Lithium-ion Battery Binders Market Size & Overview:

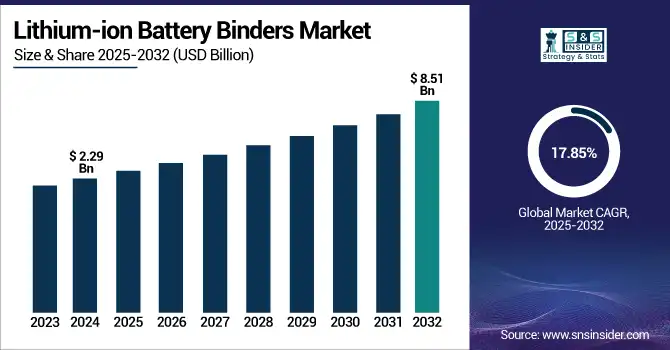

The Lithium-Ion Battery Binders Market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 8.51 billion by 2032, growing at a CAGR of 17.85% over the forecast period of 2025-2032.

To Get more information on Lithium-ion Battery Binders Market - Request Free Sample Report

The lithium-ion battery binders market is being shaped by increased demand for EVs, grid storage, and handheld devices. Emerging trends in the lithium-ion battery binders industry are an increased usage of environmentally friendly binder materials, which are SBR and CMC, and the positioning of non-fluorinated surfactants in PVDF. The battery electrode binders in both anodes and cathodes are changing to support the requirements of fast charging and high energy capacity.

The IEA notes that global electric car sales had hit 14 million in 2023, making an 18% market share. The U.S. has over 1,100 GWh/year of advanced battery capacity. Meanwhile, Kureha Corporation increases PVDF production by 8,000 t/y from green bonds, and Arkema boosts the Kynar® PVDF by eco-friendly means. These announcements demonstrate robust industry growth and innovation of the lithium-ion battery binders industry driven by key companies, and enhance the overall market size and analysis within the automotive and energy storage industries.

Lithium-Ion Battery Binders Market Dynamics:

Drivers:

-

Surging Federal Investments in Domestic Battery Supply Chains Enhance Market Competitiveness

The U.S. Department of Energy's USD 3 billion investment in 25 advanced battery manufacturing projects in 14 states, underway in the U.S., is one such strong policy-driven incentive for the battery binders market. These grants, under the 2021–2024 Quadrennial Supply Chain Review, have mobilized more than USD 16 billion in private investment and are focused on domestic manufacturing of critical lithium-ion battery binder materials, such as PVDF and SBR anode and cathode binders. Thus, less dependence on imports and increased reliance on domestic manufacturing, as promoted in Workforce Development activities in the Federal Consortium for Advanced Batteries, also creates a system of skilled labor for binder production. This public–private partnership drives demand for lithium-ion battery binders and enhances supply chain resiliency, enabling the leading lithium-ion battery binder companies to competitively serve the EV, grid storage, and consumer electronics sectors for many years to come.

-

Rapid Electric Vehicle Adoption Fuels Demand for Advanced Binder Materials

Electric car sales globally neared 14 million by 2023, representing about 18% of all vehicles sold and illustrating a 35% increase compared with the previous year, which is the result of strong policy encouragement and falling costs. With original equipment manufacturers increasingly moving toward zero-emission transportation, the battery binder market must satisfy with high-performing anode and cathode binders that enable fast charging and long cycle life. This rapid growth in electric vehicle take-off is increasing the need for advanced lithium-ion battery binders, such as PVDF and bio-based CMC, and also facilitating the development of hybrid and solvent-free binder chemistries. This market momentum underscores the critical importance of accurate battery electrode binders for the enablement of advanced battery configurations and the fast-growing lithium-ion battery binders market.

Restraints:

-

Complex Multi-Tiered Supply Chain Vulnerabilities Threaten Binder Material Availability

The multi-layered supply chain in the advanced battery industry include minerals extraction, chemical intermediates, and engineered materials, and complex downstream manufacturing. In the DOE’s 2021–2024 Quadrennial Supply Chain Review, it is mentioned that disruptions at any level from fluorochemical feedstocks to polymer extrusion will have a cascading effect on binder availability and will place at risk the continuity of the electrochemical binder supply. Compounding matters are lockdowns spurred by COVID-19, geopolitical tensions, and transport bottlenecks. With this battery binder, market complexity comes a lack of accuracy in Li-ion battery binder market analysis, the challenge of inventory management, and the necessity of carrying expensive safety stocks, hindering operational flexibility and margin optimization.

Lithium-Ion Battery Binders Market Segmentation Analysis:

By Type

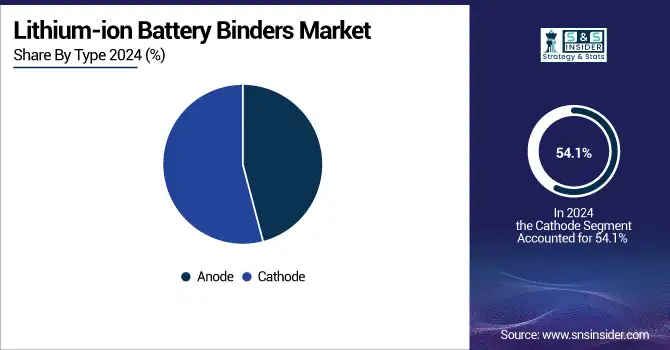

The cathode segment dominated with 54.1% share in the lithium-ion battery binders market in 2024. The dominance is due to the growing applications of high-performance batteries in electric vehicles and energy storage systems. Cathode materials are essential to enhancing the performance metrics of lithium-ion batteries, and leading vendors, such as Tesla and LG Chem have embraced cutting-edge cathode technology to unlock superior battery capacity, quality, and life. The high-energy cathodes play a significant role in boosting the growth of the segment.

The anode segment is the fastest-growing segment of the lithium-ion battery binders market with a CAGR of 18.7% due to the rapid development of anode materials, particularly silicon anodes, which exhibit an extremely high capacity for lithium-ion batteries. Increased demand for electric vehicles and portable electronics is fueling development of anode binder materials that improve the efficiency and longevity of batteries. Battery innovation is also being stoked by support from entities, such as the U.S. Department of Energy, all of which will contribute to a steep trajectory of growth for the industry.

By Material

Polyvinylidene fluoride (PVDF) material in lithium-ion battery binders dominated the market with a share of 39.5% in 2024. This material prevails as it exhibits outstanding electrochemical stability and exceptional adhesion, and is therefore the ideal candidate for anode and cathode binders. Companies, such as BASF and Arkema have been increasingly driving the need for PVDF in lithium-ion batteries, particularly in electric vehicle operations, due to its improved battery performance and life, which is being aligned with the shifting of the automotive industry toward energy-efficient alternatives.

Styrene-butadiene Copolymer (SBR) material is projected to grow with the highest CAGR of 19.3% among the various types in the lithium-ion battery binders market. The growing utilization of SBR is driven by its good adhesion performance, particularly as an anode binder. This material is being increasingly preferred due to its low cost and better cycle life and overall efficiency of the battery. Rapid increase in electric vehicle manufacturing and demand for grid energy storage systems is accelerating the growth of SBR as a binder material, backed by several sustainability programs introduced by the government.

By Application

The Electric Vehicles (EV) segment dominated the lithium-ion battery binders market, accounting for a 47.6% share of the market in 2024. The growing market of EVs, driven by increasingly strict environmental standards and consumers’ interest in green technology, has greatly increased the requirement for high-performance lithium-ion batteries. The influence of key automakers, such as General Motors and Ford on EV technologies may propel the high-performance lithium-ion batteries in the automotive industry, as this segment leads the market.

On the other side, grid energy storage systems are the fastest-growing application segment with a CAGR of 19.29%. Its growth is being driven largely by the rapid rise of solar and wind power, renewable energy sources that need reliable energy storage systems. Using energy storage technologies for maintaining the stability of grids has become increasingly popular across various governments, thus deepening the destination market for lithium-ion batteries. The trend is set to continue, as entities including the U.S. DoE press ahead with the development of energy storage technologies.

By End-use

In 2024, the automotive sector is the leading end-use segment in the lithium-ion battery binders market with a 52.3% share. The growth in this sector is dominated by the Transition of Automotive to electric vehicle to reduce the emission and energy usages. Players, such as CATL and Panasonic are focusing on advancement in battery performance to supplement the growing requirement of electric vehicles, thereby boosting automotive as the biggest end-use segment.

The consumer electronics end-use segment is projected to be the fastest growing at a CAGR of 18.94%. The increasing use of portable electronics, including smartphones, laptops, and wearables, is supporting the expansion of lithium-ion batteries in the industry. With global tech giants, such as Apple and Samsung advancing into high-tech consumer electronics and requiring more long-life batteries, the market demand for more efficient binders in consumer electronics is significantly accelerated.

Lithium-Ion Battery Binders Market Regional Analysis:

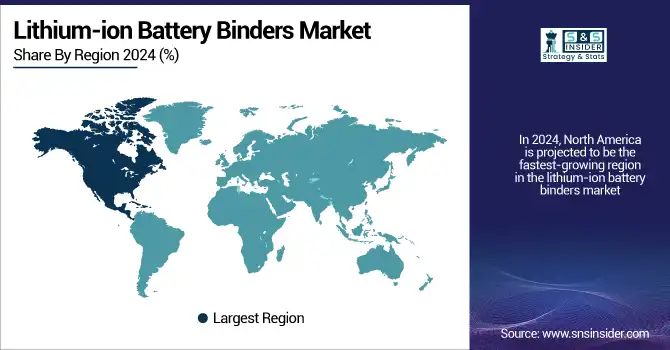

In 2024, North America is projected to be the fastest-growing region in the lithium-ion battery binders market with a CAGR of 18.9%, driven by the large EV and energy storage projects. The U.S. leads with more than 71% market share with a market size of USD 333.9 million in 2024, buoyed by DOE’s investment of USD 3 Billion in battery supply chains, and a predicted 1,100+ GWh/year battery capacity (DOE, 2024). Industry leaders such as DuPont and Kureha USA are expanding PVDF and SBR production. The Federal Consortium for Advanced Batteries encourages R&D into sustainable Anode and Cathode Binders. Canada ranks second with good clean tech investments that push the market and support local material innovation.

Europe accounts for the second-largest lithium-ion battery binders market with a significant share in 2024 on the back of policy momentum and gigafactory roll-outs. Germany is ahead with companies, such as BASF ramping up the production of binders and cathode materials under the EU Battery Innovation IPCEI. The French and Swedish governments invest in sustainable binder R&D via green mandates. With over 35 gigafactories under construction, demand for water-based lithium-ion battery materials such as SBR and CMC is increasing. The European Battery Alliance, and eco-friendly production standards are advancing the rapid rollout of Battery Electrode Binders, strengthening Europe in the Global lithium-ion battery binders market research over the long peak bloom period for the EV.

Asia Pacific dominated in 2024, owing to the huge adoption of EVs and battery production in the region, accounting for 48.2% of the market. China’s battery capacity makes up over 60% of the global total, made possible by the fuel byproducts of the MIIT support program, as well as binder capacity. Companies, such as ZEON and LG Chem are the key players in high-end anode and cathode binders. Chinese PVDF production dominance and EV subsidies further empower regional grip of lithium-ion battery binder materials. The battery ecosystem in Asia Pacific, combined with global supply chain and government-supported energy programs, continues to secure Asia Pacific’s lead in the lithium-ion battery binders market.

LAMEA is projected to be a lucrative region in the lithium-ion battery binders market, supported by large lithium reserves, investment in clean energy, and increasing battery ecosystems. Chile, the country with one of the largest lithium reserves globally, is spearheading regional binder development via pilot production on a global front and some localized binder manufacturing aligned with the growth in EVs. In Africa, South Africa develops binder projects and mineral exports, while the UAE and Saudi Arabia invest in energy storage as part of Vision 2030. This is expediting the adoption of battery electrode binder, which is resulting in LAMEA’s increasing prominence in global lithium-ion battery binder market analysis.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the lithium-ion battery binders market include KUREHA CORPORATION, ZEON CORPORATION, Solvay, Arkema, Synthomer PLC, DAIKIN INDUSTRIES, Ltd., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., and UBE Industries Ltd.

Recent Developments:

-

March 2025: BASF expanded the U.S. Licity anode binder production in Pennsylvania and Tennessee to meet growing lithium-ion battery demand with sustainable, high-performance materials.

-

November 2023: Orbia and Solvay launched an USD 850 million joint venture for PVDF production in Georgia and Louisiana, boosting North America’s EV battery material supply chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.29 billion |

| Market Size by 2032 | USD 8.51 billion |

| CAGR | CAGR of 17.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Anode, Cathode) •By Material (Polyvinylidene Fluoride (PVDF), Carboxymethyl Cellulose (CMC), Polymethyl Methacrylate (PMMA), Styrene-butadiene Copolymer (SBR), Others) •By Application (Electric Vehicles, Portable Electronics, Grid Energy Storage Systems, Industrial and Marine Devices, Others) •By End-use (Automotive, Consumer electronics, Industrial, Energy Storage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | KUREHA CORPORATION, ZEON CORPORATION, Solvay, Arkema, Synthomer PLC, DAIKIN INDUSTRIES, Ltd., Asahi Kasei Corporation, Sumitomo Chemical Co., Ltd., Mitsui Chemicals, Inc., UBE Industries Ltd. |