Parametric Insurance Market Report Scope and Overview:

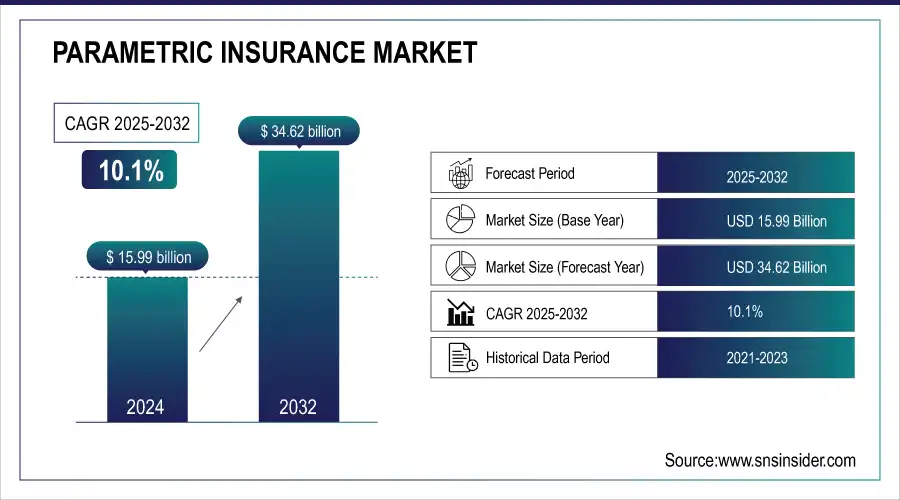

The Parametric Insurance Market Size was valued at USD 15.99 Billion in 2024 and is expected to reach USD 34.62 Billion by 2032 and grow at a CAGR of 10.1% over the forecast period 2025-2032.

Parametric insurance markets are thriving, providing fast data-triggered payouts on measurable peril episodes (like weather or disasters). It does not require a proof of loss, as does conventional insurance, so it is also lighter on the paperwork. Growing climate risk insurance and recovery urgency are driving adoption by agriculture, energy, and property. The cloud-based, hybrid, and on-premises deployment models, enhanced accessibility, with industry giants AXA, AIG, and Allianz providing tailored solutions.

To Get more information on Parametric Insurance Market - Request Free Sample Report

For example, AXA’s heatwave parametric insurance product automatically pays out if temperatures hit a certain level, benefiting those working outside. Similarly, Allianz’s parametric insurance cover for cyclone risks in vulnerable regions, also underpinned by satellite data, results in quick completion of financial payments and demonstrates how insurance innovation delivers value.

Market Size and Forecast:

-

Market Size in 2024: USD 15.99 Billion

-

Market Size by 2032: USD 34.62 Billion

-

CAGR (2025–2032): 10.1%

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Parametric Insurance Market Highlights:

-

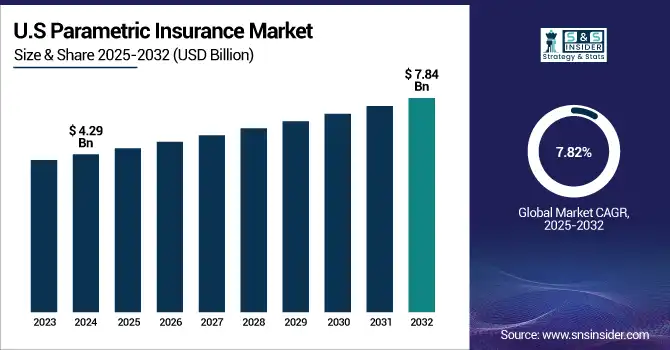

U.S. Market Leadership The U.S. parametric insurance market was valued at USD 4.29 billion in 2024 and is projected to reach USD 7.84 billion by 2032 with a CAGR of 7.82 percent

-

Technology Driven Growth Advanced tech infrastructure, insurer technology partnerships, and real time data utilization are key factors driving market expansion

-

Climate Related Demand Increasing frequency and intensity of natural disasters including hurricanes, floods, and droughts boost demand for fast, trigger based claims

-

Faster Claims Settlement Parametric insurance allows immediate payouts based on predefined triggers such as wind speed, rainfall, or temperature without traditional damage inspections

-

Market Restraints Limited awareness and understanding of parametric insurance among policyholders slows adoption and requires customer education initiatives

-

Technological Opportunities Integration of satellite data, IoT sensors, and big data analytics enables accurate trigger identification and claim processing across diverse scenarios

-

Expanded Applications Parametric insurance is extending beyond traditional sectors to renewable energy, infrastructure, and underdeveloped markets exemplified by Allianz's satellite enabled flood insurance pilot in Ghana

The U.S. Parametric Insurance Market size was USD 4.29 billion in 2024 and is expected to reach USD 7.84 billion by 2032, growing at a CAGR of 7.82% during the forecast period of 2025-2032. The U.S. leads the Parametric Insurance Market, driven by advanced tech infrastructure, high insurance adoption, and climate-related risks. Frequent natural disasters heighten demand for faster claims via parametric models. Strong insurer-tech partnerships, real-time data use, and supportive regulations further fuel growth, positioning the U.S. as a global leader in expanding parametric insurance across various sectors.

Parametric Insurance Market Drivers:

-

Rising Climate Disasters and Weather Volatility Drive Global Demand for Parametric Insurance

In the parametric insurance market growth increasingly frequent and intense climate-related events, including hurricanes, floods, and droughts, have spurred demand for faster and more robust insurance payouts. Parametric insurance provides an answer using predefined triggers wind speeds or rainfall levels, for immediate claims settlement, with no inspections of traditional damage. The impact is particularly important for disaster-prone areas, in which traditional insurance can take weeks, months, or even longer to pay out claims.

For instance, when the temperature rises above certain levels, AXA’s heatwave parametric solution in Hong Kong automatically triggers, providing compensation to outdoor workers, demonstrating again how products like this are not theoretical, but very practical.

Parametric Insurance Market Restraints:

-

Limited Awareness and Understanding of Parametric Insurance Concepts Among Policyholders Hinder Market Expansion Efforts

The benefits of parametric insurance are clear, its penetration is held back by low awareness and understanding among potential customers. Several policyholders do not understand the principle of trigger-based losses and how these are different from traditional indemnity cover. This missing information can result in skepticism, lower acceptance, or misunderstandings about the veracity or fairness of such systems. Carriers and brokers will need to spend time educating customers to understand how parametric covers operate, especially in areas/industries that are less comfortable with progressive risk transfer options.

Parametric Insurance Market Opportunities:

-

Integration of Satellite, IoT, and Big Data Analytics Offers Lucrative Expansion Opportunities for Parametric Insurance Providers

The convergence and rapid development and adoption of these technologies, including satellites, IoT sensors, and big data analytics, are opening up huge opportunities in the parametric insurance space. These technologies allow insurers to capture real-time information, establish accurate triggers, and process claims across a wide range of scenarios from failed crops to seismic activity. This capacity extends the application of parametric insurance beyond the conventional to new areas such as renewable energy and infrastructure development.

For example, Allianz’s satellite-enabled flood insurance pilot in Ghana relies on geospatial information to trigger automatic payouts, illustrating the transformative nature of tech-enabled parametric models in underdeveloped markets.

Parametric Insurance Market Segment Analysis:

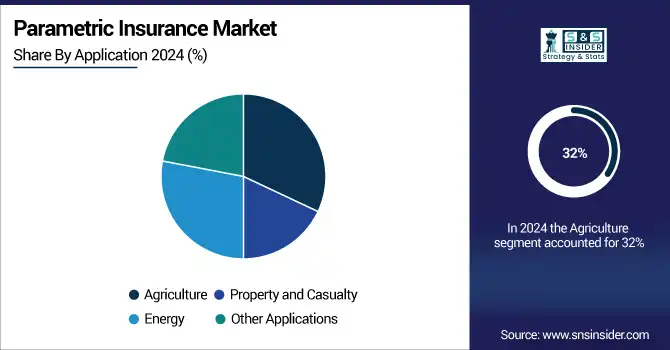

By Application

The agriculture segment held the largest revenue share of 32% in 2024, as parametric insurance provides rapid financial relief to farmers affected by drought, floods, or extreme weather. Companies like Swiss Re and the World Bank have launched index-based agricultural insurance in Africa and Asia, using rainfall or NDVI (vegetation index) triggers. These tools ensure timely payouts without the need for field assessments.

The Energy segment is growing at the highest CAGR of 11.9% during the forecast period, driven by the rising climate risk to renewable energy infrastructure. Munich Re and Lloyd’s have developed parametric wind and solar insurance to protect against low generation days or excess rainfall.

By Insurance Type

The Index-Based Insurance segment held the largest revenue share of 35% in 2024, driven by its simplicity and scalability in covering large, vulnerable populations. Companies like Swiss Re and AXA have launched innovative index-linked policies, particularly in agriculture and catastrophe-prone regions. For instance, AXA Climate's parametric agriculture cover offers index-based payouts triggered by satellite-observed data on drought and rainfall.

The Weather-Based Insurance segment is growing at the highest CAGR of 12.3% during the forecast period, fueled by increasing weather unpredictability and demand for rapid financial protection. Chubb and Munich Re have introduced customizable weather-based products using historical and forecasted data to protect businesses from climate variability.

By Deployment Mode

The Cloud-Based segment held the largest parametric insurance market share of 46% in 2024, driven by the rising demand for scalable, real-time insurance platforms. Companies such as AXA Climate and Aon are leveraging cloud-based solutions to deploy global parametric insurance schemes with real-time data analytics and automated claim triggers. This segment supports the parametric insurance market by enhancing operational agility, enabling insurers to expand coverage in climate-sensitive regions with minimal infrastructure constraints.

The On-Premise segment is growing at the highest CAGR of 12.31% during the forecast period, due to heightened security concerns and regulatory requirements in sectors such as defense, utilities, and finance. Firms like Berkshire Hathaway Specialty Insurance are investing in customized on-premise parametric platforms for sensitive data environments.

By Use Case

In 2023, the Large Enterprises segment accounted for 68% of revenue, as global corporations pursue quick and comprehensive risk transfer solutions in various regions. Aon and Swiss Re initiated parametric programs for Fortune 500 companies, addressing issues like natural disasters, supply chain interruptions, and climate-related risks. This segment propels the parametric insurance market by showcasing how large companies can navigate uncertainty with scalable, transparent, and efficient insurance models.

The SMEs segment is growing at the highest CAGR of 24.7% during the forecast period, fueled by increasing climate awareness and access to digital platforms. Startups like Skyline Partners and Arbol offer cloud-native parametric products tailored for small businesses in agriculture, tourism, and retail.

Regional Analysis

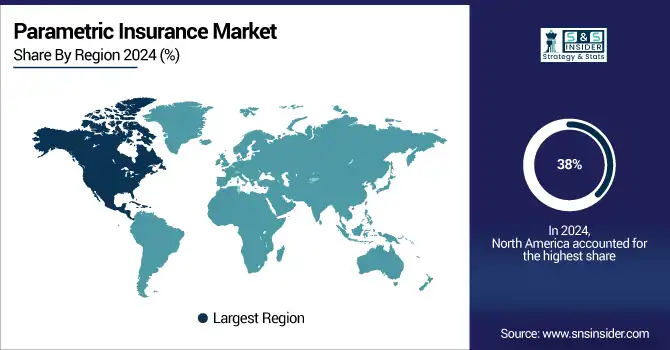

North America Parametric Insurance Market Trends:

North America is projected to account for the largest parametric insurance market share of 38% in the Parametric Insurance Market during the forecast period, with the U.S. being the leading country. The region is dominated by a very developed technology infrastructure, a high level of adoption of new insurance solutions, and increasing risk from severe weather events, including hurricanes and wildfires. U.S. insurers, including Axa and Aon, are turning to parametric products instead of traditional insurance as they cut claims-processing time and limit risk exposure, meaning that Asia is the market that's turning heads.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific Parametric Insurance Market Trends:

The Asia Pacific is expected to grow at the highest CAGR is 14.8% in the market in 2024. India, China, Japan, among other nations, have increasingly been more and more open to disruptive innovation as they find themselves more susceptible to the effects of climate change, including floods, droughts, and typhoons. India is a dominating country in the Asia Pacific Parametric Insurance Market due to its high exposure to climate-related disasters like floods and droughts. To protect rural livelihoods, the government and insurers are adopting index-based solutions for faster payouts. Initiatives such as RARM use weather and satellite data to deliver quick, data-driven compensation to affected farmers.

Europe Parametric Insurance Market Trends:

Europe is predicted to continue with substantial growth in the Market in 2024, along with added focus on offering more effective risk management solutions across agricultural, energy, and infrastructure. Germany dominates the Parametric Insurance Market due to its strong insurance ecosystem, advanced technological infrastructure, and proactive climate risk management strategies.

In march 2024, Munich Re has developed parametric products that utilize weather stations and satellite data to provide immediate payouts for events like floods or hailstorms, reducing claims processing time.

Latin America and Middle East & Africa Parametric Insurance Market Trends:

The Latin America and Middle East & Africa regions are some of those that are showing substantial growth in the Parametric Insurance Market in 2024, due to the rise in climate risks, including droughts, floods, and weather conditions. Countries such as South Africa, UAE, Brazil, and Mexico are implementing parametric insurance, and insurers such as Swiss Re, Munich Re, Aon, and Zurich are providing data-driven, rapid payout solutions for improving disaster recovery and resilience.

Parametric Insurance Market Key Players:

-

AXA

-

AIG

-

Aon

-

Berkshire Hathaway Specialty Insurance

-

Chubb

-

Marsh & McLennan

-

Munich Re

-

Swiss Re

-

Zurich Insurance Group

-

QBE Insurance Group

-

Blink Parametrics

-

Parametrix

-

Sprout AI

-

IBISA

-

Raincoat

-

Arbol

-

Kovrr

-

Weathercheck

-

Trov

-

Concirrus

Parametric Insurance Market Competitive Landscape:

-

In August 2024, AXA Hong Kong and Macau unveiled the first-to-market heatwave parametric insurance product, which protects outdoor workers against extreme heat. The policy provides payouts or heatwave kits for when temperatures reach more than 36°C for three straight days, and the process is designed to be claims automatically with triggers, and no proof of loss is necessary.

-

In September 2024, AIG has been at the lead in shaping the parametric insurance market, delivering cutting-edge options to protect against climate-related risks. The importance of parametric products in deploying rapid financial aid to disaster-hit areas and preparing for future disasters in the affected communities has been highlighted by the company.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 15.99 Billion |

| Market Size by 2032 | USD 34.62 Billion |

| CAGR | CAGR of 10.1% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Insurance Type (Index-Based Insurance, Weather-Based Insurance, Catastrophe Bonds, Other Parametric Insurance Types) • By Application (Agriculture, Property and Casualty, Energy, Other Applications) • By Deployment Model (Cloud-Based, On-Premise, Hybrid) • By Use Case (Risk Mitigation, Index Tracking, Catastrophe Response, Other Use Cases) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AXA, Munich Re, AIG, Allianz, Berkshire Hathaway Specialty Insurance, Chubb, Lloyd's of London, Swiss Re, Zurich Insurance Group, QBE Insurance Group, Blink Parametrics, Parametrix, Sprout AI, IBISA, Raincoat, Arbol, Kovrr, Weathercheck, Trov, Concirrus |