Healthcare E-Learning Services Market Report Scope & Overview:

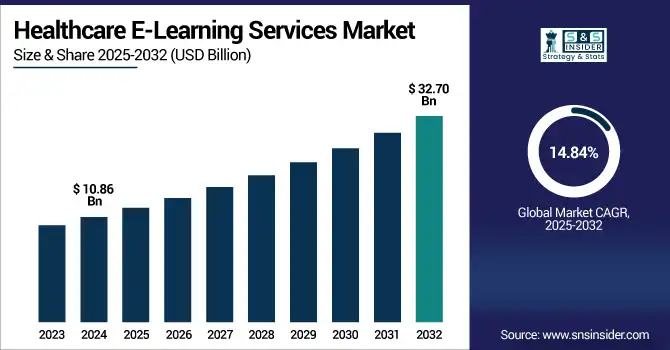

The Healthcare E-Learning Services Market size was valued at USD 10.86 billion in 2024 and is expected to reach USD 32.70 billion by 2032, growing at a CAGR of 14.84% over the forecast period of 2025-2032.

To Get more information on Healthcare E-Learning Services Market - Request Free Sample Report

The increasing demand for continuous medical education, the digital transformation in the healthcare industry, and the need for upskilling healthcare professionals and providers with the changing clinical protocols are expected to drive the growth of the global healthcare e-learning services market during the forecast period. Increasing utilization of AI-based learning platforms, increasing demand for simulation-based training, and increasing penetration of mobile learning in remote areas are some other factors driving market growth. Moreover, support from government and institutions for the online medical courses has further helped the market penetration globally, along with hospitals, pharma firms, and academic institutes.

The U.S. healthcare e-learning services market size was valued at USD 4.41 billion in 2024 and is expected to reach USD 12.96 billion by 2032, growing at a CAGR of 14.51% over the forecast period of 2025-2032.

The U.S. dominated the North American healthcare e-learning services market growth, as it adopts digital health technology (such as telemedicine and telehealth), has a well-developed IT infrastructure, and a presence of leading e-learning companies in the region. State CME requirements also help ensure the power.

Healthcare E-Learning Services Market Dynamics:

Drivers:

- Developments in E-Learning Tools are Encouraging Market Growth

The rising speed of digital education tools is driving the healthcare e-learning service market. It is possible with tools, such as learning management systems (LMS) that enable scheduled course delivery, progress monitoring, and regulation dissemination. At the same time, AI-driven personalization tailors learning paths around a user’s role, performance, and preferences. Similarly, AR/VR-based simulations are improving practical training by simulating real-world clinical situations, particularly for surgical procedures and emergency management. Such technologies provide interactive and scalable learning and client outcomes, thereby driving the uptake among healthcare establishments.

Adoption of LMS, AI, mobile health, and AR/VR tools in medical education has been rapidly accelerated, with general implementation trending from moderate to high, since the rise of COVID‑prompted digital transformation in healthcare training, according to a narrative review published in JMIR.

Recent reviews demonstrate that immersive VR simulations have been implemented in nursing and clinical education, resulting in better technical performance and safer and more engaging skills practice.

- Increasing Regulatory Compliance and Accreditation Requirements Drive the Growth of the Healthcare E-Learning Services Market

Healthcare institutions wishing to embed such features have to adhere to stringent guidelines surrounding patient safety, data privacy, and clinical ethics prescribed by bodies such as HIPAA, JCI, and the local health ministry. E-learning systems are now commonly applied to deliver standard compliance training to staff members who are required to comply with legislation or policy. These modules provide repeatable, auditable, and time-stamped training records - critical during audits and inspections. Its capacity to quickly change and disseminate new content on compliance in large areas helps e-learning stay ahead of traditional classroom setups.

According to the Brandon Hall Group, guided compliance training through e‑learning can cut employee training time by 40%–60% and boost retention by up to 60% versus traditional, in-person methods.

Medical organizations value digital compliance training more and more for audit preparedness and consistent language and knowledge distribution among staff members at large volumes, with better systems tracking and reporting power behind it all.

News coverage underscores compliance training’s relevance to healthcare as regulations such as HIPAA and CMS mandates evolve, e‑learning offers an effective way to quickly upskill and mitigate risk.

Restraints:

- Underdeveloped Digital Infrastructure in Developing Regions is an Obstacle to Market Growth

Lack of infrastructure in digital Inadequacies in digital infrastructure poses a significant challenge in the market for healthcare e-learning services across the emerging and underdeveloped economies. Most healthcare organizations in the affected regions have inferior internet connectivity, and lack of access to digital devices (computers and tablets), unreliable electricity, and an overall IT support staff shortage. But many can't even get pushed off the starting block, as they lack an adequate infrastructure just to stand up and sustain e-learning platforms, and are challenged to implement or scale digital learning initiatives.

This digital divide places boundaries on access to the most current clinical information and training, creating a wide skills gap between healthcare workers in high-income countries and those in LMCs, effectively inhibiting global efforts toward more equitable medical education.

Healthcare E-Learning Services Market Segmentation Insights:

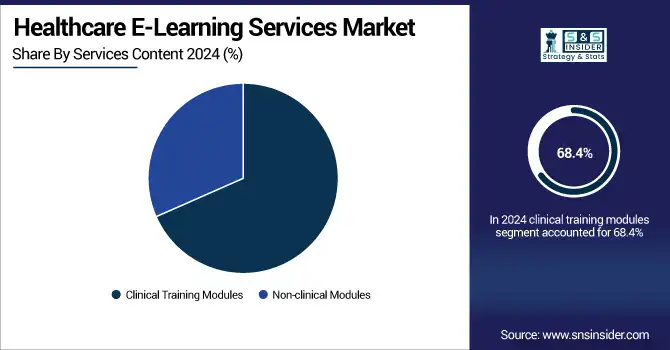

By Services Content

The clinical training modules segment dominated the healthcare e-learning services market share of 68.4% in 2024 as a result of the rising demand for ongoing clinical training among medical professionals. This is a requirement of the pace at which medical procedures, treatment guidelines, and regulation protocols evolve, and the need for professionals to maintain their expertise. Hospitals, universities, and medical societies rely on digital formats to provide standardized and accredited clinical training effectively. Simulations, case-based learning, and live assessment in combination have made clinical modules very popular among in-service practitioners and students.

The non-clinical modules segment is anticipated to grow at a significant CAGR during the projection period due to the increase has been fueled by growing demand for training that covers topics, such as healthcare administration, compliance, soft skills, data privacy, and cybersecurity. With healthcare organizations continuing to go digital amid increased regulatory oversight, there is a more profound need for more and more non-clinical staff to be trained with the necessary skills. Furthermore, the increase in demand for upskilling of workers and improvement in patient experience is further expected to fuel the growth of this segment.

By Delivery Mode

The self-paced learning dominated the healthcare e-learning services market share of 36.5% in 2024 as it is flexible, convenient, and cost-effective. Healthcare workers typically have time constraints and shift work schedules that create difficulty in attending live sessions. Self-paced modules facilitate accessing content at any time, an advantage in a clinical environment. Furthermore, the option to return to lessons, the monitoring of personal progress, and the use of multimedia tools to motivate learning foster the use of this delivery format in terms of usage.

Instructor-led virtual training segments are likely to grow at the highest CAGR in the projected period. This is in response to growing demand for real-time participation, expert consultation, and shared learning, particularly involving complex or hands-on healthcare challenges. This trend is being driven by the proliferation of virtual classrooms, an increased quality of internet infrastructure, and the adoption of video conferencing tools. Furthermore, programs are using this modality to replicate a clinical environment in distance training, effectively providing excellent training programs devoid of regional barriers.

By Technology Platform

The learning management system (LMS) segment had acquired the largest market share in 2024 in the healthcare e-learning services market trend and was widely adopted in hospitals, medical universities, and training institutes. They provide centralization and access to content, progress tracking, performance analytics, and certification management, and things that are necessary for purposes of regulatory compliance, and consistent training in health settings. Scalability, integration with other IT systems, and support for different learning formats make LMS the core technology in the industry for e-learning.

The AI-enabled personalization segment is projected to grow over the forecast period, driven by the need for more customized learning. These systems employ machine learning techniques to derive the students' behavior, learning model, and the students' space, and based on the learning model and the structure, they offer an adaptive learning material that meets individual needs. For healthcare, where knowledge needs vary greatly from specialty to role, customized learning increases engagement, accelerates competency, and enhances learning outcomes.

By End-Use

The hospitals & health systems segment held a major share in the healthcare e-learning services market in 2024 with around 30.21%, due to the growing demand for continuous professional development and consistent training among clinical and nonclinical staff. It is not an easy task to keep these facilities in compliance with all the changing medical protocols, accrediting requirements, and patient safety standards. For large, decentralized healthcare systems, e-learning can provide a low-cost, and scalable mechanism for training people.

The academic medical institutions segment is expected to record the fastest growth during the forecast period in the healthcare e-learning services market due to a growing use of these digital tools in medical and nursing curricula. The need for flexible, interactive, and virtual learning environments has never been higher, with medical schools now often relying on hybrid or fully online models for theory-based learning and simulation-based training. The trend toward competency-based instruction, the incorporation of virtual reality modules, and the growth in technology competence expectations for future healthcare providers are driving the acceptance of e-learning services in higher education.

Healthcare E-Learning Services Market Regional Insights:

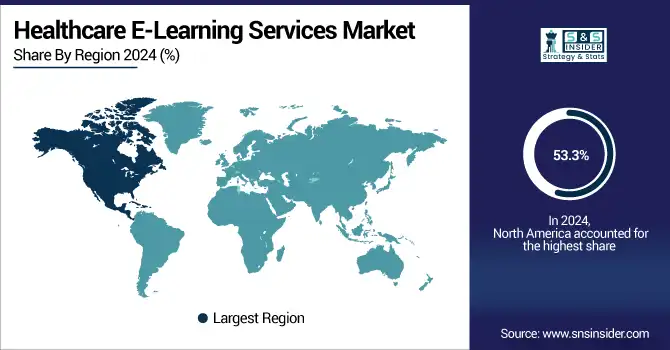

North America dominated the healthcare e-learning services market with a 53.3% market share in 2024, as they have a well-established and widely adopted healthcare infrastructure, a high number of digital educators in the healthcare sector, and was the first to adopt technology-enabled solutions for learning. It hosts many of the top players in the market who provide focused e-learning content, simulation-based training, or AI-enhanced platforms. Moreover, regulations to uphold the continuing training and education, and the large number of uses of LMS across hospitals and medical colleges have fuelled the uptake of the market in the U.S. and Canada.

In the Asia Pacific, rapidly digitizing healthcare systems, an increase in demand for quality healthcare professionals, and rising investment in medical education infrastructure are the drivers of the highest growth rate in the healthcare e-learning services market with a CAGR of 15.50% over the forecast period. A rise in the number of countries, such as India, China, and Japan actively deploying e-learning solutions to meet the skill gap, especially in rural and underprivileged regions. Government-led programs, mobile accessibility for learning, and increasing awareness about low-cost digital training solutions are other contributing factors toward the fast pace of growth in the region.

The European healthcare e-learning services market analysis is expected to register a rise in demand owing to the surging focus on continuous professional development and adherence to the regulatory standards for various healthcare systems. The region has established healthcare infrastructure, high digital technology acceptance, and strong back from academic and government institutions. Moreover, the European Union campaigns to raise digital health literacy and for standardized training of healthcare employees are fueling the adoption of sophisticated e-learning platforms and simulation-based training among hospitals and educational establishments.

The healthcare e-learning services market growth is at a moderate pace in Latin America and the Middle East & Africa (MEA). This market is growing significantly due to an increase in investments in healthcare infrastructure and growing awareness about digital learning tools among healthcare professionals. Governments and private sector organizations in countries and the UAE are increasingly integrating e-learning platforms for improving clinical competencies and ensuring access to training for remote locations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Healthcare E-Learning Services Market Key Players:

The healthcare e-learning services market companies are GE HealthCare, Siemens Healthineers, Philips Healthcare, Elsevier, Medtronic, Coursera, Relias, Arthrex, HealthStream, Docebo, Train Healthcare, Lippincott Nursing Education, EdApp, Apollo MedSkills, Thomson Reuters, Medical Realities, Informa, FutureLearn, 3D Systems, Harvard Medical School Online, and other players.

Recent Developments in the Healthcare E-Learning Services Market:

-

In October 2024, at HLTH 2024, GE HealthCare launched CareIntellect, a new cloud-first digital solution to tackle both clinical and operational issues confronting care providers. This novel solution is engineered to drive decision-making and increase workflow effectiveness for healthcare institutions.

- In September 2024, Relias placed 8th on The Healthcare Technology Report's "Top 25 Companies in Healthcare Software," its third appearance on the publication. Relias, which is owned by Bertelsmann Education Group, was listed 8th in the "Top 100 Healthcare Technology Companies" previously in 2022 and again in 2023.

- In Sep 2024, Arthrex introduced OrthoPedia Patient, an educational digital tool specifically designed for orthopedic patients. The digital platform provides a rich source of teaching material—videos and animations—to inform patients about orthopedic conditions, injuries, and new treatments, thereby increasing patient engagement and informed involvement in their care process.

Healthcare E-Learning Services Market Report Scope:

Report Attributes Details Market Size in 2024 USD 10.86 billion Market Size by 2032 USD 32.70 billion CAGR CAGR of 14.84% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Services Content (Clinical Training Modules, Non-clinical Modules)

• By Delivery Mode (Self-paced Learning, Instructor-led Virtual Training, Blended E-learning, Simulation-based E-learning)

• By Technology Platform (LMS, Mobile Learning Platforms, AI-powered Personalization, Others)

• By End Use (Hospitals & Health Systems, Pharma & Biotech Firms, Academic Medical Institutions, Health Insurance Providers, Government & Public Agencies, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles GE HealthCare, Siemens Healthineers, Philips Healthcare, Elsevier, Medtronic, Coursera, Relias, SAP Litmos, HealthStream, Docebo, Train Healthcare, Lippincott Nursing Education, EdApp, Apollo MedSkills, Thomson Reuters, Medical Realities, Informa, FutureLearn, 3D Systems, Harvard Medical School Online, and other players.