Basalt Fiber Market Report Scope & Overview:

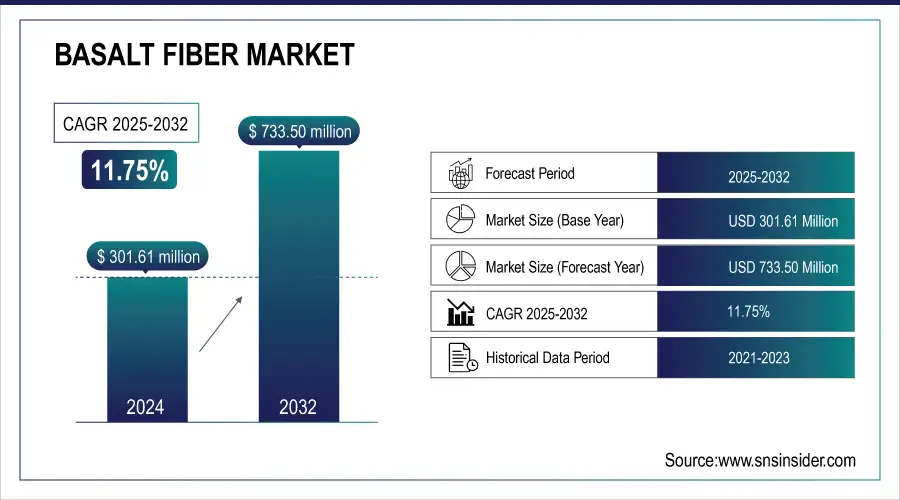

The Basalt Fiber Market Size was valued at USD 301.61 million in 2024 and is expected to reach USD 733.50 million by 2032 and grow at a CAGR of 11.75% over the forecast period 2024-2032.

The Basalt Fiber Market is experiencing significant growth driven by increasing demand for sustainable and durable materials in various applications. Basalt fiber is gaining traction due to its superior properties, including high tensile strength, excellent thermal resistance, and corrosion resistance, making it an ideal choice for sectors such as construction, automotive, aerospace, and marine. Additionally, companies are continuously innovating to enhance basalt fiber production and its applications across industries. In November 2024, Basanite secured a patent for its basalt fiber rebar production method, marking a major milestone in the development of new reinforcement technologies. This patent provides an opportunity for the company to increase its footprint in the growing demand for concrete reinforcement, where basalt fiber rebar offers advantages over steel in terms of corrosion resistance and weight. Furthermore, in 2020, Mafic collaborated with The Materials Group to expand the use of basalt fiber in thermoplastics, offering an innovative solution for thermoplastic composite materials that combine the benefits of basalt fiber with the versatility of thermoplastics. These strategic developments highlight the expanding application potential and ongoing efforts to optimize basalt fiber production processes, solidifying its position as a sustainable alternative in the materials industry.

Get More Information on Basalt Fiber Market - Request Sample Report

Key Basalt Fiber Market Trends

-

Rising adoption of basalt fiber as a sustainable and eco-friendly alternative to glass and carbon fibers in automotive and construction applications.

-

Increasing demand from wind energy and aerospace sectors due to its high tensile strength, thermal resistance, and lightweight properties.

-

Growing use of basalt fiber in infrastructure reinforcement, especially in bridges, roads, and marine applications, driven by its corrosion resistance.

-

Expansion of production capacities and technological advancements to lower manufacturing costs and improve fiber quality.

-

Rising focus on recyclable and non-toxic materials aligns with global sustainability and green building initiatives.

-

Increasing collaborations between manufacturers and research institutes to develop advanced basalt fiber composites for defense and industrial use.

Basalt Fiber Market Growth Drivers

-

Growing Demand for Sustainable and High-Performance Materials Drives Basalt Fiber Adoption in Construction and Infrastructure Projects

The increasing emphasis on sustainability and eco-friendly solutions across industries is a major factor fueling the growth of the basalt fiber market. In construction and infrastructure sectors, basalt fiber's superior properties—such as high tensile strength, resistance to corrosion, and high thermal stability—make it an ideal replacement for traditional materials like steel and fiberglass. Its environmental benefits, including being made from volcanic rocks, align with the growing trend of reducing carbon footprints and utilizing sustainable resources. As the demand for durable, long-lasting structures rises globally, basalt fiber is gaining popularity for reinforcement in concrete and composites. Governments and private sector entities are increasingly adopting basalt fiber in road construction, buildings, bridges, and other infrastructure projects, considering its cost-effectiveness, lower environmental impact, and high strength-to-weight ratio. This shift towards sustainable construction materials is expected to continue driving market growth.

-

Technological Advancements in Basalt Fiber Production Techniques Enhance Product Availability and Performance

-

Rising Adoption of Basalt Fiber Reinforcement in Concrete to Improve Durability and Longevity in Construction

Basalt Fiber Market Restraints

-

High Initial Cost of Basalt Fiber Production Limiting Widespread Adoption Across Cost-Sensitive Industries

Despite the numerous benefits of basalt fiber, its high initial production cost remains a significant restraint for its widespread adoption, especially in cost-sensitive industries such as construction. The manufacturing process for basalt fiber involves mining and heating volcanic rocks to high temperatures, a process that requires significant energy and infrastructure. This leads to higher upfront costs compared to more established materials like steel or fiberglass. While basalt fiber offers long-term durability and lower maintenance costs, the initial investment required for its production and processing can be a barrier for smaller companies or industries operating with tight budgets. The price sensitivity in certain sectors limits the material's uptake, particularly in emerging markets where cost-effective alternatives may dominate. Overcoming this pricing challenge through technological advancements and economies of scale will be crucial for increasing basalt fiber's market penetration.

Basalt Fiber Market Opportunities

-

Expanding Use of Basalt Fiber in Green Building Projects Promotes Sustainable Construction Practices

-

Potential for Basalt Fiber in Wind Energy Applications as a Sustainable Alternative to Traditional Composites

-

Growing Potential of Basalt Fiber in Reinforced Polymers for Automotive and Aerospace Applications

The use of basalt fiber-reinforced polymers in the automotive and aerospace industries is gaining traction due to its unique combination of lightweight and high-strength properties. Basalt fiber composites are increasingly being used to replace metals in automotive body parts, panels, and structural components to improve fuel efficiency and reduce overall vehicle weight. Additionally, in aerospace, basalt fiber’s heat resistance and strength make it an attractive option for producing lightweight components that can withstand extreme conditions. As both industries continue to prioritize sustainability and performance, the demand for basalt fiber-reinforced polymers is expected to grow, creating opportunities for manufacturers to supply this material for various high-performance applications.

Basalt Fiber Market Segment Analysis

By Application

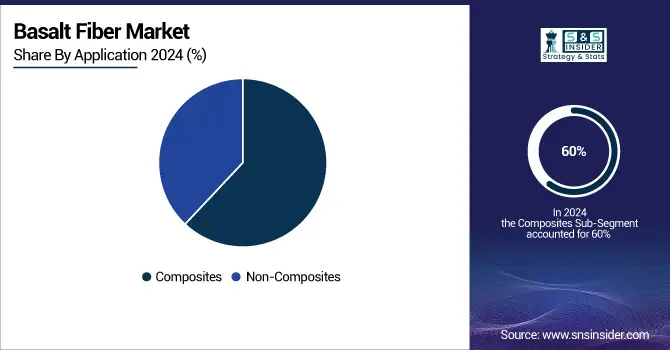

In 2024, the Composites segment dominated the basalt fiber market with a market share of 60%. Basalt fibers are increasingly being used in composite applications due to their excellent performance in enhancing the mechanical properties of materials. The ability of basalt fiber to improve strength, durability, and resistance to temperature and chemicals makes it an ideal material for various composite applications in industries such as automotive, aerospace, and construction. In the automotive sector, for example, basalt fiber-reinforced composites are used in manufacturing lighter and more fuel-efficient vehicles, which is a significant driver for this segment's growth.

By Product Type

In 2024, Continuous Basalt Fibers dominated the basalt fiber market with a market share of 45%. Continuous basalt fibers are widely used for reinforcement purposes in concrete, composites, and construction materials due to their excellent mechanical properties, high tensile strength, and durability. Their consistent and continuous form provides higher strength and resistance, making them ideal for applications that require long-lasting materials. For example, continuous basalt fibers are increasingly used in construction and infrastructure projects, replacing traditional steel reinforcement for enhanced durability and corrosion resistance. This makes them the preferred choice in industries focused on sustainability and performance.

By Form

In 2024, Continuous form dominated the basalt fiber market with a market share of 65%. Continuous basalt fibers are more commonly used in industries such as automotive, construction, and aerospace due to their superior strength-to-weight ratio and long-lasting performance. These fibers are versatile and can be woven or braided into fabrics, making them ideal for manufacturing composite materials used in high-performance applications, such as vehicle parts and structural components. The demand for continuous form basalt fibers is increasing, particularly in the construction sector, for use in reinforced concrete and other materials, owing to their enhanced mechanical properties.

By End-Use Industry

In 2024, Construction & Infrastructure was the dominant end-use industry for basalt fiber, capturing a market share of 40%. The demand for basalt fiber in the construction and infrastructure sector is primarily driven by its superior durability, corrosion resistance, and strength, which are essential for reinforcing concrete and other structural elements. Basalt fibers are increasingly being used in road construction, bridge reinforcement, and building facades to enhance the lifespan of structures. For instance, basalt fiber rebar is gaining popularity as a replacement for steel rebar due to its corrosion resistance, which helps extend the service life of concrete structures, especially in harsh environmental conditions. This widespread use in construction applications solidified its dominance in 2023.

Basalt Fiber Market Regional Outlook

Asia Pacific Basalt Fiber Market Insights

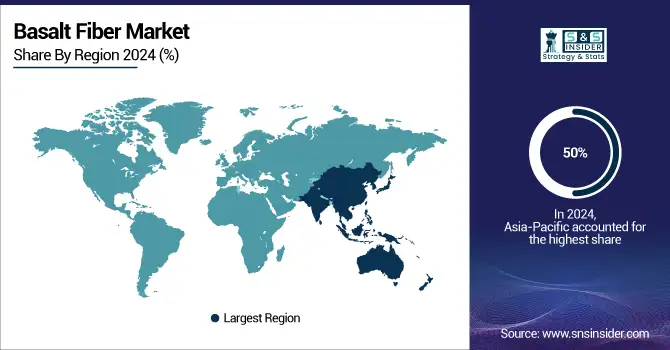

In 2024, the Asia Pacific region dominated the basalt fiber market, accounting for a market share of 50%. This dominance can be attributed to the rapid industrialization and urbanization in countries like China, India, and Japan, which have significantly increased the demand for high-performance materials in construction and infrastructure projects. For example, China, as the largest market for basalt fiber, has witnessed substantial investments in infrastructure development, including roads, bridges, and residential buildings, where basalt fiber's durability and strength are increasingly recognized. India also shows promising growth, with ongoing initiatives to improve the quality of infrastructure under various government schemes, boosting the demand for advanced composite materials like basalt fibers. Furthermore, Japan's focus on disaster-resistant construction materials has led to a rise in the adoption of basalt fibers due to their excellent mechanical properties and resistance to environmental factors. The increasing awareness of sustainable construction practices and the benefits of basalt fibers in enhancing the performance of concrete and other construction materials further contribute to the region's market leadership.

North America Basalt Fiber Market Insights

On the other hand, North America emerged as the fastest growing region in the basalt fiber market in 2024 and accounted for a CAGR of 7%. This growth can be attributed to the rising demand for advanced materials in various applications, particularly in the aerospace, automotive, and construction industries, driven by a focus on lightweight and high-strength materials. The United States is the primary contributor to this growth, where aerospace and automotive industries are increasingly utilizing basalt fibers for their superior performance characteristics. For instance, in the aerospace sector, companies are exploring basalt fiber composites for aircraft components, as they offer reduced weight while maintaining structural integrity. Moreover, the construction industry in North America is experiencing a shift towards sustainable building practices, leading to the adoption of basalt fibers for reinforcing concrete structures. In Canada, government initiatives promoting green building practices and sustainable materials further accelerate the market growth. As the focus on reducing carbon footprints and enhancing material performance intensifies, the North American market for basalt fiber is poised for substantial growth, reinforcing its position as a key player in the global landscape.

Europe Basalt Fiber Market Insights

Europe remains the leader in the basalt fiber market in 2024 with robust demand from automotive, aerospace, and construction applications. The emphasis on lightweight, environment-friendly material# to achieve stringent sustainability and emission reduction targets in the region has underscored the demand for basalt fiber as well. Some countries, including Germany, France and UK, are leading the effort to incorporate basalt fibers in composite for wind energy, transportation as well as defense applications. The leading manufacturers and increasing research and development activities gives Europe an upper hand in the market.

Latin America Basalt Fiber Market Insights

The Basalt Fiber market in Latin America is growing steadily owing to the increasing infrastructure development, construction activities and, government schemes for sustainable construction materials. Brazil and Mexico are the two major markets in which basalt fibres are used more and more in civil construction due to their good characteristics (i.e., durability, resistance to corrosion and low cost). The rising Automotive and Energy sectors are also starting to look at basalt fiber composites to make their products more efficient and environmentally friendly, and LATAM is becoming a hot spot for growth.

Middle East & Africa (MEA) Basalt Fiber Market Insights

The Middle East & Africa region will witness moderate growth in the use of basalt fibers throughout 2024, owing to massive construction projects, rapid urbanization, and increasing requirements for reliable construction materials in extreme weather conditions. Nations such as Saudi Arabia, the U.A.E., and South Africa are typified by early adoption, where basalt fibers are already being used in construction, transportation and defense sectors. Moreover, the encouragement for economic diversification away from oil and the expanding renewables industry are promoting the use of basalt fibers in MEA composites and other industrial applications.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Competitive Landscape for Basalt Fiber Market:

Jogani Reinforcement

Jogani Reinforcement is an India-based provider of advanced reinforcement solutions, focusing on basalt fiber products for the construction and infrastructure sectors. The company emphasizes sustainable and durable materials to replace conventional steel reinforcements.

-

In July 2024, Jogani Reinforcement introduced high-tensile basalt fiber reinforcement for India’s concrete and infrastructure sectors, enhancing durability and sustainability.

Basanite Inc.

Basanite is a U.S.-based manufacturer specializing in basalt fiber reinforced polymer (BFRP) products, offering eco-friendly alternatives to traditional steel reinforcement in construction. The company focuses on high-performance and corrosion-resistant materials.

-

In November 2024, Basanite patented a new method for producing basalt fiber rebar, improving manufacturing efficiency and performance for eco-friendly construction solutions.

Basalt Fiber Market Companies are:

-

BASALTEX NV (Basalt Fabrics, Basalt Yarn)

-

BGF Industries (Basalt Fiber, Basalt Mats)

-

Kamenny Vek (Continuous Basalt Fiber, Basalt Roving)

-

Mafic SA (Basalt Fiber, Basalt Roving)

-

Mudanjiang Basalt Fiber Co. (Basalt Fiber, Basalt Yarn)

-

INCOTELOGY GmbH (Basalt Fiber, Basalt Composite Materials)

-

JFE RockFiber Corp. (Basalt Fiber, Basalt Mesh)

-

Shanxi Basalt Fiber Technology Co., Ltd (Basalt Fiber, Basalt Roving)

-

Sudaglass Basalt Fiber Technology (Basalt Roving, Basalt Mats)

-

Technobasalt-Invest LLC (Continuous Basalt Fiber, Basalt Yarn)

-

Zhejiang GBF Basalt Fiber Co. (Basalt Fiber, Basalt Chopped Strand)

-

Basalt Fiber Tech (Basalt Fiber, Basalt Fabric)

-

Beijing Jingcheng Group (Basalt Fiber, Basalt Roving)

-

Chongqing Polycomp International Corp. (Basalt Fiber, Basalt Yarn)

-

Jiangsu Tianlong Basalt Fiber Co., Ltd (Basalt Fiber, Basalt Roving)

-

Nizhny Novgorod Basalt Fiber Plant (Basalt Fiber, Basalt Mats)

-

Owens Corning (Basalt Fiber, Basalt Roving)

-

Rockwood Basalt Fiber (Basalt Fiber, Basalt Yarn)

-

Shanxi Xinfeng Basalt Fiber Co., Ltd (Basalt Fiber, Basalt Roving)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$301.61Million |

| Market Size by 2032 | US$ 733.50 Million |

| CAGR | CAGR of 11.75% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Continuous Basalt Fibers, Super Thin Basalt Fibers, Staple Thin Basalt Fibers, Basalt Scale & Materials) • By Form (Discrete, Continuous) • By Application (Non-Composites, Composites) • By End-Use Industry (Construction & Infrastructure, Electrical & Electronics, Automotive & Transportation, Wind Energy, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Kamenny Vek, Mudanjiang Basalt Fiber Co., Zhejiang GBF Basalt Fiber Co., Shanxi Basalt Fiber Technology Co., Ltd, JFE RockFiber Corp., Sudaglass Basalt Fiber Technology, Mafic SA, INCOTELOGY GmbH, Technobasalt-Invest LLC, BASALTEX NV and other key players |