Forensic Genomics Market Report Scope & Overview:

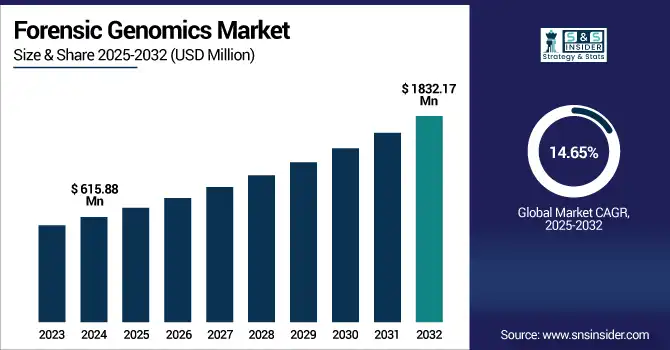

The forensic genomics market size was valued at USD 615.88 million in 2024 and is expected to reach USD 1832.17 million by 2032, growing at a CAGR of 14.65% over the forecast period of 2025-2032.

To Get more information on Forensic Genomics Market - Request Free Sample Report

The global forensic genomics market is growing rapidly due to increasing demand for advanced DNA analysis in forensic, disaster victim identification, and kinship testing. Growing acceptance of next-generation sequencing (NGS), rapid DNA techniques, and STR analysis is advancing analytical efficiency within the forensic process. Rising funding by the government in forensic infrastructure, development of national DNA databases, and legal acceptance of genomics in evidence are driving the global market growth across law enforcement agencies, private labs, and global judiciary platforms.

The U.S. forensic genomics market size was valued at USD 225.50 million in 2024 and is expected to reach USD 656.45 million by 2032, growing at a CAGR of 14.34% over the forecast period of 2025-2032.

The U.S. holds the largest share of the North American forensic genomics market due to its large DNA databases, such as CODIS, robust federal funding of forensic science, and high adoption of advanced technologies including NGS and rapid DNA systems. Its leadership role in the region is also due to the availability of leading market players and accredited forensic laboratories.

Forensic Genomics Market Dynamics:

Drivers

-

High Crime Rates and Need for DNA-Based Criminal Investigation are in Turn Driving the Market Growth

The serious crime rates are increasing globally, especially in crimes, such as murder, rape, or burglary. Forensic agencies are adopting DNA-based tools for accurate suspect identification and evidence matching, opposing the traditional paradigm. Conventional forensic techniques can fail when the evidence is inconclusive and the case has gone cold. Forensic genomics, particularly STR typing and rapid DNA profiling, provides unrivalled evidential discrimination and has revolutionized modern criminal investigation. Such growing dependence on DNA evidence has raised the requirements for genomic tools and technologies in the forensic labs of various countries globally.

INTERPOL states that DNA fingerprinting is a key weapon deployed in more than 190 countries to fight transnational crime and help identify victims and suspects in criminal investigations.

For instance, as of 2024, the CODIS database (Combined DNA Index System), managed by the U.S. Dept of Justice (DOJ), has generated more than 20 million offender profiles, and the DNA data has helped resolve more than 600,000 investigations, indicating a burgeoning necessity for DNA-enabled forensic tools.

-

Increasing Technological Advancements in Genomic Analysis are Boosting the Market

The field of forensic genomics has developed rapidly as a result of the explosion of the technical and technological landscapes, including next-generation sequencing (NGS), digital PCR, and AI-based bioinformatics platforms. Such innovations enable forensic investigation of incomplete, low-quality, or degraded samples, prediction of phenotypes, such as eye or hair color, and inference of descent based on trace evidence. In addition, laboratory workflow has been made more efficient through automation and software integration, which has reduced turnaround time and increased rates of case resolution. These tools are becoming increasingly powerful, and, accordingly, they are being adopted more and more by public and private forensic laboratories, fueling the forensic genomics market growth.

According to ScienceDirect (2024), the use of next-generation sequencing (NGS) in forensic science is likely to become more common due to it can work with degraded DNA and low-copy number DNA, including in cases and disaster victim identification.

In May 2024, QIAGEN unveiled a CRADA (Cooperative Research and Development Agreement) with the U.S. Federal Bureau of Investigation (FBI) to develop a new test with QIAcuity digital PCR technology that would enhance the quantification of DNA in the forensic workflow.

Forensic genomics is now relying more and more on artificial intelligence (AI) assisted software to reduce analyst bias and automate the interpretation of complex DNA mixtures or predicting kinship, and thereby, improve the resolution of cases, as reported in Nature Genetics.

Restraints:

-

Expensive Nature of Advanced Genomic Technologies is Restraining the Market from Growing

The establishment of forensic genomics (FG) type of technologies, such as NGS, rapid DNA analysis, and digital PCR, was financially demanding. The latter technologies rely on expensive devices, expensive reagents, and complex software for data analysis. Beyond the initial capital expense, labs also have to factor in maintenance, quality control, and ongoing software upgrades, which further increase the total cost of ownership.

This type of financial constraint is especially relevant to small and underfunded forensic labs, especially those in developing countries, where the forensic infrastructure is still developing. Consequently, the expense prevents wide use of forensic genomics, holds back forensic services modernization, and confines implementation of advanced genomic tools to expensive laboratories at well-endowed institutions or government-run labs.

Forensic Genomics Market Segmentation Analysis:

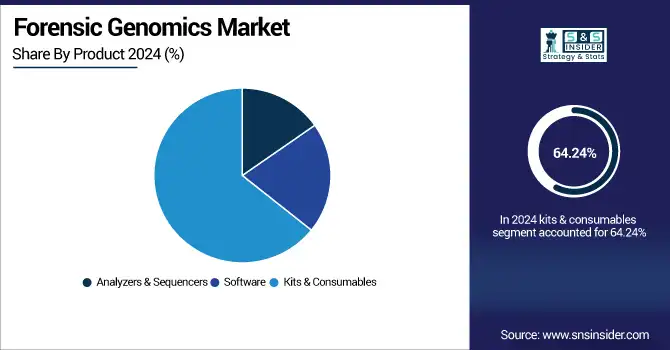

By Product

The kits & consumables segment dominated the forensic genomics market share in 2024 with a 64.24% as it plays an important role in DNA extraction, amplification, and profiling workflows, and as a result, accounts for the largest share of the forensic genomics market. These items are essential for routine forensic, STR, PCR, and next-generation sequencing applications. The need is particularly acute at government and private labs processing a high volume of samples, since many of the kits are made to be highly accurate, efficient, and to work with a range of instruments. Their continued, widespread use in several testing procedures has resulted in a steady stream of revenue and ensured their market dominance.

The software segment is expected to grow at the highest CAGR during the forecast period, owing to the growing demand for sophisticated bioinformatics solutions, automated data interpretation, and AI-driven analysis in the field of forensic genomics. DNA analysis is getting more complicated with high-throughput NGS techniques, and forensic labs increasingly need advanced software tools to handle large amounts of data, boost result accuracy, and produce streamlined evidence reports. Moreover, increased uptake of cloud-based solutions and integrated LIMS (laboratory information management systems) is promoting the deployment of software-based solutions in both public and private forensic institutions.

By Method

The capillary electrophoresis (CE) segment held the largest share of the forensic genomics market in 2024, with around 33.28%, a technology being used as the gold standard for STR (short tandem repeat) analysis, as it is accepted globally in criminal justice systems. CE has proven to be robust in the production of DNA profiles, providing precise allele separation and detection using fully validated methods. Its wide-ranging validation in law enforcement and court contexts and compatibility with national DNA databases, such as CODIS, have guaranteed its lasting prevalence in routine forensic casework.

The next-generation sequencing (NGS) is estimated to be the fastest-growing segment during the forecast period due to its ability to analyze complex and degraded DNA samples with high resolution and depth. NGS allows for the sequencing of whole genomes or of specific areas, and can provide general information, such as STR and SNP markers, and ancestry markers. Rising applications in cold case analysis, disaster victim identification, and phenotype prediction are promoting deployment in advanced forensic laboratories. Decreasing the costs for sequencing and the availability of bioinformatics provide impetus to move NGS as a standard technique into forensic environments.

By Application

The criminal testing segment dominated the forensic genomics market share in 2024, with around 67.4% owing to police putting much store by DNA profiling in cases that span the gamut from violent crime to property crime globally. Applying established methods, such as STR analysis and capillary electrophoresis, and using very large national databases (such as CODIS), criminal testing has been the most pervasive aspect of forensic genomics. Government support, the judiciary’s embrace of DNA science, and the institutionalization of forensic genomics in criminal justice systems all serve to consolidate the influence of this sector.

The paternity & kinship testing segment is expected to witness the fastest growth during the forecast period due to increasing demand for family relationship testing for legal, immigration, and personal identification purposes. Growing awareness of DNA-based identity resolution, along with the ease of access to affordable genomic services provided by private labs and online platforms, is helping to drive this trend. Advances of next-generation sequencing and SNP-based genotyping have permitted more accurate kinship testing related to extended scenarios, inheritance, custody, and forensic casework for a wider range of applications. Its increasing significance on a legal and consumer level is spearheading growth in the sector.

By End-User

The law enforcement agencies segment accounted for the largest share of the forensic genomics market in 2024 due to the typical users of genomic techniques, including short tandem repeat analysis, polymerase chain reaction, and rapid DNA tests to match suspects to crimes and connect evidence across jurisdictions. Governments are spending extensively on forensic capacity building for law enforcement and related infrastructure, laboratory accreditation, and integration with the national DNA databases, such as CODIS, thus reinforcing their position where in-licensing continues to dominate the market.

The private DNA testing companies segment is expected to be the fastest-growing segment during the forecast period, due to increasing consumer interest in relationship tests, tests for ancestry tracing, and personal identification. Similarly, immigration verification, paternity disputes, and missing persons resolution are being outsourced to accredited private labs, as the labs tend to be able to turn things around faster and possess more and better technology than state and local crime labs. Online platforms and direct home testing kits are also making DNA testing accessible by maintaining double-digit growth in this segment outside of traditional forensics.

Forensic Genomics Market Regional Insights:

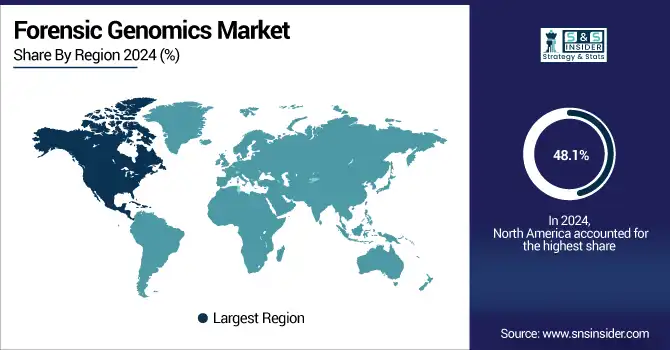

North America dominated the forensic genomics market trend with a 48.1% market share in 2024 on account of the mature forensic structure, robust law enforcement system, and the adoption of genomic technologies such as STR analysis, rapid DNA testing, and next-generation sequencing (NGS) at an early stage in the region. The region has established forensic genomics companies, including Thermo Fisher Scientific, Promega, and Illumina, which already work hand in hand with the U.S. federal agencies, such as the FBI. Entities such as CODIS, supported by continuous public financial investment, have allowed the U.S. to create one of the largest forensic DNA databases globally, maintaining its competitive advantage.

The Asia Pacific region is a high-growth region in the forensic genomics market analysis due to growing investments in public safety, strengthening of forensic infrastructure, and growing criminal cases. A growing number of government crime labs in China, India, and Japan are being equipped with NGS & PCR technologies to modernize their forensic capabilities. The increasing presence of DNA-based evidence in judicial cases, and greater demand for disaster victim identification and human trafficking investigations is driving the uptake. The region’s burgeoning population and its increasing digitization of public security will likely continue to drive its growth over the forecast years.

The forensic genomics market in Europe is growing at a significant pace, as countries in the region have strong support from the government and regulatory bodies towards the adoption of innovative DNA testing technologies, along with the modernization of national forensic policies. Nations including the U.K., Germany, and France are bolstering their DNA databases, while driving demand for next-generation sequencing (NGS) and rapid DNA systems to meet their needs in criminal investigations and border protection. Initiatives between forensic laboratories, police forces, and universities throughout the EU are stimulating research and standardization. Furthermore, increasing requirements for cross-border criminal identification and the adoption of GDPR and forensic data-sharing guidelines are also propelling the market expansion in the region.

Latin America and the Middle East & Africa (MEA) demonstrate moderate growth of the forensic genomics market analysis, owing to the slow rise concerted to leverage forensic infrastructure and a rise in focus of the government on the reform of the criminal justice system. In Latin America, countries are making significant investments in DNA profiling to fight organized crime and help with missing persons investigations, but budget shortages and a lack of lab space are still hindering the spread.

In the MEA, South Africa, and the UAE are driving the demand for forensic genomics, owing to a few government projects and partnerships with international tech providers. The market growth in general is kept in check by issues, such as restricted access to technology or shortage of talent, or the fact that regulatory frameworks remain disjointed.

Get Customized Report as per Your Business Requirement - Enquiry Now

Forensic Genomics Market Key Players:

The forensic genomics market companies are Thermo Fisher Scientific, QIAGEN, Promega Corporation, Verogen, Illumina, Eurofins Scientific, Agilent Technologies, GE Healthcare Life Sciences, NEOGEN Corporation, Bio-Rad Laboratories, NicheVision Forensics, IntegenX, DNAScan, Forensic Genomics Consortium Netherlands, Genemarkers, InnoGenomics Technologies, STRmix, Parabon NanoLabs, Gene by Gene, Sirchie, and other players.

Recent Developments in the Forensic Genomics Market:

-

May 2024 – QIAGEN Frankfurt Prime Standard (QIA) announced a Cooperative Research and Development Agreement (CRADA) with the U.S. Federal Bureau of Investigation (FBI) to jointly develop a new DNA quantification test optimally tailored for the company's QIAcuity digital PCR systems. The partnership is designed to improve forensic capabilities by allowing more accurate quantification of human DNA in difficult forensic samples.

-

May 2024 – Promega Corporation launched the PowerPlex 18E System in forensic laboratories across Europe. Its cutting-edge eight-color STR (short tandem repeat) chemistry enables labs to recover more detailed genetic profiles from problem or degraded forensic samples, enhancing the effectiveness and accuracy of DNA testing in problematic casework.

Forensic Genomics Market Report Scope:

Report Attributes Details Market Size in 2024 USD 615.88 million Market Size by 2032 USD 1832.17 million CAGR CAGR of 14.65% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Product (Analyzers & Sequencers, Software, Kits & Consumables)

• By Method (Capillary Electrophoresis, Next-Generation Sequencing, PCR Amplification, Polymerase Chain Reaction (PCR), Microarray, Rapid DNA Analysis, STR (Short Tandem Repeat) Analysis, Mitochondrial DNA Analysis)

• By Application (Criminal Testing, Missing Persons Identification, Disaster Victim Identification (DVI), Paternity & Kinship Testing, Military DNA Database Management, Human Trafficking & Abuse Case Resolution)

• By End User (Law Enforcement Agencies, Forensic Laboratories, Academic & Research Institutions, Government Agencies, Private DNA Testing Companies)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles The forensic genomics market companies are Thermo Fisher Scientific, QIAGEN, Promega Corporation, Verogen, Illumina, Eurofins Scientific, Agilent Technologies, GE Healthcare Life Sciences, NEOGEN Corporation, Bio-Rad Laboratories, NicheVision Forensics, IntegenX, DNAScan, Forensic Genomics Consortium Netherlands, Genemarkers, InnoGenomics Technologies, STRmix, Parabon NanoLabs, Gene by Gene, Sirchie, and other players.