Millimeter Wave Technology Market Report Scope and Overview:

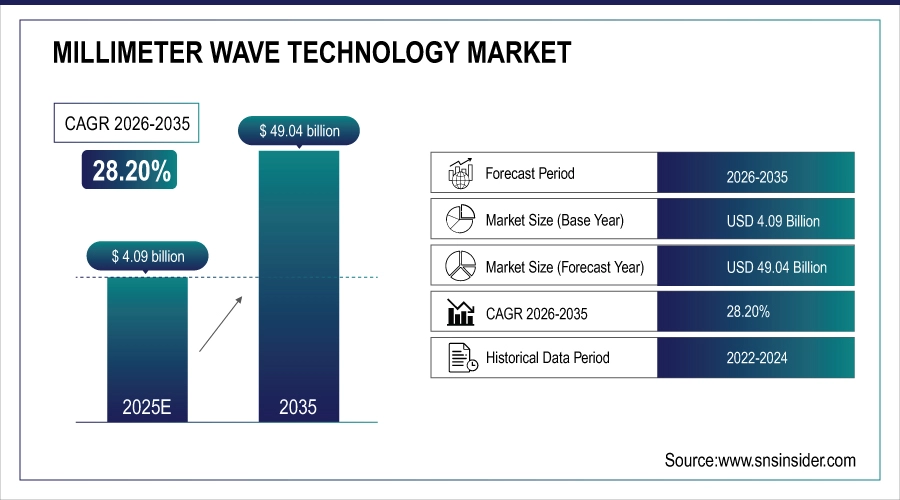

The Millimeter Wave Technology Market was valued at USD 4.09 billion in 2025 and is expected to reach USD 49.04 billion by 2035, growing at a CAGR of 28.20% over the forecast period 2026-2035.

The emerging Millimeter Wave (mmWave) Technology Market is on the rise, as the growing deployment and eventual rollout of 5G and future 6G networks continue to grow and evolve. It is being rapidly deployed in urban telecom infrastructure, smart cities, and high-speed wireless broadband. Advances in antenna Transceivers & Frequency Converter technology boost efficiency and lower signal latency.

Millimeter Wave Technology Market Size and Forecast:

-

Market Size in 2025: USD 4.09 Billion

-

Market Size by 2035: USD 49.04 Billion

-

CAGR: 28.20% (from 2026 to 2035)

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To get more information on Millimeter Wave Technology Market - Request Free Sample Report

Millimeter Wave Technology Market Highlights:

-

Global deployment of 5G networks is driving mmWave adoption for ultra-fast data speeds and low latency

-

Increasing use of mmWave in ADAS, autonomous vehicles, and automotive radar enhances safety and connectivity

-

Rising demand in aerospace, defense, and surveillance applications boosts market momentum

-

Short transmission range, high attenuation, and infrastructure costs remain key technical restraints

-

High equipment costs and inconsistent spectrum policies across regions slow standardization

-

Advancements in 6G, IoT, satellite broadband, and smart cities present strong long-term growth potential

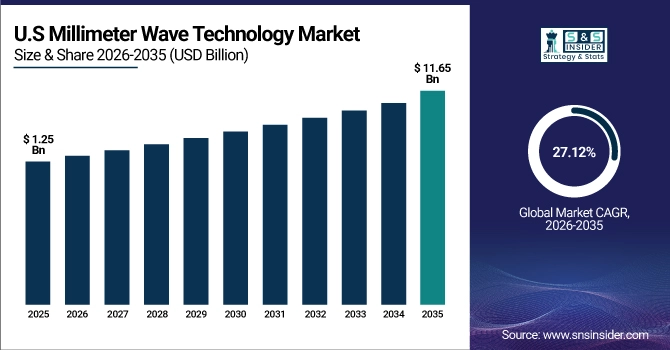

The U.S. Millimeter Wave Technology market size was valued at an estimated USD 1.25 billion in 2025 and is projected to reach USD 11.65 billion by 2035, growing at a CAGR of 27.12% over the forecast period 2026–2035. Market growth is driven by rapid deployment of 5G networks, increasing demand for high-speed wireless communication, and growing adoption of millimeter wave solutions in telecommunications, automotive radar, and defense applications. Rising investments in next-generation connectivity, expansion of small-cell infrastructure, and advancements in semiconductor and antenna technologies are accelerating market expansion. Additionally, increasing use of millimeter wave technology in smart cities, IoT, and industrial automation further strengthens the robust growth outlook of the U.S. millimeter wave technology market during the forecast period.

Millimeter Wave Technology Market Drivers:

-

Accelerating Millimeter Wave Technology Growth Driven by 5G Expansion Automotive Advancements and Security Innovations

The rising requirement for FRM (firm range meter) development and operation of 5G networks and satellite communication crystals are boosting the Millimeter Wave (mmWave) Technology Market. The global expansion of 5G infrastructure has driven the adoption of mmWave technology which supports ultra-fast data transfer rates and low latency. Furthermore, the rising adoption of mmWave for automotive applications such as ADAS (advanced driver assistance systems) and autonomous vehicles is a significant factor supplementing the growth of the market. Moreover, the upsurge in the need for security and surveillance solutions and escalated adoption of high-resolution imaging and radar applications in the aerospace, defense, and healthcare sectors are further fueling market growth.

Millimeter Wave Technology Market Restraints:

-

Millimeter Wave Technology Faces Challenges with Signal Limitations High Costs Infrastructure Demands and Regulatory Hurdles

The biggest potential challenge is the limitation in signal propagation: mmWave frequencies have a shorter range and are sensitive to attenuation through vehicles, buildings, trees, and even humidity or rain. The need for dense small cells means increased infrastructure costs and larger-scale deployments are more complex. Moreover, the high cost of equipment including specialized antennas, transceivers, and frequency converters inhibits widespread adoption, especially in cost-sensitive markets. Red tape about spectrum allocation is another blocker with every region having its own rules and likelihood of bandwidths, delaying standardization and universal authorization.

Millimeter Wave Technology Market Opportunities:

-

Millimeter Wave Technology Unlocks Opportunities in 6G Smart Cities IoT Healthcare Satellite Broadband and Consumer Electronics

The mmWave technology market is brimming with opportunities, especially for emerging applications including 6G communication, smart cities, and high-frequency imaging systems. This drives fast connected device and Internet of Things (IoT) application penetration, creating a promising growth path, especially in the areas of industrial automation and healthcare. Moreover, rapid growth in satellite-based broadband services, along with the commercialization of some high-growth mmWave-based consumer electronics (e.g. AR/VR devices and wearables) as well as unprecedented interest in ESG, all represent a growing market opportunity. Continuing investments in research and development to improve mmWave technologies and expanding on advancements in signal propagation techniques will accelerate adoption in more verticals.

Millimeter Wave Technology Market Segment Analysis:

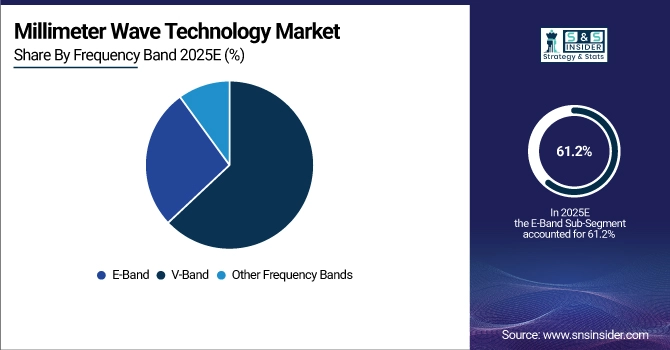

By Frequency Band

In 2025, E-Band held the largest market share of 61.2% in the Millimeter Wave (mmWave) Technology Market. E-Band (71–76 GHz and 81–86 GHz) is a set of frequencies for very high-capacity backhaul solutions in 5G networks, military radars, satellites, etc. Due to its low latency capability, it has made a favorable choice for telecommunication infrastructure, as well as aerospace & defense applications, which require extremely high, multi-gigabit data rates.

The V-Band garnered the highest revenue CAGR through 2026-2035, largely attributed to its growing use in wireless broadband, unlicensed 5G, and short-range communications. This is driving its growth through the rise of smart cities, fixed wireless access (FWA), and high-speed indoor connectivity. As regulators free up V-Band to commercial operators, this frequency will witness strong market growth due to its application as a low-cost, high-speed data transmission technology.

By Product

The telecommunication equipment segment led the global Millimeter Wave (mmWave) Technology market, contributing 55.3% of the global market share in 2025. Adoption of mmWave technology in telecommunication infrastructure the boom of 5G networks and need-based transmission of high-speed data. Representative applications consist of small cells, macro cells, and backhaul link solutions that provide higher-capacity and lower late.

The category of imaging & scanning systems is expected to grow at a rapidly growing CAGR from 2026 to 2035 due to developments in the medical imaging, security screening, and industrial inspection fields. The surge adoption of mmWave-based body scanners at airports coupled with the growing need for non-invasive medical diagnostics, and high-resolution radar in the automotive Industry & defense sectors is expected to drive this growing demand and create a healthy space in the market.

By Component

In 2025, antennas & transceivers led the millimeter wave (mmWave) technology market with a 40.4% share of the total market. These components are crucial to facilitate high-frequency signals being sent and received across different applications, including 5G telecommunications, automotive radar, and satellite communications. This segment share has been there since the growing deployment of mmWave-based 5G infrastructure and also the growing use of these advanced radar systems in defense applications and autonomous vehicles.

Frequency converters are expected to grow at a rapid CAGR during the forecast period (2026 - 2035) owing to their increasing use in various telecommunication applications including frequency translation and signal processing in telecommunications, aerospace, and industrial automation. The development of efficient frequency converters will enhance the performance and decrease the mutual interference, thus driving the adoption of mmWave technology in 6G, high-speed satellite communications, as well as imaging systems continue to open new doors for market growth.

By Application

Telecommunications lead the MMwave Technology Market by commanding 46.7% of the market share in 2025. mmWave adoption in this segment includes growing demand for high-speed data transmission, rapid deployment of 5G networks, and increasing need for wireless broadband infrastructure. Telecom operators are using mmWave for small cells, backhaul, and fixed wireless access (FWA) to provide greater network capacity and coverage.

The Military & defense sector is projected to register the fastest CAGR during 2026 – 2035 due to advancements in radar, surveillance, and secure communication systems. As a result, mmWave technology is rapidly adopted for high-resolution imaging, electronic warfare, and missile guidance systems. The growth in this section can be attributed to the increasing demand for advanced defense technologies, combined with rising investments in battlefield connectivity and drone communication.

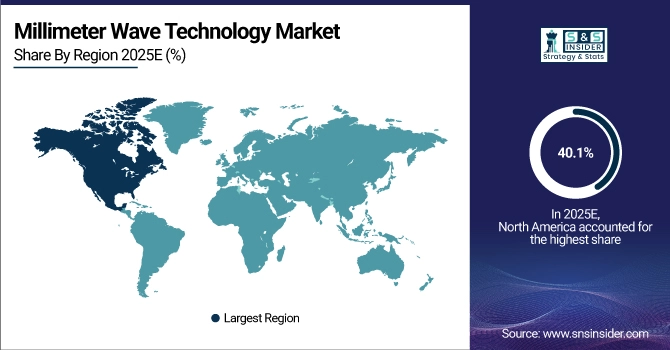

Millimeter Wave Technology Market Regional Analysis:

North America Millimeter Wave Technology Market Trends:

North America held the highest mmWave Technology Market share of 40.1% in 2025 The 5G networks are being widely deployed while the strong growth in defense and aerospace applications and autonomous vehicles sectors also supports this dominance. The U.S. has embraced mmWave early on, as evidenced by U.S. telecom powerhouses Verizon, AT&T, and T-Mobile using mmWave bands for high-speed 5G. Furthermore, mmWave technology is being used for satellite communication, radar systems, and other military applications by NASA, and the U.S. Department of Defense (DoD) also exists, reinforcing North America's leadership in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Millimeter Wave Technology Market Trends:

The Asia-Pacific region will grow at the fastest CAGR from 2026-2035, as a result of growing 5G infrastructure, rising industrial automation, and higher defense spending. China, Japan, and South Korea are pouring resources into mmWave-based 5G networks for smart cities and industrial facilities. Examples include China Mobile and Huawei in developing mmWave keys to ultra-fast mobile broadband and Japan's NEC and South Korea's Samsung to mmWave-enabled automotive radar and security applications, all propelling very fast regional market growth.

Europe Millimeter Wave Technology Market Trends:

Europe represents a steadily expanding mmWave technology market driven by advancements in telecom infrastructure, automotive radar, and industrial automation. Countries such as Germany, the U.K., and France are accelerating 5G network rollouts with mmWave frequencies for dense urban connectivity. The European Union’s emphasis on smart mobility, connected vehicles, and defense modernization also contributes to the region’s growth. Key players like Ericsson, Nokia, Infineon Technologies, and Rohde & Schwarz are leading research and commercialization of mmWave-enabled components and testing solutions, further strengthening Europe’s technological edge in this sector.

Latin America Millimeter Wave Technology Market Trends:

The Latin American mmWave market is emerging, supported by telecom upgrades, urban connectivity projects, and growing demand for high-capacity backhaul solutions. Countries such as Brazil, Mexico, and Chile are taking early steps toward mmWave-based 5G trials and fixed wireless access (FWA) deployments. Government initiatives to expand broadband penetration and collaborations with global telecom vendors like Ericsson and Nokia are key drivers. Although adoption is currently limited, the region shows strong potential as operators focus on bridging digital divides and expanding smart city infrastructure.

Middle East & Africa Millimeter Wave Technology Market Trends:

The Middle East & Africa region is witnessing increasing adoption of mmWave technologies, primarily led by Gulf countries such as the UAE, Saudi Arabia, and Qatar, which are pioneers in 5G commercialization and smart infrastructure development. mmWave is being integrated into defense communications, surveillance systems, and smart city projects. Governments are partnering with international telecom vendors like Huawei, Nokia, and Ericsson to accelerate next-generation network deployment. In Africa, countries such as South Africa and Kenya are exploring mmWave for broadband and satellite communication applications, contributing to the region’s gradual but promising market expansion.

Millimeter Wave Technology Market Competitive Landscape:

Logitech Founded in 1981, Switzerland-based Logitech designs computer peripherals, video collaboration tools, and smart workspace devices. The company launched the Spot mmWave radar sensor in January 2025, featuring a four-year battery life for office occupancy tracking, though it raised privacy concerns regarding potential covert employee monitoring in workplaces.

-

In January 2025, Logitech introduced the Spot mmWave radar sensor with a 4-year battery life, designed for office occupancy tracking, but concerns arise over potential covert employee monitoring.

Filtronic plc Founded in 1977 and headquartered in the UK, Filtronic designs advanced RF, microwave, and mmWave components for telecom, defense, and satellite sectors. In February 2025, it secured a USD 20.9 million contract with SpaceX to supply radio-frequency power amplifiers for the Starlink satellite broadband network expansion.

-

In February 2025, Filtronic signed a USD 20.9 million contract with SpaceX to supply radio-frequency power amplifiers for the Starlink satellite network.

Keysight Technologies Inc. Established in 2014 in California, Keysight Technologies provides test and measurement solutions for communications, aerospace, and semiconductors. In November 2024, Keysight partnered with Virginia Diodes Inc. to extend its FieldFox analyzers up to 170 GHz, enabling compact, efficient, and cost-effective millimeter-wave signal analysis across multiple emerging applications.

-

In November 2024, Keysight Technologies partnered with Virginia Diodes Inc. to extend FieldFox analyzers up to 170 GHz, enabling compact and cost-effective mmWave signal analysis.

Millimeter Wave Technology Market Key Players:

-

Logitech

-

Filtronic

-

Vayyar

-

Rohde & Schwarz

-

pSemi (formerly Peregrine Semiconductor)

-

Siklu

-

E-Band Communications

-

NEC Corporation

-

Sivers Semiconductors

-

Quintech Electronics & Communications

-

Anokiwave

-

Aviat Networks

-

Qualcomm Incorporated

-

Ericsson AB

-

Nokia Corporation

-

Samsung Electronics Co., Ltd.

-

Infineon Technologies AG

-

Texas Instruments Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.09 Billion |

| Market Size by 2035 | USD 49.04 Billion |

| CAGR | CAGR of 28.20% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Telecommunication Equipment, Imaging & Scanning Systems, Radar & Satellite Communication Systems) • By Component (Antennas & Transceivers, Amplifiers, Oscillators, Control Devices, Frequency Converters, Passive Components, Others (Ferrite Devices, Radiometers, etc.)) • By Frequency Band (V-Band, E-Band, Other Frequency Bands) • By Application (Telecommunications, Military & Defense, Automotive & Transport, Healthcare, Electronics & Semiconductor, Security) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Logitech, Cambium Networks, Filtronic, Vayyar, Rohde & Schwarz, pSemi (formerly Peregrine Semiconductor), Keysight Technologies, Siklu, E-Band Communications, NEC Corporation, Sivers Semiconductors, Quintech Electronics & Communications, Anokiwave, Aviat Networks, Eravant (formerly SAGE Millimeter). |