Aseptic Paper Packaging Market Key Insights:

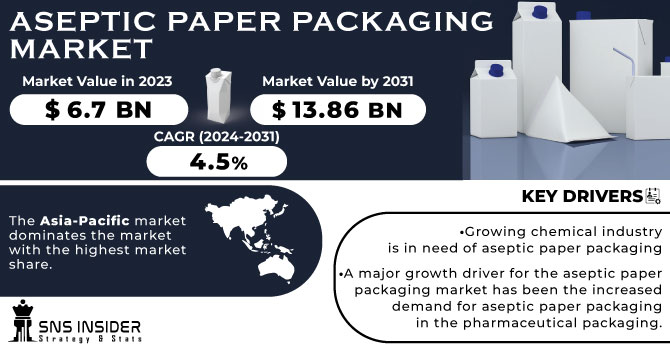

The Aseptic Paper Packaging Market size was USD 6.7 billion in 2023 and is expected to Reach USD 13.86 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The market for Aseptic paper packaging has grown significantly and is becoming the preferred choice for packaging solutions in the food and beverage industry. Aseptic paper packaging combines the benefits of paper-based packaging with aseptic technology to ensure product freshness, extend shelf life, and reduce reliance on preservatives and refrigeration.

Get More Information on Aseptic Paper Packaging Market - Request Sample Report

One of the major drivers of the Aseptic paper packaging market is the growing consumer demand for convenience and sustainability. Consumers are looking for packaging solutions that are easy to use, have a long shelf life and have minimal environmental impact. Aseptic paper packaging meets these needs by providing storage and transportation convenience while reducing food waste and carbon footprint management. Made from renewable raw materials such as cellulose, it offers a more sustainable alternative to plastic packaging.

The increased demand for packaged foodstuffs and beverages is a further factor that contributes to the growth of the Aseptic Paper Packaging Market. As urbanization and busy lifestyles continue to prevail, consumers are opting for convenient on-the-go products. Aseptic paper packaging provides safe and hygienic packaging solutions for a wide range of products such as dairy products, juices, sauces, soups and baby food. The extended shelf life of aseptic packaging allows manufacturers to reach wider geographic markets, reduce food waste and increase product availability.

Additionally, regulatory efforts and environmental concerns continue to drive the adoption of Aseptic paper packaging. Governments and regulators are introducing strict regulations to reduce plastic waste and encourage sustainable packaging practices. Aseptic paper packaging is consistent with these efforts as it is Recyclable Packaging, reduces our carbon footprint, minimizes the need for preservatives and contributes to a circular economy.

MARKET DYNAMICS

KEY DRIVERS:

-

Growing chemical industry is in need of aseptic paper packaging

During the product life cycle, chemical products often require specific packaging in order to guarantee their integrity, prevention of contamination and maintenance of quality. The perfect solution is the aseptic paper package, which has a great barrier action to protect chemicals from moisture, light and oxygen. As a result, the chemical industry is increasingly adopting aseptic paper packaging, driving its growth in this sector.

-

A major growth driver for the aseptic paper packaging market has been the increased demand for aseptic paper packaging in the pharmaceutical packaging.

RESTRAIN:

-

With respect to packaging for some products, concerns in relation to the compatibility of aseptic paper.

OPPORTUNITY:

-

The growing emphasis on sustainability offers opportunities for the aseptic paper packaging

Companies can position aseptic paper packaging as an environmentally friendly alternative to plastic and metal packaging. By emphasizing the renewable and recyclable nature of aseptic paper packaging, manufacturers can appeal to environmentally conscious consumers and businesses seeking sustainable packaging solutions.

-

With the UHT technology, Aseptic Packaging acts as an agile packaging solution that could contribute to market growth.

CHALLENGES:

-

The growth of the market will be hampered by high investment costs and environmental impacts resulting from aseptic paper packaging.

IMPACT OF RUSSIA-UKRAINE WAR

Conflicts have adversely affected businesses in various industries. The war also affected the market for aseptic packaging. A major problem in the aseptic paper packaging industry has been the supply of raw materials in the form of plastic, polyethylene or other materials containing metal. These raw materials majorly contribute to the production. Supply chain disruptions between nations have affected the costs of this raw material, which resulted in less production and higher costs of production.

Higher oil and gas prices pushed up production costs across the European region. Crude oil prices rose to $120 per barrel in March 2022. Natural gas prices rose to €270/MWh.

Russia has an export capacity of 5 million barrels per day, half of which goes to Europe. The war reduced oil and gas exports which is majorly required to operate the plants and machinery.

During the war, the price of metals such as aluminium soared. Aluminium prices climbed to $4,100 per ton, the highest ever. This affected production around the world.

Companies have to deal with the loss and find ways to sustain the business at the time of this conflict.

IMPACT OF ONGOING RECESSION

Consumer behaviour throughout the world has been greatly altered by the recession. US spending increased by 40%. Panic buying, combined with factory closures and global shortages of cardboard and polymers, has led to higher commodity prices. Operating and labor costs have risen, and food prices have soared.

During the recession, corporate Research &Development investment fell by 13%, slowing the progress of new products. This slows down the overall market growth. New innovations and advancements in every industry fuel the market. Therefore, market growth either decreases or exhibits a significant increase during recessions.

KEY MARKET SEGMENTATION

By Material

-

Metals

-

Plastics

-

Glass

-

Others

By Paper Type

-

Aseptic Bleached Paperboard

-

Aseptic Coated Unbleached Kraft Paperboard

By Packaging Type

-

Bags & Pouches

-

Cans

-

Cartons

-

Others

By Thickness

-

Up to 100 microns

-

100-200 microns

-

200-300 microns

-

Above 300 microns

By Application

-

Food & Beverage

-

Dairy Packaging

-

Pharmaceuticals

REGIONAL ANALYSIS

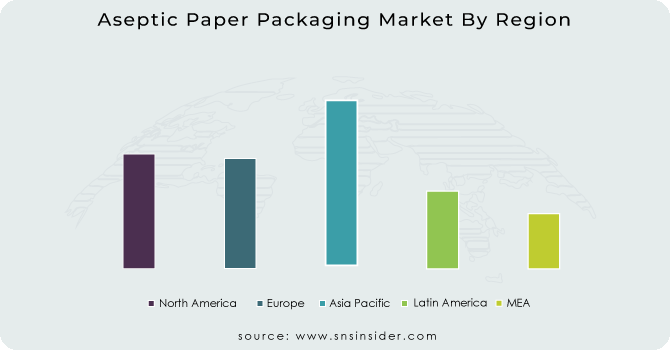

The Asia-Pacific market dominates the market with the highest market share. The region has the highest market share in the global region due to high consumer demand for ready-to-eat foods in the region. Aldo, the rise of the pharmaceutical industry has further increased the demand for aseptic paper packaging. Population growth is creating demand for better healthcare and nutrition. This includes essentials such as dairy products that need to be aseptically packaged to keep the product fresh longer. Rising income levels have further increased the demand for innovative and attractive aseptic packaging.

In the North American region, the rapid growth of the pharmaceutical industry has increased the demand for aseptic packaging. The ability to manufacture technologically advanced medical products, fueled by the country's advanced economic strength, drives product consumption. In addition, with many demographics seeking better medical care, the product consumption of medical packaging for medicines, vials and ampoules also continues to increase.

Packaging consumption in Europe is driven by companies investing in better beverage packaging solutions. The high demand for spirits and other non-alcoholic beverages in the region has increased the need for aseptic paper packaging for the beverage industry. Companies can invest in this package to prevent contamination of these beverages.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

The Major Players are Amcor Limited, Mondi Limited, Elopak SA, Nampak Limited, Uflex Limited, Tetra Pak International SA, Ducart Group, Sealed Air Corporation, IMA Group, DS Smith and other players.

Nampak Limited-Company Financial Analysis

RECENT DEVELOPMENTS

-

SIG announced that it would invest EUR 60 million to build its first aseptic packaging plant in India, with an expected production capacity of 4 billion packs per year.

-

The company, UFLEX Limited, which is a Flexible Packaging Materials Manufacturer and Polymer Sciences Company, intends to initiate an initiative in order to achieve the sustainability of its business by setting up India's 1st UFLEX shaped paper straw manufacturing line that will produce aseptic packaging.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.7 Billion |

| Market Size by 2031 | US$ 13.86 Billion |

| CAGR | CAGR of 4.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper & Paperboard, Metals, Plastics, Glass, Others) • By Paper Type (Aseptic Bleached Paperboard, Aseptic Coated Unbleached Kraft Paperboard) • By Packaging Type (Bags & Pouches, Cans, Cartons, Others) • By Thickness (Up to 100 microns, 100-200 microns, 200-300 microns, Above 300 microns) • By Application (Food & Beverage, Dairy Packaging, Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, Mondi Limited, Elopak SA, Nampak Limited, Uflex Limited, Tetra Pak International SA, Ducart Group, Sealed Air Corporation, IMA Group, DS Smith |

| Key Drivers | • Growing chemical industry is in need of aseptic paper packaging • A major growth driver for the aseptic paper packaging market has been the increased demand for aseptic paper packaging in the pharmaceutical packaging. |

| Market Restraints | • With respect to packaging for some products, concerns in relation to the compatibility of aseptic paper. |