Automotive finance Market Report Scope & Overview:

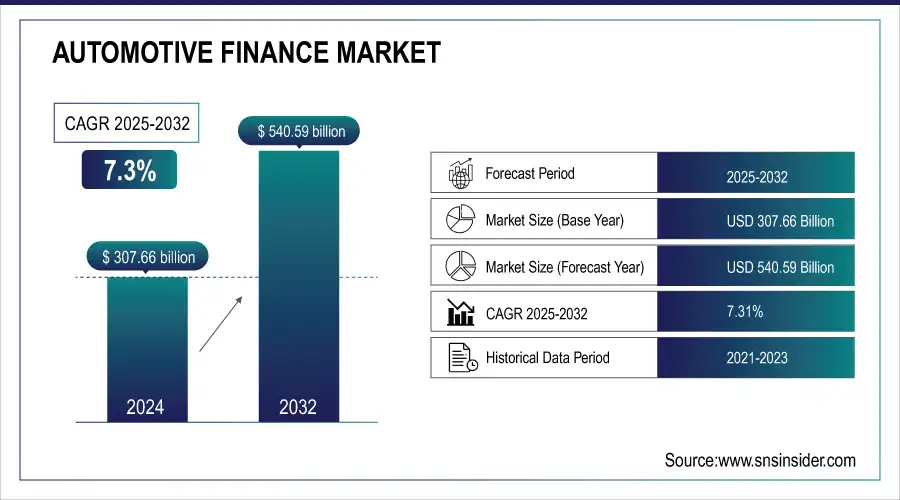

The Automotive Finance Market was valued at USD 307.66 billion in 2024 and is expected to reach USD 540.59 billion by 2032, growing at a CAGR of 7.3% from 2025-2032.

To Get more information on Automotive Finance Market - Request Free Sample Report

This expansion is fueled by growth in vehicle ownership, rising customer demand for electric and luxury cars, and the increasing use of digital financing tools. OEMs and financial institutions are providing convenient loan and lease terms, improving customer convenience and marketplace penetration. Meanwhile, technologies like AI-based credit scoring and online lending platforms are revolutionizing the automotive finance ecosystem, becoming more accessible and efficient for lenders and borrowers alike.

Automotive Finance Market Trends

-

Rising vehicle sales and growing consumer financing needs are driving Automotive Finance market growth.

-

Increasing adoption of digital lending platforms and mobile banking is enhancing accessibility and convenience.

-

Integration of AI and analytics is improving credit assessment, risk management, and personalized loan offerings.

-

Expansion of electric and hybrid vehicle markets is boosting specialized financing solutions.

-

Leasing, subscription models, and flexible repayment plans are gaining popularity among consumers.

-

Regulatory support and favorable interest rates are encouraging market participation.

-

Collaborations between banks, fintech firms, and automakers are fostering innovative financing products and services.

U.S. Automotive Finance Market was valued at USD 74.33 billion in 2024 and is expected to reach USD 145.95 billion by 2032, growing at a CAGR of 8.80% from 2025-2032.

Increasing demands for complex technologies like robotic process automation (RPA), artificial intelligence (AI), and machine learning in finance are the drivers of this growth. These tools improve efficiency, lower operational costs, and enhance financial services' accuracy. The transition towards digital transformation, combined with the requirement for streamlined processes and compliance, is largely driving the use of automation solutions throughout the U.S. finance industry.

Automotive Finance Market Growth Drivers:

-

Rising Consumer Demand for Flexible Auto Loans and Leasing Solutions Fuels Market Expansion

Increasing vehicle ownership and a growing preference for flexible financing options are driving the Automotive Finance market globally. Consumers are seeking customized loan and lease products, including digital-first solutions, low-interest rates, and extended repayment terms. Banks, captive finance companies, and fintech platforms are responding with innovative offerings, boosting adoption. This rising consumer demand, combined with strong dealership financing partnerships, is significantly contributing to market growth across North America, Europe, and emerging economies.

Automotive Finance Market Restraints:

-

Economic Volatility and Rising Interest Rates Pose Challenges to Automotive Loan Uptake

Fluctuating economic conditions, inflationary pressures, and increasing interest rates are restraining the growth of the Automotive Finance market. Higher borrowing costs reduce consumer affordability and slow down vehicle purchases. In addition, uncertainties in global trade and supply chain disruptions can impact dealership operations and financing approvals. These financial constraints discourage both retail customers and commercial fleet operators from opting for loans or leases, limiting the overall market growth despite the increasing availability of innovative financing solutions.

Automotive Finance Market Opportunities:

-

Growth of Electric Vehicles and Sustainable Mobility Solutions Drives New Financing Segments

The shift toward electric vehicles (EVs) and sustainable mobility is opening new opportunities for Automotive Finance providers. EV adoption is rising due to government incentives, lower operating costs, and environmental awareness. Financial institutions are introducing specialized loans, leases, and subscription models tailored for EVs and hybrid vehicles. Additionally, financing packages for charging infrastructure and green mobility solutions create additional revenue streams. These developments enable market expansion while aligning with global sustainability trends and the growing demand for eco-friendly transportation.

Automotive finance Market Segment Analysis

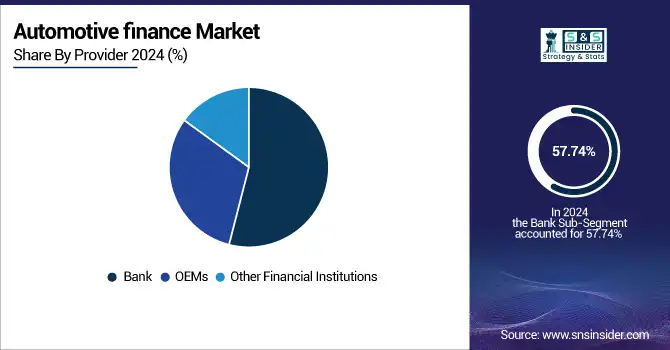

By Provider, Bank segment dominated, Financial institutions like NBFCs, credit unions, and fintech lenders are expected to grow fastest

in 2024 Bank segment is the leading portion of the Automotive Finance Market, representing 57.74% of overall revenue. This is due to their built-up trust, extensive customer base, and strong financial framework. JPMorgan Chase, Bank of America, and Wells Fargo, among other banks, have grown their car loan portfolios by providing competitive interest rates and easy payment plans. For example, in 2023, JPMorgan Chase rolled out its digital car-buying platform in partnership with TrueCar, facilitating end to end financing and purchase of vehicles. In addition, Wells Fargo improved its online loan management features, facilitating enhanced customer interaction and loan monitoring. The strong capital support and strict regulatory compliance ensure that banks are a first choice for financing both new and used vehicles.

The financial institutions like NBFCs, credit unions, and fintech lenders are anticipated to register the fastest CAGR of 8.18% over the forecast period. These organizations have witnessed popularity by providing more lenient and convenient credit terms, especially to subprime or underserved consumers. Fintech platforms like AutoFi and Carvana brought in AI-powered lending platforms that offer customized auto loan products according to real time credit ratings and purchase behaviour. In the same vein, firms such as Capital Float and Upstart are penetrating tier II and tier III cities with rapid disbursal loans and less paperwork. Their speed and technology integration have enabled them to fill the gap in financing where banks hold back. This spurt of innovation and customer-oriented service models is transforming the competitive dynamics of the automotive finance sector, particularly in emerging economies and among younger, digitally native consumers.

By Finance, Direct segment dominated, Indirect financing segment is expected to grow fastest

The Direct segment in financing held the largest revenue share of 42.16% in 2024, mainly due to the cost effectiveness and transparency it provides. Under this model, borrowers obtain financing directly from lenders without going through dealerships. Major banks and credit unions encourage direct lending through simplified mobile apps and pre-approved offers. For instance, Capital One Auto Navigator enables customers to pre-qualify for loans and browse vehicles at the same time, enhancing customer independence. Credit unions such as Navy Federal also launched auto loan refinancing features to attract price sensitive customers. Direct financing is attractive to savvy buyers who want greater management of loan terms and interest rates, and therefore is a significant driver of the organized expansion of the global automotive finance market.

The indirect financing segment is expected to grow at the fastest CAGR of 9.06%, with dealer-lender partnerships and interconnected retail experiences fueling the move. Under such an arrangement, dealers serve as intermediaries to bring buyers into contact with lenders, typically offering promotional prices. Ally Financial and Santander Consumer USA enhanced dealership networks and crafted in-house online platforms in 2024 in order to quicken loan authorization. In addition, OEMs like Ford Credit and Toyota Financial Services strengthened their dealer support programs by providing low-interest financing and seasonal promotions. Indirect financing streamlines the process of buying a car, which is more attractive for first-time buyers, thereby driving market growth in developed and emerging markets.

By Purpose, Loans segment dominated, Leasing segment is expected to grow fastest

The Loans segment held the largest revenue share of 22% in the automobile finance industry during 2024. Car loans remain the first choice for funding because of ease in EMI options and good interest rates. Major players like Ford Credit and ICICI Bank (India) introduced new automobile loan schemes with no down payment and longer tenors during 2023, making car purchasing more affordable. Digital lenders further brought with them instant disbursal features with e commerce platforms. This convenient access and ownership have played a significant role in the segment's continued leadership, particularly in markets with increasing middle-class populations and car aspirations.

The leasing segment is projected to grow at a CAGR of 8.46%, fueled by changing consumer tastes in Favor of vehicle usage rather than ownership. Hyundai Capital and ALD Automotive have introduced flexible leasing programs in 2023, targeting electric vehicles and short-term contracts. Other startups such as Zoomcar and Revv also introduced subscription-based leasing models, which are in high demand among urban millennials. The growth in demand for environmentally friendly mobility and the cost savings offered by off balance sheet financing are stimulating leasing adoption, particularly by fleet buyers and corporate customers, making it a high-growing segment in the automotive finance market.

By Vehicle, Commercial vehicles segment dominated, Passenger cars segment is expected to grow fastest

Commercial vehicles led the auto finance industry in 2024 with 36% revenue contribution. Strength in the segment comes from steady demand from logistics, infrastructure, and public transportation industries. Financial institutions such as Tata Capital and Mahindra Finance adapted commercial vehicle loans with asset backed securities and risk mitigation strategies to target MSMEs and fleet owners. Volvo Financial Services increased financing offerings in Europe and Asia in 2023, such as lease to own for electric trucks. Infrastructure growth and freight movement remain driving the financial requirement and investment in this segment further, strengthening its position as the industry leader.

Passenger cars are expected to grow at CAGR of 6.8% driven by increasing disposable incomes, urbanization, and a spurt in personal car ownership after the COVID pandemic. Auto financiers such as Maruti Suzuki Smart Finance and Tesla Financial Services deepened their digital presence in 2023 with real-time loan approvals, trade-ins, and customized finance plans. The transition towards compact SUVs and EVs has boosted need for new age financing options such as balloon payment and zero interest EMI. With younger customers looking for mobility with affordability and flexibility, the passenger vehicle market is emerging as a key growth sector for car financiers all over the world.

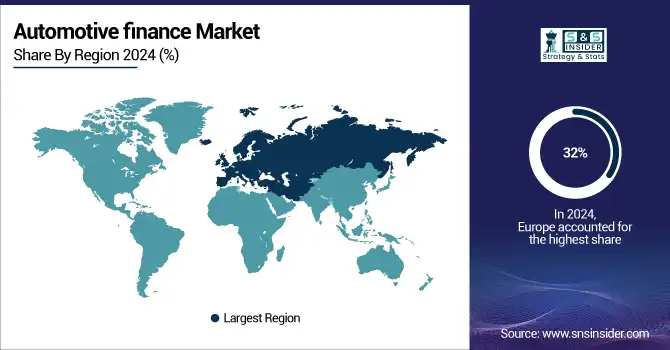

Automotive Finance Market Regional Analysis

Europe Automotive Finance Market Insights

In 2024, Europe became the largest region in the motor finance market, with an estimated market share of approximately 32%. These are driven by the region's robust regulatory structure, high rate of vehicle ownership, and superior credit penetration. The trio of Germany, France, and the UK spearhead this, facilitated by institutions such as Volkswagen Financial Services and BNP Paribas. Their new models of finance such as green loans for electric vehicles and maintenance leasing are among the drivers. Support by the EU for clean mobility and digital finance also powers structured growth making Europe a prime and mature automotive finance market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Automotive Finance Market Insights

The Asia-Pacific region is the fastest growing in the automotive finance market, expected to grow at a CAGR of 9.3%. Nations such as China, India, and Indonesia are experiencing accelerated urbanization, growing vehicle demand, and a widening fintech ecosystem. In 2023, Indian fintech companies such as KreditBee and Chinese titans such as Ping An Auto Finance launched AI-based lending apps targeting underbanked consumers. Growth in electric two-wheelers and small cars has drawn flexible financing models towards it. Government initiatives focusing on digital payments and financial inclusion also complement the growth, making Asia-Pacific a region with potential for future automotive finance growth.

North America Automotive Finance Market Insights

North America dominates the Automotive Finance Market due to high vehicle ownership, strong consumer credit availability, and widespread adoption of digital financing platforms. Key players like Ally Financial, Bank of America, and Capital One offer diverse loan and lease products, driving market growth. The region benefits from advanced regulatory frameworks, growing preference for electric vehicles, and increased online financing adoption, making it a highly competitive and technologically progressive Automotive Finance landscape.

Middle East & Africa and Latin America Automotive Finance Market Insights

The Middle East & Africa and Latin America Automotive Finance Markets are expanding steadily, driven by rising vehicle demand, urbanization, and improving financial inclusion. In these regions, banks and specialized lenders provide tailored auto loans and leasing solutions to cater to diverse consumer segments. Digital financing platforms and partnerships with dealerships are boosting accessibility, while economic development and growing middle-class populations present significant opportunities for market growth across both regions.

Automotive Finance Market Competitive Landscape:

Ally Financial

Ally Financial is a leading player in the North American Automotive Finance Market, offering products like Ally Auto Finance and Ally SmartLease®. The company focuses on providing flexible auto loans, leasing solutions, and digital financing platforms to enhance customer convenience. Strong partnerships with dealerships and innovative technology adoption have helped Ally maintain a competitive edge, supporting growth in both retail and commercial automotive financing segments.

- Ally Financial (2025): Rolling out Ally.ai, a proprietary AI platform, to over 10,000 employees improves digital productivity across departments. Ally also joined the Responsible AI Institute to reinforce ethical AI governance.

GM Financial

GM Financial is a prominent player in the Automotive Finance Market, offering services such as GM Financial loans and the Right Lease by GM Financial program. The company provides flexible financing and leasing solutions for both individual consumers and dealerships, supporting GM vehicle sales and enhancing customer retention. Its strong integration with GM’s brand and dealer network strengthens its market presence across North America.

-

GM Financial (2024): Announced withdrawal of its FDIC insurance application for GM Financial Bank planning to restructure and resubmit, showcasing strategic adaptability in banking.

-

GM Financial (2023): GM Insurance was rebranded from OnStar Insurance, aligning the captive finance arm’s insurance offerings more closely with the GM brand starting January 2024.

Volkswagen Group

Volkswagen Group is a key player in the Automotive Finance Market, providing financing solutions through Volkswagen Financial Services and the Volkswagen Drive Easy program. The company offers loans, leases, and insurance products tailored for both individual and fleet customers. Its focus on digital platforms, flexible payment options, and integrated mobility solutions strengthens customer engagement and supports the growth of Volkswagen vehicle sales globally.

-

November 2024: Volkswagen Group Mobility reported a 5.4% increase in new contracts, totaling over 7.5 million units for the first nine months of 2024. The contract portfolio exceeded 26 million units for the first time, with strong growth in leasing and insurance services.

Key Players

-

Ally Financial – [Ally Auto Finance, Ally SmartLease®]

-

Bank of America – [Bank of America Auto Loans, Preferred Rewards Auto Loan]

-

Capital One – [Capital One Auto Finance, Capital One Auto Navigator®]

-

Chase Auto Finance – [Chase Auto Loans, Chase Auto Prequalified Offers]

-

Daimler Financial Services – [Mercedes-Benz Financial Services, Mercedes-Benz First Class Lease®]

-

Ford Motor Credit Company – [Ford Credit, Ford Options Plan]

-

GM Financial Inc. – [GM Financial, Right Lease by GM Financial]

-

Hitachi Capital – [Hitachi Capital Vehicle Solutions, Hitachi Electric Vehicle Leasing]

-

Toyota Financial Services – [Toyota Financial Services, Toyota iFi Program]

-

Volkswagen Financial Services – [Volkswagen Financial Services, Volkswagen Drive Easy]

-

Hyundai Capital America – [Hyundai Motor Finance, Hyundai Lease-End Protection]

-

Nissan Motor Acceptance Company – [Nissan Finance, SignaturePURCHASE® Program]

-

Santander Consumer USA – [Drive® Auto Loan, RoadLoans®]

-

Wells Fargo Auto – [Wells Fargo Auto Loan Services, Wells Fargo Dealer Services]

-

PNC Financial Services Group – [PNC Auto Loans, PNC Total Auto®]

-

TD Auto Finance – [TD Auto Loans, TD Auto Payment Relief Program]

-

American Honda Finance Corporation – [Honda Financial Services, Honda Leadership Leasing]

-

Alfa Financial Software – [Alfa Systems, Alfa Start]

-

Credit Acceptance Corporation – [CAP Automotive Loan Program, Credit Acceptance Portfolio Program]

-

BMO Harris Bank – [BMO Auto Finance, BMO Harris Auto Loan Refinancing

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 307.66 Billion |

| Market Size by 2032 | US$ 540.59 Billion |

| CAGR | CAGR of 7.3% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •Provider Outlook (Banks, OEMs, Other Financial Institutions) •Finance Outlook (Direct, Indirect) •Purpose Outlook (Loan, Leasing, Others) •Vehicle Outlook (Commercial Vehicles, Passenger Vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ally Financial, Bank of America, Capital One, Chase Auto Finance, Daimler Financial Services, Ford Motor Credit Company, GM Financial Inc., Hitachi Capital, Toyota Financial Services, Volkswagen Financial Services |