Benzoic Acid Market Report Scope & Overview:

The Benzoic Acid Market size was valued at USD 1.53 billion in 2023. It is estimated to hit USD 2.41 billion by 2032 and grow at a CAGR of 5.16% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Benzoic Acid Market - Request Sample Report

Benzoic acid, a versatile aromatic carboxylic acid, plays a pivotal role across various industries due to its multifaceted applications. In the food and beverage sector, it serves as an effective preservative, extending shelf life by inhibiting microbial growth in acidic products like jams, sauces, and fruit juices. This preservative function is crucial as the global demand for processed foods continues to rise, driven by changing consumer lifestyles and the need for longer-lasting products.

In the pharmaceutical industry, benzoic acid is utilized in the synthesis of antifungal and anti-inflammatory medications, highlighting its significance in healthcare. Its derivatives, such as benzyl benzoate, are also employed in the treatment of scabies and lice infestations, underscoring its therapeutic versatility. The chemical industry leverages benzoic acid as a precursor for producing various compounds, including plasticizers, which are essential in manufacturing flexible plastics. This application is particularly pertinent as the demand for plastic products grows, driven by advancements in packaging, automotive, and construction sectors.

Recent developments in the benzoic acid market reflect a trend toward sustainable and eco-friendly production methods. Some companies are introducing greener manufacturing methods to reduce the environmental impact of benzoic acid production. This move aligns with the increasing consumer preference for natural ingredients and sustainable practices across industries.

Benzoic Acid Market Dynamics

DRIVERS

- The growing demand for processed foods, pharmaceuticals, cosmetics, and polymers drives the increased use of benzoic acid across multiple industries.

The growing demand for benzoic acid is largely driven by its extensive use across various end-use industries. In the food and beverage sector, benzoic acid serves as a preservative, helping extend shelf life by inhibiting microbial growth, particularly in processed foods and soft drinks. The pharmaceutical industry relies on benzoic acid for the synthesis of various drugs, including antiseptics and analgesics, thus benefiting from its versatile applications. Additionally, the cosmetics industry utilizes benzoic acid in products like skin creams, shampoos, and deodorants for its preservative and antimicrobial properties. In the polymers and plastics sector, benzoic acid is a key ingredient in producing plasticizers, resins, and dyes, which are vital for the automotive and construction industries. As global consumption of processed foods, pharmaceuticals, and personal care products continues to rise, the demand for benzoic acid is expected to grow, fueling the market across these diverse sectors.

RESTRAINT

- Health and safety concerns regarding skin irritation and toxicity from improper use of benzoic acid led to regulatory challenges and limited usage in sensitive applications like food and cosmetics.

Health and safety concerns surrounding benzoic acid primarily arise from its potential to cause skin irritation and other adverse effects if used improperly. When applied in high concentrations, benzoic acid can lead to skin burns, rashes, and allergic reactions, particularly in sensitive individuals. Ingesting excessive amounts can also result in toxicity, causing symptoms such as nausea, vomiting, and gastrointestinal distress. These health risks have led to strict regulatory scrutiny, particularly in industries like food and cosmetics, where benzoic acid is commonly used as a preservative. Regulatory bodies such as the FDA have set limits on its concentration in food products to ensure consumer safety. Additionally, there are concerns regarding its use in cosmetics, as it may cause irritation or allergic reactions in some people. These health and safety concerns often result in reduced usage of benzoic acid in sensitive applications and increased demand for safer alternatives.

Benzoic Acid Market Segmentation

By Form

The anhydrous segment dominated with the market share over 62% in 2023, due to its superior stability and versatility across various industries. It is widely used as a preservative in food and beverages, pharmaceuticals, and personal care products. The anhydrous form offers better preservation properties, extending the shelf life of products by preventing microbial growth. Its stable chemical structure makes it ideal for industrial applications, where precision and durability are crucial. Compared to the liquid form, anhydrous benzoic acid provides more efficient preservation and is easier to handle in manufacturing processes, contributing to its dominance in the market.

By Application

The Sodium Benzoate segment dominated with the market share over 34% in 2023, due to its vital role as a preservative in the food and beverage industry. It effectively prevents the growth of mold, yeast, and bacteria in acidic foods, helping to prolong shelf life and maintain product safety. This ability makes it particularly important in preserving items such as carbonated beverages, fruit juices, and condiments, where microbial growth could otherwise lead to spoilage. The widespread and consistent demand for sodium benzoate in these products has solidified its position as the leading application in the market.

By End-use

The Food & Beverage segment dominated with the market share over 42% in 2023, due to its widespread use as a preservative in processed and packaged foods. Benzoic acid prevents the growth of harmful microorganisms such as mold, yeast, and bacteria, thus extending the shelf life of food products. As consumer demand for convenience foods increases and food safety awareness rises, the reliance on preservatives like benzoic acid grows. This trend is driven by the need for longer-lasting, safe-to-consumer products in the market. As a result, benzoic acid plays a crucial role in maintaining food quality and safety, bolstering its demand in this sector.

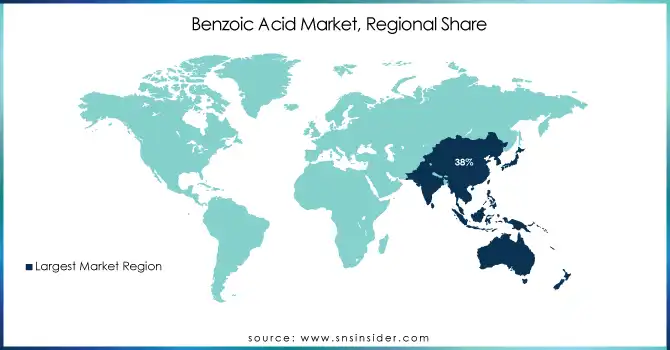

Benzoic Acid Market Regional Analysis

Asia-Pacific region dominated with the market share over 38% in 2023. This dominance is fueled by the strong demand from key industries such as food & beverages, pharmaceuticals, and plastics. Countries like China and India are major contributors to this demand due to their large manufacturing sectors and growing industrialization. Benzoic acid is widely used as a preservative in food products, in the production of medicines, and in the creation of polymers and resins. The region's expanding industrial base and rising population continue to drive the market's growth.

The North American region is experiencing rapid growth in the Benzoic Acid market, driven by its increasing use across diverse industries. In the food and beverage sector, it serves as a preservative, while in personal care and cosmetics, it is utilized for its antimicrobial properties. Additionally, the rising consumer preference for sustainable and eco-friendly products is contributing to the growing demand for Benzoic Acid, as it is often used in natural formulations. This trend aligns with the region's focus on reducing chemical usage and promoting environmentally friendly alternatives, further fueling the market’s expansion in North America.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Some of the major key players of the Benzoic Acid Market

- Chemcrux Enterprises Ltd (Benzoic Acid, Sodium Benzoate, Potassium Benzoate)

- Merck KGaA (Benzoic Acid, Sodium Benzoate)

- LANXESS (Benzoic Acid, Sodium Benzoate, Benzotriazole)

- Thermo Fisher Scientific Inc. (Benzoic Acid, Chemical Reagents)

- Ganesh Benzoplast Limited(Benzoic Acid, Sodium Benzoate, Benzyl Alcohol)

- Fushimi (Benzoic Acid, Food Additives)

- I G Petrochemicals Ltd. (Benzoic Acid, Benzene Derivatives)

- Hemadri Chemicals (Benzoic Acid, Benzene Derivatives)

- Eastman Chemical Company (Benzoic Acid, Food Additives, Specialty Chemicals)

- GFS Chemicals Inc. (Benzoic Acid, Sodium Benzoate)

- Spectrum Chemical (Benzoic Acid, Reagents for Laboratory Use)

- Shandong Jinnuo Chemical Co., Ltd. (Benzoic Acid, Sodium Benzoate)

- Anhui Bayi Chemical Industry Co., Ltd. (Benzoic Acid, Benzene Derivatives)

- Mitsubishi Chemical Corporation (Benzoic Acid, Benzene Derivatives)

- Jiangsu SOPO Chemical Co., Ltd. (Benzoic Acid, Food Grade Benzoic Acid)

- BASF (Benzoic Acid, Chemical Products)

- SABIC (Benzoic Acid, Specialty Chemicals)

- Cargill, Incorporated (Benzoic Acid, Food Additives)

- Aarti Industries Ltd. (Benzoic Acid, Benzene Derivatives)

- Laxmi Organic Industries Ltd. (Benzoic Acid, Sodium Benzoate)

Suppliers for (benzoic acid with high purity and consistent quality, catering to pharmaceutical, food, and cosmetic industries) on Benzoic Acid Market

- Ganesh Benzoplast Ltd.

- Shreeji Pharma International

- Hemadri Chemicals

- Global Pharmachem

- Uma Chem

- Kesar Chemicals

- Swati Enterprises

- Seema Biotech

- Shree Ram Chemsource

- Shiv Chemicals

Recent Development:

In February 2024: Eastman Chemical Company entered into a partnership with LANXESS to advance sustainable benzoic acid production technology. The collaboration seeks to develop eco-friendly manufacturing methods that could revolutionize the industry by reducing harmful emissions and improving resource efficiency.

In August 2023: Sinteza S.A. initiated a project aimed at harnessing thermal energy from waste. The project will utilize various by-products from the benzoic acid production process to generate thermal energy (steam), which will then be fed back into the production process.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.53 billion |

| Market Size by 2032 | USD 2.41 billion |

| CAGR | CAGR of 5.16% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form (Liquid and Anhydrous) •By Application (Sodium Benzoate, Benzyl Benzoate, Potassium Benzoate, Benzoate Plasticizers, Benzoyl Chloride, Alkyd Resin, Feed Additives, and Others) •By End-use (Food & Beverage, Chemical, Cosmetics and Personal Care, Pharmaceuticals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chemcrux Enterprises Ltd., Merck KGaA, LANXESS, Thermo Fisher Scientific Inc., Ganesh Benzoplast Limited, Fushimi, I G Petrochemicals Ltd., Hemadri Chemicals, Eastman Chemical Company, GFS Chemicals Inc., Spectrum Chemical, Shandong Jinnuo Chemical Co., Ltd., Anhui Bayi Chemical Industry Co., Ltd., Mitsubishi Chemical Corporation, Jiangsu SOPO Chemical Co., Ltd., BASF, SABIC, Cargill, Aarti Industries Ltd., and Laxmi Organic Industries Ltd. |

| Key Drivers | •The growing demand for processed foods, pharmaceuticals, cosmetics, and polymers drives the increased use of benzoic acid across multiple industries. |

| Restraints | •Health and safety concerns regarding skin irritation and toxicity from improper use of benzoic acid led to regulatory challenges and limited usage in sensitive applications like food and cosmetics. |