Hot Melt Adhesives (HMA) Market Report Scope & Overview:

The Hot Melt Adhesives (HMA) Market was valued at USD 8.44 billion in 2023 and is expected to reach USD 12.10 Billion by 2032, growing at a CAGR of 4.11 % over the forecast period 2024-2032. Rising demand within varied verticals including packaging, electronics, automobile, and pressure-sensitive products drives HMA market expansion. This growth can be largely attributed to the large use of HMAs in the packaging sector for carton sealing, labeling, and flexible packaging. Growing online shopping and online retail are driving the need for cost-effective, durable, and fast-bonding adhesives, boosting the market further. Apart from this, HMAs provide benefits like a fast cure period, flexibility, and very low Volatile Organic Compounds (VOCs) emissions, making it an environment-friendly and efficient alternative over traditional adhesives. Worldwide consumption of HMAs was +3 million tonnes in 2023 with 30-35% in packaging. 60% of HMA demand comes from e-commerce, with the automotive sector growing at 5-7% annually The HMAs have proven to cut VOC emissions by as much as 95%, cure in 1-2 seconds, and provide over a 20% savings in production costs.

Get E-PDF Sample Report on Flat Steel Market - Request Sample Report

Market growth is also driven by the increasing usage of HMAs in pressure-sensitive applications, such as tapes, labels, and medical products. Growing demand for lightweight high-strength adhesives, particularly in the automotive and electronics industries, is driving advances in product performance and durability. Novel formulations such as amorphous poly-alpha-olefin (AMOP) and metallocene polyolefins (MPO) have further enhanced thermal properties, flexibility, and adhesion force for targeted applications. Furthermore, increasing sustainable and bio-based adhesives interest leads to innovation as manufacturers now need to tackle sustainability concerns while adhering to the tough regulatory standards, which opens up even more opportunities for the market. Packaging accounted for 28% of the global PSA market in 2023, while medical products accounted for another 6%. The global adhesive ended demand was driven by the automotive industry which accounted for greater than 30% of the demand at 92 million vehicle productions. The adhesive demand from the electronics sector increased by 15% between 2022 and 2023, and growing trends towards the use of HMAs remain a part of this increase of durable adhesive and fast-curing properties present in HMAs.

Hot Melt Adhesives (HMA) Market Dynamics:

KEY DRIVERS

- Automation and Lightweight Materials Drive Hot Melt Adhesive Growth in Automotive Furniture and Medical Applications

HMA Market is poised to grow as innovation in automated manufacturing processes and increasing demand for lightweight materials from various industries. Due to the increasing adoption of automation for production lines such as automotive, furniture, textiles, etc., demand for fast, reliable, and efficient bonding adhesives is increasing. HMAs can fill this gap owing to their rapid curing time and simple application enabling manufacturers to achieve optimized production rates with no sacrifice in quality. Moreover, HMAs can be used with automated dispensing systems for unwanted accuracy and low material wastage which is very important for a high-volume production industry. The trend toward automation improves overall efficiency and cost-effectiveness leading to increased penetration of hot melt adhesives. Compared to conventional solvent-based adhesives, HMAs cut down material waste by 20% or more. More than 60% of production lines in sectors such as automotive, electronics, and furniture will be automated and supported by HMAs featuring fast, efficient bonding, through 2024. Also, the medical adhesives market is accounted by HMAs ranging between 25-30% that have contributed to the growth of demand for medical adhesives over the forecast period attributed to their application for non-invasive and skin-friendly applications such as wound care and medical devices.

- Renewable Energy and Sustainable Construction Drive Hot Melt Adhesive Growth in Solar and Green Building Markets

A major factor contributing to this market growth is the rapid growth of the renewable energy and sustainable construction sectors. With the shift of the construction industry towards green and energy-efficient buildings, HMAs have been utilized for insulation products, flooring systems, and window assembly. These qualities, along with the ability to form durable weather-resistant bonds, make them valuable in modern construction solutions. The same goes for the renewable energy field, especially the solar energy field, which is experiencing significant amounts of growth. Hot melt adhesives are widely used in the assembly of solar panels, particularly for their performance of high bonding strength and resistance to environmental factors. In addition to the environmental benefits of such adhesives in manufacturing processes, the increasing growth of the eco-friendly consumer and government product market has propelled manufacturers to develop bio-based hot melt adhesives. The seamless recommendation of these developments in line with overall sustainability goals globally and environmental concerns is also expected to accelerate market growth. The world's renewable energy capacity passed the 3,400 GW mark in 2023, with more than a third of this comprising solar energy. Approximately 250 GW of solar panels were installed, which drove the growth of hot melt adhesives (for bonding and weather resistance). Global energy consumption and CO2 emissions are rising, but the construction sector has begun to transition toward energy-efficient buildings, employing HMAs in insulation, flooring, and window systems. In 2023, adhesives based on renewable sources were only responsible for 15% of the total HMA market, so they are considered bio-based HMAs.

RESTRAIN

- Challenges in HMA Adoption Heat Sensitivity Raw Material Price Fluctuations and Sustainability Concerns Impact Growth

Hold temperatures are one of the main problems faced due to the temperature resistance limitation of HMAs. They lose their adhesion upon exposure to high temperatures which makes them unsuitable for high thermal stability applications such as those found in aerospace or heavy industrial settings. However, this limited their adoption of heat-sensitive applications and also reduced their competitiveness versus other adhesive technologies such as epoxies or solvent-based adhesives. The second and another one of the crucial problems is a change in the price of raw materials. HMAs are mainly made from petroleum-based products, including ethylene-vinyl acetate (EVA) and polyolefins. Crude oil price variation causes production cost fluctuations, leading to price instability and profit margin pressure on producers. Moreover, the need for sustainability, tied together with the regulatory concerns regarding ecological implications of petroleum-based adhesives along with the rise in R&D investments for developing sustainable alternatives add to the cost and time spent towards the said approach.

Hot Melt Adhesives (HMA) Market Segments:

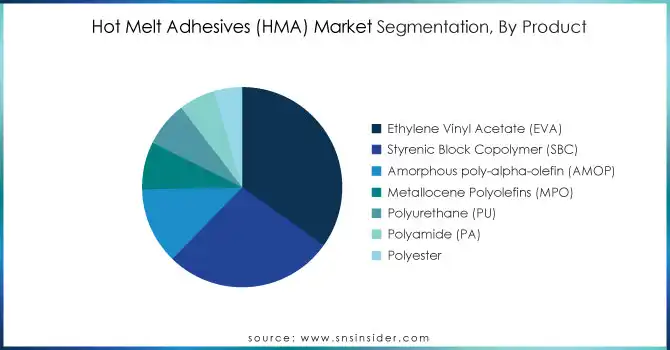

BY PRODUCT

In 2023, Ethylene Vinyl Acetate (EVA) accounted for the largest share of 34.8% of the Hot Melt Adhesives (HMA) Market share and is a preferred choice of hot melt adhesive owing to its versatility, price-performance relation, and broad-based application in key industries including packaging, footwear and automotive among others. Packaging applications consume a large share of the market and, therefore, EVA-based adhesives are preferred for use here. These features make it ideal for carton sealing, labeling, and flexible packaging due to its wide applicability in several different industries as a result of rapid growth in e-commerce and other retail sectors thanks to excellent flexibility, adhesion, and compatibility with an array of substrates. Additionally, EVA being less costly than other forms of adhesive attracts many price-sensitive sectors & industries to manufacture on a mass scale.

Amorphous Poly-Alpha-Olefin (AMOP) will grow at a significant CAGR during 2024-2032 owing to its advantages like superior thermal stability excellent adhesion, and resistance against moisture and chemicals. Moreover, these properties make it well-suited for rapid growth in specialized and high-performance applications such as automotive, electronics, and construction sectors. AMOP-based adhesives are also gaining traction as they generate low odor and very low VOC emissions, thus catering to rising environmental concerns and stringent regulatory standards. With the gradual shift of industries towards sustainable and high-performance adhesive solutions, AMOP will become the preferred adhesive, which in turn brings up the demand for AMOP during the period of forecast.

BY APPLICATION

In 2023, packaging accounted for 39.2% hot melt adhesives (HMA) market share. This is primarily attributed to the wide adoption of HMAs in packaging applications, which comprise carton sealing, labeling, and food packaging. With quick-drying characteristics, they excel in bond strength, durability, and packaging speed which makes HMAs suitable for high-speed packaging operations. The growth of HMAs in packaging is mainly due to the increasing demand for packaged goods, particularly in the food and beverage industry. The growing international e-commerce and retail industry fuels the demand for secure and effective packaging solutions thereby propelling the growth of the market for these adhesives.

The fastest growth in the HMA market during the period 2024 to 2032 is anticipated for pressure-sensitive products. The rising adoption of HMAs in adhesive tape, label, and sticker production processes where high-end convenience and ease of use are relevant to drive this growth. The most prevalent are modified with human mucosal antigen (HMA) because of their properties, which include the ability to bind at room temperature without requiring heat or moisture, resulting in more versatile and easier-to-apply products. Moreover, the increasing use of smart packaging, medical devices, and electronics that utilize Hot Melt Adhesives need accurate and long-lasting adhesion solutions, which in turn contributes to the strengthening demand for pressure-sensitive products.

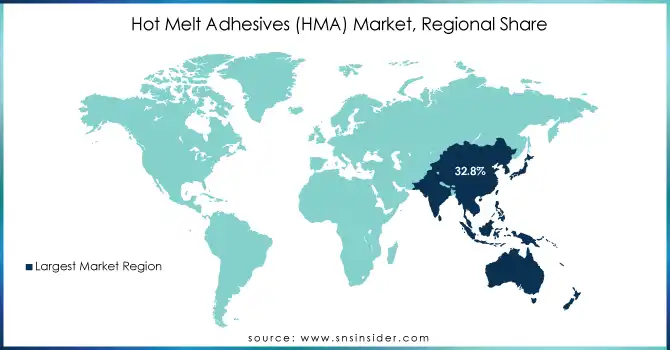

Hot Melt Adhesives (HMA) Market Regional Analysis:

The market share in 2023 was led by Asia Pacific, accounting for 32.8% of the market share in 2023, and it is anticipated to register the highest CAGR from 2024 to 2032. The surge in regional growth can be attributed to the swift industrialization, trends in urbanization, and the growth of major industries like packaging, automotive, construction, and electronics across the region. The steady growth of end-use industries such as textile, automotive, and packaging along with the increasing number of new entrants from the above-mentioned region has become key factors driving the market all around the world, especially for emerging countries such as China, India, Japan, and South Korea. This is particularly evident in China, where demand for hot melt adhesives (HMAs) in packaging applications has surged due to the e-commerce boom driven by companies such as Alibaba and JD. Full-com truck driving scarcity and the requirement for secure and efficient packaging solutions. In addition, the demand for HMAs for bonding lightweight materials and fixtures and fasteners used in interior components has been driven by the mass production of cars in China.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in the Hot Melt Adhesives (HMA) Market are:

- Henkel AG & Co. KGaA (Germany) – [Technomelt Supra PS, Loctite HHD 3544F]

- H.B. Fuller Company (USA) – [Flextra Evolution, Advantra 9274]

- Dow Chemical Company (USA) – [AFFINITY GA, MOR-FREE LPlus]

- Exxon Mobil Corporation (USA) – [Escorez 5300, Vistamaxx 8880]

- Arkema Group (France) – [Fixatti Thermobonding Adhesive Powders, Bostik Thermogrip]

- Jowat SE (Germany) – [Jowatherm-Reaktant MR 604.90, Jowatherm 280.50]

- LyondellBasell Industries (Netherlands) – [Purell PE 1810E, Lupolen 1800S]

- 3M Company (USA) – [Scotch-Weld Hot Melt Adhesive 3762, Jet-Melt Adhesive 3764]

- Bostik (France) – [Thermogrip 6363, Thermobond 8703]

- Beardow Adams (UK) – [BAMFutura 1, BAMFutura 3]

- Sika AG (Switzerland) – [Sikaflex-223, SikaMelt-9677]

- Avery Dennison (USA) – [Fasson Hot Melt Adhesive, Rapid-Roll Adhesive]

- Evans Adhesive Corporation (USA) – [QuickMelt 34-450, QuickMelt 34-500]

- Ashland Global Holdings Inc. (USA) – [Aroset 1085, Flexcryl 1625]

- Sika AG (Switzerland) – [SikaMelt-9607, SikaMelt-9677]

- Toyobo Co., Ltd. (Japan) – [Vylon UR1400, Vylon UR1800]

- Huntsman Corporation (USA) – [Araldite 2051, Araldite 2015]

- Eastman Chemical Company (USA) – [Eastotac H-100, Eastoflex E1060]

- Sinopec Limited (China) – [YH-792, YH-793]

- Adtek Malaysia Sdn Bhd (Malaysia) – [Adtek HM-165, Adtek HM-175]

Some of the Raw Material Suppliers for Hot Melt Adhesives (HMA) companies:

- Ethylene-vinyl acetate (EVA)

- Polyolefins

- Polyamides

- Polyesters

- Styrene Block Copolymers

- Polyethylene

- Ethylene-methyl acrylate (EMA)

- Ethylene n-butyl Acrylate (EnBA)

- Tackifying Resins

- Waxes

RECENT TRENDS:

- In November 2024, Packsize partnered with Henkel Adhesive Technologies to launch Eco-Pax, a bio-based adhesive that reduces carbon emissions by up to 32%. The collaboration aims to enhance sustainability in packaging production.

- In April 2024, Dow, Henkel, and Kraton teamed up to reduce the carbon footprint of Henkel’s hot melt adhesives by 25% using bio-based alternatives, supporting sustainable packaging solutions.

- In July 2023, H.B. Fuller acquired Beardow Adams, a leading global adhesive manufacturer, enhancing its innovation and market reach. This acquisition strengthens both companies’ capabilities in serving diverse industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.44 Billion |

| Market Size by 2032 | USD 12.10 Billion |

| CAGR | CAGR of 4.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ethylene Vinyl Acetate (EVA), Styrenic Block Copolymer (SBC), Amorphous poly-alpha-olefin (AMOP), Metallocene Polyolefins (MPO), Polyurethane (PU), Polyamide (PA), Polyester) • By Application (Pressure sensitive products, Packaging, Disposables, Book Binding, Furniture, Footwear, Textile, Automobiles, Electronics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, H.B. Fuller Company, Dow Chemical Company, Exxon Mobil Corporation, Arkema Group, Jowat SE, LyondellBasell Industries, 3M Company, Bostik, Beardow Adams, Sika AG, Avery Dennison, Evans Adhesive Corporation, Ashland Global Holdings Inc., Sika AG, Toyobo Co., Ltd., Huntsman Corporation, Eastman Chemical Company, Sinopec Limited, Adtek Malaysia Sdn Bhd |

| Key Drivers | • Automation and Lightweight Materials Drive Hot Melt Adhesive Growth in Automotive Furniture and Medical Applications • Renewable Energy and Sustainable Construction Drive Hot Melt Adhesive Growth in Solar and Green Building Markets |

| Restraints | • Challenges in HMA Adoption Heat Sensitivity Raw Material Price Fluctuations and Sustainability Concerns Impact Growth |