Protein Engineering Market Size & Growth Overview:

Get more information on Protein Engineering Market - Request Free Sample Report

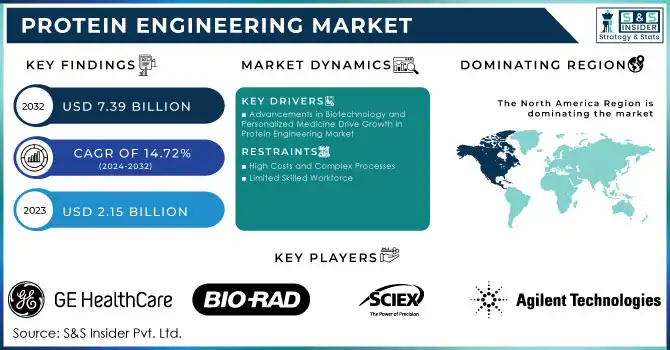

The Protein Engineering Market Size was estimated at USD 2.15 billion in 2023 and is expected to reach USD 7.39 billion by 2032 at a CAGR of 14.72% during the forecast period of 2024-2032.

Robust growth in the protein engineering market has been driven by the surging demand for customized therapeutic solutions and advanced diagnostic tools. The core driver for this growth largely lies in the advancement of biotechnological innovations that can modify proteins to enhance their functionality and stability. One of the major drivers of this growth is the increasing need for personalized medicine, and more biopharmaceuticals, including monoclonal antibodies, vaccines, and enzymes-based therapies. This technology helps in solving challenging healthcare issues that are driving this industry's demand for engineered proteins for health, agricultural, and industrial use. Yet, the market is also supported by growing investments in biotechnology research, accelerating the discovery and development of novel therapeutic proteins and diagnostics.

One of the major drivers of the protein engineering market is the rising incidence of chronic diseases such as cancer, diabetes, and autoimmune disorders, which require innovative treatment solutions. The integration of protein engineering with advanced technologies like CRISPR, quantum computing, and AI-based drug design has accelerated research and development in this space. Moreover, increased investment in biopharmaceutical R&D, particularly in areas like antibody-drug conjugates (ADCs), gene therapies, and personalized medicine, is contributing to market growth. The projections regarding the global cancer burden and diabetes prevalence are based on studies from prominent health organizations. The Global Cancer Statistics 2020 report by the American Cancer Society (ACS) and the International Agency for Research on Cancer (IARC) forecasts that the global cancer burden will reach 30 million cases by 2040, contributing to a rising demand for protein-engineered treatments. In parallel, the International Diabetes Federation (IDF) Diabetes Atlas 10th Edition (2021) estimates that the prevalence of diabetes will exceed 700 million people globally by 2045, further driving the need for engineered insulin and other protein-based therapeutics. These studies highlight the increasing healthcare burden posed by chronic diseases and emphasize the growing importance of protein engineering in addressing these global health challenges.

The pharmaceutical and healthcare industries are the primary beneficiaries of protein engineering, with engineered proteins playing a crucial role in the creation of more effective therapeutic agents. The demand for high-quality protein therapeutics, driven by the growing preference for biologics over traditional chemical drugs, is pushing the market forward. Additionally, protein engineering techniques are being widely adopted in industrial applications for enzyme development, with applications ranging from biofuels to food processing.

With advancements in high-throughput screening, computational methods, and automated systems, protein engineering has become more efficient and cost-effective. This has allowed researchers to rapidly design and test novel proteins, optimizing them for specific uses. As a result, the market is expected to continue expanding, driven by ongoing innovations and strategic collaborations across the healthcare and biotechnology sectors. Furthermore, the emergence of new applications in diagnostics, vaccine development, and regenerative medicine promises to further enhance the growth prospects of the protein engineering market in the coming years.

Protein Engineering Market Dynamics

Drivers

-

Advancements in Biotechnology and Personalized Medicine Drive Growth in Protein Engineering Market

Major growth drivers of the protein engineering market include increased demand for personalized medicine, advances in biotechnology, and increasing applications of engineered proteins in medical and industrial areas. These factors, among others, have increased the incidence of chronic diseases such as cancer, diabetes, and genetic disorders, which has driven the requirements for target therapies and, in addition, protein-based treatments. Protein engineering has thus played an important role in the development of biologics and other therapeutic proteins, making them individualized to the specific profiles of the patients and enhancing the efficacy of treatment. Cancer, the second leading cause of death globally, accounted for an estimated 10 million deaths in 2020, creating a high demand for targeted therapies, including engineered proteins. Similarly, the global diabetes population is expected to grow from 537 million in 2021 to 783 million by 2045, further driving the need for protein-based treatments. Cardiovascular diseases, responsible for 17.9 million deaths annually, and genetic disorders affecting over 30 million people in the U.S. also amplify the need for personalized protein therapies, boosting market growth.

Innovations in gene editing tool technologies, including CRISPR-Cas9, have greatly improved the efficiency and precision of protein design methods related to computational developments. Enhanced stability, activity, and specificity in designed proteins significantly increase their efficacy in drug development, diagnostics, and industrial applications.

-

Increasing Demand for Targeted Therapies and Industrial Applications Fuel Market Expansion

Increased utilization of engineered proteins in the food and beverage industry for flavoring and in agriculture for increasing crop yield, resistance towards diseases, and other factors further boost the market growth. Increased investment in biopharmaceutical research, with greater interest in synthetic biology, act as added major contributors to the market of protein engineering. This market is also supported by rising investment in biotechnology start-ups and research centers, as it forces innovation and extends the scope of protein engineering applications into a vast number of sectors.

Restraints

-

High Costs and Complex Processes

-

Limited Skilled Workforce

Protein Engineering Market Segmentation Overview

By Product & Service

The Consumables segment led the protein engineering market in 2023, accounting for approximately 45.0% of the market. This dominance is driven by the essential role consumables play in protein engineering workflows, from reagents and buffers to specialized kits for protein labeling and modification. Consumables are in constant demand due to their critical application in routine and repetitive processes, particularly in research and biopharmaceutical labs. This demand is further heightened by increasing biopharma investments in R&D and the continuous growth of the life sciences sector, which relies heavily on consumables for protein characterization and optimization.

The Software & Services segment is anticipated to grow at the fastest rate over the forecast period. The increasing reliance on computational tools for protein modeling and engineering, as well as the demand for outsourced protein engineering services, is driving this segment’s growth. The adoption of AI and machine learning-based software for rational protein design and analysis allows companies to accelerate the design process and improve protein stability and function prediction, positioning software and services as a vital segment with substantial growth potential.

By Technology

Rational Protein Design held the dominant share, approximately 60.0% of the market in 2023, due to its structured approach to protein modification, where researchers use computational methods to predict changes in protein function and stability. This technology allows for targeted protein design, which is essential for drug discovery and therapeutic development. The focus on precision medicine and increased investment in biopharmaceutical R&D significantly support this segment's growth, as rational design aligns with the industry's need for tailored therapeutic proteins and enzyme engineering.

Irrational Protein Design is projected to be the fastest-growing segment in the coming years. This approach, which involves creating large libraries of protein variants followed by high-throughput screening, is gaining popularity due to advancements in directed evolution techniques. These techniques, which do not require prior knowledge of protein structure, enable the development of proteins with new or enhanced functions. The rapid expansion of synthetic biology and the growing use of directed evolution in biotech and pharmaceutical applications make irrational protein design a critical growth area in protein engineering.

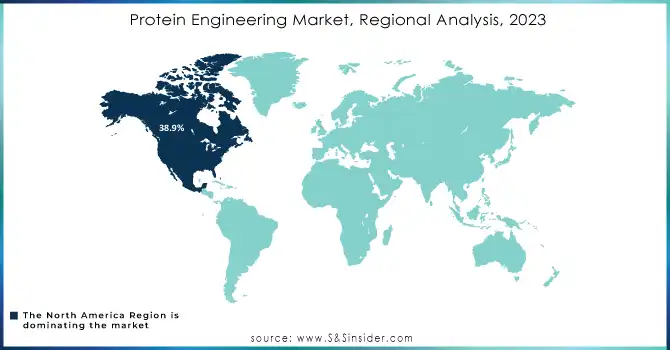

Protein Engineering Market Regional Analysis

The North American region dominated the protein engineering market, holding a 38.9% market share in 2023, primarily due to its advanced healthcare infrastructure, substantial research funding, and the presence of major biopharmaceutical players. The U.S. is a key contributor to this dominance, driven by the increasing demand for biologics, personalized medicine, and protein-based therapeutics to treat chronic diseases like cancer and diabetes. The high prevalence of these conditions, coupled with strong government support through agencies like the National Institutes of Health (NIH), has significantly boosted research and development in protein engineering. Moreover, numerous strategic collaborations, such as those between biotech firms and academic institutions, are fostering innovation in protein design, further solidifying North America's leadership in this space.

Europe is another in the protein engineering market, with countries like Germany, the U.K., and Switzerland leading the charge in biotech advancements. The region benefits from well-established healthcare systems, substantial funding for medical research, and a growing focus on biologics. The European Union's Horizon 2020 program has also supported numerous initiatives, contributing to the expansion of protein engineering applications.

The Asia-Pacific region is expected to witness the fastest growth, primarily due to the rapid economic development of countries like China and India. The increasing prevalence of chronic diseases, combined with significant investments in healthcare infrastructure and research, is driving the demand for protein engineering solutions. China, in particular, leads in protein engineering R&D, with substantial government and private sector funding propelling innovations in drug discovery and therapeutic applications.

Need any customization research on Protein Engineering Market - Enquiry Now

Key Players in Protein Engineering Market

-

Agilent Technologies: BioTek Instruments, Automated Capillary Electrophoresis Systems, 1260 Infinity II LC System

-

AB Sciex: TripleTOF Systems, QTRAP Mass Spectrometers, ZenoTOF 7600 System

-

Bio-Rad Laboratories: PROTEAN i12 IEF System, ChemiDoc Imaging Systems, NGC Chromatography Systems

-

Bruker Cor.: MALDI Biotyper, ProteinScape Software, BioTools for Structural Biology

-

GE Healthcare: ÄKTA Protein Purification Systems, Biacore Surface Plasmon Resonance (SPR) Systems, Amersham Typhoon Imaging Systems

-

PerkinElmer, Inc.: LabChip GXII Touch Protein Characterization System, NexION ICP-MS Systems, EnVision Multimode Plate Reader

-

Sigma-Aldrich Corp.: CRISPR/Cas9 Genome Editing, Proteomics Reagents, Gene Editing Kits

-

Thermo Fisher Scientific: Orbitrap Mass Spectrometers, Pierce Protein Assays, NanoDrop Spectrophotometers

-

Waters Corp.: ACQUITY UPLC System, Synapt G2-Si Mass Spectrometer, Xevo TQ-S Micro Triple Quadrupole

-

Merck KGaA: CRISPR & CRISPRi Tools, Recombinant Proteins, Protein Expression Kits

-

Danaher Corp.: Cytiva ÄKTA Pure, Pall Protein Characterization Solutions, Leica SP8 Confocal Microscopes

-

Genscript Biotech Corp.: Gene Synthesis, Protein Expression and Purification Services, CRISPR Libraries

-

Amgen, Inc.: Recombinant Protein Therapeutics, Biologics Portfolio, Custom Protein Engineering Services

Recent Developments

-

In January 2024, Agilent Technologies Inc. introduced an advanced automated parallel capillary electrophoresis system specifically designed for streamlined protein analysis.

-

In April 2024, the Northpond-backed Laboratory for Bioengineering Research and Innovation partnered with the Wyss Institute for the AmnioX project, funding research to advance protein-based drug development and enhance patient access to new treatments.

-

In June 2023, Astellas Pharma entered a collaborative research agreement with Cullgen to drive the discovery of innovative protein degraders.

-

In March 2023, NVIDIA expanded its generative AI cloud services, enabling customized AI foundation models to accelerate the development of novel proteins and therapeutic solutions.

-

In March 2023, Arzeda formed a collaboration with Takeda, utilizing AI-powered protein design technology to optimize protein biologics, which is anticipated to accelerate the development of therapeutic proteins and related products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.15 Billion |

| Market Size by 2032 | US$ 7.39 Billion |

| CAGR | CAGR of 14.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product & Service (Instruments, Consumables, Software & Services) •By Technology (Rational Protein Design, Irrational Protein Design) •By Protein Type (Monoclonal Antibodies, Erythropoietin, Interferons, Vaccines, Colony-stimulating Factors, Growth Hormones, Coagulation Factors, Other Proteins) •By End User (Biopharmaceutical Companies, Contract Research Organizations, Academic Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agilent Technologies, AB Sciex, Bio-Rad Laboratories, Inc., Bruker Corporation, GE Healthcare, PerkinElmer, Inc., Sigma-Aldrich Corp., Thermo Fisher Scientific, Waters Corp., Merck KGaA, Danaher Corp., Genscript Biotech Corp., Amgen, Inc. |

| Key Drivers | • Advancements in Biotechnology and Personalized Medicine Drive Growth in Protein Engineering Market • Increasing Demand for Targeted Therapies and Industrial Applications Fuel Market Expansion |

| Restraints | • High Costs and Complex Processes • Limited Skilled Workforce |