeser Energy-Saving Membrane Dryers)

-

Norgren (Norgren Membrane Dryers, Norgren Energy-Saving Membrane Dryers)

-

SMC Corporation (SMC Membrane Dryers, SMC Energy-Saving Membrane Dryers)

-

SPX FLOW, Inc. (SPX FLOW Membrane Dryers, SPX FLOW Energy-Saving Membrane Dryers)

-

Wilkerson Corporation (Wilkerson Membrane Dryers, Wilkerson Energy-Saving Membrane Dryers)

-

Zeks Compressed Air Solution (Zeks Membrane Dryers, Zeks Energy-Saving Membrane Dryers)

RECENT TRENDS

-

In September 2024, Atlas Copco reinforced its market position by acquiring a distributor of compressors based in the Netherlands. With this development, the company will probably reinforce distribution links within Europe for air compressors and their related products, like membrane air dryers. An acquisition of this nature is in line with more general corporate strategies of broadening reach while also improving efficiency in core industrial sectors.

-

In October 2024, Changes in global regulations and competition in the market for refrigerated air dryers have a significant effect on air treatment solutions, including membrane air dryers. With the aid of technological advances, companies such as Parker Hannifin and Sullair are striving to meet new regulatory standards and work toward more efficient and reliable air drying systems. The increasing demand by industries like telecommunication, food & beverage, and healthcare are starting to vie for contamination-free, dry compressed air drives this market shift.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.88 Billion |

| Market Size by 2032 | USD 1.60 Billion |

| CAGR | CAGR of 6.9 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Porous, Non-Porous) • By Application Type (Food & Beverage, Medical, (Dental, Breathing Equipment, MIT), Industrial (Pneumatic Equipment, Electronics/Semiconductor, Feed Gas Preparation, Others), Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atlas Copco AB, Ingersoll Rand, MIKROPOR MAKINA SAN.TIC.A.S., PARKER HANNIFIN CORP, Pentair, Compressed Air Parts Company, Donaldson Company, Inc., Gardner Denver, Graco Inc., Hankison, Industrial Air Power, Rainer Lammertz, Sullair, LLC, AIRPAX Corp., Kaeser Compressors, Inc., Norgren, SMC Corporation, SPX FLOW, Inc., Wilkerson Corporation, Zeks Compressed Air Solution. |

| Key Drivers | • Rising Industrialization and Automation Drive Membrane Air Dryers Demand in Emerging Economies. • Regulatory Pressures Drive Demand for Membrane Air Dryers in Key Industries. |

| Restraints | • High Initial Investment Costs Hinder Adoption of Membrane Air Dryers Among SMEs. |