RFID and Barcode Printer Market Size & Growth Trends:

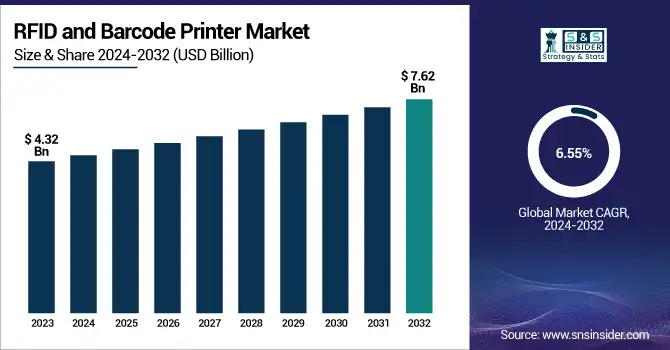

The RFID and Barcode Printer Market Size was valued at USD 4.32 billion in 2023 and is expected to reach USD 7.62 billion by 2032, growing at a CAGR of 6.55% over the forecast period 2024-2032. Driven by its increasing usage in retail, logistics, health care, and manufacturing industries where companies desire real-time tracking and automation, the RFID and Barcode Printer Market is gaining quite a lot of traction. Metrics such as how fast it can print, how well it can quickly repeat that print, and how many errors it makes. These are all important factors of efficiency.

As the demand for wireless, cloud, and mobile printing continues to rise, deployment trends are changing to IoT-enabled and remotely managed printers. To accommodate multi-printer networks, integrate AI-based analytics, and make offerings to specific industry verticals, scalability is growing. In an increasingly digital landscape, digital necessities such as connectivity, automation, and high-performance labeling solutions have become a must-have for supply chain efficiency and optimization.

To Get more information on RFID and Barcode Printer Market - Request Free Sample Report

RFID and Barcode Printer Market Dynamics

Key Drivers:

-

RFID and Barcode Printers Driving Smart Automation with Advanced Tracking High-Speed Printing and Connectivity

The growth of e-commerce, retail, and logistics sectors requiring better tracking and inventory management solutions is driving the demand for RFID and Barcode Printers Market. Increased deployment of RFID technology in applications such as supply chain automation, warehouse management, and, real-time asset tracking is a primary driver stimulating demand. At the same time, the rising demand for no-fault high-speed printing solutions in various sectors like the healthcare and manufacturing sectors is promoting market growth Increasing demand for small-sized, portable, and affordable printing systems is also fuelling the transition to direct thermal and mobile printing solutions. In the pipeline of a digitally transforming world, Technologies like cloud print, IoT-powered RFID printers, or AI-based automation, are all building a more connected, data-driven ecosystem.

Restrain:

-

High Costs Integration Challenges and Security Risks Hindering RFID and Barcode Printer Market Growth

The high initial investment and high maintenance cost attached to operating advanced RFID printing are the key challenges that hamper the growth of the global RFID and Barcode Printer Market. For various SMEs, when number of small and medium-sized enterprises (SMEs) are hesitant to adopt the technology because of limited budget size and complications in integration with existing IT infrastructure. In addition, existing thermal printing technologies that hold the market share use a technology that requires regular replacements of printheads and consumables, increasing the total cost of ownership of these printers. Additionally, the market is plagued by issues of counterfeiting and data security, as RFID tags and barcodes can be susceptible to tampering, hacking, or duplication, a concern in industries such as pharmaceuticals and government applications.

Opportunity:

- Smart Tracking Industry 4.0 and Sustainability Driving RFID and Barcode Printer Market Expansion

Emerging economies are witnessing the growth of the smart tracking and labeling solutions market as industries look to become efficient. The growing adoption of Industry 4.0, smart manufacturing, and regional digital transformation in different industry sectors continue to create demand for modern barcode and RFID printing solutions. In addition, government rules on product labeling and assurance against counterfeiting are getting stricter, urging companies to adopt advanced printing technologies. As demand for eco-friendly and linerless printing solutions increases, several companies are also working on sustainable innovations, which in turn, are expected to provide new growth opportunities in the market.

Challenges:

- RFID Standardization Digital Shift Sustainability and Price Pressure Challenging Barcode Printer Market Growth

A further problem lies in the fact that there is no uniform standard for RFID technology, which complicates the situation due to incompatibility between different industries and regions. Another potential challenge barcode printers face is the increasing shift to cloud-based and digital tracking solutions. On the other hand, environmental issues regarding disposable labels, ink waste, and thermal paper are leading to more stringent regulations, thus forcing manufacturers to invest in sustainable alternatives. In price-sensitive markets, the presence of low-cost unbranded barcode printers is also intensifying the competitive pressure on frontline players to continue investing in product innovations at acceptable profitability levels. These challenges need continuous R and D, optimization in costs, and strategic collaborations to overcome.

RFID and Barcode Printer Market Segment Analysis

By Type

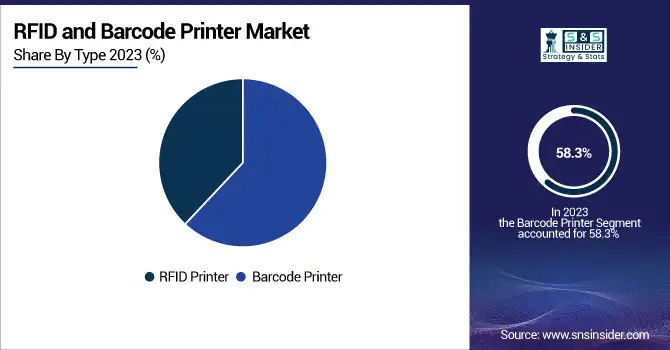

The barcode printer market held a dominant share at 58.3% in 2023, owing to its extensive usage in retail, logistics, and manufacturing sectors for inventory tracking and point-of-sale applications. From being economical to easy to use, and catering to a plethora of industries; they have become the most favored printing option. Besides this, improvements in direct thermal and thermal transfer printing technologies have improved the efficiency of barcode printers which is accelerating their need.

RFID printers to grow at the highest CAGR from 2024-2032 due to an increase in smart supply chain implementations, real-time tracking, and automation. With RFID, power industries like healthcare, transportation, and manufacturing have adopted RFID for better visibility, reduced errors, and better asset management.

By Format Type

Industrial printers accounted for, 49.7% of the market share in 2023, owing to their outstanding durability, efficiency, and readiness for large-scale printing operations. Industrial Printers– These printers are commonly used in manufacturing, logistics, and warehouse management with support for heavy-duty labeling, high-volume printing, and durable print quality, all of which are crucial in industrial settings. The incorporation of advanced features such as high-speed printing, durable design, and automated features played an additional role in further cementing their position in the market.

The mobile printer is expected to grow with the highest CAGR from 2024-2032, due to the increasing need for portable printing solutions in retail, healthcare, and field services. These battery-operated, compact printers having both wireless and portable features facilitate on-the-spot printing of RFID tags as well as barcodes, positively impacting operational efficiency, flexibility as well as mobility of the workforce.

By Technology

Thermal transfer technology accounted for a 53.4% share of the market in 2023 due to its durability, high print quality, and capability for long-lasting tags. It is heavily deployed in industries such as manufacturing, healthcare, and logistics, where resistance to heat, chemicals, and abrasion is of utmost priority." For applications that need non-removable barcodes, asset tags, and crisp, higher-definition labels, businesses opt for thermal transfer printers as this supports permanent marking and guarantees accurate tracking and inventory management.

Direct thermal technology is anticipated to register the highest CAGR between 2024 to 2032 owing to its cost efficiency and environmentally safe advantages. Direct thermal printing is emerging in the retail, transportation, and food labeling markets which require fast, short-term printing without the use of ink or ribbons.

By Application

The retail segment accounted for the largest market share of 29.6% in 2023, which is driven by the high adoption of barcode and RFID printers to manage inventory, make POS transactions, and label prices. The growth in e-commerce, omnichannel retailing, and automated checkout systems has driven demand for high throughput and efficient printing systems. Retailers depend on these technologies to improve customer experience, create fewer errors, and simplify operations to help with supply chain management.

Transportation and logistics are predicted to grow the highest CAGR between 2024-2032 due to the growing demand for real-time tracking of goods, warehouse automation, and supply chain efficiency. With the rapid growth in e-commerce, cross-border trade, and last-mile delivery solutions, there has been a rising demand for RFID and barcode printers for accurate shipment labeling and asset tracking, thereby enhancing operational efficiency.

RFID and Barcode Printer Market Regional Landscape

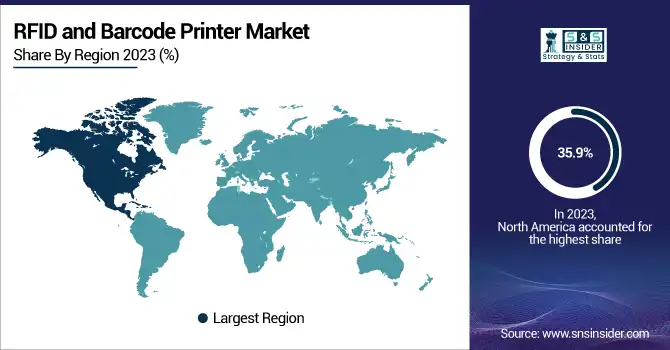

North America was the leading regional market with 35.9% market share in 2023 driven by strong adoption of barcode and RFID printers in retail, logistics, healthcare, and manufacturing industries. The continuous technological improvements and high implementation of the smart tracking solution among major market players, such as Zebra Technologies, Honeywell, and SATO, are some of the reasons attributing to fast market growth. Furthermore, the upsurge e-commerce industry, automated warehouse facilities, and stringent guidelines for enforcing product labels are further propelling the growth of the market. Take Fulfillment centers, for instance; they utilize truckloads of barcode and RFID printers to gain better control over their stock and enable automation in package checking, which is essential for timely standards. In much the same way, Walmart incorporated RFID technology throughout its supply chain to improve efficiency and minimize stockouts.

Asia-Pacific is expected to grow at the fastest CAGR from 2024-2032, fueled by rapid industrialization, booming e-commerce, and government programs supporting smart manufacturing. In particular, the adoption of RFID and barcode technologies in the fields of logistics, retail, and healthcare nurtures high-growth markets in countries such as China, India, and Japan. As an example, Alibaba has mobilized RFID and barcode printers on their Cainiao logistics network to allow seamless tracking of orders and inventory worldwide. For instance, the increase in adoption of automated tracking solutions for business-related activities and transmission systems for an effective supply chain is majorly driven by the India National Logistics Policy, which rules that nearly 3/4th of cargo transportation should be accommodated by the market and strengthens the growth in the market in the nation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the RFID and Barcode Printer Market are:

-

Zebra Technologies (ZT411 Industrial Printer, ZD621 Desktop Printer)

-

Honeywell International (PM45 Industrial Printer, PC42t Desktop Printer)

-

Avery Dennison (Monarch 9419 Printer, ADTP1 Tabletop Printer)

-

SATO Holdings Corporation (CL4NX Plus Industrial Printer, WS4 Desktop Printer)

-

Toshiba Tec Corporation (B-EX4T1 Industrial Printer, B-FV4T Desktop Printer)

-

Brother Industries (TJ-4420TN Industrial Printer, TD-4550DNWB Desktop Printer)

-

Epson (ColorWorks C7500 Industrial Printer, TM-L90 Plus Label Printer)

-

Printronix (T8000 Thermal Printer, T4000 RFID Printer)

-

GoDEX International (ZX1600i Industrial Printer, RT700i Desktop Printer)

-

Impinj (Speedway Revolution RFID Reader, Monza R6-P RFID Tag Chip)

-

TSC Auto ID Technology (MX240P Industrial Printer, TE200 Desktop Printer)

-

Datamax-O'Neil (H-Class H-8308p Industrial Printer, E-Class Mark III Desktop Printer)

-

CITIZEN Systems (CL-E720 Industrial Printer, CL-S621 Desktop Printer)

-

Intermec (by Honeywell) (PM43 Industrial Printer, PC43t Desktop Printer)

-

Postek Electronics (TX3 Industrial Printer, C168 Desktop Printer)

Recent Trends

-

In January 2025, Avery Dennison, BD, and Turck Vilant Systems showcase an RFID-enabled digital ID solution for pre-filled syringe traceability at Pharmapack 2025, enhancing supply chain transparency and patient safety.

-

In February 2025, SATO launched the WT4-AXB 4-inch industrial label printer in APAC as part of its new Basic Line, offering an affordable solution for SMEs expanding in e-commerce.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.32 Billion |

| Market Size by 2032 | USD 7.62 Billion |

| CAGR | CAGR of 6.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (RFID Printer, Barcode Printer) • By Format Type (Industrial Printers, Desktop Printers, Mobile Printers) • By Technology (Thermal Transfer, Direct Thermal, Others) • By Application (Retail, Transportation and Logistics, Manufacturing and Industrial, Healthcare and Hospitality, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zebra Technologies, Honeywell International, Avery Dennison, SATO Holdings Corporation, Toshiba Tec Corporation, Brother Industries, Epson, Printronix, GoDEX International, Impinj, TSC Auto ID Technology, Datamax-O'Neil, CITIZEN Systems, Intermec (by Honeywell), Postek Electronics. |