Aspartic Acid Market Report Scope & Overview:

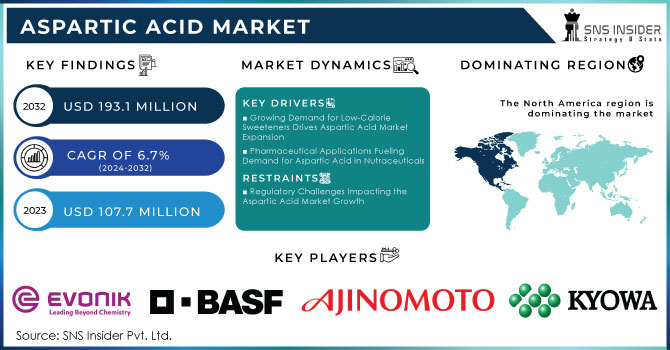

The Aspartic Acid Market Size was valued at USD 107.7 million in 2023 and is expected to reach USD 193.1 million by 2032 and grow at a CAGR of 6.7% over the forecast period 2024-2032.

The Aspartic Acid market is growing due to the rising demand in such diverse sectors as food and beverages, pharmaceuticals, and agriculture. The amino acid is used extensively as an artificial sweetener, especially to make up aspartame, that low-calorie sugar substitute widely used in diet foods and drinks. This is largely because of the increased awareness about health problems, and thus, customers require low-calorie and sugar-free products. In consequence, the demand for aspartic acid is directly acquired from this latter market demand and is a crucial building block in synthesizing proteins in nutritional supplements that accelerate the dynamics of the market. Another outcome of the global attention on health and fitness is that aspartic acid has been introduced into fitness and well-being-promoting products.

Aspartic Acid Market Size and Forecast

-

Market Size in 2023: USD 107.7 Million

-

Market Size by 2032: USD 193.1 Million

-

CAGR: 6.7% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Aspartic Acid Market - Request Sample Report

Aspartic Acid Market Trends

-

Rising demand for low-calorie sweeteners such as aspartame in food and beverage products is driving increased consumption of aspartic acid.

-

Growing use in nutraceuticals and dietary supplements due to its role in protein synthesis, muscle recovery, and overall health support.

-

Increasing adoption in pharmaceutical applications for drug formulations and production of amino acid-based intermediates.

-

Advancements in fermentation and bio-based production technologies improving efficiency, sustainability, and cost-effectiveness.

-

Rising consumer preference for sugar-free, diet, and functional food products supporting market expansion.

-

Expanding applications in biodegradable polymers, coatings, and eco-friendly industrial materials.

-

Strategic collaborations, product innovations, and expansion of production capacities strengthening global market presence.

Development in production technologies also positively impacted the market. For example, development in fermentation technologies enhanced the productivity and sustainability of aspartic acid production. Some are using bio-based approaches whereby aspartic acid is produced from renewable feedstocks more sustainably. This shift helps align the new global goals with sustainability while reducing the environmental footprint of a production process. Such innovations lead to improved profitability but also attract environmentally sensitive consumers and businesses. The integration of green chemistry into a manufacturing process has attracted investments and partnerships that aim at developing better ways of cleaner and efficient production.

Another important driver of the Aspartic Acid market is the pharmaceuticals industry, particularly in pharmaceutical formulation and nutritional commodities. Aspartic acid is used in the production of various pharmaceutical intermediates and APIs. The growing incidences of chronic diseases have increased the demand for effective pharmaceuticals, thus raising the demand for amino acids such as aspartic acid. Companies are interested in increasing the number of drugs and dietary supplements that have amino acids as the base amino acids. For instance, companies recently introduced new formulas that have aspartic acid in combination with some other amino acids to maximize the effectiveness and to assist the muscle tissues in recovering from the stresses that occur in athletes.

Strategic alliances between manufacturers and mergers have also shaped the market's competitive environment. These partnerships will further enhance the product portfolios of both companies and improve the distribution channels as well. For instance, recent collaborations have led to the formulation of designer aspartic acid derivatives tailored for industrial-specific applications such as biodegradable plastics and coatings. This diversification brings in revenue streams but is also perfectly in line with the bigger picture of market trends, which are continuously changing toward sustainable and more eco-friendly products. Innovative applications along with strategic positioning of aspartic acid, and therefore, it forms an appropriate structure wherein the suitability and importance in various sectors of end-use contribute to the overall growth trajectory in the market.

Aspartic Acid Market Dynamics:

Drivers:

-

Growing Demand for Low-Calorie Sweeteners Drives Aspartic Acid Market Expansion

Greater health awareness among consumers has fueled demand for low-calorie sweeteners, thus driving the growth of the aspartic acid market. Aspartic acid is one of the main constituents of aspartame, the most widely used low-calorie artificial sweetener in foods and beverages, often associated with "diet" and "sugar-free" applications. The rising desire to cut sugar, hence calorie, consumption as a consequence of increasingly surging obesity statistics and related health problems remains one of the significant drivers for aspartame and aspartic acid. This trend is backed by increased applications for aspartame-containing soft drinks, snacks, dairy products, and baked goods. The food and beverage industry caters to health-conscious consumers by reformulating its products to contain aspartame as a sugar substitute. Moreover, approval for artificial sweeteners with evaluations concerning their safety has boosted the consumer's confidence and therefore increased market penetration. As health-conscious attitudes lead to increased attention towards healthier diets, the aspartic acid market is likely to see continued growth from its fundamental role in the production of low-calorie sweeteners.

-

Pharmaceutical Applications Fueling Demand for Aspartic Acid in Nutraceuticals

The pharmaceutical industry is rising as one of the primary drivers for the aspartic acid market through nutraceutical and dietary supplement formulation. Aspartic acid is an essential amino acid that, in this regard, assumes critical importance in the synthesis of proteins ever so increasingly being integrated into health products that are meant to promote overall physical well-being. The increasing awareness of health and fitness today is what fuels the demand for dietary supplements targeted at supporting muscle recovery, immune function, and overall health. Manufacturers are busy developing products that combine aspartic acid with other amino acids and nutrients to make the formula more potent in delivering the potential for muscle building and recovery in athletes and fitness enthusiasts. Aspartic acid has been found to have a role in the production of neurotransmitters, an area of growing interest in the nutraceutical market. The growth of the sports nutrition segment and increasing trends of individualized nutrition present further supporting calls for increasing demand for aspartic acid-based products. This growing application of the product in pharmaceuticals and nutraceuticals positions aspartic acid as one of the essential active ingredients in combating contemporary health issues and consumer demands.

Restraint:

-

Regulatory Challenges Impacting the Aspartic Acid Market Growth

Despite the excellent growth prospects of the aspartic acid market, regulatory challenges are one of the main constraints. Nevertheless, stringent guidelines imposed by several regulatory agencies around the world on food additives, including artificial sweeteners such as aspartame, a derivative of aspartic acid, demand very rigorous safety assessment and approbation before a novel product can be released to market. Apart from the above considerations, safety controversies over the adverse health impact associated with long-term intake of artificial sweeteners have increased the level of examination by the regulatory authorities and consumer watchdogs. Regulatory issues are likely to increase in terms of restrictive measures or prohibitions on certain products in different areas, and hence it adversely affects the market landscape. Companies have to face the complex regulation environment to ensure safety compliance which costs more than usual and extends the product development period. An environment of increased vigilance by the regulators is likely to create uncertainty in the market dynamics. The growth potential of the aspartic acid market is limited by regulatory hurdles, for a company cannot invest in new product lines if there are possible problems of regulation.

Opportunity:

-

Advancements in Sustainable Production Techniques for Aspartic Acid

Advanced developments in more sustainable production techniques propel a tremendous opportunity for aspartic acid at a time when governments of the world are urging its sustainability along with greater emphasis on eco-friendliness. As concerns for the environment grow, there is an increasing trend towards bio-based and renewable methods of production. Advances in fermentation technology and biotechnology have driven the pursuit of increasingly more sustainable methods of producing aspartic acid, not relying on petroleum-based processes. Companies are exploring renewable feedstocks from which to source aspartic acid-plant-based materials that contribute not only to lessened environmental impact but also activate demand from eco-sensitive consumers and businesses, helping manufacturers to strengthen their market positions and seize the growing consumer preference for green products. Moreover, regulatory moves on green chemistry create opportunities for the acceptance of these technologies. This is likely to promote investment and encourage even more cooperation among stakeholders in the company. Since the market is moving toward sustainability, companies that embrace eco-friendly manufacturing processes for aspartic acid will be expected to have a competitive advantage. Companies that embrace eco-friendly production processes for aspartic acid will be able to capitalize on new market segments focused on sustainable solutions.

Challenge:

-

Competition from Alternative Sweeteners Threatening Aspartic Acid Market Share

Alternative sweeteners, increasingly competitive in their market are posing a strong challenge to the aspartic acid market. Besides synthetic aspartame, consumers seek more alternatives so, the varieties of natural and organic types of sweeteners are increasingly becoming popular with a change in preference. Marketing of these health conscious and natural varieties includes stevia, monk fruit extract, and erythritol. Clean label products, emphasizing greater transparency and lesser processing, will further amplify the competition for aspartic acid-based sweeteners. The interest that increases regarding artificial-free products in the market further creates competition for aspartic acid manufacturers because they must diligently make consumers aware of the safety and benefits of their products. In addition to this, new sweetening agents that receive considerable marketing effort can also challenge consumer interest from the traditional artificial sweetener. Companies must innovate and develop formulations of the products that match the preference alterations of the consumer while making its product, aspartic acid safer. By this, stakeholders can approach the competition in an active manner with their market positioning so that it stays innovative in the sweetener market.

Aspartic Acid Market Segmentation Overview

By Type

In 2023, L-aspartic acid dominated the aspartic acid market with an estimated market share of approximately 70%. This dominance is primarily due to L-aspartic acid's widespread application in food and beverage products, where it serves as a key ingredient in low-calorie sweeteners like aspartame. The increasing consumer demand for healthier dietary options has driven the growth of products utilizing L-aspartic acid, particularly in the booming diet and sugar-free segments. Furthermore, L-aspartic acid is essential in the synthesis of various pharmaceuticals, including supplements aimed at enhancing athletic performance and recovery. For example, its role in creating protein powders and energy drinks has made it a preferred choice among fitness enthusiasts, contributing to its significant share in the market.

By Form

In 2023, the powder form of aspartic acid dominated the aspartic acid market with an estimated market share of around 65%. The powder form's prevalence is attributed to its versatility and ease of incorporation into various applications, especially in the food and beverage industry. Manufacturers favor powdered aspartic acid for its extended shelf life and convenience in formulations, making it a popular choice for product developers. For instance, powdered aspartic acid is widely used in protein supplements, sports nutrition products, and health foods, where it serves as an essential amino acid for muscle recovery and growth. Additionally, the powder form's compatibility with various production processes further solidifies its position as the dominating segment in the market.

By Application

In 2023, the food and beverage application segment dominated the aspartic acid market, capturing approximately 60% of the market share. This segment's prominence is largely driven by the increasing demand for low-calorie and sugar-free products, that utilize aspartame—a sweetener derived from L-aspartic acid. With consumers becoming more health-conscious and opting for products that offer reduced sugar content, the food and beverage industry has significantly integrated aspartic acid into its formulations. For example, many leading beverage brands have reformulated their products to include aspartame, enhancing their appeal in the competitive market. Additionally, as manufacturers continue to innovate and create new flavor profiles for diet products, the demand for aspartic acid in this application is expected to grow.

By End-User Industry

In 2023, the food industry dominated the end-user segment in the aspartic acid market, accounting for an estimated 55% market share. The food industry's leading position is largely driven by the growing consumer preference for healthier, low-calorie options and the increasing use of aspartame in various food products, including soft drinks, candies, and dairy items. As manufacturers respond to the rising demand for sugar alternatives, they are increasingly incorporating aspartic acid into their formulations to create appealing products for health-conscious consumers. Additionally, the versatility of aspartic acid in enhancing flavor profiles and improving overall product quality further cements its importance in the food industry. As trends continue to favor healthier eating habits, the food industry is expected to maintain its dominance in the aspartic acid market.

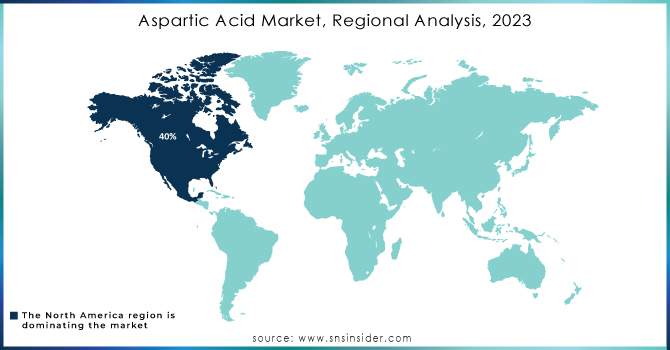

Aspartic Acid Market Regional Analysis

In 2023, North America dominated the aspartic acid market, holding an estimated market share of around 40%. This dominance is attributed to the region's well-established food and beverage industry, which increasingly incorporates low-calorie sweeteners, including aspartame, into various products. The rising health consciousness among consumers has led to a growing demand for sugar substitutes, particularly in the United States, where numerous brands have reformulated their products to meet the needs of health-focused consumers. Additionally, the robust pharmaceutical sector in North America contributes significantly to the demand for aspartic acid, as it is widely used in dietary supplements and performance-enhancing products. For example, major brands in the sports nutrition segment utilize aspartic acid in their formulations to promote muscle recovery, further solidifying North America’s leading position in the aspartic acid market.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for aspartic acid, with an estimated CAGR of approximately 6%. This rapid growth can be attributed to the increasing demand for processed food and beverages in emerging economies such as China and India, where rising disposable incomes and changing lifestyles drive consumer preferences toward healthier alternatives. The region is witnessing a surge in the adoption of low-calorie sweeteners in various applications, including soft drinks, snacks, and dairy products, as manufacturers respond to the growing health awareness among consumers. Additionally, the expanding pharmaceutical and nutraceutical sectors in the Asia-Pacific region are further propelling the demand for aspartic acid. For instance, the popularity of sports supplements is rising, leading to an increased incorporation of aspartic acid in product formulations aimed at fitness enthusiasts. As these trends continue, the Asia-Pacific region is poised for sustained growth in the aspartic acid market.

Need Any Customization Research On Aspartic Acid Market - Inquiry Now

Recent Developments in Aspartic Acid Market

October 2023: Ronish Bioceuticals introduced the L-Ornithine L-Aspartate Syrup, which, in combination with Silymarin, demonstrates our commitment to providing healthcare professionals, wholesalers, and medical representatives with exceptional formulations.

Key Players in Aspartic Acid Market

-

Ajinomoto Co., Inc. (Aspartame, L-Aspartic Acid)

-

BASF SE (Aspartic Acid, Bio-based Surfactants)

-

Cargill, Incorporated (Aspartame, L-Aspartic Acid)

-

Evonik Industries AG (L-Aspartic Acid, Surfactants)

-

Fufeng Group Company Limited (Aspartic Acid, Feed Grade Amino Acids)

-

Hunan Huasheng Biotechnology Co., Ltd. (L-Aspartic Acid, Aspartic Acid)

-

Kyowa Hakko Bio Co., Ltd. (Kyowa AjiPro-L, L-Aspartic Acid)

-

Mitsubishi Gas Chemical Company, Inc. (L-Aspartic Acid, Amino Acids)

-

Mitsui & Co., Ltd. (Aspartic Acid, Amino Acid Products)

-

Ningxia Sunnyfield Food Co., Ltd. (L-Aspartic Acid, Food Grade Amino Acids)

-

Amino GmbH (Amino Acids, L-Aspartic Acid)

-

Ginkgo BioWorks, Inc. (Genetically Engineered Aspartic Acid, Bioengineered Products)

-

Green Biologics Ltd. (Biobased Chemicals, L-Aspartic Acid)

-

Hefei TNJ Chemical Industry Co., Ltd. (Aspartic Acid, Amino Acids)

-

Hangzhou Kelin Chemicals Co., Ltd. (L-Aspartic Acid, Amino Acids)

-

Hubei Hongyuan Pharmaceutical Co., Ltd. (Aspartic Acid, L-Aspartic Acid)

-

Lactic Acid Bacteria Co., Ltd. (Amino Acids, L-Aspartic Acid)

-

Puyang Shucheng Chemical Co., Ltd. (L-Aspartic Acid, Aspartic Acid)

-

Shanghai Jiuding Chemical Co., Ltd. (L-Aspartic Acid, Amino Acids)

-

Tianjin Zhongxin Chemtech Co., Ltd. (Aspartic Acid, L-Aspartic Acid)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 107.7 Million |

| Market Size by 2032 | USD 193.1 Million |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (L-Aspartic Acid, D-Aspartic Acid) •By Form (Powder, Liquid) •By Application (Food & Beverage, Pharmaceuticals, Animal Feed, Personal Care Products, Industrial Applications) •By End-User Industry (Food Industry, Nutraceuticals, Agriculture, Chemical Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ajinomoto Co., Inc., Evonik Industries AG, BASF SE, Mitsubishi Gas Chemical Company, Inc., Kyowa Hakko Bio Co., Ltd., Cargill, Incorporated, Fufeng Group Company Limited, Mitsui & Co., Ltd., Ningxia Sunnyfield Food Co., Ltd., Hunan Huasheng Biotechnology Co., Ltd. and other key players |