Bicycle Accessories Market Report Scope & Overview:

Get More Information on Bicycle Accessories Market - Request Sample Report

The Bicycle Accessories Market Size was valued at USD 16.63 Billion in 2023 and is expected to reach USD 30.44 Billion by 2032 and grow at a CAGR of 6.97% over the forecast period 2024-2032.

Growth in the bicycle accessories market is enormous and has grown exponentially through cyclist increases for fitness, transportation, and leisure. Government policies seeking to advance eco-friendly transport and infrastructure development, particularly in urban areas, have further enhanced this industry. For example, the U.S government introduced tax incentives as well as subsidies for cycling to control traffic congestion and carbon emissions. With cycling increasingly becoming the mode of transport, all sorts of accessories like helmets, gloves, lights, and other protective equipment are in huge demand. According to the Bureau of Economic Analysis, Americans spent USD 5.3 billion on bikes and accessories in 2023. Consumer spending on bicycles and accessories reached more than USD 6.8 billion in 2023, and it was higher by nearly 30% compared with the pre-pandemic average. Over the last two years, consumer spending on bicycle gears has flattened at that level. One hopes that this might keep the industry in a higher gear than before the covid-19 times.

Innovations in accessories such as GPS enabled smart helmets, smart locks with alarm features, and smart lighting systems that add more technical elements in them are rising and are preferred by most technical cyclists. These make cycling safer, in the first place, but also further enhance the experience and product as a whole, which helps attract new consumers to the market. Considerable opportunities are also created for the accessories market because e-bike riders often require specific accessories, such as improved saddles, storage solutions, and battery packs.

Regarding future prospects, the increase in health and fitness awareness post-pandemic has seen cycling rise as an exercise, therefore upping demand for cycling gear and accessories. In this regard, trends are increasingly driven by the need for comfort, durability, and safety in apparel and accessories. Companies have developed ergonomic, breathable, and protective products to meet the needs of both recreational cyclists and professional cyclers.

Market growth in the U.S. is expected to be the strongest because of increasing investments in cycling infrastructure, dedicated bike lanes, and bike-sharing programs. This provides opportunities for manufacturers to expand their product line if there are enough cities that promote cycling and encourage a fitness culture. So, the bicycle accessories market will witness steady growth during 2024-2032, mainly on account of technological upgradations and government support as well as consumer demand.

Bicycle Accessories Market Dynamics

Key Drivers:

-

Rising health awareness bolsters demand for bike accessories

Increased awareness of health and fitness is one of the main demand drivers for bike accessories. As many in the U.S. are trying to introduce exercise into their daily lives, cycling is becoming an exciting option for several of them. Thus, both the bicycle sales overall and bicycle-accessory sales such as cycling clothes, gloves, and other protective gear are starting to become visible; most cyclists try to seek comfort and safety as they go about riding the bikes. Access to accessories such as padded shorts, breathable jerseys, and helmets with improved safety features helps in providing consumers with the best cycling experience.

The need to come out of their houses, maintain social distance, and consume more healthy habits played a big role in the accelerated outdoor fitness trends amidst the raging COVID-19 pandemic. It has led to the development of new opportunities for manufacturers to introduce innovative, ergonomic, and health-enhancing accessories towards the growing fitness enthusiast population, thus driving the market.

-

Government policies push bicycle and their accessory sales.

Government policies supporting eco-friendly modes of transport have contributed much towards meeting the demand for bicycle accessories. Incentives by federal and state administrations to cyclists through rebates, tax breaks, and grants encourage the use of bicycles to reduce traffic and the emission of carbon in the atmosphere. Increased federal and state encouragement have led to increased bicycle and bicycle accessory sales because consumers are encouraged to use bicycles for daily commutation and travel instead of other alternative transport means. For instance, Austria's Federal Ministry for Climate Protection, Environment, Energy, Mobility, Innovation and Technology offers cash grants until the end of February, 2025 "for the acquisition and operational use of electric bicycles, electric cargo bikes, and cargo bikes as well as electric folding bikes and folding bikes with operation solely with electricity from renewable energy sources."

Moreover, such policies tend to supplement projects in infrastructure development wherein new bike lanes are being built and safer cycling environments established so that more people will begin investing in good quality accessories such as helmets, lighting systems, and locks for safety and convenience. These supportive policies trickle down, benefiting bicycle accessory sales and developing the practice of cycling into mass and "green" modes of transportation.

Restraint:

-

Lack of necessary infrastructure in a few regions inhibits bicycle accessory sales.

Limited infrastructure in some parts of the geographic world hampers bicycle accessory sales, a key restraint in the bicycle accessories market. Although countries like those in Europe and Asia have significantly increased their cycling networks, still, there are many areas around the United States and other parts of the world lacking adequate bike lanes, parking spaces, and safety measures. Inadequate infrastructure may discourage people from using bicycles as a primary means of transportation and affect their demand for bicycle accessories in return. For instance, in regions perceived to have an unsafe or inconvenient cycling environment due to low infrastructure quality, the spending on high-quality accessory parts such as light kits, mirrors, or protective gears is lowered.

However, cyclists in those regions are more at risk of accidents and less likely to have cycling as a routine activity of their daily living. This would make infrastructure gap an enormous barrier for the market, which requires a need to address governments and municipalities to invest in safer and cyclist-friendly environments to unlock the full growth potential of the bicycle accessories industry.

Bicycle Accessories Market Segmentation Overview

By Product Type

The bicycle accessories market can be broadly divided into two categories: apparels and components. Apparels comprise cycling gloves, cycling clothes, cycling shoes, protective gears, and other things created to enhance comfort and safety. They find application in many casual and professional riders who are looking for the best grips, comfort, and protection during their rides. With more and more people into cycling or who are fitness-conscious, there has been an upward trend in demand for apparels for cycling. High performance clothing with moisture-wicking properties and low wind resistance, along with advanced protective gear, has increased cyclist usage in terms of long-distance rides and competitive cycling.

Components include saddles, pedals, lights, mirrors, water bottle cages, locks, bar ends/grips, kickstands, fenders & mud flaps, air pumps, tire pressure gauges, etc. Components accounted for 61.59% of the total market share in 2023. For this reason, there is a great influence of components since they are attributed to major functions for enhancing functionality, safety, and comfort in bicycles. The simple components include saddles and pedals while the more complex ones include lighting systems and air pumps which each of the cyclists may not lack for use. Components are likely to grow the most at a CAGR of 5.0% in the forecast period from 2024 to 2032. For them to be installed, constant growing popularity of e-bikes as well as an ever-growing demand for technologically advanced accessories is expected to drive growth in the components segment.

By Sales Channel

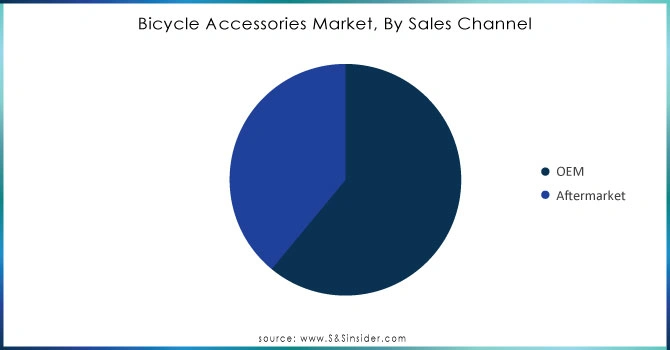

The market is further divided into OEM and Aftermarket on the basis of sales channel. OEMs offer accessories that are fitted in a shop or sold with newly purchased bicycles at the point of sales. Aftermarket is the sale of separate accessories after the bicycle has been purchased. In the year 2023, OEM happened to be the market leader, and captured an amount of 56.12% of the total share. This dominance can be attributed to the fact that most consumers prefer purchasing fully equipped bicycles from manufacturers that include vital accessories like saddles, pedals, and lights. Additionally, several OEMs have partnered with bicycle brands in the inclusion of accessories into their products for sale with the new bicycles to ensure that customers get quality parts and components.

However, the aftermarket segment is expected to record the largest growth, at a CAGR of 7.63% from 2024 to 2032. This growth can be attributed to increasing trends on customization among cyclists who want to better their bikes with some of the finest parts and accessories as cycling becomes increasingly popular. Nearly every customer wishes to advance their performance and, as such, purchases additional accessories, such as improved saddles, lighting systems, and protective gear, from the aftermarket.

Need Any Customization Research On Bicycle Accessories Market - Inquiry Now

Bicycle Accessories Market Regional Analysis

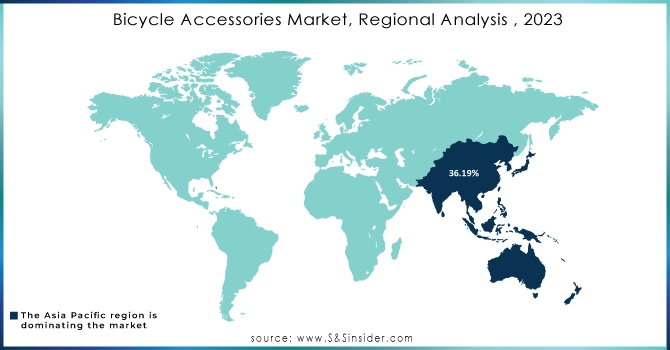

Asia Pacific dominated the bicycle accessories market in 2023, holding a global market share of 36.19%. Reasons for dominance is high population density. Countries like China and India experience much population density, where bicycles often become a primary mode of conveyance. Growth in fitness trends, accompanied by cycling culture in Japan and South Korea, has catapulted the region into market leadership. Bike exports from the China have reached almost 11 Billion units for the first quarter of 2024, up 13.7 percent from the previous fourth quarter of 2023, according to data from the China Bicycle Association. China also exported around 2.3 Billion bicycles to the United States in the period, which rose 47.2 % year-on-year. The country's exports to Russia jumped 52.1% year-on-year to 930,000 units, the data showed.

Europe will lead the market with growth at an 8.8% CAGR from 2024 to 2032. The main reason for growth is the growing government focus on carbon emissions reduction and green mode of transport in European countries. Cities like Amsterdam and Copenhagen, where cycling infrastructure is widely spread, experience significant traffic in cyclists, thereby directly increasing the demand for high-quality bicycle accessories in the regions.

Key Players in Bicycle Accessories Market

Some of the major players in the Bicycle Accessories Market are

-

Shimano (Pedals, Saddles)

-

Giant Bicycles (Cycling Gloves, Water Bottle Cages)

-

Trek Bicycle Corporation (Cycling Shoes, Kickstands)

-

Specialized Bicycle Components (Protective Gear, Lighting Systems)

-

Garmin (Cycling Computers, Mirrors)

-

Bontrager (Saddles, Locks)

-

Lezyne (Air Pumps, Tyre Pressure Gauges)

-

CatEye (Lighting Systems, Mirrors)

-

Abus (Locks, Protective Gears)

-

Fizik (Saddles, Bar Ends/Grips)

-

Kryptonite (Locks, Fenders & Mud Flaps)

-

Park Tool (Air Pumps, Kickstands)

-

Thule (Bike Racks, Water Bottle Cages)

-

Topeak (Fenders, Air Pumps)

-

Pearl Izumi (Cycling Clothes, Gloves)

-

POC Sports (Helmets, Protective Gear)

-

Zefal (Mud Flaps, Water Bottle Cages)

-

Sigma Sport (Lighting Systems, Mirrors)

-

Brooks England (Saddles, Grips)

-

Fox Racing (Cycling Gloves, Protective Gear)

Recent Developments:

-

E-bikes have support at the regional and municipal level in Belgium. Electric Bike Report says, "Brussels-Capital Region has also provided residents with up to USD 550 toward the new or used e-bike or even accessories. Wallonia has an e-bike incentive of up to USD 1,350.”

-

Japan's Shimano, a bicycle parts maker, is preparing to roll out next year a system on gear shifting that taps into artificial intelligence to assist cyclists. The Japanese giant has now started calling on people from the Shibuya ward of Tokyo to try its latest arrival, the Q'Auto gear shifter on a bike.

-

Garmin brand is coming out with its new update for Epix Gen 2, Fenix 7, Forerunner, Vivoactive, and Venu 3 Series smartwatches, besides the Edge 540, Edge 840, and the Edge 1040 cycling computers, full of inside information about scores of new features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.63 Billion |

| Market Size by 2032 | US$ 30.44 Billion |

| CAGR | CAGR of 6.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Apparels(Cycling Gloves, Cycling Clothes, Cycling Shoes, Protective Gears, Others), Components(Saddles, Pedals, Lighting System, Mirrors, Water Bottle Cages, Lock, Bar Ends/Grips, Kickstands, Fenders & Mud Flaps, Air Pumps & Tyre Pressure Gauge, Others)) • By Bicycle Type (Mountain, Hybrid, Road, Cargo,Comfort, Youth, Cruiser, Electric, Others) • By Sales Channel (OEM, Aftermarket) • By Sales Platform ( Specialty Bicycle Retailers, Full-Line Sporting Goods Stores, Department Stores & Others, Online) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shimano, Giant Bicycles, Trek Bicycle Corporation, Specialized Bicycle Components, Garmin, Bontrager, Lezyne, CatEye, Abus, Fizik, Kryptonite, Park Tool, Thule, Topeak, Pearl Izumi, POC Sports, Zefal, Sigma Sport, Brooks England, Fox Racing |

| Key Drivers | • Rising health awareness bolsters demand for bike accessories • Government policies push bicycle and their accessory sales. |

| Restraints | • Lack of necessary infrastructure in a few regions inhibits bicycle accessory sales. |